As

Filed with the Securities and Exchange Commission on July 15, 2022

Registration

No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

S-1

UNDER

THE

SECURITIES ACT OF 1933

STAFFING

360 SOLUTIONS, INC.

(Exact

Name of Registrant as Specified in its Charter)

| Delaware |

|

7363 |

|

68-0680859 |

(State

or other jurisdiction

of

incorporation or organization) |

|

(Primary

Standard Industrial Classification Code Number) |

|

(I.R.S.

Employer

Identification

No.) |

757

Third Avenue, 27th Floor

New

York, New York 10017

(646)

507-5710

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Brendan

Flood

Chairman

and Chief Executive Officer

Staffing

360 Solutions, Inc.

757

Third Avenue, 27th Floor

New

York, New York 10017

(646)

507-5710

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies

to:

Rick

A. Werner, Esq.

Jayun

Koo, Esq.

Haynes

and Boone, LLP

30

Rockefeller Plaza, 26th Floor

New

York, New York 10112

(212)

659-7300

Approximate

date of commencement of proposed sale to the public: As soon as practicable after this registration statement is declared effective.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933 check the following box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company” and “emerging growth company” in Rule 12b–2 of the Exchange Act.

| Large

accelerated filer |

|

☐ |

|

Accelerated

filer |

|

☐ |

| Non-accelerated

filer |

|

☒ |

|

Smaller

reporting company |

|

☒ |

| |

|

|

|

Emerging

growth company |

|

☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective

on such date as the Securities and Exchange Commission acting pursuant to said Section 8(a) may determine.

The

information in this prospectus is not complete and may be changed. The selling stockholders named in this prospectus may not sell these

securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an

offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not

permitted.

Subject

to Completion, dated July 15, 2022

PROSPECTUS

Staffing

360 Solutions, Inc.

2,022,913

Shares of Common Stock

This

prospectus relates to the resale by the selling stockholders named in this prospectus from time to time of up to 2,022,913 shares of

our common stock, par value $0.00001 per share. These 2,022,913 shares of common stock consist of:

| ● |

409,531

shares of common stock, or the Common Shares, that were issued in the July 2022 Private Placement (as defined herein), pursuant to

the securities purchase agreement, dated as of July 1, 2022, by and among us and the several purchasers named therein, or the July

2022 Purchase Agreement; |

| |

|

| ● |

248,327

shares of common stock, or the Pre-Funded Warrant Shares, issuable upon the exercise of certain pre-funded warrants, or the Pre-Funded

Warrants, that were issued pursuant to the July 2022 Purchase Agreement in the July 2022 Private Placement; |

| |

|

| ● |

657,858

shares of common stock, or the Amended Warrant Shares, issuable upon the exercise of certain existing warrants, or the Amended Warrants,

that were amended pursuant to the warrant amendment agreements, or the Warrant Amendment Agreements, entered into by the selling

shareholders in the July 2022 Private Placement; |

| |

|

| ● |

657,858

shares of common stock, or the Warrant Shares, issuable upon the exercise of warrants, or the Warrants, that were issued pursuant

to the July 2022 Purchase Agreement in the July 2022 Private Placement; and |

| |

|

| ● |

49,339

shares of common stock, or the Wainwright Warrant Shares, issuable upon the exercise of warrants, or the Wainwright Warrants, that

were issued to H.C. Wainwright & Co., LLC, or Wainwright, as part of Wainwright’s compensation for serving as exclusive

placement agent in connection with the July 2022 Private Placement; |

The

Common Shares, the Pre-Funded Warrants, the Amended Warrants, the Warrants and the Wainwright Warrants were issued in reliance upon the

exemption from the registration requirements in Section 4(a)(2) of the Securities Act and Regulation D promulgated thereunder. Each purchaser

represented that it was an “accredited investor” (as defined by Rule 501 under the Securities Act). We are registering the

offer and resale of the Common Shares and the Pre-Funded Warrant Shares, Warrant Shares issuable upon the exercise of the Pre-Funded

Warrants and the Warrants to satisfy a provision in that certain registration rights agreement, dated July 1, 2022, or the Registration

Rights Agreement, pursuant to which we agreed to register the resale of the Common Shares and the shares of common stock issuable upon

the exercise of the Pre-Funded Warrants, and the Warrants. We are also registering the shares of common stock issuable upon the exercise

of the Amended Warrants and the Wainwright Warrants in order to permit the selling stockholders to offer the Amended Warrant Shares and

the Wainwright Warrant Shares for resale from time to time pursuant to this prospectus

Our

registration of the shares of common stock covered by this prospectus does not mean that the selling stockholders will offer or sell

any of such shares of common stock. The selling stockholders named in this prospectus, or their donees, pledgees, transferees or other

successors-in-interest, may resell the shares of common stock covered by this prospectus through public or private transactions at prevailing

market prices, at prices related to prevailing market prices or at privately negotiated prices. For additional information on the possible

methods of sale that may be used by the selling stockholders, you should refer to the section of this prospectus entitled “Plan

of Distribution.”

We

will not receive any of the proceeds from the sale of common stock by the selling stockholders. However, we will receive proceeds from

the exercise of the Pre-Funded Warrants, the Amended Warrants, the Warrants and the Wainwright Warrants if the Pre-Funded Warrants, the

Amended Warrants, the Warrants and the Wainwright Warrants are exercised for cash. We intend to use those proceeds, if any, for working

capital purposes.

Any

shares of common stock subject to resale hereunder will have been issued by us and acquired by the selling stockholders prior to any

resale of such shares pursuant to this prospectus.

No

underwriter or other person has been engaged to facilitate the sale of the common stock in this offering. We will bear all costs, expenses

and fees in connection with the registration of the common stock. The selling stockholders will bear all commissions and discounts, if

any, attributable to their respective sales of our common stock.

Effective

as of 4:05 pm Eastern Time on June 23, 2022, we filed a Certificate of Amendment to our Amended and Restated Certificate of Incorporation,

or the Certificate of Incorporation to effect a reverse stock split of the issued and outstanding shares of our common stock, at a ratio

of 1-for-10. All share and per share prices in this prospectus have been adjusted to reflect the 1-for-10 Reverse Stock Split (as defined

herein); however, common stock share and per share amounts in certain of the documents incorporated by reference herein have not been

adjusted to give effect to the 1-for-10 Reverse Stock Split.

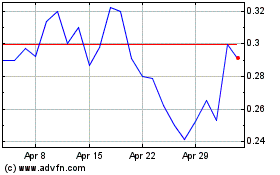

Our

common stock is listed on The Nasdaq Capital Market, or Nasdaq, under the symbol “STAF.” On July 14, 2022, the last reported

sales price for our common stock was $3.73 per share.

Investment

in our common stock involves risk. See “Risk Factors” contained in this prospectus, in our periodic reports filed from time

to time with the Securities and Exchange Commission, which are incorporated by reference in this prospectus and in any applicable prospectus

supplement. You should carefully read this prospectus and the documents we incorporate by reference, before you invest in our common

stock.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed

upon the adequacy or the accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The

date of this prospectus is , 2022.

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus is part of the registration statement that we filed with the Securities and Exchange Commission pursuant to which the selling

stockholders named herein may, from time to time, offer and sell or otherwise dispose of the shares of our common stock covered by this

prospectus. As permitted by the rules and regulations of the Securities and Exchange Commission, the registration statement filed by

us includes additional information not contained in this prospectus.

