UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

☑ | | | Filed by the Registrant | | | ☐ | | | Filed by a Party other than the Registrant |

Check the appropriate box: |

☑ | | | Preliminary Proxy Statement |

☐ | | | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☐ | | | Definitive Proxy Statement |

☐ | | | Definitive Additional Materials |

☐ | | | Soliciting Material Under §240.14a-12 |

Owlet, Inc.

(Name of Registrant as Specified in its Charter)

_________________________________________________________

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

| | | | | | | | |

| Payment of Filing Fee (Check all boxes that apply): |

| |

☒ | | No fee required. |

| |

☐ | | Fee paid previously with preliminary materials. |

| |

☐ | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Owlet, Inc.

3300 North Ashton Boulevard, Suite 300

Lehi, Utah 84043

[ ], 2023

Dear Fellow Stockholders:

I am pleased to invite you to attend the 2023 Annual Meeting of Stockholders (the “Annual Meeting”) of Owlet, Inc. on Friday, June 23, 2023 at 1:00 p.m. (Eastern Time). Our Annual Meeting will be completely virtual, and you will not be able to attend the Annual Meeting in person. We believe this format will provide a consistent experience for our stockholders and allows all stockholders with Internet connectivity to participate in the Annual Meeting regardless of location. Our Annual Meeting will be conducted via live webcast, and you can access the Annual Meeting at www.virtualshareholdermeeting.com/OWLT2023.

We are using the “Notice and Access” method of providing proxy materials to our stockholders by electronic delivery via the Internet. We believe electronic delivery expedites your receipt of and provides convenient access to our proxy materials, reduces the environmental impact of the Annual Meeting and reduces proxy material printing and distribution costs. Under this method, we have sent a Notice of Internet Availability of Proxy Materials (the “Notice & Access Card”) to stockholders of record as of the close of business on April 24, 2023 (the “Record Date”). The notice contains instructions on how to access our 2023 Proxy Statement (the “Proxy Statement”) and 2022 Annual Report and vote electronically on the Internet. This notice and our Proxy Statement also contain instructions on how to request and receive a printed copy of our proxy materials if you prefer.

To attend and participate in the Annual Meeting, visit www.virtualshareholdermeeting.com/OWLT2023 or follow the instructions provided by your bank or broker. Please be advised that only stockholders who held Owlet shares as of the close of business on the Record Date are entitled to notice of and will be permitted to participate and vote at the Annual Meeting. Your proxy card, voting instruction form or Notice & Access Card will include a 16-digit control number. Upon entering your control number online, you will receive further instructions, including unique hyperlinks that will allow you to access, submit questions and vote at the virtual Annual Meeting.

Whether or not you plan to attend the Annual Meeting, we encourage you to vote. It is important that your shares be represented and voted at the Annual Meeting. Please promptly cast your vote by telephone or electronically via the Internet, or, if you requested to receive printed proxy materials, by completing and returning your signed proxy card in the enclosed postage-paid envelope or to the address indicated on your proxy card or voting instruction form. Voting electronically, by telephone or by returning your proxy card does not deprive you of the right to attend the Annual Meeting virtually and vote your shares during the Annual Meeting for the business matters acted upon. Additional attendance, participation and voting information is included in the Proxy Statement and with your proxy materials.

As co-founder and President and Chief Executive Officer of Owlet, I am inspired by our customers and deeply committed to helping parents find joy and extra peace of mind in parenting through our connected and accessible nursery ecosystem. As you know, Owlet became a publicly traded company in July 2021, and we are incredibly proud of our resilient team and how we navigated those challenges while executing our mission and remaining focused on Owlet’s growth. On behalf of the Board of Directors and management, we appreciate your continued support, confidence and investment in Owlet, Inc.

| | | | | | | | | | | |

| | |

|

| | | Kurt Workman |

| | | Co-Founder, President & Chief Executive Officer and Director |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

Friday, June 23, 2023, 1:00 p.m. (Eastern Time)

Virtual Meeting Only – No Physical Meeting Location

The 2023 Annual Meeting of Stockholders (the “Annual Meeting”) of Owlet, Inc. (the “Company”) will be held on Friday, June 23, 2023, at 1:00 p.m. (Eastern Time). The Annual Meeting will be completely virtual, and you will not be able to attend the Annual Meeting in person. The Annual Meeting will be conducted via live webcast at www.virtualshareholdermeeting.com/OWLT2023, and stockholders will be able to attend, vote and submit questions via the Internet during the webcast.

| | | | | | | | |

| 1. | Elect Jayson Knafel and Kurt Workman as Class II directors to hold office until the Company’s 2026 annual meeting of stockholders and until their respective successors have been duly elected and qualified; |

| | |

| 2. | Approve amendments to the Company’s Second Amended and Restated Certificate of Incorporation to effect a reverse stock split of the Company’s Class A common stock, par value $0.0001 per share (“Common Stock”), at a ratio ranging from any whole number between 1-for-10 to 1-for-20, inclusive, with such ratio to be determined at the discretion of the Company’s Board of Directors and reduce the number of authorized shares of Common Stock and unissued authorized shares of the Company’s preferred stock, par value $0.0001 per share (the “Preferred Stock”); |

| | |

| 3. | Approve, as a “change of control” of the Company for purposes of Section 312.03(d) of the New York Stock Exchange Listed Company Manual, the issuance of Common Stock upon conversion of shares of the Company’s Series A convertible preferred stock, par value $0.0001 per share (“Series A Preferred Stock”) and exercise of warrants issued and sold to Eclipse Ventures LLC as described herein; |

| | |

| 4. | Ratify the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for 2023; and |

| | |

| 5. | Transact such other business as may properly come before the Annual Meeting or any continuation, postponement or adjournment thereof. |

The record date for the Annual Meeting is April 24, 2023 (“Record Date”). Only holders of shares of Common Stock and Series A Preferred Stock as of the close of business on the Record Date are entitled to notice of the Annual Meeting and to vote on all business transacted at the Annual Meeting or any continuation, postponement or adjournment thereof. A complete list of such stockholders will be open to the examination of any stockholder for a period of ten days prior to the Annual Meeting for a purpose germane to the meeting by sending an email to the Company at legal@owletcare.com, stating the purpose of the request and providing proof of ownership of Company stock. The list of these stockholders will also be available on the bottom of your screen during the Annual Meeting after entering the 16-digit control number included on your Notice of Internet Availability of Proxy Materials, on your proxy card or on the instructions that accompanied your proxy materials.

Your vote is important. Voting your shares will ensure the presence of a quorum at the Annual Meeting and will save the Company the expense of further solicitation. Stockholders are encouraged to attend, participate in and vote at the virtual Annual Meeting via the live webcast. Whether or not you plan to attend the virtual Annual Meeting, your vote is important. Please promptly complete and return your signed proxy card in the enclosed

envelope or submit your proxy by telephone or via the Internet as described on your proxy card or voting instruction form. As described in the 2023 Proxy Statement (the “Proxy Statement”), you may also vote electronically at the virtual Annual Meeting if you attend and participate in the virtual Annual Meeting.

| | | | | | | | |

Annual Meeting Attendance and Participation |

Please be advised that to attend and participate in the Annual Meeting, you must either visit www.virtualshareholdermeeting.com/OWLT2023 and enter the 16-digit control number (included on your proxy card or Notice of Internet Availability of Proxy Materials) or follow the instructions provided by your bank or broker. Upon entering your control number, you will receive further instructions, including unique hyperlinks that will allow you to access, submit questions and vote at the virtual Annual Meeting. If the shares you own are held in “street name” by a bank or brokerage firm, you must obtain a valid proxy from your bank or brokerage firm in order to submit your vote at the virtual Annual Meeting.

