Quarterly Schedule of Portfolio Holdings of Registered Management Investment Company (n-q)

November 21 2019 - 4:17PM

Edgar (US Regulatory)

|

|

OMB APPROVAL

|

|

|

OMB Number: 3235-0578

Expires: February 28, 2022

Estimated average burden hours per response: 10.5

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-Q

QUARTERLY SCHEDULE OF PORTFOLIO HOLDINGS

OF REGISTERED

MANAGEMENT INVESTMENT COMPANY

|

Investment Company Act file number

|

811-05150

|

|

|

Cornerstone Strategic Value Fund, Inc.

|

|

(Exact name of registrant as specified in charter)

|

|

225 Pictoria Drive, Suite 450 Cincinnati, Ohio

|

45246

|

|

(Address of principal executive offices)

|

(Zip code)

|

Benjamin V. Mollozzi, Esq.

|

Ultimus Fund Solutions, LLC 225 Pictoria Drive, Suite 450 Cincinnati, Ohio 45246_

|

|

(Name and address of agent for service)

|

|

Registrant's telephone number, including area code:

|

(513) 587-3400

|

|

|

Date of fiscal year end:

|

December 31

|

|

|

|

|

|

|

Date of reporting period:

|

September 30, 2019

|

|

Form N-Q is to be used by management investment

companies other than small business investment companies registered on Form N-5 (§§ 239.24 and 274.5 of this chapter),

to file reports with the Commission, not later than 60 days after the close of the first and third fiscal quarters, pursuant to

Rule 30b1-5 under the Investment Company Act of 1940 (17 CFR 270.30b1-5). The Commission may use the information provided on Form

N-Q in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information

specified by Form N-Q, and the Commission will make this information public. A registrant is not required to respond to the collection

of information contained in Form N-Q unless the Form displays a currently valid Office of Management and Budget ("OMB")

control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions

for reducing the burden to the Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609.

The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

|

|

Item 1.

|

Schedule of Investments.

|

|

CORNERSTONE STRATEGIC VALUE FUND, INC.

|

|

SCHEDULE OF INVESTMENTS - SEPTEMBER 30, 2019 (Unaudited)

|

|

Description

|

|

No. of Shares

|

|

|

Value

|

|

|

EQUITY SECURITIES - 99.15%

|

|

|

|

|

|

|

|

|

|

CLOSED-END FUNDS - 20.12%

|

|

|

|

|

|

|

|

|

|

CORE - 6.23%

|

|

|

|

|

|

|

|

|

|

Adams Diversified Equity Fund, Inc.

|

|

|

1,180,639

|

|

|

$

|

18,701,321

|

|

|

General American Investors Company, Inc.

|

|

|

455,079

|

|

|

|

16,542,121

|

|

|

Royce Micro-Cap Trust, Inc.

|

|

|

344,436

|

|

|

|

2,769,265

|

|

|

Royce Value Trust, Inc.

|

|

|

421,856

|

|

|

|

5,804,739

|

|

|

Source Capital, Inc.

|

|

|

72,244

|

|

|

|

2,637,961

|

|

|

Tri-Continental Corporation

|

|

|

107,471

|

|

|

|

2,928,592

|

|

|

|

|

|

|

|

|

|

49,383,999

|

|

|

DEVELOPED MARKET - 0.49%

|

|

|

|

|

|

|

|

|

|

Aberdeen Japan Equity Fund, Inc.

|

|

|

28,058

|

|

|

|

204,262

|

|

|

European Equity Fund, Inc. (The)

|

|

|

13,909

|

|

|

|

123,790

|

|

|

Japan Smaller Capitalization Fund, Inc.

|

|

|

182,599

|

|

|

|

1,601,394

|

|

|

New Germany Fund, Inc. (The)

|

|

|

52,109

|

|

|

|

722,231

|

|

|

New Ireland Fund, Inc. (The) *

|

|

|

66,227

|

|

|

|

566,903

|

|

|

Swiss Helvetia Fund, Inc. (The) *

|

|

|

83,874

|

|

|

|

673,508

|

|

|

|

|

|

|

|

|

|

3,892,088

|

|

|

DIVERSIFIED EQUITY - 0.05%

|

|

|

|

|

|

|

|

|

|

Sprott Focus Trust, Inc.

|

|

|

56,014

|

|

|

|

376,974

|

|

|

|

|

|

|

|

|

|

|

|

|

EMERGING MARKETS - 1.79%

|

|

|

|

|

|

|

|

|

|

Aberdeen Emerging Markets Equity Income Fund, Inc.