This

prospectus and the documents incorporated by reference into this prospectus include important information about us, the securities being

offered and other information you should know before investing in our securities. You should not assume that the information contained

in this prospectus is accurate on any date subsequent to the date set forth on the front cover of this prospectus or that any information

we have incorporated by reference is correct on any date subsequent to the date of the document incorporated by reference, even though

this prospectus is delivered or shares of common stock are sold or otherwise disposed of on a later date. It is important for you to

read and consider all information contained in this prospectus, including the documents incorporated by reference therein, in making

your investment decision. You should also read and consider the information in the documents to which we have referred you under “Where

You Can Find More Information” and “Incorporation of Certain Information by Reference” in this prospectus.

You

should rely only on this prospectus and the information incorporated or deemed to be incorporated by reference in this prospectus. We

have not, and the selling stockholders have not, authorized anyone to give any information or to make any representation to you other

than those contained or incorporated by reference in this prospectus. If anyone provides you with different or inconsistent information,

you should not rely on it. This prospectus does not constitute an offer to sell or the solicitation of an offer to buy securities in

any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction.

We

further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document

that is incorporated by reference in this prospectus were made solely for the benefit of the parties to such agreement, including, in

some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation,

warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly,

such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

Unless

otherwise indicated, information contained or incorporated by reference in this prospectus concerning our industry, including our general

expectations and market opportunity, is based on information from our own management estimates and research, as well as from industry

and general publications and research, surveys and studies conducted by third parties. Management estimates are derived from publicly

available information, our knowledge of our industry and assumptions based on such information and knowledge, which we believe to be

reasonable. In addition, assumptions and estimates of our and our industry’s future performance are necessarily uncertain due to

a variety of factors, including those described in “Risk Factors” beginning on page 5 of this prospectus. These and other

factors could cause our future performance to differ materially from our assumptions and estimates.

PROSPECTUS

SUMMARY

This

summary provides an overview of selected information contained elsewhere or incorporated by reference in this prospectus and does not

contain all of the information you should consider before investing in our securities. You should carefully read the prospectus, the

information incorporated by reference and the registration statement of which this prospectus is a part in their entirety before investing

in our securities, including the information discussed under “Risk Factors” in this prospectus and the documents incorporated

by reference and our financial statements and related notes that are incorporated by reference in this prospectus. In this prospectus,

unless the context indicates otherwise, “Staffing 360,” the “Company,” the “registrant,” “we,”

“us,” “our,” or “ours” refer to Staffing 360 Solutions, Inc. and its consolidated subsidiaries.

Overview

We

are a high-growth international staffing company engaged in the acquisition of United States and United Kingdom based staffing companies.

Our services principally consist of providing temporary contractors, and, to a much lesser extent, the recruitment of candidates for

permanent placement. As part of our consolidation model, we pursue a broad spectrum of staffing companies supporting primarily accounting

and finance, IT, engineering, administration and commercial disciplines. Our typical acquisition model is based on paying consideration

in the form of cash, stock, earn-outs and/or promissory notes. In furthering our business model, we are regularly in discussions and

negotiations with various suitable, mature acquisition targets. To date, we have completed eleven acquisitions since November 2013.

Recent

Developments

Amendment

to Articles of Incorporation

On

June 23, 2022, we filed a Certificate of Amendment of Amended and Restated Certificate of Incorporation (the “Certificate of Amendment”)

with the Secretary of State of Delaware to effect a 1-for-10 reverse stock split of the shares of our common stock, either issued and

outstanding or held us as treasury stock, effective as of 4:05 p.m. (Delaware time) on June 23, 2022 (the “1-for-10 Reverse Stock

Split”). As previously reported on our Current Report on Form 8-K, filed on June 23, 2022, we held a special meeting of stockholders

on June 23, 2022 (the “Special Meeting”), at which meeting our stockholders, by an affirmative vote of the majority of our

outstanding shares of capital stock (including holders of our Series H Convertible Preferred Stock, voting on an as-converted basis and

Series J Preferred Stock), approved the amendment to our Certificate of Incorporation to effect, at the discretion of our Board of Directors

(the “Board”), a reverse stock split (the “Approved Reverse Stock Split”) of the common stock at a ratio determined

by the Board in the range of 1-for-2 to 1-for-20, such ratio to be determined by the Board, without reducing the authorized number of

shares of common stock. Following the Special Meeting, the Board determined to effect the Approved Reverse Stock Split at a ratio of

1-for-10 and approved the corresponding final form of the Certificate of Amendment.

As

a result of the 1-for-10 Reverse Stock Split, every ten shares of issued and outstanding common stock were automatically combined on

June 23, 2022 into one issued and outstanding share of common stock, without any change in the par value per share. No fractional shares

were issued as a result of the 1-for-10 Reverse Stock Split. Any fractional shares that would otherwise have resulted from the 1-for-10

Reverse Stock Split were rounded up to the next whole number. The 1-for-10 Reverse Stock Split reduced the number of shares of common

stock outstanding from 17,618,300 shares to approximately 1,761,830 shares, subject to adjustment for the rounding up of fractional shares.

The number of authorized shares of common stock under the Certificate of Incorporation remained unchanged at 200,000,000 shares.

Proportionate

adjustments will be made to the number of shares of common stock that may be received upon conversion of the issued and outstanding shares

of our Series H Convertible Preferred Stock. In addition, proportionate adjustments will be made to the per share exercise price and

the number of shares of common stock that may be purchased upon exercise of outstanding stock options granted by us, and the number of

shares of common stock reserved for future issuance under our 2014 Equity Incentive Plan, 2015 Omnibus Plan, 2016 Omnibus Plan and 2020

Omnibus Plan.

The

common stock began trading on a reverse stock split-adjusted basis on Nasdaq on June 24, 2022. The trading symbol for the common stock

remains “STAF.” The new CUSIP number for the common stock following the 1-for-10 Reverse Stock Split is 852387505.

July

2022 Private Placement

On

July 1, 2022, we entered into the July 2022 Purchase Agreement with certain institutional and accredited investors. Pursuant to the July

2022 Purchase Agreement, we sold, in a private placement (the “July 2022 Private Placement”), 657,858 shares of our common

stock (or pre-funded warrants) and warrants to purchase up to an aggregate of 657,858 shares of our common stock to the investors at

a combined purchase price of $6.10 per share (or pre-funded warrant) and associated warrant. The Pre-Funded Warrants are exercisable

at a price of $0.00001 per share, are exercisable immediately upon issuance and are exercisable until the Pre-Funded Warrants are exercised

in full. The Warrants are exercisable at an exercise price of $5.85 per share, were exercisable immediately upon issuance and have a

term of exercise equal to five and one-half years from the date of issuance.

The

net proceeds to us from the July 2022 Private Placement were approximately $3.08 million, after deducting placement agent fees and other

estimated offering expenses payable by us.

On

June 28, 2022, we entered into an engagement letter (the “Engagement Letter”) with Wainwright, pursuant to which Wainwright

agreed to serve as our exclusive placement agent, on a reasonable best-efforts basis, in connection with the July 2022 Private Placement.

We paid Wainwright an aggregate cash fee equal to 7.5% of the gross proceeds of the July 2022 Private Placement and a management fee

equal to 1.0% of the gross proceeds of the July 2022 Private Placement, and additionally reimbursed Wainwright for a non-accountable

expense allowance of $85,000. Additionally, we issued to Wainwright or its designees as compensation, the Wainwright Warrants to purchase

up to 49,339 shares of common stock, equal to 7.5% of the aggregate number of shares of common stock placed in the July 2022 Private

Placement. The Wainwright Warrants have a term of five and one-half years from the date of issuance and an exercise price of $7.625 per

share of common stock (equal to 125% of the combined purchase price per share of common stock (or pre-funded warrant) and associated

warrant issued and sold in the July 2022 Private Placement). The July 2022 Private Placement closed on July 7, 2022.