Please refer to the accompanying Proxy Statement for additional details and important information about the virtual Annual Meeting.

| | | | | | | | | | | |

| | | By Order of the Board of Directors: |

| | | |

| | | Kurt Workman |

| | | Co-Founder, President & Chief Executive Officer and Director |

| | | [ ], 2023 |

| | |

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held on June 23, 2023: This Notice of Annual Meeting of Stockholders, the 2023 Proxy Statement and the 2022 Annual Report to Stockholders are available free of charge at www.proxyvote.com. |

TABLE OF CONTENTS

| | | | | | | | |

| | Page |

| | 1 |

| | |

| | 1 |

| | |

| | 8 |

| | 8 |

| | 8 |

| | 8 |

| | 8 |

| | 11 |

| | |

| | 12 |

| | 12 |

| | 13 |

| | 14 |

| | 15 |

| | 15 |

| | 16 |

| | 20 |

| | 20 |

| | 21 |

| | 21 |

| | 21 |

| | 21 |

| | 22 |

| | 22 |

| | 23 |

| | |

| | 24 |

| | 24 |

| | 26 |

| | 28 |

| | 28 |

| | 28 |

| | |

| | 29 |

| | 29 |

| | 30 |

| | 30 |

| | 31 |

| | |

| | 31 |

| | | | | | | | |

| | |

| | 32 |

| | |

| | 32 |

| | 32 |

| | 33 |

| | 33 |

| | 34 |

| | 36 |

| | 36 |

| | 37 |

| | 38 |

| | 38 |

| | 38 |

| | 38 |

| | |

| | 39 |

| | 39 |

| | 42 |

| | 43 |

| | 44 |

| | |

| | 45 |

| | |

| | 46 |

| | 46 |

| | 48 |

| | |

| | 49 |

| | 49 |

| | 49 |

| | 51 |

| | |

| | 51 |

| | |

| | 52 |

| | |

| | 52 |

| | |

| | 52 |

| | |

| | A-1 |

Owlet, Inc.

3300 North Ashton Boulevard, Suite 300

Lehi, Utah 84043

PROXY STATEMENT

FOR THE 2023 ANNUAL MEETING OF STOCKHOLDERS

This 2023 proxy statement (the “Proxy Statement”) includes certain information about Owlet, Inc. (the “Company,” “Owlet,” “we,” “us” or “our”), and is being solicited by the Company’s Board of Directors (the “Board”), in connection with our 2023 Annual Meeting of Stockholders to be held virtually on Friday, June 23, 2023 at 1:00 p.m. (Eastern Time) and any continuation, postponement or adjournment thereof (the “Annual Meeting”). You should read this Proxy Statement carefully before voting at the Annual Meeting. For more complete information regarding Owlet’s 2022 performance, you are encouraged to review the Company’s 2022 Annual Report to Stockholders (the “2022 Annual Report”) or our Annual Report on Form 10-K for the fiscal year ended December 31, 2022 (the “2022 Form 10-K”).

References in this Proxy Statement to “Old Owlet” refer to Owlet Baby Care Inc., and “2022,” “2021” and other years refer to the Company’s fiscal year for the respective period indicated. Websites referenced throughout this Proxy Statement are provided for convenience only, and the content on the referenced websites does not constitute a part of, and is not incorporated by reference into, this Proxy Statement.

On or about [ ], 2023, this Proxy Statement and an accompanying proxy card will first be mailed to stockholders or made available to stockholders electronically via the Internet at www.proxyvote.com and on our Investor Relations website at www.investors.owletcare.com. Our website is not part of this Proxy Statement; references to our website address in this Proxy Statement are intended to be inactive textual references only.

INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

When and where will the Annual Meeting be held?

The Annual Meeting will be held on Friday, June 23, 2023 at 1:00 p.m. (Eastern Time). The Annual Meeting will be a virtual meeting that will be conducted via live webcast. You will be able to attend the Annual Meeting online and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/OWLT2023 and entering your 16-digit control number included in your Notice of Internet Availability of Proxy Materials (the “Notice & Access Card”), on your proxy card or on the instructions that accompanied your proxy materials. If you lose your 16-digit control number, you may join the Annual Meeting as a “Guest” but you will not be able to vote, ask questions or access the list of stockholders as of the close of business on the April 24, 2023 record date (the “Record Date”).

Why is the Company holding a virtual meeting?

We want to use the latest technology to provide expanded access, improved communication and cost savings for the Company and our stockholders while providing stockholders the same rights and opportunities to participate as they would have at an in-person meeting. Furthermore, we believe this format will provide a consistent experience to our stockholders, allow stockholders with Internet connectivity to participate in the Annual Meeting regardless of location and a virtual meeting enable increased stockholder attendance and participation because stockholders can participate from any location around the world.

How do I attend the Annual Meeting?

To attend and participate in the Annual Meeting, you will need the 16-digit control number included on your proxy card or Notice & Access Card that accompanied your proxy materials. If your shares are held in “street name,” you should contact your bank, broker or other nominee to obtain your 16-digit control number or otherwise vote through the bank or broker. If you lose your 16-digit control number, you may join the Annual Meeting as a “Guest” but you will not be able to vote, ask questions or access the list of stockholders as of the Record Date. The meeting webcast will begin promptly at 1:00 p.m. (Eastern Time). We encourage you to

access the meeting prior to the start time, and please refer to the proxy materials and visit www.virtualshareholdermeeting.com/OWLT2023 for additional information regarding online check-in times and procedures.

We will be hosting the Annual Meeting live via audio webcast. Any stockholder can attend the Annual Meeting live online at www.virtualshareholdermeeting.com/OWLT2023. If you were a stockholder as of the Record Date, or you hold a valid proxy for the Annual Meeting, you can vote at the Annual Meeting. A summary of the information you need to attend the Annual Meeting online is provided below:

| | | | | | | | |

| • | Instructions on how to attend and participate via the Internet, including how to demonstrate proof of stock ownership, are posted at www.virtualshareholdermeeting.com/OWLT2023. |

| | |

| • | Assistance with questions regarding how to attend and participate via the Internet will be provided at www.virtualshareholdermeeting.com/OWLT2023 on the day of the Annual Meeting. |

| | |

| • | Webcast starts at 1:00 p.m. (Eastern Time). |

| | |

| • | You will need your 16-digit control number to enter the Annual Meeting. |

| | |

| • | Stockholders may submit questions while attending the Annual Meeting via the Internet. |

What am I being asked to vote on at the Annual Meeting?

You are being asked to vote on the following four proposals described in this Proxy Statement:

| | | | | | | | |

| Proposal 1: | Elect Jayson Knafel and Kurt Workman as Class II directors to hold office until the Company’s 2026 annual meeting of stockholders and until their respective successors have been duly elected and qualified. |

| | |

| Proposal 2: | Approve amendments to the Company’s Second Amended and Restated Certificate of Incorporation to effect a reverse stock split of the Company’s Class A common stock, par value $0.0001 per share (“Common Stock”), at a ratio ranging from any whole number between 1-for-10 to 1-for-20, inclusive, with such ratio to be determined at the discretion of the Board and reduce the number of authorized shares of Common Stock and unissued authorized shares of the Company’s preferred stock, par value $0.0001 per share (the “Preferred Stock”). |

| | |

| Proposal 3: | Approve, as a “change of control” of the Company for purposes of Section 312.03(d) of the New York Stock Exchange Listed Company Manual, the issuance of Common Stock upon conversion of shares of the Company’s Series A convertible preferred stock, par value $0.0001 per share (“Series A Preferred Stock”) and exercise of warrants issued and sold to Eclipse Ventures LLC (“Eclipse”) as described herein (the “Eclipse Ownership Proposal”). |

| | |

| Proposal 4: | Ratification of the appointment of PricewaterhouseCoopers LLP (“PwC”) as our independent registered public accounting firm for 2023. |

Could other matters be decided at the Annual Meeting?

At the date of this Proxy Statement, we do not know of any matters to be raised at the Annual Meeting other than those referred to in this Proxy Statement. If other matters are properly presented at the Annual Meeting or any adjournment or postponement thereof for consideration, and you are a registered stockholder and have submitted a proxy card, the persons named in your proxy card (the “Named Proxies”) will have the discretion to vote on those matters for you.

When is the Record Date, and who is entitled to vote?

