TIDMCPP

RNS Number : 5272A

CPPGroup Plc

26 September 2022

26 September 2022

CPPGroup Plc

("CPP Group"; "the Group"; or "the Company")

HALF YEAR REPORT FOR THE SIX MONTHSED 30 JUNE 2022

CPP Group (AIM: CPP), a provider of assistance and insurance

products, which reduce disruptions to everyday life for millions of

customers across the world, is pleased to announce its half year

results for the six months ended 30 June 2022.

Financial Highlights:

-- Group revenue from continuing operations increased by 18% to

GBP77.8 million (H1 2021 restated: GBP65.7 million)

-- Core revenues increased by 26% to GBP69.5 million (H1 2021: GBP55.0 million)

-- EBITDA from continuing operations increased by 18% to GBP3.1

million (H1 2021 restated: GBP2.6 million)

-- Central overheads reduced to GBP4.8 million (H1 2021: GBP5.5 million)

-- Exceptional items of GBP0.5 million (H1 2021: GBP1.5 million)

-- Profit before tax from continuing operations increased to

GBP1.3 million (H1 2021 restated: GBP0.5 million loss)

-- Loss after tax from continuing operations improves to GBP0.2

million (H1 2021 restated: GBP1.6 million loss)

-- Cash balance of GBP19.3 million at 30 June 2022 (H1 2021: GBP19.6 million)

-- Dividends suspended pending completion of the strategy review (Change Programme)

Operational Highlights:

-- Simplified structure focused on four business units

-- Simplified the proposition away from "insurance" to "assurance" services

-- Simplified the management and operational structures

-- Core business (CPP India, CPP Turkey, Blink and Globiva) performing well

-- Major partner renewals for CPP India, and new partner wins for both CPP Turkey and Blink

-- Legacy Business (UK & European back book) revenues continue to record year-on-year decline

Simon Pyper, CEO of CPP Group, commented:

"Despite global economic headwinds, the Group has, from a

trading perspective, delivered robust revenue growth, particularly

from its Indian and Turkish operations. Blink, the Group's

InsurTech business focused on the Global Travel Sector, also

performed well, albeit from a low base. As international travel

recovers, Blink is starting to see real growth in its new business

pipeline both domestically and internationally. The good

performance from our core markets somewhat masks the structural

decline in profitability from our Legacy Businesses, a decline long

understood by the business though never addressed.

On appointment, I found a business which had no adequate plan to

address the decline in its Legacy Business, which had no sense of

purpose, and no strategy for the future. Consequently, much of my

time since appointment as CEO has been focused on simplifying the

business, simplifying our proposition, and simplifying our

management and operating structures. Additionally, the management

team and I have been working on a broader Change Programme, the aim

of which is to define what CPP's purpose is, and to set a course

("strategy") for the business which over time should improve

outcomes for our key stakeholder groups.

It is my expectation that I will be able to share the key

outputs from the Change Programme with shareholders in October of

this year.

In spite of the uncertain economic climate, the Board remains

confident in the outlook and growth prospects for our core

operations. However, structural issues pertaining to our Legacy

Business and associated IT costs need to be addressed which will

have some impact on overall performance and we will provide further

guidance in due course."

Financial and non-financial highlights - continuing

operations

Six months

Six months to 30 June

to 30 June 2021 (Restated(1)

GBP millions 2022 ) Change

------------------------------ ----------- ------------------- ------

Financial highlights:

Group

Revenue 77.8 65.7 18%

EBITDA(2) 3.1 2.6 18%

Operating profit/(loss) 1.3 (0.3) 529%

Profit/(loss) before tax

* Reported 1.3 (0.5) 363%

* Underlying(3) 1.8 1.0 78%

(Loss)/profit after tax

- Reported (0.2) (1.6) 90%

- Underlying(3) 0.3 (0.3) 223%

Basic loss per share (pence) (4.09) (21.53) 81%

Cash and cash equivalents 19.3 19.6 (1)%

Segmental revenue

Core(4) 69.5 55.0 26%

Legacy(5) 8.3 10.7 (22)%

Non-financial highlights:

Customer numbers (millions) 12.1 11.9 2%

============================== =========== =================== ======

1. Restated to reflect China as a discontinued operation.

2. EBITDA represents earnings before interest, taxation,

depreciation, amortisation and exceptional items.

3. Underlying profit before tax excludes exceptional items of

GBP0.5 million (H1 2021: GBP1.5 million). The tax effect of the

exceptional items is GBPnil (H1 2021: GBP0.1 million). Further

detail of exceptional items is provided in note 4 of the condensed

consolidated interim financial statements.

4. Core revenue comprises CPP India, CPP Turkey, Blink and Globiva.

5. Legacy Business primarily comprises the UK and European

renewal books of business, which are principally Card Protection

and Identity Protection policies.

Enquiries:

CPP Group plc

Simon Pyper, Chief Executive Tel: via Alma PR

Officer

David Bowling, Chief Financial

Officer

Liberum Capital Limited

(Nominated Adviser and Sole Tel: +44 (0)20 3100 2000

Broker)

Richard Lindley

Lauren Kettle

Alma PR

(Financial PR Adviser) Tel: +44 (0)20 3405 0205

Josh Royston

David Ison

Kieran Breheny

About CPP Group:

CPP Group is a technology-driven assistance company that creates

embedded and ancillary real-time assistance products and resolution

services that reduce disruption to everyday life for millions of

people across the world, at the time and place they are needed, CPP

Group is listed on AIM, operated by the London Stock Exchange.

For more information on CPP visit

https://international.cppgroup.com/

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) No 596/2014 which

is part of UK law by virtue of the European Union (Withdrawal) Act 2018.

Chief Executive's Statement

First Half Performance

Despite global economic headwinds, the Group has, from a trading

perspective, delivered robust revenue growth, particularly from its

Indian and Turkish operations. Blink, the Group's InsurTech

business focused on the Global Travel Sector, also performed well,

albeit from a low base. As international travel recovers, Blink is

starting to see real growth in its new business pipeline both

domestically and internationally. The good performance from our

core markets somewhat masks the structural decline in profitability

from our Legacy Businesses, a decline long understood by the

business though never addressed.

The Group's revenue performance against prior year has also

benefited from favourable comparatives (impact of COVID-19

restrictions on 2021 revenues) and foreign exchange movements. Of

the 18% increase in year-on-year revenues to GBP77.8 million (H1

2021 restated: GBP65.7 million), circa 5% is due to favourable

comparatives from COVID-19 and 2% is due to favourable foreign

exchange movements. Adjusting for these two factors, the Group's

underlying revenue growth for the first half was 11%, which given

the prevailing economic environment is a more than satisfactory

outcome.

EBITDA improved by 18% or GBP0.5 million to GBP3.1 million (H1

2021 restated: GBP2.6 million). The Legacy business, as expected,

recorded a decline in EBITDA for the period of GBP0.4 million which

partially offset the GBP0.4 million improvement from the Core

business and the GBP0.4 million benefit of reduced central costs.