Corporate

Information

Staffing

360 Solutions, Inc., was incorporated in the State of Nevada on December 22, 2009, as Golden Fork Corporation, which changed its name

to Staffing 360 Solutions, Inc., and its trading symbol to “STAF”, on March 16, 2012. On June 15, 2017, we changed our state

of domicile to the State of Delaware. Our principal executive office is located at 757 Third Avenue, 27th Floor, New York, New York 10017,

and our telephone number is (646) 507-5710. Our website is www.staffing360solutions.com, and the information included in, or linked to

our website is not part of this prospectus. We have included our website address in this prospectus solely as a textual reference.

THE

OFFERING

Common

Stock to be Offered by the selling stockholders |

|

Up

to 2,022,913 shares of our common stock, which are comprised of (i) 409,531 Common Shares, (ii) 248,327 shares of common stock issuable

upon the exercise of the Pre-Funded Warrants, (iii) 657,858 shares of common stock issuable upon the exercise of the Amended Warrants,

(iv) 657,858 shares of common stock issuable upon the exercise of the Warrants, and (v) 49,339 shares of common stock issuable upon

the exercise of the Wainwright Warrants. |

| |

|

|

| Use

of Proceeds |

|

All

shares of our common stock offered by this prospectus are being registered for the accounts of the selling stockholders and we will

not receive any proceeds from the sale of these shares. However, we will receive proceeds from the exercise of the Pre-Funded Warrants,

the Amended Warrants, the Warrants and the Wainwright Warrants if the Pre-Funded Warrants, the Amended Warrants, the Warrants and

the Wainwright Warrants are exercised for cash. We intend to use those proceeds, if any, for working capital purposes. See “Use

of Proceeds” beginning on page 8 of this prospectus for additional information. |

| |

|

|

| Registration

Rights |

|

Under

the terms of the Registration Rights Agreement, we agreed to file this registration statement with respect to the registration of

the resale by the selling stockholders of shares of common stock issuable pursuant to the July 2022 Purchase Agreement and the exercise

of the Pre-Funded Warrants and the Warrants, as applicable, by the 15th calendar day following the date of the Registration Rights

Agreement, and to use best efforts to have the registration statement declared effective as promptly as practical thereafter, and

in any event, no later than the 45th calendar day following the date of the Registration Rights Agreement. In addition, we agreed

that, upon the registration statement being declared effective under the Securities Act of 1933, as amended (the “Securities

Act”), we will use our best efforts to maintain the effectiveness of the registration statement until the date that (i) the

selling stockholders have sold all of the shares of common stock issuable under the Registration Rights Agreement or (ii) such shares

may be resold by the selling stockholders pursuant to Rule 144 of the Securities Act, without the requirement for us to be in compliance

with the current public information required under such rule and without volume or manner-of-sale restriction. |

| |

|

|

| Plan

of Distribution |

|

The

selling stockholders named in this prospectus, or their pledgees, donees, transferees, distributees,

beneficiaries or other successors-in-interest, may offer or sell the shares of common stock

from time to time through public or private transactions at prevailing market prices, at

prices related to prevailing market prices or at privately negotiated prices. The selling

stockholders may also resell the shares of common stock to or through underwriters, broker-dealers

or agents, who may receive compensation in the form of discounts, concessions or commissions.

See

“Plan of Distribution” beginning on page 16 of this prospectus for additional information on the methods of sale that

may be used by the selling stockholders. |

| |

|

|

| Nasdaq

Capital Market Symbol |

|

Our

common stock is listed on Nasdaq under the symbol “STAF.” |

| |

|

|

| Risk

Factors |

|

Investing

in our common stock involves significant risks. See “Risk Factors” beginning on page 5 of this prospectus and the documents

incorporated by reference in this prospectus. |

RISK

FACTORS

An

investment in our securities involves certain risks. Before deciding to invest in our common stock, you should consider carefully the

following discussion of risks and uncertainties affecting us and our securities, together with other information in this prospectus and

the other information and documents incorporated by reference in this prospectus, including the risks, uncertainties and assumptions

discussed under the heading “Risk Factors” in our most recent Annual Report on Form 10-K for the fiscal year ended January

1, 2022, or any updates in our Quarterly Reports on Form 10-Q or Current Reports on Form 8-K. Our business, business prospects, financial

condition or results of operations could be seriously harmed as a result of these risks. This could cause the trading price of our common

stock to decline, resulting in a loss of all or part of your investment. Additional risks and uncertainties not presently known to us

or that we currently deem immaterial also may materially and adversely affect our business, financial condition and results of operations.

Please also read carefully the section below entitled “Special Note Regarding Forward-Looking Statements.”

Risks

Related to Our Business

The

COVID-19 pandemic has adversely affected our business and may continue to adversely affect our business.

In

December 2019, a strain of coronavirus was reported to have surfaced in Wuhan, China, and spread globally. The COVID-19 pandemic has,

from time to time, led to government-imposed quarantines, limitations on business activity and shelter-in-place mandates to mitigate

or contain the virus, and has contributed to financial market volatility and uncertainty, significant disruptions in general commercial

activity and the global economy, including in the United States and the United Kingdom where our operations are based. Much of the independent

contractor work we provide to our clients is performed at the site of our clients. As a result, we are subject to the plans and approaches

of our clients have made to address the COVID-19 pandemic, such as whether they support remote working or if they have simply closed

their facilities and furloughed employees. To the extent that our clients were to decide or are required to close their facilities, or

not permit remote work when they close facilities, we would no longer generate revenue and profit from that client. In addition, in the

event that our clients’ businesses suffer or close as a result of the COVID-19 pandemic, we may experience decline in our revenue

or write-off of receivables from such clients. Developments such as social distancing and shelter-in-place directives have impacted our

ability to deploy our staffing workforce effectively during the COVID-19 pandemic, thereby impacting contracts with customers in our

commercial staffing and professional staffing business streams, and may continue to impact our business and results of operations should

such measures be implemented again. While some government-imposed precautionary measures have been relaxed in certain countries or states,

more strict measures may be put in place again due to a resurgence in COVID-19 cases or emergence of new variants of the virus.

Our

business was impacted in the fiscal year ended January 1, 2022, by numerous government-mandated lockdown periods in the United States

and United Kingdom. This had a large impact on the financial results of our numerous business streams, which differed in their financial

recoveries primarily due to the geographies and industries in which they operate.

The

ultimate impact of the COVID-19 pandemic continues to be highly uncertain and subject to future developments. A continuation or worsening

of the levels of market disruption and volatility seen in the recent past could have an adverse effect on our ability to access capital

and on the market price of our common stock, and affect our ability to successfully raise needed capital. If we are unsuccessful in raising

capital in the future, we may need to reduce activities, curtail or cease operations. The ongoing COVID-19 pandemic may continue to disrupt

the marketplaces in which we operate, which may negatively affect our business, results of operations and overall liquidity, as it has

previously.

Risks

Related to Our Common Stock and this Offering

We

may not meet the continued listing requirements of The Nasdaq Capital Market, which could result in a delisting of our common stock.