All holders of record of shares of Common Stock and Series A Preferred Stock at the close of business on April 24, 2023 are entitled to notice of and to vote at the Annual Meeting and any continuation, postponement or adjournment thereof. Except as otherwise provided in the certificate of designation relating to the Series A Preferred Stock or as required by law, holders of shares of Series A Preferred Stock are entitled to vote with the holders of shares of Common Stock (and any other class or series that may similarly be entitled to vote with the holders of Common Stock) and not as a separate class, at any annual or special meeting of stockholders of the Company.

At the close of business on the Record Date, there were 117,672,234 shares of our Common Stock issued and outstanding and entitled to vote. At the close of business on the Record Date, there were 30,000 shares of Series A Preferred Stock issued and outstanding, representing 38,276,768 in voting power entitled to vote.

Each share of Common Stock entitles its holder to one vote and each share of Series A Preferred Stock entitles its holder to a number of votes equal to the whole number of shares of Common Stock into which a share of Series A Preferred Stock can be converted, subject to the Share Cap (as defined below). As described in Proposal 3 below, Eclipse is not currently permitted to vote shares of Series A Preferred Stock it holds to the extent such shares would result in Eclipse beneficially owning more than 29.99% of our Common Stock (the “Share Cap”), provided that all outstanding Series A Preferred Stock and all of the shares of Common Stock underlying such Series A Preferred Stock are deemed to be outstanding for such calculation (but, in the case of Eclipse, only up to the Share Cap) and no unexercised rights, options, warrants or conversion privileges to acquire shares of Common Stock are included.

How do I vote my shares without attending the Annual Meeting?

You may vote your shares prior to the Annual Meeting in any of the following three ways:

| | | | | | | | |

| • | Internet — Visit www.proxyvote.com or the website shown on your Notice & Access Card, proxy card or voting instruction form, and follow the instructions on how to vote your shares and complete an electronic proxy card. You will need the 16-digit control number included on your Notice & Access Card to vote by Internet. |

| | |

| • | Telephone — Call 800-690-6903 or the toll-free telephone number shown on your Notice & Access Card, proxy card or voting instruction form. You will need the 16-digit control number included on your Notice & Access Card to vote by telephone. |

| | |

| • | Mail — Complete, sign and date your proxy card where indicated, and return the proxy card in the postage-paid envelope provided to you. You should sign your name exactly has it appears on the proxy card. If you are signing in a representative capacity (for example, as a guardian, executor, trustee, custodian, attorney or officer of a corporation), indicate your name and title or capacity. |

If your shares are held in the name of a bank, broker or other nominee, you will receive instructions on how to vote from the bank, broker or other nominee. You must follow the instructions of such bank, broker or other nominee in order for your shares to be voted.

How do I vote my shares during the Annual Meeting?

You may vote your shares electronically during the virtual Annual Meeting, even if you have previously submitted your vote. To vote at the Annual Meeting, you must attend the Annual Meeting. To attend and participate in the Annual Meeting, you must either visit www.virtualshareholdermeeting.com/OWLT2023 and enter the 16-digit control number (included on your proxy card or Notice of Internet Availability of Proxy Materials) or follow the instructions provided by your bank or broker. Upon entering your control number at www.virtualshareholdermeeting.com/OWLT2023, you will receive further instructions, including unique hyperlinks that will allow you to access, submit questions and vote at the virtual Annual Meeting. If the shares you own are held in “street name” by a bank or brokerage firm, you must obtain a valid proxy from your bank or brokerage firm in order to submit your vote at the virtual Annual Meeting.

What is the deadline for submitting a proxy?

In order to be counted, proxies submitted by beneficial owners via the Internet and telephone voting facilities will close for stockholders of record as of the Record Date at 11:59 p.m. (Eastern Time) on June 22, 2023. Proxy cards with respect to shares held of record must be received prior to the start of the Annual Meeting.

How does the Board recommend that I vote?

The Board recommends that you vote:

| | | | | | | | |

| • | FOR the each of the Class II director nominees to the Board set forth in this Proxy Statement. |

| | |

| • | FOR the amendments to the Company’s Second Amended and Restated Certificate of Incorporation to effect a reverse stock split of Common Stock, at a ratio ranging from any whole number between 1-for-10 to 1-for-20, inclusive, with such ratio to be determined at the discretion of the Board and reduce the number of authorized shares of Common Stock and the number of unissued authorized shares of Preferred Stock. |

| | |

| • | FOR the approval, as a “change of control” of the Company for purposes of Section 312.03(d) of the New York Stock Exchange Listed Company Manual, of the issuance of Common Stock upon conversion of shares of Series A Preferred Stock and exercise of warrants issued and sold to Eclipse in excess of the Share Cap. |

| | |

| • | FOR the ratification of the appointment of PwC as our independent registered public accounting firm for 2023. |

How many votes are required to approve each proposal?

| | | | | | | | |

| Proposal 1: | Our directors are elected by a plurality of the votes cast. This means that the director nominees receiving the highest number of affirmative “FOR” votes cast, by holders of shares of our Common Stock and shares of our Series A Preferred Stock voting on an as-converted-to-Common Stock basis (not to exceed the Share Cap as described below), voting together as a single class, even if less than a majority, will be elected. Votes that are “withheld” will have the same effect as an abstention and will not count as a vote “FOR” or “AGAINST” a director nominee because directors are elected by plurality voting. Because this proposal is not considered a discretionary matter, brokers lack authority to exercise their discretion to vote uninstructed shares on this proposal. Any broker non-votes will have no effect on the outcome of this proposal. There is no cumulative voting. |

| | |

| Proposal 2: | The proposal to approve amendments to the Company’s Second Amended and Restated Certificate of Incorporation (“Certificate of Incorporation”) to effect a reverse stock split of our Common Stock, at a ratio ranging from any whole number between 1-for-10 to 1-for-20, inclusive, with such ratio to be determined at the discretion of the Board and reduce the number of authorized shares of our Common Stock and unissued authorized shares of our Preferred Stock requires the affirmative vote of the holders of a majority in voting power of the outstanding shares of our Common Stock and our Series A Preferred Stock, voting on an as-converted-to-Common Stock basis (not to exceed the Share Cap as described below) entitled to vote on the proposal, voting together as a single class. A vote marked as an “abstention” will have the same effect as a vote against this proposal. Because this proposal is considered a discretionary matter, brokers are permitted to exercise their discretion to vote uninstructed shares on this proposal, and we do not expect any broker non-votes on this proposal. However, if there are any broker non-votes, they will have the same effect as a vote against this proposal. |

| | |

| Proposal 3: | The proposal to approve the issuance of Common Stock upon conversion of shares of Series A Preferred Stock or exercise of warrants issued and sold to Eclipse as described herein requires the affirmative vote of a majority in voting power of the votes cast (excluding abstentions and broker non-votes) by holders of shares of our Common Stock and shares of our Series A Preferred Stock voting on an as-converted-to-Common Stock basis (not to exceed the Share Cap as described below), voting together as a single class. A vote marked as an “abstention” is not considered a vote cast and will, therefore, not affect the outcome of this proposal. Because this proposal is not considered a discretionary matter, brokers lack authority to exercise their discretion to vote uninstructed shares on this proposal. Any broker non-votes will have no effect on the outcome of this proposal. |

| | | | | | | | |

| | |

| Proposal 4: | The proposal to ratify the appointment of PwC as our independent registered public accounting firm for 2023 requires the affirmative vote of the holders of a majority in voting power of the votes cast (excluding abstentions and broker non-votes) on such matter by holders of shares of our Common Stock and shares of our Series A Preferred Stock voting on an as-converted-to-Common Stock basis (not to exceed the Share Cap as described below), voting together as a single class. A vote marked as an “abstention” is not considered a vote cast and will, therefore, not affect the outcome of this proposal. Also, because this proposal is considered a discretionary matter, brokers are permitted to exercise their discretion to vote uninstructed shares on this proposal, and we do not expect any broker non-votes on this matter. However, if there are any broker non-votes, they will have no effect on the outcome of this proposal. |

What if I do not specify how my shares are to be voted?

If you submit your proxy card but do not indicate any voting instructions, the Company, by way of the Named Proxies, will vote your shares FOR the election of each of the Class II director nominees named in Proposal 1 and FOR Proposals 2, 3 and 4.