Group EBITDA margin for the period remained broadly level with

prior year at 4.0%.

Operating profit has increased to GBP1.3 million (H1 2021

restated: GBP0.3 million loss) which includes depreciation charges

of GBP1.3 million (H1 2021 restated: GBP1.4 million) and

exceptional items which have reduced to GBP0.5 million (H1 2021:

GBP1.5 million). The exceptional items in the period principally

reflect the exit costs of the former CEO. As a result, the Group's

profit before tax has improved to GBP1.3 million (H1 2021 restated:

GBP0.5 million loss).

Key Performance Metrics:

GBP millions REVENUE EBITDA

H1 2022 H1 2021(1) CHANGE H1 2022 H1 2021(1) CHANGE

-------- ----------- -------- ---------- ----------- -------

CPP India 60.7 48.7 25% 3.1 2.8 13%

-------- ----------- -------- ---------- ----------- -------

Globiva 7.1 4.4 61% 1.3 1.1 12%

-------- ----------- -------- ---------- ----------- -------

CPP Turkey 1.5 1.8 (21)% 0.2 0.4 (49)%

-------- ----------- -------- ---------- ----------- -------

Blink 0.2 0.1 58% (0.1) (0.2) 53%

-------- ----------- -------- ---------- ----------- -------

Core Business 69.5 55.0 26% 4.5 4.1 8%

-------- ----------- -------- ---------- ----------- -------

Legacy Business 8.3 10.7 (22)% 0.8 1.2 (31)%

-------- ----------- -------- ---------- ----------- -------

Business

Unit Total 77.8 65.7 18% 5.3 5.3 0%

-------- ----------- -------- ---------- ----------- -------

Central Functions - - - (2.2) (2.6) 15%

-------- ----------- -------- ---------- ----------- -------

Share of JV - - - - (0.1) 100%

-------- ----------- -------- ---------- ----------- -------

Group Total 77.8 65.7 18% 3.1 2.6 18%

-------- ----------- -------- ---------- ----------- -------

Attributable

to:

-------- ----------- -------- ---------- ----------- -------

CPP Shareholders 2.5 2.1 20%

-------- ----------- -------- ---------- ----------- -------

Non-Controlling

Interests 0.6 0.5 12%

-------- ----------- -------- ---------- ----------- -------

1. Restated to reflect China as a discontinued operation.

CPP India: EBITDA of GBP3.1 million (H1 2021: GBP2.8 million),

EBITDA margin 5.1% (H1 2021: 5.6%)

Revenue has increased by GBP12.0m or 25% versus prior year, and

by 21% on a constant currency basis, in part due to prior year

comparatives being impacted by COVID-19, with volume growth derived

from our My Tech, My Health, and My Home assistance products.

During the period, CPP India secured contract extensions with its

two largest partners, Bajaj Finance Limited (Bajaj), and SBI Cards.

EBITDA margin reduced by 0.5% reflecting a modest change in revenue

mix during the period towards lower margin products (particularly

in My Health), and amortisation of the Bajaj marketing

incentive.

Globiva : EBITDA of GBP1.3 million (H1 2021: GBP1.1 million),

EBITDA margin 17.5% (H1 2021: 25.2%)

Third party revenue of GBP7.1 million which is +61% versus prior

year, and on a constant currency basis by +55%. Revenue growth

reflects new business wins and underlying occupancy (number of

seats) improvement, noting that prior year comparatives reflect a

business recovering from the impact of COVID-19 restrictions. The

EBITDA margin has reduced by 7.7% which is function of new business

growth and occupancy utilisation.

Turkey: EBITDA of GBP0.2 million (H1 2021: GBP0.4 million),

EBITDA margin 14.7% (H1 2021: 23.0%)

Revenues have decreased by GBP0.4 million or -21% versus prior

year, this reduction is all foreign exchange related as on a

constant currency basis the business recorded revenue growth of

27%, reflecting in part, the development of the Turkiye Insurance

relationship established in 2021. The EBITDA margin reduced by 8.3%

reflecting cost inflation brought about by local economic

conditions.

Blink: EBITDA loss of GBP0.1 million (H1 2021: GBP0.2 million

loss)

There is a dedicated management and operational team now in

place to build capacity and to drive growth. The pipeline for

Blink's Travel Disruption products (Flight Delay and Lost Baggage)

is starting to see real growth. Post period end, the business has

started to provide its services to four new partners.

Legacy Business: EBITDA of GBP0.8 million (H1 2021: GBP1.2

million)

There has been a continued decline in both revenue and EBITDA

from the UK and European Back Books (predominantly Card Protection

and Identity Protection).

Central costs: GBP2.2 million (H1 2021: GBP2.6 million)

Central overheads before appropriate recharge to business units

are GBP4.8 million (H1 2021: GBP5.5 million) which is a reduction

of GBP0.7 million primarily reflecting lower Executive and Board

costs. The central costs include GBP1.8 million (H1 2021: GBP2.0

million) relating to the cost of the Group's IT operations which

forms the principal element of the costs recharged to business

units.

EBITDA Attributable to Shareholders

The Group holds a 51% majority interest in Globiva, a Business

Processes Management company incorporated in India, with the other

49% of the shares beneficially owned by the three founders of the

business. As the Group demonstrates control of the business through

its majority holding, CPP is required under accounting standards to

consolidate 100% of Globiva's revenues and earnings into its

financial statements. The minority interest, being the 49% held by

the founders, is recorded at the foot of the Group's income

statement as "Attributable to non-controlling interests". When our

holding in Globiva falls below the 51% threshold the Group will

relinquish control and will no longer consolidate Globiva's

revenues and earnings. In the normal course of business, this is

expected to occur in 2026.

Taxation

The Group's tax charge from continuing operations is GBP1.4

million (H1 2021: GBP1.1 million) which reflects an effective tax

rate (ETR) of 113% (H1 2021 restated: negative 232%). The tax

charge mainly comprises tax payable in India, along with smaller

charges from our European and Turkish markets.

The Group's ETR is expected to remain high and variable over the

medium term, as the Group executes its Change Programme. The

programme once complete is expected to lead to a stabilisation in

the ETR at a much lower level. However, it is still expected to

remain notably higher than the UK statutory rate of 19% as we make

most of our taxable profit in India, provide for withholding taxes

on overseas distributions and continue to generate losses in

certain markets against which we are not able to recognise deferred

tax assets.

Adjusted ETR

The adjusted ETR (which excludes the impact of exceptional

items) at 81% (H1 2021 restated: 127%) demonstrates the progressive

improvement in the Group's tax position as the Group addresses its

loss-making operations and overall cost-base. The adjusted ETR

reflects a more normalised tax charge for the Group.