Our

common stock is listed on Nasdaq. We have in the past, and may in the future, be unable to comply with certain of the listing standards

that we are required to meet to maintain the listing of our common shares on Nasdaq.

On

April 27, 2021, we received a letter from the Listing Qualifications Department of Nasdaq (the “Staff”) indicating that,

based upon the closing bid price of our common stock for the 30 consecutive business day period between March 12, 2021 through April

27, 2021, we did not meet the minimum bid price of $1.00 per share required for continued listing on Nasdaq pursuant to Nasdaq Listing

Rule 5550(a)(2) (the “Bid Price Requirement”). On July 27, 2021, we received notice from Nasdaq indicating that we had regained

compliance with the minimum bid price requirement under Nasdaq Listing Rule 5550(a)(2).

On

February 23, 2022, we received a letter from the Listing Qualifications of Nasdaq notifying us that we were no longer in compliance with

the Bid Price Requirement, for continued listing on Nasdaq. Pursuant to the Panel Decision (as defined below) dated June 28, 2021, we

were not eligible for the 180-day bid price compliance period set forth in the Listing Rules. As a result, we were subject to delisting

from Nasdaq unless we timely requested a hearing before a Nasdaq Hearings Panel (the “Panel”). We had a hearing before the

Panel on March 30, 2022, which automatically stayed any suspension or delisting action pending the issuance of a decision by the Panel

following the hearing and the expiration of any additional extension period granted by the Panel following the hearing. On April 12,

2022, we received a letter from Nasdaq notifying us that the Panel determined to grant our request for continued listing on Nasdaq, subject

to the following: (i) on or about May 2, 2022, we advised the Panel of the status of the proxy statement it plans to file to obtain shareholder

approval for a reverse stock split, (ii) on or about May 23, 2022, we advised the Panel on the status of the shareholder meeting we plan

to hold to obtain approval of the reverse stock split, (iii) on or about May 26, 2022, we will affect a reverse stock split and (iv)

on or before about June 22, 2022, we shall demonstrate compliance with the Bid Price Requirement by evidencing a closing bid price above

$1.00 per share for the previous ten consecutive trading sessions. On April 19, 2022, we received a letter from the Staff notifying us

that as we had not yet filed our Form 10-K for the period ended January 1, 2022, such matter serves as an additional basis for delisting

our securities from Nasdaq under Nasdaq Listing Rule 5810(c)(2)(A). On May 4, 2022 the Panel granted us an extension request until July

11, 2022 to demonstrate compliance with the bid price requirement. On May 20, 2022, we received a notice from the Staff notifying us

that as we had not yet filed our Form 10-Q for the period ended April 2, 2022, such matter serves as a basis for delisting our securities

from Nasdaq in addition to the aforementioned matters. On June 23, 2022, we effected the 1-for-10 Reverse Stock Split, on June 24, 2022,

we filed our Annual Report on Form 10-K for the year ended January 1, 2022, and on July 14, 2022, we filed our Quarterly

Report on Form 10-Q for the period ended April 2, 2022.

On

June 3, 2020, we received a letter from the Listing Qualifications Department of Nasdaq notifying us that we were no longer in compliance

with the minimum stockholders’ equity requirement for continued listing on Nasdaq under Nasdaq Listing Rule 5550(b)(1) to maintain

stockholders’ equity of at least $2,500,000. A hearing before the Panel was held on January 21, 2021, and we were granted an extension

to regain compliance until February 28, 2021, which was subsequently further extended to May 31, 2021 (the “Panel Decision”).

On June 11, 2021, we received a letter from the Staff notifying us that the Panel had determined to delist our shares from Nasdaq and

that trading in our shares would be suspended effective at the open of business on June 15, 2021 but that due to a procedural issue,

the Panel determined not to implement the decision and afforded us an opportunity to make an additional submission for the Panel’s

consideration. On June 28, 2021, we received a letter from the Staff informing us that we had regained compliance with the Rule. As a

result, the Panel determined to continue the listing of our securities on Nasdaq. The Panel also determined to impose a Panel Monitor

under Listing Rule 5815(d)(4)(A) for a period of one year from the date of the June 28, 2021 letter (the “Monitoring Period”).

We were expected to remain in compliance with all of Nasdaq’s continued listing requirements during the Monitoring Period.

If

Nasdaq delists our common stock from trading on its exchange for failure to meet the listing standards, an investor would likely find

it significantly more difficult to dispose of or obtain our shares, and our ability to raise future capital through the sale of our shares

could be severely limited. We additionally may not be able to list our common stock on another national securities exchange, which could

result in our securities being quoted on an over-the-counter market. If this were to occur, our shareholders could face significant material

adverse consequences, including limited availability of market quotations for our common stock and reduced liquidity for the trading

of our securities. In addition, we could experience a decreased ability to issue additional securities and obtain additional financing

in the future. There can be no assurance that an active trading market for our common stock will develop or be sustained. Delisting could

also have other negative results, including the potential loss of confidence by employees, the loss of institutional investor interest

and fewer business development opportunities.

There

may be future sales of our securities or other dilution of our equity, which may adversely affect the market price of our common stock.

We

are generally not restricted from issuing additional common stock, including any securities that are convertible into or exchangeable

for, or that represent the right to receive, common stock. The market price of our common stock could decline as a result of sales of

common stock or securities that are convertible into or exchangeable for, or that represent the right to receive, common stock after

this offering or the perception that such sales could occur.

A

more active, liquid trading market for our common stock may not develop, and the price of our common stock may fluctuate significantly.

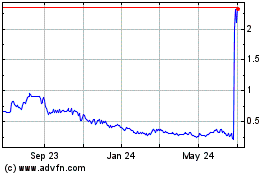

Historically,

the market price of our common stock has fluctuated over a wide range. During the 12-month period prior to the date of this prospectus,

after giving effect to the 1-for 10 Reverse Stock Split, our common stock traded as high as $47.40 per share and as low as $3.60

per share. There has been relatively limited trading volume in the market for our common stock, and a more active, liquid public

trading market may not develop or may not be sustained. Limited liquidity in the trading market for our common stock may adversely affect

a stockholder’s ability to sell its shares of common stock at the time it wishes to sell them or at a price that it considers acceptable.

If a more active, liquid public trading market does not develop we may be limited in our ability to raise capital by selling shares of

common stock and our ability to acquire other companies or assets by using shares of our common stock as consideration. In addition,

if there is a thin trading market or “float” for our stock, the market price for our common stock may fluctuate significantly

more than the stock market as a whole. Without a large float, our common stock would be less liquid than the stock of companies with

broader public ownership and, as a result, the trading prices of our common stock may be more volatile and it would be harder for a stockholder

to liquidate any investment in our common stock. Furthermore, the stock market is subject to significant price and volume fluctuations,

and the price of our common stock could fluctuate widely in response to several factors, including:

| |

● |

our

quarterly or annual operating results; |

| |

● |

changes

in our earnings estimates; |

| |

● |

investment

recommendations by securities analysts following our business or our industry; |

| |

● |

additions

or departures of key personnel; |

| |

● |

changes

in the business, earnings estimates or market perceptions of our competitors; |

| |

● |

our

failure to achieve operating results consistent with securities analysts’ projections; |

| |

● |

changes

in industry, general market or economic conditions; and |

| |

● |

announcements

of legislative or regulatory changes. |

The

stock market has experienced extreme price and volume fluctuations in recent years that have significantly affected the quoted prices

of the securities of many companies, including companies in the staffing industry. The changes often appear to occur without regard to

specific operating performance. The price of our common stock could fluctuate based upon factors that have little or nothing to do with

us and these fluctuations could materially reduce our stock price.