Can I change my vote after I have delivered my proxy card or voting instruction form?

Yes. Regardless of whether you voted by Internet, telephone or mail, if you are a registered stockholder, you may change your vote and revoke your proxy by taking one of the following actions:

| | | | | | | | |

| • | Delivering a written notice of revocation to our Chief Legal Officer at our principal executive offices (our address is provided under the “Principal Executive Offices” section), provided such statement is received no later than June 22, 2023. |

| | |

| • | Voting again by Internet or telephone at a later time but before the closing of those voting facilities at 11:59 p.m. (Eastern Time) on June 22, 2023. |

| | |

| • | Submitting a properly signed proxy card with a later date that is received by the Company no later than June 22, 2023. |

| | |

| • | Attending the Annual Meeting and voting during the Annual Meeting live webcast. |

Your most recent proxy card or telephone or Internet proxy is the one that is counted. Your attendance at the Annual Meeting by itself will not revoke your proxy unless you give written notice of revocation to the Company’s Chief Legal Officer before your proxy is voted or you vote online at the Annual Meeting.

If your shares are held in street name, please refer to information from your bank, broker or other nominee on how to revoke or submit new voting instructions.

What is the difference between a registered stockholder and a beneficial owner or “street name” holder?

If your shares are registered in your name directly with Continental Stock Transfer & Trust Company, our stock transfer agent, you are considered a stockholder of record, or a registered stockholder, of those shares.

If your shares are held on your behalf by a broker, bank or other nominee, you are considered the beneficial owner of those shares, and your shares are said to be held in “street name.” With respect to those shares, your bank, broker or other nominee is considered the registered stockholder and should provide you with a Notice & Access Card or voting instruction form for you to use in directing the bank, broker or other nominee on how to vote your shares. Please refer to the information from your bank, broker or other nominee on how to submit your voting instructions.

What constitutes a quorum?

A quorum must be present at the Annual Meeting for any business to be conducted. The holders of a majority in voting power of the stock issued and outstanding and entitled to vote, present in person, or by remote communication, if applicable, or represented by proxy, constitutes a quorum for the transaction of business at the Annual Meeting. If you sign and return your proxy card or authorize a proxy to vote electronically or telephonically, your shares will be counted to determine whether we have a quorum even if you abstain or fail to vote as indicated in the proxy materials. Broker non-votes are counted as present for purposes of determining whether a quorum is present at the Annual Meeting.

Virtual attendance of a stockholder at the Annual Meeting constitutes presence in person for purposes of determining whether a quorum is present at the Annual Meeting. Abstentions and broker non-votes (described below) will be included for purposes of determining whether a quorum is present at the Annual Meeting.

What if a quorum is not present at the Annual Meeting?

If a quorum is not present or represented at the scheduled time of the Annual Meeting, then (i) the chairperson of the Annual Meeting or (ii) a majority in voting power of the stockholders entitled to vote at the Annual Meeting, present in person or by remote communication, if applicable, or represented by proxy, may adjourn the Annual Meeting until a quorum is present or represented.

What are abstentions and broker non-votes?

Abstentions. If you specify on your proxy card that you “abstain” from voting on an item, your shares will be counted as present and entitled to vote for the purpose of establishing a quorum. Abstentions will have the same effect as an “against” vote on Proposal 2. Abstentions or votes “withheld” will not be included in the tabulation of voting results for Proposals 1, 3 and 4.

Broker Non-Votes. Generally, a broker non-vote occurs when shares held by a broker in “street name” for a beneficial owner are not voted with respect to a particular proposal because (i) the broker has not received voting instructions from the stockholder who beneficially owns the shares and (ii) the broker lacks discretionary voting power to vote those shares. A broker is entitled to vote shares held for a beneficial owner, without voting instructions from such beneficial owner, on routine matters, such as the approval of amendments to the Certificate of Incorporation to effect a reverse stock split of our Common Stock and a reduction of the number of authorized shares of our Common Stock and unissued authorized shares of our Preferred Stock (Proposal 2) and the ratification of the appointment of the Company’s independent registered public accounting firm (Proposal 4). On the other hand, the proposal regarding the election of directors (Proposal 1) and the proposal to approve the issuance of Common Stock upon conversion of shares of Series A Preferred Stock or exercise of warrants issued and sold to Eclipse Ventures LLC as described herein (Proposal 3) are each a non-routine matter and, absent voting instructions from the beneficial owner of such shares, your broker does not have discretion and is not entitled to vote shares held for a beneficial owner on such matters. Broker non-votes will have no effect on Proposals 1, 3 and 4, but any broker non-votes will have the same effect as a vote against Proposal 2.

Why did I receive a Notice of Internet Availability of Proxy Materials in the mail regarding the Internet availability of proxy materials instead of a paper copy of proxy materials?

The rules of the Securities and Exchange Commission (the “SEC”) permit us to furnish our proxy materials, including this Proxy Statement and the 2022 Annual Report, to our stockholders by providing access to such documents on the Internet instead of mailing printed copies. Stockholders will not receive paper copies of the proxy materials unless they request them. Instead, the Notice & Access Card provides instructions on how to access on the Internet all of the proxy materials. The Notice & Access Card also instructs you as to how to authorize via the Internet or telephone your proxy to vote your shares according to your voting instructions. If you would like to receive a paper or email copy of our proxy materials, you should follow the instructions for requesting such materials described in the Notice & Access Card.

What does it mean if I receive more than one Notice & Access Card or more than one set of proxy materials?

It means that your shares are held in more than one account at the transfer agent and/or with banks or brokers. Please vote all of your shares. To ensure that all of your shares are voted, for each Notice & Access Card or set of proxy materials, please submit your proxy by phone, via the Internet, or, if you received printed copies of the proxy materials, by signing, dating and returning the enclosed proxy card in the enclosed envelope.

What if during the check-in time or during the Annual Meeting I have technical difficulties or trouble accessing the virtual meeting website?

If you encounter any technical difficulties with accessing or participating in the Annual Meeting via the virtual meeting website on the meeting day, please contact technical support at the email address or telephone number displayed on the virtual Annual Meeting webpage on the www.virtualshareholdermeeting.com/OWLT2023 website.

Who will count the votes?

Representatives of Broadridge Investor Communications Services (“Broadridge”) will tabulate the votes, and a representative of Broadridge will act as inspector of election.

Who will pay for the cost of this proxy solicitation?

The Company will pay the cost of soliciting proxies. Proxies may be solicited on our behalf by directors, officers or employees (for no additional compensation) in person or by telephone, electronic transmission and facsimile transmission. Brokers and other nominees will be requested to solicit proxies or authorizations from beneficial owners and will be reimbursed for their reasonable expenses. We may also engage the services of a proxy solicitor to assist in the solicitation of proxies and provide related advice and informational support for a services fee and the reimbursement of customary disbursements that are not expected to exceed $15,000 in the aggregate.

Where can I find the voting results of the Annual Meeting?

We intend to announce the preliminary voting results at the Annual Meeting, and we expect to publish the final voting results in a Current Report on Form 8-K filed with the SEC within the four business day deadline of the Annual Meeting.

PROPOSAL 1 — ELECTION OF DIRECTORS

Board Size and Structure

Our Certificate of Incorporation provides that the number of directors shall be established from time to time by our Board of Directors. Our Board has fixed the number of directors at seven, and as of the date of this Proxy Statement, there are seven members of our Board of Directors.

Our Certificate of Incorporation provides that the Board be divided into three classes, designated as Class I, Class II and Class III. Each class of directors must stand for reelection no later than the third annual meeting of stockholders subsequent to their initial appointment or election to the Board, provided that the term of each director will continue until the election and qualification of his or her successor or his or her earlier death, resignation, disqualification or removal. Generally, subject to the Amended and Restated Stockholders Agreement described herein, vacancies or newly created directorships will be filled, upon the recommendation of the Nominating & Corporate Governance Committee, only by (i) the vote of a majority of the directors then in office, although less than a quorum, or (ii) a sole remaining director. A director appointed by the Board to fill a vacancy will hold office until the next election of the class for which such director was chosen, subject to the election and qualification of his or her successor and his or her earlier death, resignation, retirement, disqualification or removal.