The adjusted ETR is summarised as follows:

H1 2022 H1 2021

---------------------------------- ----------------------------------

Exceptional Exceptional

Continuing operations Reported items(1) Adjusted Reported items(1) Adjusted

Profit before tax 1.3 0.5 1.8 (0.5) 1.5 1.0

Tax charge 1.4 - 1.4 1.1 0.2 1.3

ETR 113% n/a 81% (232)% 9% 127%

1. Refer to note 4 of the condensed consolidated interim financial statements.

Overall, we expect a progressive reduction in our ETR as our

loss-making operations reduce, distributions from overseas markets

stabilise and volatility arising from one-off charges declines.

Financial Position

The Group had cash balances at 30 June 2022 of GBP19.3 million

(H1 2021: GBP19.6 million; 31 December 2021: GBP22.3 million). The

extension of the Bajaj contract included payment of upfront fees,

which along with costs to develop the IT platform in India,

restructuring costs in the UK and payment of the dividend have led

to the GBP3.1 million reduction in cash since the year end.

Although the Group's cash cycle is naturally weighted to H2 this

benefit will be reduced this year as development work on the India

platform accelerates. Whilst the Group has previously and continues

to report healthy cash balances, it should be noted that not all

cash is available for distribution or able to be used on demand for

working capital purposes in all parts of the Group. At present,

approximately 40% of the Group's cash balances are "restricted" due

to either tax, legal, or regulatory requirements.

Operational Highlights

Simplified Structure

The business is now organised around four business units being

CPP India, CPP Turkey, Blink and the Legacy Business (UK &

European back book) along with Central Functions. Each business

unit is managed by a dedicated CEO who has full accountability for

delivering agreed financial and non-financial objectives. This

simplified structure will allow for local decisions to be made more

quickly and moreover, allow each business to more effectively react

to changing business partner needs.

Globiva is managed independently of the Group and save for CPP

holding three Board seats (including the Chairman) and having the

majority voting rights there is minimal management and operational

interaction between the two companies.

Simplified Proposition

There is a move to providing a suite of technology-enabled

assistance products and services focused around six themes: My

Travel; My Tech; My Health; My Digital Life; My Home; and My

Finances. Our simplified proposition reflects and supports our

purpose, one of being a "technology-driven assistance company that

creates embedded and ancillary real-time assistance products and

resolution services that reduce disruption to everyday life for

millions of people across the world, at the time and place they are

needed".

Simplified Management and Operational Structure

The Executive Management Committee ("EMC"), is chaired by me and

comprises the four Business Unit CEOs, the Group Chief Financial

Officer, the Chief Risk and Operating Officer, the Group HR

Director, and the Group Legal Counsel. The EMC is the key

decision-making committee of the business focused on delivering the

Group's strategic, operational, and financial objectives. The

committee meets weekly.

The Operational Board, which reports to the EMC, reviews,

implements, and monitors actions agreed at the EMC. In simple terms

the Operational Board is focused on the "doing" whilst the EMC is

focused on the "management" of the business. The Operational Board

meets weekly, is chaired by me, and comprises several EMC members

and other senior executives and managers of the Group.

Dividend

Due to the costs and uncertainties associated with the Change

Programme, the Board has taken the decision to suspend dividend

payment until further notice. If circumstances change, the Board

will review and update shareholders when appropriate to do so.

Outlook

We are confident about the outlook and growth prospects for our

core operations for the second half of the year. However, we do

expect some softening in reported margin in the second half

reflecting a modest mix change towards lower margin products, the

impact of the new commercial terms agreed with Bajaj when extending

the contract in May and revised incentive costs for our CPP India

team. However, structural issues pertaining to our Legacy Business

and associated IT costs need to be addressed which will have some

impact on overall performance and we will provide further guidance

in due course. Our expectations are that we will be able to provide

the key outputs of the Change Programme in October.

Simon Pyper

Chief Executive Officer

23 September 2022

CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

CONSOLIDATED INCOME STATEMENT

6 months ended 6 months ended 30 June 2021 Year ended

30 June 2022 (Restated*) 31 December 2021

GBP'000 GBP'000 GBP'000

Note (Unaudited) (Unaudited) (Audited)

Continuing operations

Revenue 3 77,768 65,670 143,625

Cost of sales (62,173) (50,230) (110,708)

--------------- ---------------------------------- ------------------

Gross profit 15,595 15,440 32,917

Administrative expenses (14,256) (15,633) (29,827)

Share of loss in joint venture - (119) (189)

Operating profit/(loss) 1,339 (312) 2,901

Analysed as:

EBITDA 3 3,100 2,619 7,524

Depreciation and amortisation (1,264) (1,442) (2,995)

Exceptional items 4 (497) (1,489) (1,628)

Investment revenues 176 112 223

Finance costs (228) (289) (358)

Other gains and losses - - 1,459

--------------- ---------------------------------- ------------------

Profit/(loss) before taxation 1,287 (489) 4,225

Taxation 5 (1,449) (1,136) (3,707)

(Loss)/profit for the period from

continuing operations (162) (1,625) 518

Discontinued operations

Profit for the period from

discontinued operations 8 616 2,901 2,490

--------------- ---------------------------------- ------------------

Profit for the period 454 1,276 3,008

=============== ================================== ==================

Attributable to:

Equity holders of the Company 254 1,013 2,565

Non-controlling interests 200 263 443

--------------- ---------------------------------- ------------------

454 1,276 3,008

=============== ================================== ==================

(Loss)/earnings per share

Basic Pence Pence (Restated*) Pence

Continuing operations 7 (4.09) (21.53) 0.85

Continuing and discontinued

operations 7 2.87 11.55 29.16

=============== ================================== ==================

Diluted Pence Pence (Restated*) Pence

Continuing operations 7 (4.09) (21.53) 0.83

Continuing and discontinued operations 7 2.87 11.55 28.43

======= ================== ======

* Restated to reflect China as a discontinued operation. See

note 2.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

Year ended

6 months ended 30 June 2022 6 months ended 30 June 2021 31 December 2021

GBP'000 GBP'000 GBP'000

(Unaudited) (Unaudited) (Audited)

Profit for the period 454 1,276 3,008

Items that may be reclassified

subsequently to profit or loss:

Exchange differences on

translation of foreign

operations 196 (451) (695)

Exchange differences

reclassified on disposal of

foreign operations (1,081) (4) (4)

Other comprehensive expense for

the period net of taxation (885) (455) (699)

---------------------------- ---------------------------- ------------------

Total comprehensive

(expense)/income for the period (431) 821 2,309

============================ ============================ ==================

Attributable to:

Equity holders of the Company (704) 588 1,867

Non-controlling interests 273 233 442

---------------------------- ---------------------------- ------------------

(431) 821 2,309

============================ ============================ ==================

CONSOLIDATED BALANCE SHEET

30 June 2022 30 June 2021 31 December 2021

GBP'000 GBP'000 GBP'000

Note (Unaudited) (Unaudited) (Audited)