We

do not anticipate paying dividends on our common stock and, accordingly, stockholders must rely on stock appreciation for any return

on their investment.

We

initiated a dividend program in early 2019 under which we intended to pay a regular quarterly cash dividend of $0.10 per share to holders

of our common stock. The first such dividend was paid on February 28, 2019 to shareholders of record as of February 15, 2019, but subsequent

dividends were suspended by our Board. In the future, our Board may, without advance notice, determine to initiate, reduce or suspend

our dividends in order to maintain our financial flexibility and best position us for long-term success. The declaration and amount of

future dividends is at the discretion of our Board and will depend on our financial condition, results of operations, cash flows, prospects,

industry conditions, capital requirements and other factors and restrictions our Board deems relevant. In addition, we are limited in

our ability to pay dividends by certain of our existing agreements. In particular, our debt agreements only permit us to pay a quarterly

cash dividend of one cent per share of common stock issued and outstanding, provided, that such cash dividend does not exceed $100 in

the aggregate per fiscal quarter. We may not pay such dividends if any events of default exist under our debt agreements.

Accordingly,

we cannot be certain if we will be able to pay quarterly cash dividends to holders of our common stock in the foreseeable future. Consequently,

investors must mainly rely on sales of their common stock after price appreciation, which may never occur, as the primary way to realize

any future gains on their investment. There is no guarantee that shares of our common stock will appreciate in value or even maintain

the price at which our stockholders have purchased their shares.

The

1-for-10 Reverse Stock Split may decrease the liquidity of the shares of our common stock.

The

liquidity of the shares of our common stock may be affected adversely by the 1-for-10 Reverse Stock Split given the reduced number of

shares that are outstanding following the 1-for-10 Reverse Stock Split. In addition, the 1-for-10 Reverse Stock Split would have increased

the number of stockholders who own odd lots (less than 100 shares) of our common stock, creating the potential for such stockholders

to experience an increase in the cost of selling their shares and greater difficulty effecting such sales.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus and the information incorporated by reference in this prospectus contain “forward-looking statements,” which include

information relating to future events, future financial performance, strategies, expectations, competitive environment and regulation.

Our use of the words “may,” “will,” “would,” “could,” “should,” “believes,”

“estimates,” “projects,” “potential,” “expects,” “plans,” “seeks,”

“intends,” “evaluates,” “pursues,” “anticipates,” “continues,” “designs,”

“impacts,” “forecasts,” “target,” “outlook,” “initiative,” “objective,”

“designed,” “priorities,” “goal” or the negative of those words or other similar expressions is intended

to identify forward-looking statements that represent our current judgment about possible future events. Forward-looking statements should

not be read as a guarantee of future performance or results and will probably not be accurate indications of when such performance or

results will be achieved. All statements included or incorporated by reference in this prospectus, and in related comments by our management,

other than statements of historical facts, including without limitation, statements about future events or financial performance, are

forward-looking statements that involve certain risks and uncertainties.

These

statements are based on certain assumptions and analyses made in light of our experience and perception of historical trends, current

conditions and expected future developments as well as other factors that we believe are appropriate in the circumstances. While these

statements represent our judgment on what the future may hold, and we believe these judgments are reasonable, these statements are not

guarantees of any events or financial results. Whether actual future results and developments will conform with our expectations and

predictions is subject to a number of risks and uncertainties, including the risks and uncertainties discussed in this prospectus, any

prospectus supplement and the documents incorporated by reference under the captions “Risk Factors” and “Special Note

Regarding Forward-Looking Statements” and elsewhere in those documents.

Consequently,

all of the forward-looking statements made in this prospectus as well as all of the forward-looking statements incorporated by reference

to our filings under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), are qualified by these cautionary

statements and there can be no assurance that the actual results or developments that we anticipate will be realized or, even if realized,

that they will have the expected consequences to or effects on us and our subsidiaries or our businesses or operations. We caution investors

not to place undue reliance on forward-looking statements. We undertake no obligation to update publicly or otherwise revise any forward-looking

statements, whether as a result of new information, future events, or other such factors that affect the subject of these statements,

except where we are expressly required to do so by law.

USE

OF PROCEEDS

All

shares of our common stock offered by this prospectus are being registered for the accounts of the selling stockholders and we will not

receive any proceeds from the sale of these shares. However, we will receive proceeds from the exercise of the Pre-Funded Warrants, the

Amended Warrants, the Warrants and the Wainwright Warrants if the Pre-Funded Warrants, the Amended Warrants, the Warrants and the Wainwright

Warrants are exercised for cash. We intend to use those proceeds, if any, for working capital purposes.

SELLING

STOCKHOLDERS

Unless

the context otherwise requires, as used in this prospectus, “selling stockholders” includes the selling stockholders listed

below and donees, pledgees, transferees or other successors-in-interest selling shares received after the date of this prospectus from

the selling stockholders as a gift, pledge or other non-sale related transfer.

We

have prepared this prospectus to allow the selling stockholders or their successors, assignees or other permitted transferees to sell

or otherwise dispose of, from time to time, up to 2,022,913 shares of our common stock, which are comprised of (i) 409,531 Common Shares,

(ii) 248,327 shares of common stock issuable upon the exercise of the Pre-Funded Warrants, (iii) 657,858 shares of common stock issuable

upon the exercise of the Amended Warrants, (iv) 657,858 shares of common stock issuable upon the exercise of the Warrants, and (v) 49,339

shares of common stock issuable upon the exercise of the Wainwright Warrants.

July

2022 Private Placement

On

July 1, 2022, we entered into the July 2022 Purchase Agreement with certain institutional and accredited investors for the issuance and

sale of 657,858 shares of common stock (or pre-funded warrants) and warrants to purchase up to an aggregate of 657,858 shares of common

stock at a combined purchase price of $6.10 per share of common stock (or pre-funded warrant) and associated warrant. The Pre-Funded

Warrants are exercisable at a price of $0.00001 per share, are exercisable immediately upon issuance and are exercisable until the Pre-Funded

Warrants are exercised in full. The Warrants are exercisable at an exercise price of $5.85 per share, are exercisable immediately upon

issuance and have a term of exercise equal to five and one-half years from the date of issuance. The July 2022 Private Placement closed

on July 7, 2022.

A

holder of the Pre-Funded Warrants, the Amended Warrants or the Warrants may not exercise its Pre-Funded Warrants, Amended Warrants or

Warrants, respectively, to the extent that the holder, together with its affiliates, would beneficially own more than 4.99% (or, at the

election of the holder prior to the date of issuance, 9.99%) of our outstanding shares of common stock immediately after exercise, except

that upon at least 61 days’ prior notice from the holder to us, the holder may increase the beneficial ownership limitation to

up to 9.99% of the number of shares of common stock outstanding immediately after giving effect to the exercise.

In

connection with the July 2022 Private Placement, we entered into the Registration Rights Agreement with the purchasers under the July

2022 Purchase Agreement, pursuant to which, among other things, we agreed to prepare and file with the Securities and Exchange Commission,

by the 15th calendar day following the date of the Registration Rights Agreement, a registration statement on Form S-3, or

another such appropriate form, to register for resale the shares of common stock issued pursuant to the July 2022 Purchase Agreement

and issuable upon the exercise of the Pre-Funded Warrants and the Warrants, as applicable. We have agreed to use best efforts to have

the registration statement declared effective as promptly as practical thereafter, and in any event, no later than the 45th

calendar day following the date of the Registration Rights Agreement. In addition, we agreed that upon the registration statement being

declared effective under the Securities Act, we will use our best efforts to maintain the effectiveness of the registration statement

until the date that (i) the selling stockholders have sold all of the shares of common stock registrable under the Registration Rights

Agreement or (ii) such shares may be resold by the selling stockholders pursuant to Rule 144 of the Securities Act, without the requirement

for us to be in compliance with the current public information required under such rule and without volume or manner-of-sale restriction.

