Registration No. 333-264388

Filed Pursuant to Rule 433

NEW ISSUE: Bank of Montreal’s Autocallable Barrier Notes with Contingent Coupons Linked to a Basket of Ten Equities These notes do not guarantee the return of your principal at maturity NOTE INFORMATION Bank of Montreal Issuer: $1,000 (and $1,000 increments thereafter) Minimum Investment: DATES June 29, 2023 (at 2 pm NY Time.) Offering Period Closes: On or about June 29, 2023 Pricing Date: On or about July 05, 2023 Settlement Date: On or about July 01, 2025 Valuation Date: On or about July 07, 2025 Maturity Date: Approximately 2 Years Term: ARC 2884 Issue: REFERENCE ASSET The Reference Asset is an equally weighted basket consisting of the following equity securities (the “Basket” and the underlying equity securities, the “Basket Components”): PRELIMINARY TERMS 9.00% of the principal per annum (0.750% per month), if payable, unless earlier redeemed. Contingent Interest Rate: 100.00 Initial Level: The Basket Closing Level on the Valuation Date. Final Level: 100% of the Initial Level Call Level: 70.00% of the Initial Level Trigger Level: 70.00% of the Initial Level Coupon Barrier Level: 06374VW69 CUSIP Please see the following page for additional information about the terms included on this cover page, and how your investment ma y be impacted. This term sheet, which gives a brief summary of the preliminary terms of the notes, relates to, and should be read in conjunction with, the pr eli minary pricing supplement dated May 26, 2023, the Product Supplement dated July 22, 2022, the Prospectus Supplement dated May 26, 2022, and to the Prospectus da ted May 26, 2022. We urge investors to carefully review all documents, including the pricing supplement and the product supplement, prior to making an inv estment decision. 1 SEC File No. 333 - 264388 | May 26, 2023 PRELIMINARY TERMS CONTINUED If the Basket Closing Level is greater than or equal to its Coupon Barrier Level as of the applicable Coupon Observation Date, a Contingent Coupon will be paid at the Contingent Interest Rate. Interest will be paid monthly on each Contingent Coupon Payment Date, subject to the automatic redemption feature. Please see page 2 of this term sheet for the table of Contingent Coupon Payment Dates and Coupon Observation Dates. Contingent Coupons: The third scheduled trading day prior to the applicable Contingent Coupon Payment Date , subject to postponement. Coupon Observation Dates: Interest will be paid on the 7th day of each month (or, if such day is not a business day, the next following business day), beginning on August 07, 2023, and until the Maturity Date, subject to the automatic redemption feature. Contingent Coupon Payment Dates: If, on any Call Observation Date, the Basket Closing Level is greater than its Call Level, the notes will be automatically redeemed. Automatic Redemption: Beginning on January 03, 2024, each Coupon Observation Date. Call Observation Dates: If the notes are automatically redeemed, the Contingent Coupon Payment Date immediately following the relevant Call Observation Date. Call Settlement Dates: The Basket Closing Level is less than its Trigger Level on the Valuation Date . Trigger Event: If the notes are automatically redeemed, then, on the applicable Call Settlement Date, for each $1,000 principal amount, investors will receive $1,000 plus the Contingent Coupon otherwise due. Payment Upon Automatic Redemption : If the notes are not automatically redeemed, the payment at maturity for the notes is based on the performance of the Basket. You will receive $1,000 for each $1,000 in principal amount of the note, unless a Trigger Event has occurred. If a Trigger Event has occurred, you will receive at maturity, for each $1,000 in principal amount of your notes, a cash amount equal to: $1,000 + [$1,000 x Percentage Change] This amount will be less than the principal amount of your notes, and may be zero. Payment at Maturity (if held to the Maturity Date): INVESTMENT OBJECTIVE The objective of the notes is to provide clients the potential to earn periodic income, subject to an automatic redemption, while offering limited downside protection against a slight to moderate decline in the Basket over the term of the notes. As such, the notes may be suitable for investors with a moderately bullish view of the Basket over the term of the notes. The performance of the notes may not be consistent with the investment objective. Weighting Percentage Bloomberg Ticker Basket Component 10.00% ADI The common stock of Analog Devices, Inc. 10.00% APH The Class A common stock of Amphenol Corporation 10.00% EW The common stock of Edwards Lifesciences Corporation 10.00% FCX The common stock of Freeport - McMoRan Inc. 10.00% ISRG The common stock of Intuitive Surgical, Inc. 10.00% KLAC The common stock of KLA Corporation 10.00% NOW The common stock of ServiceNow, Inc. 10.00% PLD The common stock of Prologis, Inc. 10.00% SLB The common stock of Schlumberger N.V. 10.00% SNPS The common stock of Synopsys, Inc.