|

|

|

138,143

|

|

|

|

961,475

|

|

|

Central and Eastern Europe Fund, Inc. (The)

|

|

|

61,622

|

|

|

|

1,602,172

|

|

|

China Fund, Inc. (The)

|

|

|

39,425

|

|

|

|

765,239

|

|

|

First Trust/Aberdeen Emerging Opportunity Fund

|

|

|

17,566

|

|

|

|

232,398

|

|

|

Herzfeld Caribbean Basin Fund, Inc. (The) *

|

|

|

14,016

|

|

|

|

89,142

|

|

|

India Fund, Inc. (The)

|

|

|

12,488

|

|

|

|

256,379

|

|

|

Mexico Equity and Income Fund, Inc. (The)

|

|

|

12,477

|

|

|

|

131,232

|

|

|

Mexico Fund, Inc. (The)

|

|

|

120,361

|

|

|

|

1,570,711

|

|

|

Morgan Stanley China A Share Fund, Inc.

|

|

|

123,297

|

|

|

|

2,522,657

|

|

|

Morgan Stanley India Investment Fund, Inc. *

|

|

|

134,733

|

|

|

|

2,553,191

|

|

|

Taiwan Fund, Inc. (The) *

|

|

|

10,072

|

|

|

|

186,029

|

|

|

Templeton Dragon Fund, Inc.

|

|

|

66,155

|

|

|

|

1,184,836

|

|

See accompanying notes to schedule of investments.

|

CORNERSTONE STRATEGIC VALUE FUND, INC.

|

|

SCHEDULE OF INVESTMENTS - SEPTEMBER 30, 2019 (Unaudited)(Continued)

|

|

Description

|

|

No. of Shares

|

|

|

Value

|

|

|

EMERGING MARKETS - 1.79% (Continued)

|

|

|

|

|

|

|

|

|

|

Templeton Emerging Markets Fund

|

|

|

120,191

|

|

|

$

|

1,762,000

|

|

|

Voya Emerging Markets High Dividend Equity Fund

|

|

|

48,753

|

|

|

|

349,559

|

|

|

|

|

|

|

|

|

|

14,167,020

|

|

|

ENERGY MLP FUNDS - 0.98%

|

|

|

|

|

|

|

|

|

|

ClearBridge Energy Midstream Opportunity Fund Inc.

|

|

|

140,897

|

|

|

|

1,225,804

|

|

|

ClearBridge Energy MLP and Midstream Fund Inc.

|

|

|

72,185

|

|

|

|

821,465

|

|

|

ClearBridge Energy MLP and Midstream Total Return Fund Inc.

|

|

|

58,677

|

|

|

|

522,812

|

|

|

Cushing Energy Income Fund (The)

|

|

|

18,840

|

|

|

|

115,928

|

|

|

Kayne Anderson Midstream/Energy Fund, Inc.

|

|

|

332,742

|

|

|

|

3,603,597

|

|

|

Neuberger Berman MLP Income Fund Inc.

|

|

|

167,926

|

|

|

|

1,209,067

|

|

|

Salient Midstream & MLP Fund

|

|

|

31,478

|

|

|

|

247,417

|

|

|

|

|

|

|

|

|

|

7,746,090

|

|

|

GENERAL BOND - 0.06%

|

|

|

|

|

|

|

|

|

|

Eaton Vance Limited Duration Income Fund

|

|

|

34,862

|

|

|

|

435,788

|

|

|

|

|

|

|

|

|

|

|

|

|

GLOBAL - 2.36%

|

|

|

|

|

|

|

|

|

|

Aberdeen Global Dynamic Dividend Fund

|

|

|

151,699

|

|

|

|

1,463,896

|

|

|

Aberdeen Total Dynamic Dividend Fund

|

|

|

996,457

|

|

|

|

8,310,452

|

|

|

Clough Global Dividend and Income Fund

|

|

|

4,369

|

|

|

|

47,404

|

|

|

Clough Global Equity Fund

|

|

|

18,657

|

|

|

|

214,556

|

|

|

Delaware Enhanced Global Dividend and Income Fund

|

|

|

131,691

|

|

|

|

1,298,473

|

|

|

Gabelli Global Small and Mid Cap Value Trust (The)

|

|

|

124,326

|

|

|

|

1,383,748

|

|

|

GDL Fund (The)

|

|

|

271,068

|

|

|

|

2,491,114

|

|

|

John Hancock Tax-Advantaged Global Shareholder Yield Fund

|

|

|

18,156

|

|

|

|

124,005

|

|

|

Lazard Global Total Return and Income Fund, Inc.

|

|

|

2,997

|

|

|

|

46,843

|

|

|

Lazard World Dividend & Income Fund, Inc.

|

|

|

5,668

|

|

|

|

52,939

|

|

|

Royce Global Value Trust, Inc.