In

connection with the July 2022 Private Placement, we entered into the Warrant Amendment Agreements with each of the investors in which

we agreed to amend certain existing warrants pursuant to purchase up to an aggregate of 657,858 shares of our common stock that were

previously issued to the investors, with exercise prices ranging from $18.50 to $38.00 per share and expiration dates ranging from July

22, 2026 to November 1, 2026, effective upon the closing of the July 2022 Private Placement. The Amended Warrants have a reduced exercise

price of $5.85 per share and expire five and one-half years following the closing of the July 2022 Private Placement.

Wainwright

served as our exclusive placement agent in connection with the July 2022 Private Placement. Pursuant to the Engagement Letter, we paid

Wainwright (i) a total cash fee equal to 7.5% of the aggregate gross proceeds of the July 2022 Private Placement, (ii) a management fee

equal to 1.0% of the gross proceeds of the July 2022 Private Placement; and (iii) a non-accountable expense allowance of $85,000. In

addition, we issued to Wainwright or its designees the Wainwright Warrants to purchase up to 49,339 shares of our common stock at an

exercise price equal to $7.625. The Wainwright Warrants were exercisable immediately upon issuance and have a term of five and one-half

years from the date of issuance.

We

are registering the Common Shares, and the shares of common stock issuable upon the exercise of the Pre-Funded Warrants, the Amended

Warrants, the Warrants and the Wainwright Warrants in order to permit the selling stockholders to offer such shares for resale from time

to time pursuant to this prospectus. The selling stockholders may also sell, transfer or otherwise dispose of all or a portion of their

shares in transactions exempt from the registration requirements of the Securities Act, or pursuant to another effective registration

statement covering those shares.

Relationships

with the selling stockholders

Except

as described below, none of the selling stockholders has, or within the past three years has had, any position, office or other material

relationship with us.

Each

of Michael Vasinkevich, Noam Rubinstein, Craig Schwabe and Charles Worthman are associated persons of Wainwright, which served as our

underwriter for the public offering we consummated in December 2020, our placement agent in connection with the registered direct offering

we consummated in December 2020, our placement agent in connection with the public offering we consummated in February 2021, our placement

agent in connection with the private placement we consummated in April 2021 (the “April 2021 Private Placement”), our placement

agent in connection with the registered direct offering and concurrent private placement we consummated in July 2021 (together, the “July

2021 Offerings”), our placement agent in connection with the first registered direct offering and concurrent private placement

we consummated in August 2021 (together, the “First August 2021 Offerings”), our placement agent in connection with the second

registered direct offering and concurrent private placement we consummated in August 2021 (together, the “Second August 2021 Offerings”),

our placement agent in connection with the private placement we consummated in November 2021 (the “November 2021 Private Placement”),

and our placement agent in connection with the July 2022 Private Placement, for each of which Wainwright received compensation.

Each

of Armistice Capital Master Fund Ltd., Cavalry Fund I LP and Lind Global Macro Fund, LP purchased securities in the April 2021 Private

Placement, the July 2021 Offerings, the First August 2021 Offerings, the Second August 2021 Offerings and the November 2021 Private Placement.

Lind Global Fund II LP purchased securities in the July 2021 Offerings, the First August 2021 Offering, the Second August 2021 Offerings

and the November 2021 Private Placement. Intracoastal Capital LLC purchased securities in the July 2021 Offerings, the First August 2021

Offerings and the Second August 2021 Offerings. Iroquois Capital Investment Group purchased securities in the July 2021 Offerings and

the First August 2021 Offerings. Iroquois Master Fund purchased securities in the July 2021 Offerings. Each of Bigger Capital Fund, LP

and District 2 Capital Fund LP purchased securities in the April 2021 Private Placement.

Information

About Selling Stockholders Offering

The

shares of common stock being offered by the selling stockholders are the Common Shares issued pursuant to the July 2022 Purchase Agreement,

and the shares of common stock issuable to the selling stockholders upon the exercise of the Pre-Funded Warrants, the Amended Warrants,

the Warrants and Wainwright Warrants. For additional information regarding the issuances of the Common Shares, the Pre-Funded Warrants,

the Amended Warrants, the Warrants and the Wainwright Warrants, see “—July 2022 Private Placement” above. We are registering

the Common Shares and the shares of common stock underlying the Pre-Funded Warrants, the Amended Warrants, the Warrants and the Wainwright

Warrants in order to permit the selling stockholders to offer the shares for resale from time to time.

The

table below lists the selling stockholders and other information regarding the ownership of the shares of common stock by each of the

selling stockholders. The second column lists the number of shares of common stock owned by each selling stockholder, based on its ownership

of the shares of common stock and securities convertible or exercisable into shares of common stock, as of July 14, 2022, assuming exercise

of the securities exercisable into shares of common stock held by the selling stockholders on that date, if applicable, without regard

to any limitations on conversions or exercises.

The

third column lists the shares of common stock being offered pursuant to this prospectus by the selling stockholders.

In

accordance with the terms of the Registration Rights Agreement and the Warrant Amendment Agreements, as applicable, this prospectus generally

covers the resale of the sum of (i) the maximum number of Common Shares, (ii) the maximum number of Pre-Funded Warrant Shares, (iii)

the maximum number of Amended Warrant Shares, (iv) the maximum number of Warrant Shares, and (v) the maximum number of Wainwright Warrant

Shares. The table below assumes that the outstanding Pre-Funded Warrants, Amended Warrants, Warrants and Wainwright Warrants were exercised

in full as of the trading day immediately preceding the date this registration statement was initially filed with the Securities and

Exchange Commission, each as of the trading day immediately preceding the applicable date of determination and all subject to adjustment

as provided in the July 2022 Purchase Agreement, without regard to any limitations on the exercise of the Pre-Funded Warrants, the Amended

Warrants, the Warrants and the Wainwright Warrants. The fourth column assumes the sale of all of the shares offered by the selling stockholders

pursuant to this prospectus.

Under

the terms of the Pre-Funded Warrants, the Amended Warrants, the Warrants and the Wainwright Warrants, a selling stockholder may not exercise

the Pre-Funded Warrants, the Amended Warrants, the Warrants or the Wainwright Warrants to the extent such exercise would cause such selling

stockholder, together with its affiliates and attribution parties, to beneficially own a number of shares of common stock which would

exceed 4.99% (or 9.99% at the election of the holder prior to the date of issuance), of our then outstanding common stock following such

exercise, excluding for purposes of such determination shares of common stock issuable upon the exercise of such Pre-Funded Warrants,

Amended Warrants, Warrants or Wainwright Warrants which have not been exercised. The number of shares in the second and fourth columns

do not reflect this limitation. The selling stockholders may sell all, some or none of their shares in this offering. See “Plan

of Distribution.”