Current Directors, Classes and Terms

Our current directors and their respective classes and terms are set forth below. The current term of the Class II directors ends at the Annual Meeting, and Class III and Class I at the 2024 and 2025 annual meeting of stockholders, respectively.

| | | | | | | | | | | | | | | | | | | | |

| CLASS I | | CLASS II | | CLASS III | |

| | | | | | |

| Zane M. Burke | | Jayson Knafel | | Laura J. Durr | |

| | | | | | |

| John C. Kim | | Kurt Workman | | Amy Nam McCullough | |

| | | | | | |

| | | | | Lior Susan | |

Nominees for Director

Messrs. Knafel and Workman have been, upon the recommendation of the Nominating & Corporate Governance Committee, nominated by the Board to stand for election. As the directors assigned to Class II, the current terms of service of Messrs. Knafel and Workman will expire at the Annual Meeting. If elected by the stockholders at the Annual Meeting, Messrs. Knafel and Workman will each serve for a term expiring at our annual meeting of stockholders to be held in 2026 (the “2026 Annual Meeting”) and the election and qualification of his successor or until his earlier death, resignation or removal.

Each person nominated for election has consented to be named and to serve as a director if elected at the Annual Meeting, and management has no reason to believe that any nominee will be unable to serve. If, however, prior to the Annual Meeting, the Board of Directors should learn that any nominee will be unable to serve for any reason, the proxies that otherwise would have been voted for this nominee will be voted for a substitute nominee as selected by the Board. Alternatively, the proxies, at the Board’s discretion, may be voted for that fewer number of nominees as results from the inability of any nominee to serve. The Board has no reason to believe that any of the nominees will be unable to serve.

Director & Director Nominee Qualifications and Biographical Information

The following pages contain professional and other biographical information (as of May 1, 2023) for each director nominee and each director whose term as a director will continue after the Annual Meeting, including all positions they hold, their principal occupation and business experience for the past five years, and the names of other publicly traded companies of which the director or nominee currently serves as a director or has served as a director during the past five years.

We believe that all of our directors and nominees possess the characteristics noted in our Corporate Governance Guidelines. In accordance with those guidelines, the Board and the Nominating Committee personal and professional integrity; satisfactory levels of education and/or business experience; broad-based business acumen; an appropriate level of understanding of our business and its industry and other industries relevant to our business; the ability and willingness to devote adequate time to the work of our Board of Directors and its committees, as applicable; skills and personality that complement those of our other directors that helps build a board that is effective, collegial and responsive to the needs of our Company; strategic thinking and a willingness to share ideas; a diversity of experiences, expertise and background; and the ability to represent the interests of all of our stockholders. The information presented below regarding each nominee and continuing director also sets forth specific experience, qualifications, attributes and skills that led our Board of Directors to the conclusion that such individual should serve as a director in light of our business and structure.

Nominees for Election to Three-Year Terms Expiring No Later than the 2026 Annual Meeting

| | | | | | | | | | | | | | | | | | | | |

Class II Directors | | Age | | Director Since | | Current Position at Owlet |

| | | | | | |

Jayson Knafel | | 29 | | 2023 | | Director |

| | | | | | |

Kurt Workman | | 33 | | 2021 | | Co-Founder, President and Chief Executive Officer and Director |

Jayson Knafel is a partner at Eclipse, a venture capital firm, where he leads the firm’s growth investment strategies and Eclipse Carbon Optimization. Mr. Knafel has worked at Eclipse since June 2021. In addition, Mr. Knafel served as the interim chief operating officer of Bright Machines, driving efficient and scalable processes across the global operations of the full-stack industrial automation company, from January 2022 to October 2022. Mr. Knafel was previously employed by Fidelity Investments as an Equity Research Associate and then as an Equity Research Analyst from 2015 to 2021, where he invested in global growth companies across sectors and stages of a company’s life cycle. Currently, Mr. Knafel also serves on the board of Axlehire, Inc. Mr. Knafel holds a Bachelor of Business Administration, Finance from University of Notre Dame. We believe Mr. Knafel is qualified to serve on our Board due to his significant experience investing in and working with technology companies.

Kurt Workman has served as our Chief Executive Officer since January 2021, as President since September 2022, and as a member of the Board since July 2021. Mr. Workman co-founded and served as the Chief Executive Officer of Owlet Baby Care Inc. (“Old Owlet”) from the company’s founding in 2012 until December 2019. During his tenure as chief executive officer of Old Owlet, Mr. Workman led the company’s growth from its inception and was instrumental in overseeing the research and development of several of the company’s key product offerings, including the iconic Owlet Smart Sock, Owlet Cam and the Owlet Band. He also served as a member of Old Owlet’s board of directors from when he co-founded the Company in 2012 to July 2021. Mr. Workman also studied chemical engineering at Brigham Young University. We believe Mr. Workman’s intimate knowledge of Owlet and his proven success building and overseeing Owlet’s growth and development make him qualified to serve as a member of the Board.

Class III Directors Whose Terms Expire at the 2024 Annual Meeting of Stockholders

| | | | | | | | | | | | | | | | | | | | |

Class III Directors | | Age | | Director Since | | Current Position at Owlet |

| | | | | | |

| Laura J. Durr | | 62 | | 2021 | | Director |

| | | | | | |

| Amy Nam McCullough | | 43 | | 2018 | | Director |

| | | | | | |

| Lior Susan | | 39 | | 2015 | | Chairman of the Board |

Laura J. Durr served on the board of directors of Old Owlet from February 2021 to July 2021 and has been a member of our Board since July 2021. Ms. Durr was previously an Executive Vice President and Chief Financial Officer of Polycom, Inc. from May 2014 until its acquisition by Plantronics, Inc. in July 2018. Prior to holding that role, Ms. Durr held various finance leadership roles at Polycom between 2004 and 2014, including Senior Vice President of Worldwide Finance, Chief Accounting Officer and Worldwide Controller. Prior to her tenure with Polycom, Ms. Durr held executive positions in finance and administration at Lucent Technologies, Inc. and International Network Services Inc. and also worked for six years at Price Waterhouse LLP. Ms. Durr has served as a director and chairperson of the audit committee of Xperi Inc. and Netgear, Inc., since September 2022 and January 2020, respectively. She previously served as a director of TiVo Corporation from April 2019 until its merger with Xperi Holding Corporation in June 2020, and served as a director of Xperi Holding Corporation from June 2020 until its spin-off of its former subsidiary, Xperi Inc. in October 2022. Ms. Durr was a certified public accountant and holds a Bachelor of Science in Accounting from San Jose State University. We believe Ms. Durr is qualified to serve as a member of our Board because she can provide valuable operational and strategic experience and insight, given her background in finance and strategy for leading Silicon Valley technology companies.

Amy Nam McCullough served on the board of directors of Old Owlet from April 2018 to July 2021 and has served on the Board since July 2021. Ms. McCullough is the President and Managing Director of Trilogy Equity Partners, LLC (“Trilogy”), an early-stage venture capital firm. Ms. McCullough has been a member of the investment team at Trilogy for the last 16 years and has served in her current role for the last seven years. She leads the investment team and is a member of Trilogy’s board of managers, which sets the strategic direction of the fund. Also, Ms. McCullough currently serves on the board of directors of several privately held companies, including Skilljar, Inc., Boundless Immigration, Inc., and Bluejay Labs, Inc. (doing business as Showdigs) and Guide Care Inc. (doing business as Alongside). She is also a board observer at Tacita Inc. (doing business as Bright Canary). Prior to her tenure at Trilogy Equity Partners, Ms. McCullough spent four years as an equity research analyst for JPMorgan Chase and was a member of the team that covered the small and mid-cap applied technologies sector for the firm. Ms. McCullough began her career on the treasury operations team within the portfolio management group at Microsoft Corporation and has experience working in both corporate treasury and financial analysis roles. She is a member of the Board of Trustees of Epiphany School, an independent elementary school in Seattle. Ms. McCullough received her Bachelor of Arts in Business Administration with a focus in Finance from the University of Washington. We believe Ms. McCullough is qualified to serve as a member of our Board due to her significant financial services and investing experience with technology companies and her broad leadership experience.