|

|

|

185,341

|

|

|

|

1,875,651

|

|

|

Voya Infrastructure, Industrials and Materials Fund

|

|

|

120,588

|

|

|

|

1,380,733

|

|

|

|

|

|

|

|

|

|

18,689,814

|

|

See accompanying notes to schedule of investments.

|

CORNERSTONE STRATEGIC VALUE FUND, INC.

|

|

SCHEDULE OF INVESTMENTS - SEPTEMBER 30, 2019 (Unaudited)(Continued)

|

|

Description

|

|

No. of Shares

|

|

|

Value

|

|

|

GLOBAL INCOME - 0.32%

|

|

|

|

|

|

|

|

|

|

BrandywineGLOBAL - Global Income Opportunities Fund Inc.

|

|

|

206,252

|

|

|

$

|

2,495,649

|

|

|

|

|

|

|

|

|

|

|

|

|

HIGH YIELD LEVERAGED - 0.02%

|

|

|

|

|

|

|

|

|

|

Franklin Universal Trust

|

|

|

19,088

|

|

|

|

143,924

|

|

|

|

|

|

|

|

|

|

|

|

|

INCOME & PREFERRED STOCK - 0.45%

|

|

|

|

|

|

|

|

|

|

Eagle Growth and Income Opportunities Fund

|

|

|

98,682

|

|

|

|

1,572,991

|

|

|

LMP Capital and Income Fund Inc.

|

|

|

140,627

|

|

|

|

1,984,247

|

|

|

|

|

|

|

|

|

|

3,557,238

|

|

|

NATURAL RESOURCES - 1.95%

|

|

|

|

|

|

|

|

|

|

Adams Natural Resources Fund, Inc.

|

|

|

535,580

|

|

|

|

8,478,231

|

|

|

BlackRock Resources & Commodities Strategy Trust

|

|

|

930,248

|

|

|

|

6,958,255

|

|

|

|

|

|

|

|

|

|

15,436,486

|

|

|

OPTION ARBITRAGE/OPTIONS STRATEGIES - 1.90%

|

|

|

|

|

|

|

|

|

|

AllianzGI NFJ Dividend, Interest & Premium Strategy Fund

|

|

|

802,422

|

|

|

|

9,805,597

|

|

|

BlackRock Enhanced Global Dividend Trust

|

|

|

356,473

|

|

|

|

3,718,013

|

|

|

BlackRock Enhanced International Dividend Trust

|

|

|

183,993

|

|

|

|

999,082

|

|

|

Madison Covered Call & Equity Strategy Fund

|

|

|

49,247

|

|

|

|

315,181

|

|

|

Voya Asia Pacific High Dividend Equity Income Fund

|

|

|

29,669

|

|

|

|

251,593

|

|

|

Voya International High Dividend Equity Income Fund

|

|

|

700

|

|

|

|

3,682

|

|

|

|

|

|

|

|

|

|

15,093,148

|

|

|

PACIFIC EX JAPAN - 0.08%

|

|

|

|

|

|

|

|

|

|

Korea Fund, Inc. (The)

|

|

|

21,756

|

|

|

|

596,767

|

|

|

|

|

|

|

|

|

|

|

|

|

REAL ESTATE - 1.37%

|

|

|

|

|

|

|

|

|

|

Aberdeen Global Premier Properties Fund

|

|

|

27,234

|

|

|

|

169,395

|

|

|

CBRE Clarion Global Real Estate Income Fund

|

|

|

1,029,349

|

|

|

|

8,142,151

|

|

|

RMR Real Estate Income Fund

|

|

|

125,575

|

|

|

|

2,560,473

|

|

|

|

|

|

|

|

|

|

10,872,019

|

|

|

SECTOR EQUITY - 1.53%

|

|

|

|

|

|

|

|

|

|

Gabelli Healthcare & WellnessRx Trust (The)

|

|

|

251,458

|

|

|

|

2,620,192

|

|

|

Nuveen Real Asset Income and Growth Fund

|

|

|

346,685

|

|

|

|

6,070,455

|

|

|

Tekla Healthcare Investors

|

|

|

127,000

|

|

|

|

2,329,180

|

|

See accompanying notes to schedule of investments.

|

CORNERSTONE STRATEGIC VALUE FUND, INC.

|

|

SCHEDULE OF INVESTMENTS - SEPTEMBER 30, 2019 (Unaudited)(Continued)

|

|

Description

|

|

No. of Shares

|

|

|

Value

|

|

|

SECTOR EQUITY - 1.53% (Continued)

|

|

|

|

|

|

|

|

|

|

Tekla Life Sciences Investors

|

|

|

74,400

|

|

|

$

|

1,123,440

|

|

|

|

|

|

|

|

|

|

12,143,267

|

|

|

UTILITY - 0.54%

|

|

|

|

|

|

|

|

|

|

Macquarie/First Trust Global Infrastructure/Utilities Dividend & Income Fund

|

|

|

41,363

|

|

|

|

409,907

|

|

|

Macquarie Global Infrastructure Total Return Fund Inc.