Name

of Selling Stockholder | |

Number

of shares of common stock owned prior to offering | |

Maximum

number of shares of common stock to be sold pursuant to this Prospectus | |

Number

of shares of common stock owned after offering | |

Percentage

of common stock owned after offering |

| | |

| |

| |

| |

|

| Armistice

Capital Master Fund Ltd. (1) | |

| 1,314,981 | | |

| 1,314,981 | (2) | |

| 0 | | |

| 0 | % |

| Bigger

Capital Fund, LP(3) | |

| 25,002 | | |

| 25,002 | (4) | |

| 0 | | |

| 0 | % |

| Cavalry

Fund I LP (5) | |

| 108,723 | | |

| 108,723 | (6) | |

| 0 | | |

| 0 | % |

| District

2 Capital Fund LP(3) | |

| 25,002 | | |

| 25,002 | (7) | |

| 0 | | |

| 0 | % |

| Intracoastal

Capital, LLC (8) | |

| 99,888 | | |

| 99,888 | (9) | |

| 0 | | |

| 0 | % |

| Iroquois

Capital Investment Group LLC (10) | |

| 14,079 | | |

| 14,079 | (11) | |

| 0 | | |

| 0 | % |

| Iroquois

Master Fund Ltd. (10) | |

| 32,862 | | |

| 32,862 | (12) | |

| 0 | | |

| 0 | % |

| Lind

Global Macro Fund, LP (13) | |

| 197,352 | | |

| 197,352 | (14) | |

| 0 | | |

| 0 | % |

| Lind

Global Fund II LP (13) | |

| 155,685 | | |

| 155,685 | (15) | |

| 0 | | |

| 0 | % |

| Michael

Vasinkevich (16) | |

| 101,886 | | |

| 31,639 | (17) | |

| 70,247 | | |

| 2.79 | % |

| Noam

Rubinstein (16) | |

| 34,955 | | |

| 10,855 | (18) | |

| 24,100 | | |

| * | |

| Craig

Schwabe (16) | |

| 20,456 | | |

| 6,352 | (19) | |

| 14,104 | | |

| * | |

| Charles

Worthman (16) | |

| 1,589 | | |

| 493 | (20) | |

| 1,096 | | |

| * | |

| | |

| | | |

| | | |

| | | |

| | |

| *

Less than 1% | |

| | | |

| | | |

| | | |

| | |

| (1) |

The

shares are directly held by Armistice Capital Master Fund Ltd., a Cayman Islands exempted company (the “Master Fund”),

and may be deemed to be indirectly beneficially owned by: (i) Armistice Capital, LLC (“Armistice Capital”), as the investment

manager of the Master Fund; and (ii) Steven Boyd, as the Managing Member of Armistice Capital. Armistice Capital and Steven Boyd

disclaim beneficial ownership of the securities except to the extent of their respective pecuniary interests therein. The selling

stockholder’s address is c/o Armistice Capital, LLC, 510 Madison Avenue, 7th Floor, New York, NY 10022. The Master Fund may

not exercise the Warrants to the extent such exercise would cause the Master Fund, together with its affiliates and attribution parties,

to beneficially own a number of shares of common stock which would exceed 9.99% of our then outstanding common stock following such

exercise, excluding for purposes of such determination shares of common stock issuable upon exercise of such securities which have

not been so exercised. |

| (2) |

Represents

(i) 190,000 Common Shares issued in the July 2022 Private Placement, (ii) 248,327 shares of common stock issuable upon the exercise

of the Pre-Funded Warrants, (iii) 438,327 shares of common stock issuable upon the exercise of the Amended Warrants, and (iv) 438,327

shares of common stock issuable upon the exercise of the Warrants. |

| (3) |

Michael

Bigger, the managing member of the general partner of Bigger Capital Fund, LP, has sole voting and dispositive power over the securities

held by Bigger Capital Fund, LP. Mr. Bigger, the managing member of the general partner of District 2 Capital Fund LP, has sole voting

and dispositive power over the securities held by District 2 Capital Fund LP. The business address of District 2 Capital Fund LP

is 175 West Carver, Huntington, NY, 11743. The business address of Bigger Capital Fund, LP is 2250 Red Springs Drive, Las Vegas,

NV 89135 |

| (4) |

Represents

(i) 8,334 Common Shares issued in the July 2022 Private Placement, (ii) 8,334 shares of common stock issuable upon the exercise of

the Amended Warrants, and (iii) 8,334 shares of common stock issuable upon the exercise of the Warrants. |

| (5) |

Thomas

Walsh, manager of Cavalry Fund I LP, has sole voting and dispositive power over the securities held by Cavalry Fund I LP. Mr. Walsh,

manager of Cavalry Special Ops Fund LLC, has sole voting and dispositive power over the securities held by Cavalry Special Ops Fund

LLC. The selling stockholder’s address is 82 East Allendale Road, Suite 5B, Saddle River, New Jersey 07458. Cavalry Fund I

LP and Cavalry Special Ops Fund LLC may not exercise the Warrants to the extent such exercise would cause Cavalry Fund I LP or Cavalry

Special Ops Fund LLC, together with their affiliates and attribution parties, to beneficially own a number of shares of common stock

which would exceed 4.99% of our then outstanding common stock following such exercise, or, upon notice to us, 9.99% of our then outstanding

common stock following such exercise, excluding for purposes of such determination shares of common stock issuable upon exercise

of such securities which have not been so exercised. |

| (6) |

Represents

(i) 36,241 Common Shares issued in the July 2022 Private Placement, (ii) 36,241 shares of common stock issuable upon the exercise

of the Amended Warrants, and (iii) 36,241 shares of common stock issuable upon the exercise of the Warrants. |

| (7) |

Represents

(i) 8,334 Common Shares issued in the July 2022 Private Placement, (ii) 8,334 shares of common stock issuable upon the exercise of

the Amended Warrants, and (iii) 8,334 shares of common stock issuable upon the exercise of the Warrants. |

| (8) |

Mitchell

P. Kopin and Daniel B. Asher, each of whom are managers of Intracoastal Capital, LLC (“Intracoastal”), have shared voting

control and investment discretion over the securities reported herein that are held by Intracoastal. The selling stockholder’s

address is 245 Palm Trail, Delray Beach, FL 33483. Intracoastal may not exercise the Warrants to the extent such exercise would cause

Intracoastal, together with its affiliates and attribution parties, to beneficially own a number of shares of common stock which

would exceed 4.99% of our then outstanding common stock following such exercise, or, upon notice to us, 9.99% of our then outstanding

common stock following such exercise, excluding for purposes of such determination shares of common stock issuable upon exercise

of such securities which have not been so exercised. |

| (9) |

Represents

(i) 33,296 Common Shares issued in the July 2022 Private Placement, (ii) 33,296 shares of common stock issuable upon the exercise

of the Amended Warrants, and (iii) 33,296 shares of common stock issuable upon the exercise of the Warrants. |

| (10) |

Richard

Abbe has the sole authority and responsibility for the investments made on behalf of Iroquois Capital Investment Group LLC (“ICIG”)

as its managing member and shares authority and responsibility for the investments made on behalf of Iroquois Master Fund Ltd. (the

“Iroquois Master Fund”) with Kimberly Page, each of whom is a director of the Iroquois Master Fund. As such, Mr. Abbe

may be deemed to be the beneficial owner of all shares of common stock held by and underlying the securities reported herein (subject

to the beneficial ownership blockers) held by Iroquois Master Fund and ICIG. The selling stockholder’s address is 125 Park

Ave., 25th Fl. NY, NY 10017. ICIG and Iroquois Master Fund may not exercise the Warrants to the extent such exercise would cause

