National Australia Bank 3Q Profit Rises to A$1.85 Billion

August 08 2022 - 7:14PM

Dow Jones News

By Alice Uribe

SYDNEY--National Australia Bank Ltd. recorded a rise in

third-quarter profit, with the lender reporting that the majority

of its customers are well placed to manage the challenges of higher

inflation and interest rates.

NAB, the country's biggest business lender, recorded an

unaudited net profit of 1.85 billion Australian dollars (US$1.29

billion) for the three months through June. No comparable figure

was disclosed, but it compares with a profit of A$1.65 billion

reported by the bank a year ago.

Chief Executive Ross McEwan said that around approximately 70%

of customer home loan repayments were ahead of schedule.

"Our business is also in good shape for this evolving

environment. Balance sheet settings remain strong and we are well

advanced on our FY 2022 term wholesale funding task with A$34

billion raised by end-June," he said.

The lender reported unaudited cash earnings--a measure adjusted

for fair value and hedging movements, which is the basis for

calculating dividend payouts--of A$1.80 billion, which NAB said

represented a 6.0% increase on last year.

NAB said it now expects its fiscal 2022 cost growth to be around

3-4% which includes a top-up to payroll and customer-related

remediation provisions of A$60 million-A$100 million for existing

matters.

Analysts from Citi had expected NAB would deliver cash earnings

of A$1.75 billion, which it said is largely in line with Visible

Alpha consensus of A$1.77 billion.

Write to Alice Uribe at alice.uribe@wsj.com

(END) Dow Jones Newswires

August 08, 2022 18:59 ET (22:59 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

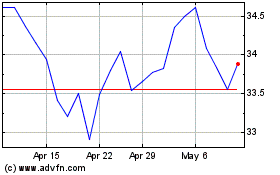

National Australia Bank (ASX:NAB)

Historical Stock Chart

From Mar 2024 to Apr 2024

National Australia Bank (ASX:NAB)

Historical Stock Chart

From Apr 2023 to Apr 2024