|

|

|

160,883

|

|

|

|

3,874,063

|

|

|

|

|

|

|

|

|

|

4,283,970

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL CLOSED-END FUNDS

|

|

|

|

|

|

|

159,314,241

|

|

|

|

|

|

|

|

|

|

|

|

|

COMMUNICATION SERVICES - 9.40%

|

|

|

|

|

|

|

|

|

|

Alphabet Inc. - Class C *

|

|

|

27,405

|

|

|

|

33,406,695

|

|

|

AT&T Inc.

|

|

|

430,900

|

|

|

|

16,305,256

|

|

|

Charter Communications, Inc. - Class A *

|

|

|

12,000

|

|

|

|

4,945,440

|

|

|

Comcast Corporation - Class A

|

|

|

280,000

|

|

|

|

12,622,400

|

|

|

Walt Disney Company (The)

|

|

|

55,000

|

|

|

|

7,167,600

|

|

|

|

|

|

|

|

|

|

74,447,391

|

|

|

CONSUMER DISCRETIONARY - 8.22%

|

|

|

|

|

|

|

|

|

|

Amazon.com, Inc. *

|

|

|

13,000

|

|

|

|

22,566,830

|

|

|

AutoZone, Inc. *

|

|

|

1,200

|

|

|

|

1,301,544

|

|

|

Dollar General Corporation

|

|

|

14,000

|

|

|

|

2,225,160

|

|

|

Home Depot, Inc. (The)

|

|

|

61,600

|

|

|

|

14,292,432

|

|

|

Lowe's Companies, Inc.

|

|

|

20,000

|

|

|

|

2,199,200

|

|

|

McDonald's Corporation

|

|

|

21,700

|

|

|

|

4,659,207

|

|

|

NIKE, Inc. - Class B

|

|

|

65,000

|

|

|

|

6,104,800

|

|

|

Ross Stores, Inc.

|

|

|

24,000

|

|

|

|

2,636,400

|

|

|

Starbucks Corporation

|

|

|

69,000

|

|

|

|

6,100,980

|

|

|

TJX Companies, Inc. (The)

|

|

|

54,000

|

|

|

|

3,009,960

|

|

|

|

|

|

|

|

|

|

65,096,513

|

|

|

CONSUMER STAPLES - 6.08%

|

|

|

|

|

|

|

|

|

|

Coca-Cola Company (The)

|

|

|

150,000

|

|

|

|

8,166,000

|

|

|

Costco Wholesale Corporation

|

|

|

25,500

|

|

|

|

7,346,805

|

|

|

Estée Lauder Companies, Inc. (The) - Class A

|

|

|

19,000

|

|

|

|

3,780,050

|

|

|

General Mills, Inc.

|

|

|

31,000

|

|

|

|

1,708,720

|

|

|

Procter & Gamble Company (The)

|

|

|

130,000

|

|

|

|

16,169,400

|

|

|

Sysco Corporation

|

|

|

32,500

|

|

|

|

2,580,500

|

|

See accompanying notes to schedule of investments.

|

CORNERSTONE STRATEGIC VALUE FUND, INC.

|

|

SCHEDULE OF INVESTMENTS - SEPTEMBER 30, 2019 (Unaudited)(Continued)

|

|

Description

|

|

No. of Shares

|

|

|

Value

|

|

|

CONSUMER STAPLES - 6.08% (Continued)

|

|

|

|

|

|

|

|

|

|

Walmart Inc.

|

|

|

71,000

|

|

|

$

|

8,426,280

|

|

|

|

|

|

|

|

|

|

48,177,755

|

|

|

ENERGY - 1.79%

|

|

|

|

|

|

|

|

|

|

Chevron Corporation

|

|

|

36,000

|

|

|

|

4,269,600

|

|

|

Exxon Mobil Corporation

|

|

|

105,636

|

|

|

|

7,458,958

|

|

|

Kinder Morgan, Inc.

