Current Report Filing (8-k)

November 08 2022 - 4:24PM

Edgar (US Regulatory)

0001784535false00017845352022-11-082022-11-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 8, 2022

PORCH GROUP, INC.

(Exact name of registrant as specified in its charter)

| | | | |

Delaware | | 001-39142 | | 83-2587663 |

(State or other jurisdiction

of incorporation) | | (Commission File Number) | | (IRS Employer

Identification No.) |

| |

411 1st Avenue S., Suite 501 | |

Seattle, Washington | 98104 |

(Address of principal executive offices) | (Zip Code) |

(855) 767-2400

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange

on which registered |

Common stock, par value $0.0001 | | PRCH | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On November 8, 2022, Porch Group, Inc. (the “Company”) issued an earnings release announcing financial results for the quarter ended September 30, 2022. The full text of the press release issued in connection with the announcement is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 7.01. Regulation FD Disclosure.

On November 8, 2022, the Company will host an earnings call at 5:00 p.m. Eastern time to discuss its financial results for the quarter ended September 30, 2022. Live and archived webcasts of the presentation will also be available on the Company’s investor relations website at https://ir.porchgroup.com.

On November 8, 2022, the Company posted supplemental investor materials on its investor relations website. The Company uses its investor relations website as a means of disclosing material non-public information, announcing upcoming investor conferences and for complying with its disclosure obligations under Regulation FD. Accordingly, investors should monitor the Company’s investor relations website in addition to following the Company’s press releases, SEC filings and public conference calls and webcasts.

The information in this Current Report on Form 8-K and the exhibit attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 8.01. Other Events.

On November 8, 2022, the Company announced that its Board of Directors has approved a new repurchase program authorizing the deployment of up to $15 million to repurchase the Company’s outstanding common stock or convertible notes. Repurchases under the newly authorized program may be made from time to time between November 10, 2022 and June 30, 2023 on the open market at prevailing market prices, in privately negotiated transactions, in block trades, and/or through other legally permissible means, depending on market conditions and in accordance with applicable rules and regulations (including through Rule 10b5-1 trading plans and under 10b-18 of the Exchange Act). Certain executive officers and directors of the Company may also purchase shares of Company common stock in accordance with the Company’s insider trading policy and federal securities laws.

The timing and amount of common stock or convertible notes repurchased will depend on various factors, including price, corporate and regulatory requirements, market conditions, and other corporate liquidity requirements and priorities. The repurchase program does not obligate the Company to acquire a specific dollar amount or number of shares or notes and may be modified, suspended, or discontinued at any time.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | |

| PORCH GROUP, INC. |

| | |

| | |

| By: | /s/ Martin L. Heimbigner |

| | Name: | Martin L. Heimbigner |

| | Title: | Chief Financial Officer |

Date: November 8, 2022

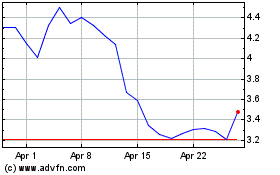

Porch (NASDAQ:PRCH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Porch (NASDAQ:PRCH)

Historical Stock Chart

From Apr 2023 to Apr 2024