ICIG or Iroquois Master Fund, together with their affiliates and attribution parties, to beneficially own a number of shares of common

stock which would exceed 4.99% of our then outstanding common stock following such exercise, or, upon notice to us, 9.99% of our

then outstanding common stock following such exercise, excluding for purposes of such determination shares of common stock issuable

upon exercise of such securities which have not been so exercised. |

| (11) |

Represents

(i) 4,693 Common Shares issued in the July 2022 Private Placement, (ii) 4,693 shares of common stock issuable upon the exercise of

the Amended Warrants, and (iii) 4,693 shares of common stock issuable upon the exercise of the Warrants. |

| (12) |

Represents

(i) 10,954 Common Shares issued in the July 2022 Private Placement, (ii) 10,954 shares of common stock issuable upon the exercise

of the Amended Warrants, and (iii) 10,954 shares of common stock issuable upon the exercise of the Warrants. |

| (13) |

Jeff

Easton is the Managing Member of Lind Global Partners, LLC, which is the General Partner and the Investment Manager of Lind Global

Macro Fund LP and Lind Global Fund II LP, respectively, and in such capacity has the right to vote and dispose of the securities

held by such entities. Mr. Easton disclaims beneficial ownership over the securities listed except to the extent of his pecuniary

interest therein. The address for Lind Global Macro Fund LP and Lind Global Fund II LP is 444 Madison Avenue, 41st Floor, New York,

NY 10022. Lind Global Partners, LLC and Lind Global Fund II LP may not exercise the Warrants to the extent such exercise would cause

Lind Global Partners, LLC or Lind Global Fund II LP, together with their affiliates and attribution parties, to beneficially own

a number of shares of common stock which would exceed 4.99% of our then outstanding common stock following such exercise, or, upon

notice to us, 9.99% of our then outstanding common stock following such exercise, excluding for purposes of such determination shares

of common stock issuable upon exercise of such securities which have not been so exercised. |

| (14) |

Represents

(i) 65,784 Common Shares issued in the July 2022 Private Placement, (ii) 65,784 shares of common stock issuable upon the exercise

of the Amended Warrants, and (iii) 65,784 shares of common stock issuable upon the exercise of the Warrants. |

| (15) |

Represents

(i) 51,895 Common Shares issued in the July 2022 Private Placement, (ii) 51,895 shares of common stock issuable upon the exercise

of the Amended Warrants, and (iii) 51,895 shares of common stock issuable upon the exercise of the Warrants. |

| (16) |

The

selling stockholder was issued compensation warrants as a designee of Wainwright in connection with the June 2022 Private Placement.

Each selling stockholder has sole voting and dispositive power over the securities held. The business address is c/o H.C. Wainwright

& Co., LLC, 430 Park Avenue, 3rd Floor, New York, New York 10022. Each selling stockholder may not exercise the Wainwright Warrants

to the extent such exercise would cause each selling stockholder, together with his affiliates and attribution parties, to beneficially

own a number of shares of common stock which would exceed 4.99% of our then outstanding common stock following such exercise, or,

upon notice to us, 9.99% of our then outstanding common stock following such exercise, excluding for purposes of such determination

shares of common stock issuable upon exercise of such securities which have not been so exercised. |

| (17) |

Represents

31,639 shares of common stock issuable upon the exercise of the Wainwright Warrants. |

| (18) |

Represents

10,855 shares of common stock issuable upon the exercise of the Wainwright Warrants. |

| (19) |

Represents

6,352 shares of common stock issuable upon the exercise of the Wainwright Warrants. |

| (20) |

Represents

493 shares of common stock issuable upon the exercise of the Wainwright Warrants. |

DESCRIPTION

OF SECURITIES TO BE REGISTERED

Authorized

Capital Stock

We

have authorized 220,000,000 shares of capital stock, of which 200,000,000 are shares of common stock and 20,000,000 are shares of “blank

check” preferred stock. On July 14, 2022, there were 2,419,688 shares of common stock issued and outstanding. We currently

have 1,663,008 shares of preferred stock designated as Series A Preferred Stock, 200,000 shares of preferred stock designated as Series

B Preferred Stock, 2,000,000 shares of preferred stock designated as Series C Preferred Stock, 13,000 shares of preferred stock designated

as Series E Convertible Preferred Stock, 6,500 shares of preferred stock designated as Series E-1 Convertible Preferred Stock,

4,698 shares of preferred stock designated as Series F Convertible Preferred Stock, 13,000 shares of preferred stock designated as Series

G Preferred Convertible Stock, 6,500 shares of preferred stock designated as Series G-1 Convertible Preferred Stock, 9,000,000 shares

of preferred stock designated as Series H Convertible Preferred Stock, and 40,000 shares of preferred stock designated as Series J Preferred

Stock. The authorized and unissued shares of common stock and the authorized and undesignated shares of preferred stock are available

for issuance without further action by our stockholders, unless such action is required by applicable law or the rules of any stock exchange

on which our securities may be listed. Unless approval of our stockholders is so required, our Board does not intend to seek stockholder

approval for the issuance and sale of our common stock or preferred stock.

As

of July 14, 2022, we had 511 holders of record of our shares of common stock.

PLAN

OF DISTRIBUTION

Each

selling stockholder of the securities and any of their pledgees, assignees and successors-in-interest may, from time to time,

sell any or all of their securities covered hereby on Nasdaq or any other stock exchange, market or trading facility on which the securities

are traded or in private transactions. These sales may be at fixed or negotiated prices. A selling stockholder may use any one or more

of the following methods when selling securities:

| |

● |

ordinary

brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| |

|

|

| |

● |

block

trades in which the broker-dealer will attempt to sell the securities as agent but may position and resell a portion of the block

as principal to facilitate the transaction; |

| |

|

|

| |

● |

purchases

by a broker-dealer as principal and resale by the broker-dealer for its account; |

| |

|

|

| |

● |

an

exchange distribution in accordance with the rules of the applicable exchange; |

| |

|

|

| |

● |

privately

negotiated transactions; |

| |

|

|

| |

● |

settlement

of short sales; |

| |

|

|

| |

● |

in

transactions through broker-dealers that agree with the selling stockholders to sell a specified number of such securities at a stipulated

price per security; |

| |

|

|

| |

● |

through

the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; |

| |

|

|

| |

● |

a

combination of any such methods of sale; or |

| |

|

|

| |

● |

any

other method permitted pursuant to applicable law. |

The

selling stockholders may also sell securities under Rule 144 or any other exemption from registration under the Securities Act, if available,

rather than under this prospectus.

Broker-dealers

engaged by the selling stockholders may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions

or discounts from the selling stockholders (or, if any broker-dealer acts as agent for the purchaser of securities, from the purchaser)

in amounts to be negotiated, but, except as set forth in a supplement to this prospectus, in the case of an agency transaction not in

excess of a customary brokerage commission in compliance with FINRA Rule 2121; and in the case of a principal transaction a markup or

markdown in compliance with FINRA Rule 2121.

In

connection with the sale of the securities or interests therein, the selling stockholders may enter into hedging transactions with broker-dealers

or other financial institutions, which may in turn engage in short sales of the securities in the course of hedging the positions they

assume. The selling stockholders may also sell securities short and deliver these securities to close out their short positions, or loan

or pledge the securities to broker-dealers that in turn may sell these securities. The selling stockholders may also enter into option

or other transactions with broker-dealers or other financial institutions or create one or more derivative securities which require the

delivery to such broker-dealer or other financial institution of securities offered by this prospectus, which securities such broker-dealer

or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The