Prospectus Filed Pursuant to Rule 424(b)(3) (424b3)

December 27 2022 - 6:11AM

Edgar (US Regulatory)

PIMCO High Income Fund

Supplement dated December 27, 2022 to the Fund’s Prospectus and Statement of Additional

Information dated May 31, 2022, each as supplemented from time to time

(respectively, the “Prospectus” and the “SAI”)

Effective immediately, the first paragraph of the “Description of Capital Structure – Preferred share

dividends” section of the Prospectus is deleted and replaced with the following:

The ARPS have complete priority over the Common

Shares as to distribution of assets. The terms of the ARPS provide that they would ordinarily pay dividends at a rate set at auctions held every seven days, normally payable on the first business day following the end of the rate period, subject to

a “maximum applicable rate” calculated as a function of the ARPS’ then-current ratings and a reference interest rate as described below. However, the weekly auctions for the ARPS, as well as auctions for similar preferred shares

issued by closed-end funds in the U.S., have failed since February 2008, and the dividend rates on the ARPS since that time have been paid at the maximum applicable rate under the Bylaws. Ratings agencies may

change their methodologies for evaluating and providing ratings for shares of closed-end funds at any time and in their sole discretion, which may affect the rating (if any) of the Fund’s shares. Fitch

Ratings published ratings criteria relating to closed-end funds on December 4, 2020, which effectively result in a rating cap of “AA” for debt and preferred stock issued by all closed-end funds and a rating cap of “A” for (i) debt and preferred shares issued by closed-end funds exposed to emerging market debt, below-investment-grade

and unrated debt, structured securities and equity, (ii) and closed-end funds with material exposure to “BBB” category rated assets. The updated ratings criteria cap the credit ratings of the

Fund’s ARPS at “A”. Accordingly, on April 30, 2021, Fitch Ratings announced that it had downgraded its rating of the ARPS from “AA” to “A.” The long-term rating actions were driven by changes in the updated

ratings criteria for closed-end funds rather than by any fundamental changes to the Fund’s credit profile. In December 2022, Moody’s announced it had upgraded its rating of the Fund’s ARPS to

“A1” from “A2.” The Fund expects that the ARPS will continue to pay dividends at the maximum applicable rate for the foreseeable future and cannot predict whether or when the auction markets for the ARPS may resume normal

functioning.

In addition, effective immediately, the fourth paragraph of the “Leverage and Borrowing”

section of the Statement of Additional Information is deleted and replaced with the following:

Regarding the costs associated with

the Fund’s Preferred Shares, the terms of the Fund’s ARPS provide that they would ordinarily pay dividends at a rate set at auctions held every seven days, normally payable on the first business day following the end of the rate period,

subject to a maximum applicable rate calculated as a function of the ARPS’ then-current rating and a reference interest rate, as described below. However, the weekly auctions for the ARPS, as well as auctions for similar preferred shares of

other closed-end funds in the U.S., have failed since February 2008, and the dividend rates on the ARPS since that time have been paid at the maximum applicable rate (i.e. a multiple of a reference rate, which

is the applicable “AA” Financial Composite Commercial Paper Rate (for a dividend period of fewer than 184 days) or the applicable Treasury Index Rate (for a dividend period of 184 days or more)). Ratings agencies may change their

methodologies for evaluating and providing ratings for shares of closed-end funds at any time and in their sole discretion, which may affect the rating (if any) of a Fund’s shares. Fitch Ratings published

ratings criteria relating to closed-end funds on December 4, 2020, which effectively result in a rating cap of “AA” for debt and preferred stock issued by all

closed-end funds and a rating cap of “A” for (i) debt and preferred shares issued by closed-end funds exposed to emerging market debt,

below-investment-grade and unrated debt, structured securities and equity, (ii) and closed-end funds with material exposure to “BBB” category rated assets. The updated ratings criteria cap the

credit ratings of the Fund’s ARPS at “A”. Accordingly, on April 30, 2021, Fitch Ratings announced that it had downgraded its rating of the ARPS from “AA” to “A.” The long-term rating actions were driven by

changes in the updated ratings criteria for closed-end funds rather than by any fundamental changes to the Fund’s credit profile. In December 2022, Moody’s announced it had upgraded its rating of the

Fund’s ARPS to “A1” from “A2.” See “Description of Capital Structure.” The Fund expects that the ARPS will continue to pay dividends at the maximum applicable rate for the foreseeable future and cannot predict

whether or when the auction markets for the ARPS may resume

normal functioning. See “Principal Risks of the Fund—Leverage Risk,” “Principal Risks of the Fund—Additional Risks Associated with the Fund’s Preferred Shares”

and “Description of Capital Structure” in the Prospectus for more information.

Investors Should Retain This Supplement for

Future Reference

PHK_SUPP1_122722

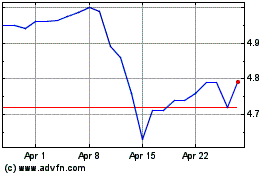

Pimco High Income (NYSE:PHK)

Historical Stock Chart

From Mar 2024 to Apr 2024

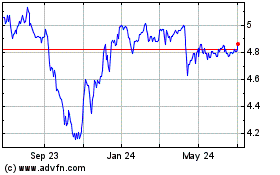

Pimco High Income (NYSE:PHK)

Historical Stock Chart

From Apr 2023 to Apr 2024