Lior Susan served on the board of directors of Old Owlet from July 2015 to July 2021 and has been Chairman of the Board since July 2021. Mr. Susan is the founder and Managing Partner of Eclipse Ventures, LLC, a venture capital firm. Prior to founding Eclipse Ventures in 2015, Mr. Susan founded and managed the hardware investment and incubation platform of Flex Ltd., a multinational electronics contract manufacturer, where he gained knowledge of and experience with scaling manufacturing operations for medical device companies. Before relocating to the United States from Israel, Mr. Susan was an entrepreneur and former member of a special forces unit within the Israel Defense Forces. Mr. Susan currently serves on the boards of privately-held Bright Machines, Inc., Augury, Inc., Metrolink, Inc., Cybertoka Ltd., Dutch Pet, Inc., SkyRyse, Inc., Senser, Ltd. and InsidePacket, Ltd. He previously served as a director of Lucira Health, Inc. from August 2020 until December 2022. We believe Mr. Susan is qualified to serve as a member of our Board due to his significant experience investing in and working with technology companies, including as a board member.

Class I Directors Whose Terms Expire at the 2025 Annual Meeting of Stockholders

| | | | | | | | | | | | | | | | | | | | |

Class I Directors | | Age | | Director Since | | Current Position at Owlet |

| | | | | | |

| Zane M. Burke | | 57 | | 2021 | | Director |

| | | | | | |

John C. Kim | | 52 | | 2021 | | Director |

Zane M. Burke served on the board of directors of Old Owlet from March 2021 to July 2021 and has served on the Board since July 2021. Since September 2021, Mr. Burke has served as the Chief Executive Officer of Quantum Health, Inc. Prior to joining Quantum Health, Mr. Burke was the Chief Executive Officer of Livongo Health, now an affiliate of Teladoc Health, Inc., from February 2019 to November 2020. Prior to his role with Livongo Health, Mr. Burke spent more than two decades at Cerner Corporation (acquired by Oracle Corporation in June 2022), ultimately serving as its President from September 2013 to November 2018. Mr. Burke is a member of the boards of Quantum Health, Inc., Cotiviti, Inc., and Bardavon Health Innovations. He also previously served on the board of directors of Livongo Health from April 2019 to November 2020. Mr. Burke is also a board member of several nonprofit organizations, including the College of Healthcare Information Management Executives and University Health (Kansas City). He is a certified public accountant (inactive). Mr. Burke earned his Bachelor of Science in Accounting and Master of Accounting from Kansas State University. We believe Mr. Burke is qualified to serve as a member of our Board due to his background in overseeing public healthcare companies and his significant experience in the healthcare industry.

John C. Kim served on the board of directors of Old Owlet from April 2021 to July 2021 and has served on the Board since July 2021. Mr. Kim has served as Executive Vice President, Chief Product Officer of PayPal Holdings, Inc. since September 2022. Mr. Kim joined PayPal Holdings, Inc. from Expedia Group, Inc., where he served as President, Marketplace from June 2021 to September 2022, as President of Platform & Marketplaces from December 2019 to June 2021, and as Chief Product Officer of Expedia Brands from July 2011 to March 2016. He also served as President of Vrbo, an Expedia Group subsidiary, from March 2019 to December 2019. Mr. Kim has more than two decades of experience in online search, recommendations, analytics and marketing at tier-one, venture-backed startups, medium-sized companies and globally known brands, having served in senior positions earlier in his career with Yahoo!, Inc., Pelago, Inc. (acquired by Groupon, Inc. in April 2011) and Medio Systems Inc., and he is an investor in over 50 startups. Mr. Kim is a vocal advocate for diversity and was appointed to advise President George W. Bush on economic policies impacting Asian Americans and Pacific Islander small businesses. He graduated from the University of California–Santa Barbara and received his Master of Business Administration from the University of Chicago Booth School of Business. We believe Mr. Kim is qualified to serve as a member of our Board due to his significant analytics and marketing experience and broad leadership experience.

BOARD RECOMMENDATION

The Board of Directors unanimously recommends a vote FOR the election of each of Mr. Knafel and Mr. Workman as a Class II director to the Board to hold office until the 2026 Annual Meeting and until his successor has been duly elected and qualified.

PROPOSAL 2 — APPROVAL OF AMENDMENTS TO OUR CERTIFICATE OF INCORPORATION

TO EFFECT A REVERSE STOCK SPLIT AND REDUCE THE NUMBER OF SHARES OF

CLASS A COMMON STOCK AND PREFERRED STOCK

General

Our Board has adopted a resolution (1) approving and declaring advisable alternative amendments to our Certificate of Incorporation to effect a reverse stock split (“Reverse Stock Split”) of our Common Stock at a ratio ranging from any whole number between 1-for-10 and 1-for-20, inclusive, with the exact ratio within such range to be determined by the Board at its discretion, and a reduction in the number of authorized shares of our Common Stock and unissued authorized shares of our Preferred Stock subject to the Board’s authority to determine when to file the applicable amendment and to abandon the other amendments notwithstanding prior stockholder approval of such amendments, (2) directing that such proposed amendments to our Certificate of Incorporation be submitted to our stockholders for their approval and adoption, and (3) recommending that our stockholders approve and adopt each of the proposed amendments. The text of the form of amendments to the Certificate of Incorporation (the “Reverse Stock Split Amendments”), one of which would be filed with the Delaware Secretary of State by means of a Certificate of Amendment to the Certificate of Incorporation to effect the Reverse Stock Split and a reduction in the number of authorized shares of Common Stock and unissued authorized shares of Preferred Stock, are set forth in Appendix A to this Proxy Statement.

By approving this proposal, stockholders will approve alternative amendments to our Certificate of Incorporation pursuant to which a number of outstanding shares of our Common Stock between 10 and 20, inclusive, would be reclassified, combined and reconstituted into one share of our Common Stock. The number of shares of Common Stock underlying outstanding equity awards and available for future awards under our equity incentive plans, as well as the number of shares issuable upon exercise of outstanding warrants and upon conversion of our outstanding Series A Preferred Stock would also be proportionately reduced in the same manner as a result of the Reverse Stock Split. Upon receiving the stockholder approval, the Board will have the authority, but not the obligation, in its sole discretion, to elect, without further action on the part of the stockholders, whether to effect the Reverse Stock Split and, if so, to determine the Reverse Stock Split ratio from among the approved range described above and to effect the Reverse Stock Split by filing a Certificate of Amendment to the Certificate of Incorporation with the Secretary of State of the State of Delaware to be effective as of the Effective Time (defined below), and all other Reverse Stock Split Amendments will be abandoned.

The Board’s decision as to whether and when to effect the Reverse Stock Split will be based on a number of factors, including, without limitation, general market and economic conditions, the historical and then-prevailing trading price and trading volume of our Common Stock, the anticipated impact of the Reverse Stock Split on the trading price and trading volume of our Common Stock, the anticipated impact on our market capitalization, and the continued listing requirements of the New York Stock Exchange (“NYSE”). Although our stockholders may approve the Reverse Stock Split, we will not effect the Reverse Stock Split if the Board does not deem it to be in the best interests of the Company and its stockholders. No further action by the stockholders will be required for the Board to abandon the Reverse Stock Split.