|

|

|

117,400

|

|

|

|

2,419,614

|

|

|

|

|

|

|

|

|

|

14,148,172

|

|

|

EXCHANGE-TRADED FUNDS - 0.94%

|

|

|

|

|

|

|

|

|

|

iShares Core S&P 500 ETF

|

|

|

10,000

|

|

|

|

2,985,200

|

|

|

SPDR S&P 500 ETF Trust

|

|

|

15,000

|

|

|

|

4,451,550

|

|

|

|

|

|

|

|

|

|

7,436,750

|

|

|

FINANCIALS - 9.92%

|

|

|

|

|

|

|

|

|

|

Aflac Incorporated

|

|

|

39,000

|

|

|

|

2,040,480

|

|

|

Allstate Corporation (The)

|

|

|

9,000

|

|

|

|

978,120

|

|

|

American Express Company

|

|

|

32,000

|

|

|

|

3,784,960

|

|

|

Aon plc

|

|

|

12,000

|

|

|

|

2,322,840

|

|

|

Bank of America Corporation

|

|

|

353,300

|

|

|

|

10,305,761

|

|

|

BB&T Corporation

|

|

|

42,000

|

|

|

|

2,241,540

|

|

|

Berkshire Hathaway Inc. - Class B *

|

|

|

62,000

|

|

|

|

12,897,240

|

|

|

Chubb Limited

|

|

|

10,000

|

|

|

|

1,614,400

|

|

|

Citigroup Inc.

|

|

|

107,000

|

|

|

|

7,391,560

|

|

|

Intercontinental Exchange, Inc.

|

|

|

15,000

|

|

|

|

1,384,050

|

|

|

JPMorgan Chase & Co.

|

|

|

181,000

|

|

|

|

21,301,890

|

|

|

Progressive Corporation (The)

|

|

|

34,000

|

|

|

|

2,626,500

|

|

|

S&P Global Inc.

|

|

|

12,000

|

|

|

|

2,939,760

|

|

|

SunTrust Banks, Inc.

|

|

|

27,000

|

|

|

|

1,857,600

|

|

|

U.S. Bancorp

|

|

|

60,000

|

|

|

|

3,320,400

|

|

|

Willis Towers Watson Public Limited Company

|

|

|

8,000

|

|

|

|

1,543,760

|

|

|

|

|

|

|

|

|

|

78,550,861

|

|

|

HEALTH CARE - 11.58%

|

|

|

|

|

|

|

|

|

|

Abbott Laboratories

|

|

|

107,000

|

|

|

|

8,952,690

|

|

|

Anthem, Inc.

|

|

|

15,000

|

|

|

|

3,601,500

|

|

|

Baxter International Inc.

|

|

|

13,000

|

|

|

|

1,137,110

|

|

|

Becton, Dickinson and Company

|

|

|

10,000

|

|

|

|

2,529,600

|

|

|

Cigna Corporation

|

|

|

19,354

|

|

|

|

2,937,744

|

|

|

Edwards Lifesciences Corporation *

|

|

|

11,000

|

|

|

|

2,419,010

|

|

See accompanying notes to schedule of investments.

|

CORNERSTONE STRATEGIC VALUE FUND, INC.

|

|

SCHEDULE OF INVESTMENTS - SEPTEMBER 30, 2019 (Unaudited)(Continued)

|

|

Description

|

|

No. of Shares

|

|

|

Value

|

|

|

HEALTH CARE - 11.58% (Continued)

|

|

|

|

|

|

|

|

|

|

Eli Lilly and Company

|

|

|

49,000

|

|

|

$

|

5,479,670

|

|

|

HCA Healthcare, Inc.

|

|

|

20,000

|

|

|

|

2,408,400

|

|

|

Humana Inc.

|

|

|

8,000

|

|

|

|

2,045,360

|

|

|

IQVIA Holdings Inc. *

|

|

|

10,000

|

|

|

|

1,493,800

|

|

|

Johnson & Johnson

|

|

|

105,700

|

|

|

|

13,675,466

|

|

|

Medtronic Public Limited Company

|

|

|

75,000

|

|

|

|

8,146,500

|

|

|

Merck & Co., Inc.

|

|

|

145,000

|

|

|

|

12,206,100

|

|

|

Pfizer Inc.

|

|

|

225,000

|

|

|

|

8,084,250

|

|

|

Stryker Corporation

|

|

|

19,000

|

|

|

|

4,109,700

|

|

|

Thermo Fisher Scientific Inc.

|

|

|

14,000

|

|

|

|

4,077,780

|

|

|

UnitedHealth Group Incorporated

|

|

|

25,000

|

|

|

|

5,433,000

|

|

|

Zoetis, Inc.

|

|

|

24,000

|

|

|

|

2,990,160

|

|

|

|

|

|

|

|

|

|

91,727,840

|

|

|

INDUSTRIALS - 7.41%

|

|

|

|

|

|

|

|

|

|

Boeing Company (The)

|

|

|

34,000

|

|

|

|

12,935,980

|

|

|

CSX Corporation

|

|

|

54,000

|

|

|

|

3,740,580

|

|

|

Cummins Inc.