Non-current assets

Goodwill 567 528 540

Other intangible assets 4,453 3,845 3,603

Property, plant and equipment 1,360 1,357 1,335

Right-of-use assets 4,101 5,577 5,109

Equity investment 1,889 - 1,889

Investment in joint venture - 331 -

Deferred tax assets 341 245 396

Contract assets 448 593 564

------------- ------------- -----------------

13,159 12,476 13,436

------------- ------------- -----------------

Current assets

Inventories 115 146 102

Contract assets 4,538 3,689 4,020

Trade and other receivables 15,776 13,150 13,605

Cash and cash equivalents 19,321 19,592 22,319

------------- ------------- -----------------

39,750 36,577 40,046

Assets classified as held for sale - - 478

39,750 36,577 40,524

Total assets 52,909 49,053 53,960

------------- ------------- -----------------

Current liabilities

Income tax liabilities (808) (1,047) (1,362)

Trade and other payables (21,732) (17,483) (19,5 44 )

Lease liabilities (869) (910) (937)

Contract liabilities (9,909) (8,405) (9,190)

------------- ------------- -----------------

(33,318) (27,845) (31,033)

------------- ------------- -----------------

Liabilities classified as held for sale - - (550)

------------- ------------- -----------------

(33,318) (27,845) (31,583)

------------- ------------- -----------------

Net current assets 6,432 8,732 8,941

------------- ------------- -----------------

Non-current liabilities

Borrowings 42 77 58

Deferred tax liabilities (626) (104) (927)

Lease liabilities (4,008) (5,304) (4,936)

Contract liabilities (898) (1,333) (1,200)

(5,490) (6,664) (7,005)

------------- ------------- -----------------

Total liabilities (38,808) (34,509) (38,588)

------------- ------------- -----------------

Net assets 14,101 14,544 15,372

============= ============= =================

Equity

Share capital 9 24,254 24,232 24,243

Share premium account 45,225 45,225 45,225

Merger reserve (100,399) (100,399) (100,399)

Translation reserve (822) 409 136

ESOP reserve 17,192 17,656 17,418

Retained earnings 26,831 26,083 27,202

------------- ------------- -----------------

Equity attributable to equity holders of the Company 12,281 13,206 13,825

Non-controlling interests 1,820 1,338 1,547

------------- ------------- -----------------

Total equity 14,101 14,544 15,372

============= ============= =================

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Share

Share premium Merger Translation ESOP Retained Non-controlling Total

capital account reserve reserve reserve earnings Total interests equity

Note GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

6 months ended

30 June 2022

(Unaudited)

At 1 January

2022 24,243 45,225 (100,399) 136 17,418 27,202 13,825 1,547 15,372

Profit for the

period - - - - - 254 254 200 454

Other

comprehensive

expense for the

period - - - (958) - - (958) 73 (885)

-------- -------- ---------- ------------ -------- --------- -------- ---------------- --------

Total

comprehensive

expense for the

period - - - (958) - 254 (704) 273 (431)

-------- -------- ---------- ------------ -------- --------- -------- ---------------- --------

Effects of

hyperinflation - - - - - 43 43 - 43

Equity-settled

share-based

payment credit - - - - (226) - (226) - (226)

Exercise of

share options 9 11 - - - - (5) 6 - 6

Dividends 6 - - - - - (663) (663) - (663)

At 30 June 2022 24,254 45,225 (100,399) (822) 17,192 26,831 12,281 1,820 14,101

======== ======== ========== ============ ======== ========= ======== ================ ========

6 months ended

30 June 2021

(Unaudited)

At 1 January

2021 24,153 45,225 (100,399) 834 17,490 27,327 14,630 1,105 15,735

Profit for the

period - - - - - 1,013 1,013 263 1,276

Other

comprehensive

expense for the

period - - - (425) - - (425) (30) (455)

-------- -------- ---------- ------------ -------- --------- -------- ---------------- --------

Total

comprehensive

income for the

period - - - (425) - 1,013 588 233 821

-------- -------- ---------- ------------ -------- --------- -------- ---------------- --------

Equity-settled

share-based

payment charge - - - - 166 - 166 - 166

Exercise of

share options 79 - - - - (69) 10 - 10

Dividends 6 - - - - - (2,188) (2,188) - (2,188)

At 30 June 2021 24,232 45,225 (100,399) 409 17,656 26,083 13,206 1,338 14,544

======== ======== ========== ============ ======== ========= ======== ================ ========

Year ended

31 December 2021

(Audited)

At 1 January

2021 24,153 45,225 (100,399) 834 17,490 27,327 14,630 1,105 15,735

Profit for the

year - - - - - 2,565 2,565 443 3,008

Other

comprehensive

expense for the

year - - - (698) - - (698) (1) (699)

-------- -------- ---------- ------------ -------- --------- -------- ---------------- --------

Total

comprehensive

income for the

period - - - (698) - 2,565 1,867 442 2,309

-------- -------- ---------- ------------ -------- --------- -------- ---------------- --------

Equity-settled

share-based

payment credit - - - - (72) - (72) - (72)

Exercise of

share options 90 - - - - (70) 20 - 20

Deferred tax on

share options - - - - - 9 9 - 9

Dividends 6 - - - - - (2,629) (2,629) - (2,629)

-------- -------- ---------- ------------ -------- --------- -------- ---------------- --------

At 31 December

2021 24,243 45,225 (100,399) 136 17,418 27,202 13,825 1,547 15,372

======== ======== ========== ============ ======== ========= ======== ================ ========

CONSOLIDATED CASH FLOW STATEMENT

6 months ended 6 months ended Year ended

Note 30 June 2022 30 June 2021 31 December 2021

GBP'000 GBP'000 GBP'000

(Unaudited) (Unaudited) (Audited)

Net cash (used in)/from operating activities 10 (327) (302) 4,562

Investing activities

Interest received 176 112 224

Purchases of property, plant and equipment (200) (136) (525)

Purchases of intangible assets 3 (1,153) (756) (1,370)

Cash consideration in respect of sale of

discontinued operations 8 - 2,353 2,366

Costs associated with disposal of discontinued

operations 8 (72) - -

Cash disposed of with discontinued operations (518) (112) (112)

Net cash (used in)/from investing activities (1,767) 1,461 583

--------------- --------------- ------------------

Financing activities

Dividends paid 6 (663) (2,188) (2,629)

Repayment of the lease liabilities (713) (775) (1,507)

Interest paid (37) (37) (76)

Issue of ordinary share capital 9 6 10 20

Net cash used in financing activities (1,407) (2,990) (4,192)

--------------- --------------- ------------------

Net (decrease)/increase in cash and cash equivalents (3,501) (1,831) 953

Effect of foreign exchange rate changes 413 (433) (400)

Cash and cash equivalents at start of period 22,409 21,856 21,856

Cash and cash equivalents at end of period 19,321 19,592 22,409

--------------- --------------- ------------------

Analysed as:

Continuing operations 19,321 19,592 22,319

Discontinued operations - - 90

--------------- --------------- ------------------

19,321 19,592 22,409

--------------- --------------- ------------------

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL

STATEMENTS

1 General information

The condensed consolidated interim financial statements for the

six months ended 30 June 2022 do not constitute statutory accounts

as defined under Section 434 of the Companies Act 2006. The Annual

Report and Financial Statements (the 'Financial Statements') for

the year ended 31 December 2021 were approved by the Board on 28

March 2022 and have been delivered to the Registrar of Companies.