The proposed Reverse Stock Split Amendments also provide that the number of authorized shares of our Common Stock will be reduced to an amount equal to 1.5 times the then-current number of authorized shares of Common Stock, divided by the Reverse Stock Split ratio determined by the Board, and the number of authorized shares of our Preferred Stock will be reduced to an amount equal to the sum of (i) 1.5 times the then-current number of unissued authorized shares of Preferred Stock, divided by the Reverse Stock Split ratio determined by the Board and (ii) the 30,000 outstanding shares of Series A Preferred Stock. Because the Reverse Stock Split will decrease the number of outstanding shares of our Common Stock, and because we are applying a multiplier of 1.5 to the authorized Common Stock and unissued authorized Preferred Stock following the Reverse Stock Split, the proposed Reverse Stock Split Amendments would result in a relative increase in the number of authorized and unissued shares of our Common Stock and Preferred Stock. For more information on the relative increase in the number of authorized shares of our Common Stock, see “— Principal Effects of the Reverse Stock Split-Issued and Outstanding Shares of Common Stock” and “—Principal Effects and Purpose of Decrease (Relative Increase) in Number of Authorized Shares of Common Stock for Issuance” below.

Purpose of the Reverse Stock Split

The Board submits the Reverse Stock Split proposal to our stockholders for approval and adoption with the primary intent of increasing the per share price of our Common Stock for the following principal reasons:

| | | | | | | | |

| • | to ensure compliance with the $1.00 per share of common stock minimum price requirement for continued listing on NYSE; |

| | |

| • | to encourage increased investor interest in our Common Stock and promote greater liquidity for our stockholders; and |

| | |

| • | to help attract, retain, and motivate employees. |

NYSE Requirements for Continued Listing

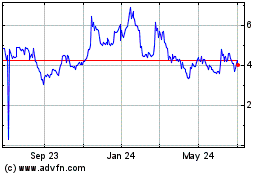

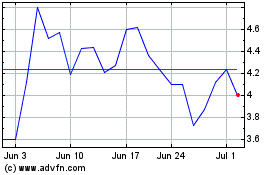

Our Common Stock is listed on NYSE under the symbol “OWLT.” For our Common Stock to continue trading on NYSE, the Company must comply with various listing standards, including that the average closing price of the Company’s Common Stock must be at least $1.00 over a consecutive 30 trading-day period.

On November 29, 2022, we received a letter (the “November NYSE Notification”) from NYSE notifying us that we are not in compliance with Section 802.01C of the NYSE Listed Company Manual (“Section 802.01C”) because the average closing price of our Common Stock was less than $1.00 over a consecutive 30 trading-day period. Under Section 802.01C, the Company has a period of six months from receipt of the November NYSE Notification to regain compliance with Section 802.01C. Section 802.01C also provides for an exception to the six-month cure period if the action required to cure the price condition requires stockholder approval, in which case, the action needs to be approved by no later than the Company’s next annual stockholder’s meeting. We can regain compliance at any time within the six-month cure period if, on the last trading day of any calendar month during the cure period, we have a closing share price of at least $1.00 and an average closing share price of at least $1.00 over the 30 trading-day period ending on the last trading day of that month.

In addition, on April 4, 2023, we received a letter (the “April NYSE Notification”) from NYSE notifying us that we are not in compliance with Section 802.01B of the NYSE Listed Company Manual because our average global market capitalization over a consecutive 30 trading-day period and, at the same time, our last reported stockholders’ equity were each less than $50 million. As required by NYSE, within 45 days of receipt of the April NYSE Notification, we plan to submit a business plan advising the NYSE of the definitive actions we have taken, or are taking, that would bring us into compliance with NYSE continued listing standards within 18 months of receipt of the April NYSE Notification. NYSE will review the plan and, within 45 days of its receipt, determine whether we have made a reasonable demonstration of an ability to conform to the relevant standards within the 18-month cure period. The April NYSE Notification has no immediate impact on the listing of our Common Stock. If the NYSE accepts the plan, our Common Stock will continue to be listed and traded on the NYSE during the 18-month cure period, subject to our compliance with the other continued listing standards of the NYSE and continued periodic review by the NYSE of our progress with respect to the plan. If the plan is not submitted on a timely basis or is not accepted by the NYSE, the NYSE could initiate delisting proceedings. The Reverse Stock Split would not impact regaining compliance under the April NYSE Notification.

If our Common Stock is delisted from NYSE, the Board believes that the trading market for our Common Stock could become significantly less liquid, which could reduce the trading price of our Common Stock and increase the transaction costs of trading in shares of our Common Stock. Such delisting from NYSE and continued or further decline in our stock price could also impair our ability to raise additional necessary capital through equity or debt financing.

If the Reverse Stock Split is effected, it would cause a decrease in the total number of shares of our Common Stock outstanding and increase the market price of our Common Stock. The Board intends to effect the Reverse Stock Split only if it believes that a decrease in the number of shares outstanding is in the best interests of the Company and its stockholders.

IF THIS PROPOSAL IS NOT APPROVED, WE MAY BE UNABLE TO MAINTAIN THE LISTING OF OUR COMMON STOCK ON NYSE, WHICH COULD ADVERSELY AFFECT THE LIQUIDITY AND MARKETABILITY OF OUR COMMON STOCK.

Investor Interest and Liquidity

In addition, in approving the proposed Reverse Stock Split Amendments, the Board considered that the Reverse Stock Split and the resulting increase in the per share price of our Common Stock could encourage increased investor interest in our Common Stock and promote greater liquidity for our stockholders.

In the event that our Common Stock were to be delisted from NYSE, our Common Stock would likely trade in the over-the-counter market. If our Common Stock were to trade on the over-the-counter market, selling our Common Stock could be more difficult because smaller quantities of shares would likely be bought and sold, and transactions could be delayed. In addition, many brokerage houses and institutional investors have internal policies and practices that prohibit them from investing in low-priced stocks or tend to discourage individual brokers from recommending low-priced stocks to their customers, further limiting the liquidity of our Common Stock. These factors could result in lower prices and larger spreads in the bid and ask prices for our Common Stock. Additionally, investors may be dissuaded from purchasing lower priced stocks because the brokerage commissions, as a percentage of the total transaction, tend to be higher for such stocks. Moreover, the analysts at many brokerage firms do not monitor the trading activity or otherwise provide coverage of lower priced stocks. A greater price per share of our Common Stock could allow a broader range of institutions to invest in our Common Stock. For all of these reasons, we believe the Reverse Stock Split could potentially increase marketability, trading volume, and liquidity of our Common Stock.

Employee Retention

The Board believes that the Company’s employees and directors who are compensated in the form of our equity-based securities may be less incentivized and invested in the Company if we are no longer listed on NYSE. Accordingly, the Board believes that maintaining NYSE listing qualifications for our Common Stock can help attract, retain, and motivate employees and members of our Board.

In light of the factors mentioned above, our Board unanimously approved the proposed Reverse Stock Split Amendments to effect the Reverse Stock Split as our best means of increasing and maintaining the price of our Common Stock to above $1.00 per share in compliance with NYSE requirements.

Board Discretion to Implement the Reverse Stock Split

The Board believes that stockholder approval of a range of ratios (as opposed to a single reverse stock split ratio) is in the best interests of the Company and its stockholders because it is not possible to predict market conditions at the time the Reverse Stock Split would be effected. We believe that a range of Reverse Stock Split ratios provides us with the most flexibility to achieve the desired results of the Reverse Stock Split. The Reverse Stock Split ratio to be selected by our Board will be a whole number in a range of 1-for-10 to 1-for-20. The Board can only authorize the filing of one Certificate of Amendment to the Certificate of Incorporation and all other Reverse Stock Split Amendments will be abandoned. The Board also has the authority to abandon all Reverse Stock Split Amendments.

In determining the Reverse Stock Split ratio and whether and when to effect the Reverse Stock Split following the receipt of stockholder approval, the Board will consider a number of factors, including, without limitation:

| | | | | | | | |

| • | our ability to maintain the listing of our Common Stock on NYSE; |

| | |

| • | the historical trading price and trading volume of our Common Stock; |

| | |

| • | the number of shares of our Common Stock outstanding immediately before and after the Reverse Stock Split; |

| | |

| • | the then-prevailing trading price and trading volume of our Common Stock and the anticipated impact of the Reverse Stock Split on the trading price and trading volume of our Common Stock; |

| | |

| • | the anticipated impact of a particular ratio on our market capitalization; and |

| | |

| • | prevailing general market and economic conditions. |

We believe that granting our Board the authority to set the ratio for the Reverse Stock Split is essential because it allows us to take these factors into consideration and to react to changing market conditions. If our Board chooses to implement the Reverse Stock Split, we will make a public announcement regarding the determination of the Reverse Stock Split ratio.