The quotient, expressed as a percentage, of the following formula: (Final Level - Initial Level) Initial Level Percentage Change: On any day, the Basket Closing Level will be calculated as (a) 100 multiplied by (b) the sum of ( i ) 1 plus (ii) the sum of the products of each Component Change multiplied by its Weighting Percentage. Basket Closing Level: On any day, with respect to each Basket Component, the quotient, expressed as a percentage, of the following formula: (Closing Basket Component Level - Initial Basket Component Level) Initial Basket Component Level Component Change: With respect to each Basket Component, its closing price on the Pricing Date. Initial Basket Component Level: On any trading day during the term of the notes, with respect to each Basket Component, its closing price on such day. Closing Basket Component Level: We will only pay cash on the Maturity Date, and you will have no right to receive any shares of any Basket Component. Physical Delivery Amount: Investors in these notes could lose all or a substantial portion of their investment at maturity if there has been a decline in the level of the Basket and the Final Level of the Basket is less than its Trigger Level. We urge you to carefully review the documents described in “Additional Information” below, including the risk factors set forth and incorporated by reference therein, prior to making an investment decision. Principal at Risk: The notes will not be listed on any securities exchange. Although not obligated to do so, BMO Capital Markets Corp. (or one of its affiliates), plans to maintain a secondary market in the notes after the Settlement Date. Proceeds from a sale of notes prior to maturity may be less than the principal amount initially invested. Secondary Market: 2

3 The risks summarized below are some of the most important factors to be considered prior to any purchase of the notes. Investors are urged to read all the risk factors related to the notes in the preliminary pricing supplement and the product supplement to which this term sheet relates before making an investment decision. • You could lose up to the entire principal amount of your notes, and your potential return on the notes is limited to any Contingent Coupon payments, if any. If the notes are not automatically redeemed and if a Trigger Event has occurred, and if the Final Level of the Basket is less than its Initial Level, you will lose 1% of the principal amount for each 1% that the Final Level of the Baske t is less than its Initial Level. • You may not receive any Contingent Coupons with respect to your notes. • Your notes are subject to automatic early redemption. If the notes are so redeemed, you will not receive any additional Contingent Coupons, and you may not be able to invest the proceeds in a security with a similar return. • Your return on the notes is limited to the Contingent Coupons, if any, regardless of any appreciation of any Basket Components. • Changes in the level of one or more Basket Components may be offset by changes in the level of one or more other Basket Components. • A higher Contingent Interest Rate or lower Trigger Level or Coupon Barrier Level may reflect greater expected volatility of the Basket Components, and greater expected volatility generally indicates an increased risk of loss at maturity. • Your return on the notes may be lower than the return on a conventional debt security of comparable maturity. • The notes are unsecured debt obligations of the Issuer and your investment is subject to the credit risk of the Issuer. • Our and our affiliates’ activities may conflict with your interests and may also adversely affect the value of the notes. • Our initial estimated value of the notes will be lower than the price to public, does not represent any future value of the notes, and may also differ from the estimated value of any other party. • The terms of the notes are not determined by reference to the credit spreads for our conventional fixed - rate debt. • The inclusion of the hedging profits, if any, in the initial price to public of the notes, as well as our hedging costs, is likely to adversely affect the price at which you can sell your notes. • You will not have any shareholder rights and will have no right to receive any shares of the Basket Components at maturity. • We have no affiliation with the sponsor of any Basket Component, and will not be responsible for their actions. • Changes that affect each Basket Component will affect the market value of the notes, whether the notes will be automatically called, and the amount you will receive at maturity. Adjustments to a Basket Component could adversely affect the notes. The sponsor of a Basket Component may make adjustments, discontinue or suspend calculations or publication of that Basket Component, or discontinue of suspend maintenance of that Basket Component at any time. • The notes will not be listed on any securities exchange. BMOCM may offer to purchase the notes in the secondary market, but is not required to do so. Even if there is a secondary market, it may not provide enough liquidity to allow you to trade or sell the notes easily. • We and our affiliates may engage in hedging and trading activities related to the notes that could adversely affect our payment to you at maturity. Selected Risk Considerations:

4 Hypothetical Calculations for the Payment at Maturity: Examples of the Hypothetical Payment at Maturity for a $1,000 Investment in the notes The following examples illustrate the hypothetical payments on a note at maturity, assuming that the notes are not automatically called. The hypothetical payments are based on a $1,000 investment in the notes, a hypothetical Initial Level o f 100.00, a hypothetical Trigger Level of 70.00 (70.00% of the hypothetical Initial Level), a hypothetical Call Level of 100 (100% of its hypothetical Initial Level), the Contingent Interest Rate of 0.750 % per month , a range of hypothetical Final Levels of the Basket and the effect on the payment at maturity if (i) a Trigger Event occurs or (ii) if a Trigger Event does not occur. The hypothetical examples shown below are intended to help you understand the terms of the notes. If the notes are not automatically called, the actual cash amount that you will receive at maturity will depend upon whether the Basket Closing Level is below its Trigger Level on the Valuation Date . If the notes are automatically called prior to maturity, the hypothetical examples below will not be relevant, and you will receive on the applicable Call Settlement Date, for each $1,000 principal amount, the principal amount plus the applicable Contingent Coupon . These examples do not give effect to any U.S. federal tax payments or brokerage commissions that you may be required to pay in connection with your purchase of the notes. The Final Level of the Basket at maturity is $40, which is less than the Trigger Level and therefore a Trigger Event has occurred. In this case, for each $1,000 in principal amount of the notes , you will receive a payment of of $ 400 on the Valuation Date, resulting in a loss of 60% of your principal amount. Your loss of principal may be partially offset by Contingent Coupons, if any, received with respect to the notes. Example 1: The Final Level of the Basket at maturity is $90 and therefore a Trigger Event has not occurred. In this case, you will receive a payment equal to the principal amount of your notes. You will not receive any positive return on your investment other than any Contingent Coupons. Example 2: The Final Level of the Basket at maturity is $115, which is 15% greater than the Initial Level. In this case, you will receive a payment equal to the principal amount of your notes. You will not receive any positive return on your investment other than any Contingent Coupons. Example 3:

Additional Information The notes will not constitute deposits insured by the U.S. Federal Deposit Insurance Corporation or under the Canada Deposit Ins urance Corporation or by any other U.S. or Canadian governmental agency or instrumentality. The notes will not be subject to conversion into our common shares or the common shares of any of our affiliates under subsec tio n 39.2(2.3) of the Canada Deposit Insurance Corporation Act. Neither the U.S. Securities and Exchange Commission (the “SEC”), nor any state securities commission, has reviewed or approve d t hese notes, nor or otherwise passed upon the accuracy of this document, to which it relates or the accompanying product supplement , p rospectus supplement, or prospectus. Any representation to the contrary is a criminal offense. The Issuer has filed a registration statement with the SEC for the offerings to which this communication relates. Before you in vest, you should read the prospectus in that registration statement and the other documents discussed below that the Issuer has filed w ith the SEC for more complete information about the Issuer and these offerings. You may obtain these documents free of charge by visiting th e S EC’s web site at http://www.sec.gov . Alternatively, the Issuer will arrange to send to you the prospectus (as supplemented by the prospectus supplement, product supplement, and preliminary pricing supplement to which this term sheet relates) if you request it by cal lin g its agent toll - free on 1 - 877 - 369 - 5412 or emailing investor.solutions@bmo.com . The information in this term sheet is qualified in its entirety by the more detailed explanations set forth elsewhere in the Iss uer’s preliminary pricing supplement dated May 26, 2023 and the accompanying product supplement, prospectus supplement, and prospectus. Unless the context provides otherwise, capitalized terms used in this term sheet but not defined shall have the meaning assigned to them in the preliminary pricing supplement, product supplement, prospectus supplement, or prospectus, as applicable, to which this term s hee t relates. Information about retrieving these documents can be found elsewhere in this term sheet. • Preliminary Pricing Supplement dated May 26, 2023: https://www.sec.gov/Archives/edgar/data/927971/000121465923007921/r526231fwp.htm • Product Supplement dated July 22, 2022: https://www.sec.gov/Archives/edgar/data/927971/000121465922009102/r712220424b2.htm • Prospectus Supplement and Prospectus dated May 26, 2022: https://www.sec.gov/Archives/edgar/data/0000927971/000119312522160519/d269549d424b5.htm Our Central Index Key, or CIK, on the SEC website is 927971. As used in this terms sheet, the “Issuer,” “we,” “us” or “our” r efe rs to Bank of Montreal, but not its consolidated subsidiaries. This term sheet contains no description or discussion of the United States tax consequences of the acquisition, holding or di spo sition of the notes. We urge you to carefully read the section entitled “U.S. Federal Tax Information” in the preliminary pricing supplement, the section entitled “Supplemental Tax Considerations — Supplemental U.S. Federal Income Tax Considerations” in the product supplement, the se ction “United States Federal Income Taxation” in the accompanying prospectus and the section entitled “Certain Income Tax Consequences ” in the accompanying prospectus supplement, in each case, to which this term sheet relates. You should consult your tax advisor abo ut your own tax situation. 5

MicroSectors FANG Index ... (AMEX:FNGD)

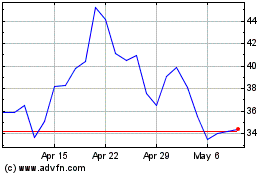

Historical Stock Chart

From Mar 2024 to Apr 2024

MicroSectors FANG Index ... (AMEX:FNGD)

Historical Stock Chart

From Apr 2023 to Apr 2024