The Auditor, PKF Littlejohn LLP, reported on these financial

statements; their report was unqualified, did not contain an

emphasis of matter paragraph and did not contain statements under

s498 (2) or (3) of the Companies Act 2006.

2 Accounting policies

Basis of preparation

The unaudited condensed consolidated interim financial

statements for the six months ended 30 June 2022 have been prepared

in accordance with IAS 34 Interim Financial Reporting. They do not

include all the information required for full annual financial

statements and should be read in conjunction with the Group's

consolidated financial statements for the year ended 31 December

2021 which were prepared in accordance with international

accounting standards in conformity with the requirements of the

Companies Act 2006 and UK-adopted International Accounting

Standards (UK IASs).

The condensed consolidated interim financial statements were

approved for release on 23 September 2022.

The accounting policies adopted in the preparation of the

condensed consolidated interim financial statements are consistent

with those followed in the preparation of the Group's consolidated

financial statements for the year ended 31 December 2021.

Discontinued operations

On 27 January 2022, the Group completed the sale of its 100%

shareholding in CPP Asia Limited and its wholly owned subsidiary

CPP Technology Services (Shanghai) Co. Ltd (together "China"). As a

result, in accordance with IFRS 5 Non-current assets held for sale

and discontinued operations, the 30 June 2021 comparative

information has been restated to recognise the China operation as

discontinued. Discontinued operations also include Germany, which

was sold on 17 May 2021 (refer to note 8). The adjustments relating

to the restatement have not been audited.

Segmental reporting

The Group has revised its segmental reporting from 1 January

2022. In accordance with IFRS 8 the operating segments have been

changed to reflect the way in which the Group is now managed and

how resources are allocated. The Group's operating segments are

identified as India, Turkey, Blink, UK & Rest of the World (UK

& ROW) and Central Functions. These segments replace the

'Ongoing Operations', 'Restricted Operations' and 'Central

Functions' basis that was previously in place. The prior period

segmental information has been restated to reflect the change.

Further detail is included in note 3. The adjustments relating to

the restatement have not been audited.

Hyperinflation

The Group has operations in Turkey, which has now met the

criteria to be classified as a hyperinflationary economy. This is

based on the Turkish Statistical Institute published consumer price

index, which has cumulative inflation of 109.4% over a three year

period as at March 2022. IAS 29 Financial Reporting in

Hyperinflationary Economies requires that inflation accounting is

applied to the financial statements of entities where the

cumulative inflation rate in three years approximates or exceeds

100%. Inflation accounting aims to restate the value of the assets,

liabilities and P&L items of an entity in terms of the monetary

values as at the reporting period end date, to better represent

their true and fair value.

This is performed by applying a conversion factor calculated

using the reporting date inflation index over the inflation index

at the date of recognition or revaluation of non-monetary or profit

and loss financial statement line items. The CPI inflation index

published by the Turkish Statistical Institute has been used for

this calculation.

In Turkey's case, this has impacted other intangible assets,

property, plant and equipment, right-of-use assets, prepayments,

contract liabilities, deferred tax, share capital and all income

statement items. Monetary items are not restated as they are

already recognised in terms of the monetary unit current at the

balance sheet date. The exchange rate then used to retranslate all

financial statement line items (including income statement items)

is the period end exchange rate, which as at 30 June 2022 was

20.33.

On initial adoption in the period ending 30 June 2022, the

impact of inflation to the start of the period is recognised as a

movement in retained earnings. Comparative balances are not

restated. Inflation for the current period has been recognised

within finance costs. The inflation index has moved by 42.35% from

31 December 2021 to 30 June 2022.

The overall impact of inflation accounting in Turkey in the

period has been as follows;

6 months

ended 30

June 2022

GBP'000

(Unaudited)

Net Assets 106

Profit before

Tax 59

Taxation (10)

Profit after

Tax 49

Retained earnings 43

Translation

reserve 14

Insurance balances

The comparative balance sheet information as at 30 June 2021 and

31 December 2021 has been re-presented to recognise insurance

assets and liabilities within 'trade and other receivables' and

'trade and other payables' respectively. This change reflects the

immaterial nature of both the balances and the Group's insurance

operations. The presentational changes have no impact on the

EBITDA, operating profit, profit before tax or net assets of either

the 30 June 2021 or 31 December 2021 comparatives.

Going concern

In reaching their view on the preparation of the condensed

consolidated interim financial statements on a going concern basis,

the Directors are required to consider whether the Group can

continue in operational existence for a period of at least 12

months from the date of this report.

The Group has a formalised process of budgeting, reporting and

review along with procedures to forecast its profitability and cash

flows. The plans provide information to the Directors which are

used to ensure the adequacy of resources available for the Group to

meet its business objectives, both in the short-term and in

relation to its strategic priorities. The Group's revenue, profit

and cash flow forecasts are subject to robust downside stress

testing which involves modelling the impact of a combination of

plausible adverse scenarios focused on crystallisation of the

Group's key operational risks, taking into consideration the

changing economic back drop. This is done to identify risks to

liquidity and covenant compliance and enable management to

formulate appropriate and timely mitigation strategies.

Taking the analysis into consideration, the Directors are

satisfied that the Group has the necessary resources to continue in

operational existence for a period of at least 12 months from the

date of this report. Accordingly, they continue to adopt the going

concern basis in preparing the condensed consolidated interim

financial statements.

3 Segmental analysis

IFRS 8 Operating segments requires operating segments to be

identified on the basis of internal reports about components of the

Group that are regularly reviewed by the Board of Directors to

allocate resources to the segments and to assess their performance.

The Group's operating segments have changed in the current year and

the comparatives have been restated accordingly.

The Group is now managed on the basis of five broad business

units:

-- India (CPP India and Globiva) ;

-- Turkey;

-- Blink;

-- UK & Rest of World (UK MGA business, UK legacy business

(previously categorised as restricted operations), Spain, Portugal,

Italy and Mexico); and

-- Central Function s - central cost base required to provide

expertise and operate a listed group. Central Functions is stated

after the recharge of certain central costs that are appropriate to

transfer to the relevant geographies for statutory purposes.