Risks Associated with the Reverse Stock Split

There are risks associated with the Reverse Stock Split, including that the Reverse Stock Split may not result in a sustained increase in the per share price of our Common Stock. There is no assurance that:

| | | | | | | | |

| • | the market price per share of our Common Stock after the Reverse Stock Split will rise in proportion to the reduction in the number of shares of our Common Stock outstanding immediately before the Reverse Stock Split; |

| | |

| • | the Reverse Stock Split will result in a per share price that will increase the level of investment in our Common Stock by institutional investors or increase analyst and broker interest in the Company; |

| | |

| • | the Reverse Stock Split will result in a per share price that will increase our ability to attract and retain employees and other service providers who receive compensation in the form of our equity-based securities; and |

| | |

| • | the market price per share of our Common Stock will either exceed or remain in excess of the $1.00 minimum price as required by NYSE, or that we will otherwise meet the requirements of NYSE for continued inclusion for trading on NYSE. |

Stockholders should note that the effect of the Reverse Stock Split, if any, upon the trading price of our Common Stock cannot be accurately predicted. In particular, we cannot assure you that the total market capitalization of our Common Stock after the implementation of the Reverse Stock Split would be equal to or greater than the total market capitalization before the Reverse Stock Split or that the price for a share of our Common Stock after the Reverse Stock Split will increase in proportion to the reduction in the number of shares of our Common Stock outstanding before the Reverse Stock Split or, even if it does, that such price will be maintained for any period of time.

Even if an increased per share price can be maintained, the Reverse Stock Split may not achieve the desired results that have been outlined above under “— Purpose of the Reverse Stock Split.” Moreover, because some investors may view the Reverse Stock Split negatively, we cannot assure you that the Reverse Stock Split will not adversely impact the market price of our Common Stock.

While we aim that the Reverse Stock Split will be sufficient to maintain our listing on NYSE, it is possible that, even if the Reverse Stock Split results in a price for our Common Stock that exceeds $1.00 per share of Common Stock, we may not be able to continue to satisfy NYSE’s additional requirements and standards for continued listing of our Common Stock on NYSE.

We believe that the Reverse Stock Split may result in greater liquidity for our stockholders. However, it is also possible that such liquidity could be adversely affected by the reduced number of shares outstanding after the Reverse Stock Split, particularly if the price of our Common Stock does not increase as a result of the Reverse Stock Split.

Additionally, if the Reverse Stock Split is implemented, it may increase the number of stockholders who own “odd lots” of less than 100 shares of Common Stock. A purchase or sale of less than 100 shares (an “odd lot” transaction) may result in incrementally higher trading costs through certain brokers, particularly “full service” brokers. Therefore, those stockholders who own fewer than 100 shares of our Common Stock following the Reverse Stock Split may be required to pay higher transaction costs if they sell their shares of our Common Stock.

Principal Effects of the Reverse Stock Split

Issued and Outstanding Shares of Common Stock

If the Reverse Stock Split is approved and effected, each holder of our Common Stock outstanding immediately prior to the effectiveness of the Reverse Stock Split will own a reduced number of shares of our Common Stock upon effectiveness of the Reverse Stock Split. The Reverse Stock Split would be effected simultaneously at the same exchange ratio for all outstanding shares of Common Stock. Except for adjustments that may result from the treatment of fractional shares (as described below), the Reverse Stock Split would affect all stockholders uniformly and would not change any stockholder’s relative percentage ownership interest in the Company, voting rights, or other rights that accompany shares of our Common Stock. Shares of our Common Stock issued pursuant to the Reverse Stock Split will remain fully paid and non-assessable, and the par value per share of Common Stock will remain $0.0001.

Principal Effects and Purpose of Decrease (and Relative Increase) in Number of Authorized Shares of Common Stock for Issuance

If the proposed Reverse Stock Split Amendments are approved by the Company’s stockholders and our Board determines to effect the Reverse Stock Split, at the Effective Time, the number of authorized shares of our Common Stock will be reduced to 1.5 times the then-current number of authorized shares of Common Stock, divided by the Reverse Stock Split ratio determined by the Board, and the number of authorized shares of our Preferred Stock will be reduced to the sum of (i) 1.5 times the then-current number of unissued authorized shares of Preferred Stock, divided by the Reverse Stock Split ratio determined by the Board, and (ii) the 30,000 outstanding shares of Series A Preferred Stock. Because the Reverse Stock Split will decrease the number of outstanding shares of our Common Stock, and because we are applying a 1.5 multiplier to the number of shares of Common Stock following the Reverse Stock Split, the Reverse Stock Split would result in a relative increase in the number of authorized and unissued shares of our Common Stock. The purpose of the relative increase in the amount of authorized and unissued shares of our Common Stock is to allow our Company the ability to issue additional shares of Common Stock in connection with future financings, employee and director benefit programs and other desirable corporate activities, without requiring our Company’s stockholders to approve an increase in the authorized number of shares of Common Stock each time such an action is contemplated. If the proposed Reverse Stock Split Amendments are approved by the Company’s stockholders and our Board determines to effect the Reverse Stock Split, all or any of the authorized and unissued shares of our Common Stock or Preferred Stock may be issued in the future for such corporate purposes and such consideration as the Board deems advisable from time to time, without further action by the stockholders of our Company and without first offering such shares to our stockholders. When and if additional shares of our Common Stock are issued, these new shares would have the same voting and other rights and privileges as the currently issued and outstanding shares of Common Stock, including the right to cast one vote per share.

Except pursuant to the Company’s equity incentive plans, outstanding warrants and Series A Preferred Stock, the Company presently has no plan, commitment, arrangement, understanding, or agreement regarding the issuance of Common Stock. However, the Company regularly considers its capital requirements and may conduct securities offerings, including equity and/or equity-linked offerings, in the future. Any shares issuable pursuant to the above-described plans will be subject to the Reverse Stock Split ratio determined by the Board.

Because our stockholders have no preemptive rights under Delaware law or our Certificate of Incorporation or Amended and Restated Bylaws (“Bylaws”) to purchase or subscribe for any of our unissued shares of Common Stock, the future issuance of additional shares of Common Stock will reduce our current stockholders’ percentage ownership interest in the total outstanding shares of Common Stock. In the absence of a proportionate increase in our future earnings and book value, an increase in the number of our outstanding shares of Common Stock would dilute our projected future earnings per share, if any, and book value per share of all our outstanding shares of Common Stock. If these factors were reflected in the price per share of our Common Stock, the potential realizable value of a stockholder’s investment could be adversely affected. An issuance of additional shares could therefore have an adverse effect on the potential realizable value of a stockholder’s investment.

Equity Compensation Plans and Outstanding Equity-Based Awards

Pursuant to the Owlet Baby Care Inc. 2014 Equity Incentive Plan, the Owlet, Inc. 2021 Incentive Award Plan and the Owlet, Inc. 2021 Employee Stock Purchase Plan (collectively, the “Plans”), we have granted stock options and restricted stock units (“RSUs”) to our employees and directors.

Our Board generally has the discretion to determine the appropriate adjustments to the Plans and outstanding awards in the event of a reverse stock split. Accordingly, if the Reverse Stock Split is approved and effected, consistent with the terms of the Plans and outstanding award agreements, the total number of shares of Common Stock issuable upon exercise, vesting or settlement of such awards and the total number of shares of Common Stock remaining available for future awards under the Plans, as well as any share-based limits in the Plans, would be proportionately reduced based on the Reverse Stock Split ratio selected by our Board, and any fractional shares that may result therefrom shall be rounded down. Furthermore, the exercise price of any outstanding options would be proportionately increased based on the Reverse Stock Split ratio selected by our Board, and any fractional cents that may result therefrom shall be rounded up to the nearest $0.01. Our Board has authorized the Company to effect any changes necessary, desirable or appropriate to give effect to the Reverse Stock Split under the Plans, including any applicable technical, conforming changes thereunder.

Warrants