|

|

|

9,000

|

|

|

|

1,464,030

|

|

|

Deere & Company

|

|

|

21,000

|

|

|

|

3,542,280

|

|

|

Fortive Corporation

|

|

|

15,000

|

|

|

|

1,028,400

|

|

|

Honeywell International Inc.

|

|

|

24,000

|

|

|

|

4,060,800

|

|

|

Ingersoll-Rand Public Limited Company

|

|

|

13,000

|

|

|

|

1,601,730

|

|

|

Lockheed Martin Corporation

|

|

|

18,000

|

|

|

|

7,021,080

|

|

|

Norfolk Southern Corporation

|

|

|

19,000

|

|

|

|

3,413,540

|

|

|

Republic Services, Inc.

|

|

|

19,000

|

|

|

|

1,644,450

|

|

|

Roper Technologies, Inc.

|

|

|

6,000

|

|

|

|

2,139,600

|

|

|

Union Pacific Corporation

|

|

|

46,000

|

|

|

|

7,451,080

|

|

|

United Parcel Service, Inc. - Class B

|

|

|

49,000

|

|

|

|

5,871,180

|

|

|

Waste Management, Inc.

|

|

|

24,000

|

|

|

|

2,760,000

|

|

|

|

|

|

|

|

|

|

58,674,730

|

|

|

INFORMATION TECHNOLOGY - 18.56%

|

|

|

|

|

|

|

|

|

|

Accenture plc - Class A

|

|

|

34,000

|

|

|

|

6,539,900

|

|

|

Apple Inc.

|

|

|

67,000

|

|

|

|

15,005,990

|

|

|

Automatic Data Processing, Inc.

|

|

|

24,000

|

|

|

|

3,874,080

|

|

|

Broadcom Inc.

|

|

|

20,000

|

|

|

|

5,521,400

|

|

|

Cisco Systems, Inc.

|

|

|

299,000

|

|

|

|

14,773,590

|

|

|

Fiserv, Inc. *

|

|

|

25,000

|

|

|

|

2,589,750

|

|

See accompanying notes to schedule of investments.

|

CORNERSTONE STRATEGIC VALUE FUND, INC.

|

|

SCHEDULE OF INVESTMENTS - SEPTEMBER 30, 2019 (Unaudited)(Continued)

|

|

Description

|

|

No. of Shares

|

|

|

Value

|

|

|

INFORMATION TECHNOLOGY - 18.56% (Continued)

|

|

|

|

|

|

|

|

|

|

Intuit Inc.

|

|

|

15,000

|

|

|

$

|

3,989,100

|

|

|

Mastercard Incorporated - Class A

|

|

|

60,000

|

|

|

|

16,294,200

|

|

|

Microsoft Corporation

|

|

|

331,000

|

|

|

|

46,018,930

|

|

|

Motorola Solutions, Inc.

|

|

|

8,000

|

|

|

|

1,363,280

|

|

|

Paychex, Inc.

|

|

|

20,000

|

|

|

|

1,655,400

|

|

|

PayPal Holdings, Inc. *

|

|

|

37,000

|

|

|

|

3,832,830

|

|

|

Texas Instruments Incorporated

|

|

|

44,000

|

|

|

|

5,686,560

|

|

|

VeriSign, Inc. *

|

|

|

7,000

|

|

|

|

1,320,410

|

|

|

Visa, Inc. - Class A

|

|

|

101,000

|

|

|

|

17,373,009

|

|

|

Xilinx, Inc.

|

|

|

12,000

|

|

|

|

1,150,800

|

|

|

|

|

|

|

|

|

|

146,989,229

|

|

|

MATERIALS - 1.34%

|

|

|

|

|

|

|

|

|

|

Air Products and Chemicals, Inc.

|

|

|

13,000

|

|

|

|

2,884,180

|

|

|

Corteva, Inc.

|

|

|

20,431

|

|

|

|

572,068

|

|

|

Dow Inc.

|

|

|

20,431

|

|

|

|

973,537

|

|

|

DuPont de Nemours, Inc.

|

|

|

20,431

|

|

|

|

1,456,935

|

|

|

Ecolab Inc.

|

|

|

17,000

|

|

|

|

3,366,680

|

|

|

Linde plc

|

|

|

7,000

|

|

|

|

1,356,040

|

|

|

|

|

|

|

|

|

|

10,609,440

|

|

|

REAL ESTATE - 1.34%

|

|

|

|

|

|

|

|

|

|

American Tower Corporation

|

|

|

23,000

|

|

|

|

5,085,990

|

|

|

Crown Castle International Corp.

|

|

|

23,000

|

|

|

|

3,197,230

|

|

|

Equinix, Inc.

|

|

|

4,000

|

|

|

|

2,307,200

|

|

|

|

|

|

|

|

|

|

10,590,420

|

|

|

UTILITIES - 2.45%

|

|

|

|

|

|

|

|

|

|

American Electric Power Company, Inc.