Segment revenue and performance for the current and comparative

periods are presented below:

UK

& Rest

of Central

India Turkey Blink World Functions Total

Six months ended 30 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

June 2022 (Unaudited)

Continuing operations

Revenue - external sales 67,836 1,453 216 8,263 - 77,768

Segmental EBITDA 4,330 213 (57) 821 (2,207) 3,100

-------- -------- -------- --------- -----------

Share of loss in joint

venture -

--------

EBITDA 3,100

Depreciation and amortisation (1,264)

Exceptional items (497)

Operating profit 1,339

Investment revenues 176

Finance costs (228)

--------

Profit before taxation 1,287

Taxation (1,449)

--------

Loss for the period

from continuing operations (162)

Discontinued operations

Profit for the period

from discontinued operations 616

--------

Profit for the period 454

========

UK

& Rest

of Central

India Turkey Blink World Functions Total

Six months ended 30 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

June 2021 (Unaudited)

Continuing operations

(Restated*(,) **)

Revenue - external sales 53,044 1,833 137 10,656 - 65,670

Segmental EBITDA 3,835 421 (120) 1,186 (2,584) 2,738

-------- -------- -------- --------- -----------

Share of loss in joint

venture (119)

--------

EBITDA 2,619

Depreciation and amortisation (1,442)

Exceptional items (1,489)

Operating loss (312)

Investment revenues 112

Finance costs (289)

--------

Loss before taxation (489)

Taxation (1,136)

--------

Loss for the period

from continuing operations (1,625)

Discontinued operations

Profit for the period

from discontinued operations 2,901

--------

Profit for the period 1,276

========

* Restated to reflect China as a discontinued operation. See

note 2. ** Restated to reflect new operating segments. See note 2

.

UK

& Rest

of Central

India Turkey Blink World Functions Total

Year ended 31 December GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

2021 (Audited)

Continuing operations

(Restated**)

Revenue - external sales 119,273 3,568 319 20,465 - 143,625

Segmental EBITDA 7,830 849 (254) 3,480 (4,192) 7,713

-------- -------- -------- --------- -----------

Share of loss in joint

venture (189)

--------

EBITDA 7,524

Depreciation and amortisation (2,995)

Exceptional items (1,628)

Operating profit 2,901

Investment revenues 223

Finance costs (358)

Other gains and losses 1,459

--------

Profit before taxation 4,225

Taxation (3,707)

--------

Profit for the period

from continuing operations 518

Discontinued operations

Profit for the period

from discontinued operations 2,490

--------

Profit for the period 3,008

========

** Restated to reflect new operating segments. See note 2 .

Segmental assets (Restated**)

30 June 2022 30 June 2021 (Restated*) 31 December 2021

GBP'000 GBP'000 GBP'000

(Unaudited) (Unaudited) (Audited)

India 31,098 29,731 2 9,252

Turkey 1,849 1,871 1 ,754

Blink 360 472 4 06

UK & Rest of World 13,012 13,619 1 2,927

Central Functions 3,793 1,539 6 ,318

Total segment assets 50,112 47,232 50,657

Assets relating to discontinued operations - 717 478

Unallocated assets 2,797 1,104 2,825

Consolidated total assets 52,909 49,053 53,960

============= ========================= =================

* Restated to reflect China as a discontinued operation. See

note 2. ** Restated to reflect new operating segments. See note

2.

Goodwill, deferred tax assets, equity investment and investment

in joint venture are not allocated to segments.

Capital expenditure (Restated**)

Other intangible assets

-----------------------------------------

6 months 6 months Year ended

ended 30 ended 30 31 December

June 2022 June 2021 2021

GBP'000 GBP'000 GBP'000

(Unaudited) (Unaudited) (Audited)

Continuing operations

India 949 267 712

Turkey - 1 -

Blink 72 99 151

UK & Rest of World 127 102 460

Central Functions 5 287 47

Total additions 1,153 756 1,370

============ ============ =============

** Restated to reflect new operating segments. See note 2.

In the period to 30 June 2022 GBP985,000 (30 June 2021:

GBP636,000, 31 December 2021: GBP1,192,000) of the total other

intangible asset additions related to internally generated software

assets in development. These reflect the capitalisation of staff

and contractor costs in IT development projects.

Timing of revenue recognition

The Group derives revenue from the transfer of goods and

services over time and at a point in time as follows:

6 months ended 30 June 2021

6 months ended 30 June 2022 (Restated*) Year ended 31 December 2021

GBP'000 GBP'000 GBP'000

(Unaudited) (Unaudited) (Audited)

Continuing

operations

At a point in

time 68,739 56,421 126,606

Over time 9,029 9,249 17,019

----------------------------- ---------------------------- -----------------------------

Revenue from

continuing

operations 77,768 65,670 143,625

Discontinued

operations 114 1,785 2,464

----------------------------- ---------------------------- -----------------------------

Total revenue 77,882 67,455 146,089

============================= ============================ =============================

* Restated to reflect China as a discontinued operation. See

note 2.

Information about major customers

Revenue from customers of one business partner in our India

segment represented approximately GBP49,825,000 (H1 2021:

GBP36,156,000; year ended 31 December 2021: GBP84,159,000) of the

Group's total revenue.

4 Exceptional items

6 months

ended 6 months Year ended

30 June ended 30 31 December

2022 June 2021 2021

GBP'000 GBP'000 GBP'000

(Unaudited) (Unaudited) (Audited)

Restructuring costs 497 1,489 1,628

Exceptional charge included

in operating profit 497 1,489 1,628

Other gains and losses -

gain on reclassification

of investment - - (1,459)

------------ ------------ -------------

Total exceptional charge

included in profit before

tax 497 1,489 169

Tax on exceptional items - (137) (171)

------------ ------------ -------------

Total exceptional charge/(gain)

after tax 497 1,352 (2)

============ ============ =============

Restructuring costs of GBP497,000 primarily relate to settlement

costs in exiting the former CEO and redundancy costs in the UK MGA

as the business moves to closure. The prior year restructuring

costs relates to wide-scale operational changes or closure

activities in Spain, Mexico, Malaysia, Blink and Head Office, as

well as closure of the Malaysian operations. The charges recognised

are primarily settlement or redundancy costs.

5 Taxation

The tax charge is calculated by aggregating the tax arising in

each jurisdiction based on estimated profits chargeable to

corporation tax and withholding taxes arising in H1 2022 at the

local statutory rate of tax. This leads to a tax charge on

continuing operations of GBP1.4 million (H1 2021 restated: GBP1.1

million; year ended 31 December 2021: GBP3.7 million) reflecting

the charges arising in India, Turkey and our European markets.

These tax charges result in an effective tax rate (ETR) at the half

year of 113% (H1 2021 restated: negative 232%; year ended 31

December 2021: 88%).

The corporate income tax in our profitable overseas

jurisdictions is higher than the current UK corporate income tax

rate of 19% and, in addition, there are withholding taxes applied

to funds repatriated from our overseas operations which further

increases the ETR. Profits generated from our UK operations are

expected to be covered by group relief from losses arising in other

UK entities.