|

|

|

28,000

|

|

|

|

2,623,320

|

|

|

Dominion Energy, Inc.

|

|

|

30,000

|

|

|

|

2,431,200

|

|

|

DTE Energy Company

|

|

|

12,000

|

|

|

|

1,595,520

|

|

|

Exelon Corporation

|

|

|

60,000

|

|

|

|

2,898,600

|

|

|

NextEra Energy, Inc.

|

|

|

18,000

|

|

|

|

4,193,820

|

|

|

Public Service Enterprise Group Incorporated

|

|

|

25,000

|

|

|

|

1,552,000

|

|

|

Sempra Energy

|

|

|

15,000

|

|

|

|

2,214,150

|

|

See accompanying notes to schedule of investments.

|

CORNERSTONE STRATEGIC VALUE FUND, INC.

|

|

SCHEDULE OF INVESTMENTS - SEPTEMBER 30, 2019 (Unaudited)(Concluded)

|

|

Description

|

|

No. of Shares

|

|

|

Value

|

|

|

UTILITIES - 2.45% (Continued)

|

|

|

|

|

|

|

|

|

|

Xcel Energy Inc.

|

|

|

30,000

|

|

|

$

|

1,946,700

|

|

|

|

|

|

|

|

|

|

19,455,310

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL EQUITY SECURITIES (cost - $675,928,214)

|

|

|

|

|

|

|

785,218,652

|

|

|

|

|

|

|

|

|

|

|

|

|

SHORT-TERM INVESTMENT - 0.73%

|

|

|

|

|

|

|

|

|

|

MONEY MARKET FUND - 0.73%

|

|

|

|

|

|

|

|

|

|

Fidelity Institutional Money Market Government Portfolio - Class I, 1.86% ^ (cost - $5,784,410)

|

|

|

5,784,410

|

|

|

|

5,784,410

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL INVESTMENTS - 99.88% (cost - $681,712,624)

|

|

|

|

|

|

|

791,003,062

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER ASSETS IN EXCESS OF LIABILITIES - 0.12%

|

|

|

|

|

|

|

953,234

|

|

|

|

|

|

|

|

|

|

|

|

|

NET ASSETS - 100.00%

|

|

|

|

|

|

$

|

791,956,296

|

|

|

*

|

Non-income producing security.

|

|

^

|

The rate shown is the 7-day effective yield as of September 30, 2019.

|

See accompanying notes to schedule of investments.

CORNERSTONE STRATEGIC VALUE FUND, INC.

NOTES TO SCHEDULE OF INVESTMENTS

SEPTEMBER 30, 2019 (Unaudited)

Federal Income Tax Cost: The following

information is computed on a tax basis for each item as of September 30, 2019:

|

Cost of portfolio investments

|

|

$

|

682,705,262

|

|

|

Gross unrealized appreciation

|

|

$

|

123,554,614

|

|

|

Gross unrealized depreciation

|

|

|

(15,256,814

|

)

|

|

Net unrealized appreciation

|

|

$

|

108,297,800

|

|

The difference between the federal income

tax cost of portfolio investments and the Schedule of Investments cost for Cornerstone Strategic Value Fund, Inc. (the “Fund”)

is due to certain timing differences in the recognition of capital gains or losses under income tax regulations and generally accepted

accounting principles. These "book/tax" differences are temporary in nature and are due to the tax deferral of losses

on wash sales.

As required by the Fair Value Measurement

and Disclosures Topic of the Financial Accounting Standards Board ("FASB") Accounting Standards Codification, the Fund

has performed an analysis of all assets and liabilities measured at fair value to determine the significance and character of all

inputs to their fair value determination.

The fair value hierarchy prioritizes

the inputs to valuation techniques used to measure fair value into the following three broad categories:

• Level

1 - quoted unadjusted prices for identical instruments in active markets to which the Fund has access at the date of measurement.

• Level

2 - quoted prices for similar instruments in active markets; quoted prices for identical or similar instruments in markets that

are not active; and model-derived valuations in which all significant inputs and significant value drivers are observable in active

markets. Level 2 inputs are those in markets for which there are few transactions, the prices are not current, little public information

exists or instances where prices vary substantially over time or among brokered market makers.

• Level

3 - model derived valuations in which one or more significant inputs or significant value drivers are unobservable. Unobservable

inputs are those inputs that reflect the Fund's own assumptions that market participants would use to price the asset or liability

based on the best available information.