The Mini-Budget on 23 September 2022, announced a reversal of

the planned increase in April 2023 to 25% of the corporate income

tax rate in the UK. The rate will now remain at its current level

of 19%. This change has not been substantively enacted at the

balance sheet date, and as a result deferred tax balances continue

to be measured at 25%. The reversal is not expected to have a

material impact on the financial statements.

The Group's forecast ETR for the full year is notably higher

than the UK corporate income tax rate due to losses principally in

Blink and the UK, which coupled with the one-time exceptional

restructuring charges will reduce the overall Group profit before

tax to a level that is lower than the tax charges recognised in our

profitable markets. The strategic refocus and restructuring

activity undertaken in 2022 is expected to alleviate this position

and enable a progressive reduction in the Group's ETR over the

longer-term.

6 Dividends

6 months 6 months Year ended

ended 30 ended 30 31 December

June 2022 June 2021 2021

GBP'000 GBP'000 GBP'000

(Unaudited) (Unaudited) (Audited)

Interim dividend for the year

ended 31 December 2021 of 5 pence - - 441

Final dividend for the year ended

31 December 2021 of 7.5 pence

(2020: 25 pence) 663 2,188 2,188

------------ ------------ -------------

663 2,188 2,629

============ ============ =============

The Directors have not proposed an interim dividend for

2022.

7 (Loss)/earnings per share

Basic and diluted (loss)/earnings per share (EPS) has been

calculated in accordance with IAS 33 Earnings per share. Underlying

(loss)/earnings per share, which excludes exceptional items, has

also been presented in order to give a better understanding of the

performance of the business. In accordance with IAS 33, potential

ordinary shares are only considered dilutive when their conversion

would decrease the EPS or increase the loss per share attributable

to equity holders. Consequently, options are not dilutive on

continuing operations in the period and therefore, in accordance

with IAS 33, have not been treated as dilutive on discontinued

operations or total EPS. The diluted (loss)/earnings per share is

therefore equal to the basic (loss)/earnings per share in the six

months ended 30 June 2022.

Continuing Discontinued

Six months ended 30 June 2022 (Unaudited) operations operations Total

(Loss)/earnings GBP'000 GBP'000 GBP'000

(Loss)/earnings for the purposes of basic and diluted (loss)/earnings per share (362) 616 254

Exceptional items (net of tax) 497 (657) (160)

----------- ----------------- ------------

Earnings/(loss) for the purposes of underlying basic and diluted earnings/(loss) per share 135 (41) 94

=========== ================= ============

Number of shares Number

(thousands)

Weighted average number of ordinary shares for the purposes of basic and diluted (loss)/earnings

per share and basic underlying earnings/(loss) per share 8,843

Effect of dilutive ordinary shares: share options 57

Weighted average number of ordinary shares for the purposes of diluted underlying earnings/(loss)

per share 8,900

============

Continuing Discontinued

(Loss)/earnings per share operations operations Total

Pence Pence Pence

Basic and diluted (loss)/earnings per share (4.09) 6.96 2.87

=============== ============= ==============

Basic and diluted underlying earnings/(loss) per share 1.53 (0.46) 1.07

=============== ============= ==============

Six months ended 30 June 2021

(Unaudited) (Restated*) Continuing operations Discontinued operations Total

(Loss)/earnings GBP'000 GBP'000 GBP'000

(Loss)/earnings for the purposes of basic

and diluted (loss)/earnings per share (1,888) 2,901 1,013

Exceptional items (net of tax) 1,352 (2,641) (1,289)

---------------------- ------------------------ --------

(Loss)/earnings for the purposes of

underlying basic and diluted

(loss)/earnings per share (536) 260 (276)

====================== ======================== ========

Number of shares Number

(thousands)

Weighted average number of ordinary shares for the purposes of basic and diluted

(loss)/earnings

per share and underlying (loss)/earnings per share 8,770

============

Continuing Discontinued Total

(Loss)/earnings per share operations operations

Pence Pence Pence

Basic and diluted (loss)/earnings per share (21.53) 33.08 11.55

================== ================= ========

Basic and diluted underlying (loss)/earnings per share (6.11) 2.96 (3.15)

================== ================= ========

* Restated to reflect China as a

discontinued operation.

Year ended 31 December 2021

(Audited) Continuing operations Discontinued operations Total

Earnings GBP'000 GBP'000 GBP'000

Profit for the purposes of basic and

diluted earnings per share 75 2,490 2,565

Exceptional items (net of tax) (2) (2,399) (2,401)

---------------------- ------------------------ -----------

Profit for the purposes of underlying

basic and diluted earnings per share 73 91 164

====================== ======================== ===========

Number of shares Number

(thousands)

Weighted average number of ordinary shares

for the purposes of basic earnings per

share and

basic underlying earnings per share 8,796

Effect of dilutive ordinary shares: share

options 225

Weighted average number of ordinary shares

for the purposes of diluted earnings per

share

and diluted underlying earnings per share 9,021

Earnings per share Continuing operations Discontinued operations Total

Pence Pence Pence

Basic earnings per share 0.85 28.31 29.16

Diluted earnings per share 0.83 27.60 28.43

===========

Basic underlying earnings per share 0.83 1.03 1.86

Diluted underlying earnings per share 0.81 1.01 1.82

8 Discontinued operations

On 27 January 2022, the Group completed the sale of its 100%

shareholding in CPP Asia Limited and its wholly owned subsidiary

CPP Technology Services (Shanghai) Co. Ltd (together "China").

Consideration on disposal was HKD 1.

In the prior period, on 17 May 2021, the Group completed the

sale of its 100% shareholding in CPP Creating Profitable

Partnerships GmbH ("Germany"). The final consideration on disposal

was GBP2,366,000 (EUR2,752,000).

In accordance with IFRS 5 Non-current assets held for sale and

discontinued operations this operation has been presented as a

discontinued operation.

Profit from discontinued operations comprises the following:

Six months ended 30 June 2022 China

GBP'000

(Unaudited)

Revenue 114

Cost of sales (33)

Gross profit 81

Administrative expenses (114)

EBITDA and operating profit (33)

Finance costs (8)

Loss before taxation (41)

Taxation -

Loss after taxation (41)

Profit on disposal 657

Total profit 616

Six months ended 30 June 2021 Germany China Total

GBP'000 GBP'000 GBP'000

(Unaudited) (Unaudited) (Unaudited)

Revenue 1,062 723 1,785

Cost of sales (430) (306) (736)

Gross profit 632 417 1,049

Administrative expenses (4) (796) (800)

EBITDA and operating profit 628 (379) 249

Finance costs 33 8 41

Profit/(loss) before taxation 661 (371) 290

Taxation (30) - (30)

Profit/(loss) after taxation 631 (371) 260

Profit on disposal 2,641 - 2,641

Total profit 3,272 (371) 2,901

Year ended 31 December 2021 Germany China Total

GBP'000 GBP'000 GBP'000

(Audited) (Audited) (Audited)

Revenue 1,062 1,402 2,464

Cost of sales (430) (547) (977)

Gross profit 632 855 1,487

Administrative expenses - (1,649) (1,649)

EBITDA and operating profit 632 (794) (162)

Finance costs 33 67 100

Profit/(loss) before taxation 665 (727) (62)

Taxation (30) - (30)

Profit/(loss) after taxation 635 (727) (92)

Profit/(loss) on disposal 2,654 (72) 2,582

Total profit/(loss) 3,289 (799) 2,490

Operating results for the six months ended 30 June 2022 reflect

the trading performance of China up to the date of disposal, being

27 January 2022. Comparative information reflects a complete six

months and 12 months respectively. Prior to disposal China was part

of the UK & ROW segment. In the prior periods, Germany is

included up to the date of disposal on 17 May 2021.