The following is a summary of the inputs

used as of September 30, 2019 in valuing the Fund's investments carried at value:

|

VALUTION INPUTS

|

|

INVESTMENTS IN SECURITIES

|

|

|

OTHER FINANCIAL INSTRUMENTS*

|

|

|

Level 1 - Quoted Prices

|

|

|

|

|

|

|

|

|

|

Equity Securities

|

|

$

|

785,218,652

|

|

|

$

|

-

|

|

|

Short-Term Investment

|

|

|

5,784,410

|

|

|

|

-

|

|

|

Level 2 - Other Significant Observable Inputs

|

|

|

-

|

|

|

|

-

|

|

|

Level 3 - Significant Unobservable Inputs

|

|

|

-

|

|

|

|

-

|

|

|

Total

|

|

$

|

791,003,062

|

|

|

$

|

-

|

|

|

|

*

|

Other financial instruments include futures, forwards

and swap contracts, if any.

|

CORNERSTONE STRATEGIC VALUE FUND,

INC.

NOTES TO SCHEDULE OF INVESTMENTS

(Continued)

The breakdown of the Fund’s investments

into major categories is disclosed in its Schedule of Investments.

The Fund did not have any assets or liabilities

that were measured at fair value on a recurring basis using significant unobservable inputs (Level 3) at September 30, 2019.

The Fund is exposed to financial market

risks, including the valuations of its investment portfolio. During the period ended September 30, 2019, the Fund did not engage

in derivative instruments and other hedging activities.

The Fund has evaluated the need for additional

disclosures and/or adjustments resulting through the date its financial statements were issued. Based on this evaluation, no additional

disclosures or adjustments were required to such Schedule of Investments.

Securities valuation policies and other

investment related disclosures are hereby incorporated by reference to the Fund's semi-annual report previously filed with the

Securities and Exchange Commission on the Form N-CSRS on August 28, 2019 with a file number 811-05150.

Other information regarding the Fund

is available in the Fund’s most recent annual report. This information is also available on the Fund’s website at www.cornerstonestrategicvaluefund.com;

or on the website of the Securities and Exchange Commission at www.sec.gov.

|

|

Item 2.

|

Controls and Procedures.

|

(a) Based on their evaluation of the registrant’s

disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940) as of a date within 90

days of the filing date of this report, the registrant’s principal executive officer and principal financial officer have

concluded that such disclosure controls and procedures are reasonably designed and are operating effectively to ensure that material

information relating to the registrant, including its consolidated subsidiaries, is made known to them by others within those entities,

particularly during the period in which this report is being prepared, and that such information is recorded, processed, summarized,

and reported on a timely basis.

(b) There were no changes in the registrant’s

internal control over financial reporting (as defined in Rule 30a-3(d) under the Investment Company Act of 1940) that occurred

during the registrant’s last fiscal quarter that have materially affected, or are reasonably likely to materially affect,

the registrant’s internal control over financial reporting.

File as exhibits as part of this Form a separate

certification for each principal executive officer and principal financial officer of the registrant as required by Rule 30a-2(a)

under the Act (17 CFR 270.30a-2(a)): Attached hereto

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

|

(Registrant)

|

Cornerstone Strategic Value Fund, Inc.

|

|

|

|

|

|

|

|

By (Signature and Title)*

|

/s/ Ralph W. Bradshaw

|

|

|

|

|

Ralph W. Bradshaw, Chairman and President

|

|

|

|

|

(Principal Executive Officer)

|

|

|

|

|

|

|

|

Date

|

November 21, 2019

|

|

|

|

|

|

|

|

|

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

|

|

|

|

|

|

|

By (Signature and Title)*

|

/s/ Ralph W. Bradshaw

|

|

|

|

|

Ralph W. Bradshaw, Chairman and President

|

|

|

|

|

(Principal Executive Officer)

|

|

|

|

|

|

|

|

Date

|

November 21, 2019

|

|

|

|

|

|

|

|

|

By (Signature and Title)*

|

/s/ Theresa M. Bridge

|

|

|

|

|

Theresa M. Bridge, Treasurer

|

|

|

|

|

(Principal Financial Officer)

|

|

|

|

|

|

|

|

Date

|

November 21, 2019

|

|

|

|

|

*

|

Print the name and title of each signing officer under

his or her signature.

|

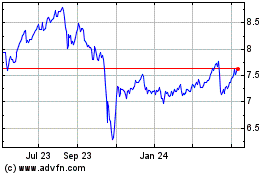

Cornerstone Strategic Va... (AMEX:CLM)

Historical Stock Chart

From Mar 2024 to Apr 2024

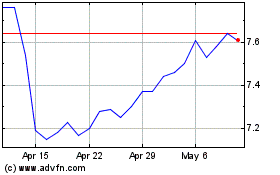

Cornerstone Strategic Va... (AMEX:CLM)

Historical Stock Chart

From Apr 2023 to Apr 2024