The Group has recognised a profit on disposal as follows:

6 months ended 30 June 2022 6 months ended 30 June 2021 Year ended 31 December 2021

(China) (Germany) (Germany and China)

GBP'000 GBP'000 GBP'000

(Unaudited) (Unaudited) (Audited)

Proceeds - 2,353 2,366

Net

(assets)/liabilities

sold (424) 2 8 4 284

Costs associated with

disposal - - (72)

Currency translation

differences on

disposal 1,081 4 4

Profit on disposal 657 2,641 2,582

9 Share capital

Share capital at 30 June 2022 is GBP24,254,000 (30 June 2021:

GBP24,232,000; 31 December 2021: GBP24,243,000). To satisfy share

option exercises in the six month period to 30 June 2022 the

Company has issued 11,069 GBP1 ordinary shares for a total equity

value of GBP11,000 and cash consideration of GBP6,000.

The total number of ordinary shares in issue at 30 June 2022 is

8,844,267 of which 8,839,268 are fully paid and 4,999 are partly

paid.

10 Reconciliation of operating cash flows

6 months ended Year ended

6 months ended 30 June 2022 30 June 2021 31 December 2021

GBP'000 GBP'000 GBP'000

(Unaudited) (Unaudited) (Audited)

Profit for the period 454 1,276 3,008

Adjustments for:

Depreciation and amortisation 1,260 1,584 3,111

Share-based payment (credit)/charge (248) 226 (64)

Impairment loss on right-of-use assets - - 48

Impairment loss on intangible assets - - 176

Impairment loss on property, plant and equipment - - 3

Loss on disposal of intangible assets 175 - -

Loss on disposal of property, plant and equipment 42 4 26

Profit on disposal of discontinued operations (657) (2,641) (2,582)

Share of loss of joint venture - 119 189

Effects of hyperinflation (69) - -

Investment revenues (176) (112) (224)

Finance costs 281 247 259

Other gains and losses - - (1,459)

Income tax charge 1,449 1,166 3,737

Operating cash flows before movement in working

capital 2,511 1,869 6,228

(Increase)/decrease in inventories (13) (4) 40

(Increase)/decrease in contract assets (148) 569 354

(Increase)/decrease in receivables (1,810) 2,099 1,672

Increase/(decrease) in payables 1,404 (3,061) ( 636)

Decrease in contract liabilities (30) (867) (276)

Cash from operations 1,914 605 7,382

Income taxes paid (2,241) (907) (2,820)

Net cash (used in)/from operating activities (327) (302) 4,562

11 Related party transactions

Transactions with associated undertakings

In the six months to 30 June 2022, the Group incurred fees of

GBP8,000 plus VAT (30 June 2020: GBP4,000 and year ended 31

December 2020: GBP8,000) for services rendered from KYND, which was

payable under 14 day credit terms. The creditor balance at 30 June

2022 was GBPnil (30 June 2021: GBPnil, 31 December 2021:

GBP1,000).

Transactions with related parties

On 27 January 2022, the Group completed the sale of China to

T-Link Holdings Limited ("T-Link") for nominal cash consideration

of HK$1. As part of the Disposal, the Group made a working capital

cash injection into China of GBP0.5 million.

The majority shareholder of T-Link is Wilson Chan, the CEO of

China. The terms of the Disposal reflect the ongoing cash losses

and investment requirements of China. The Board concluded that sale

of the business to T-Link rather than a closure was both the least

costly for the Group and the right option for all stakeholders,

enabling the Group to focus on its core markets while ensuring in

China the smooth transition of colleagues and continuity of service

to partners and their customers.

As Wilson Chan is CEO of China and a majority shareholder in

T-Link, the Disposal constitutes a related party transaction. The

Directors consider, having consulted with the Company's nominated

adviser, Liberum Capital Limited, that the terms of the Disposal

are fair and reasonable insofar as the Company's shareholders are

concerned.

Remuneration of key management personnel

The remuneration of the Directors and Senior Management Team,

who are the key management personnel of the Group, is set out

below:

6 months ended 6 months ended Year ended

30 June 2022 30 June 2021 31 December 2021

GBP'000 GBP'000 GBP'000

(Unaudited) (Unaudited) (Audited)

Short-term employee benefits 858 1,024 1,788

Post-employment benefits 25 41 74

Termination benefits 300 203 203

Share-based payments (195) 108 (65)

988 1,376 2,000

12 Events after the balance sheet date

Transactions with related parties

In July 2022, the Group agreed to amend the Globiva Shareholder

Agreement (SHA) and certain other arrangements. The Group holds a

51% majority interest in Globiva, with the other 49% of share

beneficially owned by the three founders. CPP agreed to provide

additional funding of GBP0.5 million through an existing repayable

interest-bearing loan which was utilised to make a one-time

compensation payment to the Globiva founders. The SHA further

entitled, upon achievement of certain performance targets, the

Globiva founders to either a cash payment or to buyback of 10% of

the ordinary shares in Globiva from CPP. Under the amended

arrangements, the Globiva founders will, on meeting performance

targets, buyback 10% of the ordinary shares, however in the normal

course of business, this cannot be triggered until 1 January 2026

at the earliest.

The compensation payment to the Globiva founders, who are also

Directors of Globiva, along with the other arrangements constitute

a related party transaction under AIM Rule 13. The Directors of CPP

Group consider, having consulted with the Company's nominated

adviser, Liberum Capital Limited, that the terms of the transaction

are fair and reasonable insofar as the Company's shareholders are

concerned.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR PPUAPBUPPGMW

(END) Dow Jones Newswires

September 26, 2022 02:01 ET (06:01 GMT)

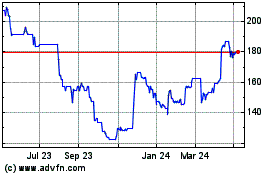

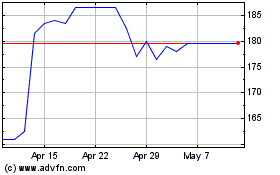

Cppgroup (LSE:CPP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cppgroup (LSE:CPP)

Historical Stock Chart

From Apr 2023 to Apr 2024