Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

March 21 2022 - 3:58PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES

EXCHANGE ACT OF 1934

For

the month of March 2022

Commission

File Number 001-40848

GUARDFORCE

AI CO., LIMITED

(Translation

of registrant’s name into English)

10

Anson Road, #28-01 International Plaza

Singapore

079903

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F: Form 20-F ☒ Form 40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Entry

into a Letter of Intent

On

March 21, 2022, Guardforce AI Co., Limited (the “Company”) signed a non-binding letter of Intent (the “LOI”)

with Shenzhen Kewei Robot Technology Co., Limited and Shenzhen Yeantec Co., Limited (together, the “Kewei Group”)

to purchase up to 36 of the Kewei Group’s subsidiaries located in China. Under the LOI, in the first of two phases, Guardforce

AI will acquire eight of the Kewei Group companies. The second phase provides Guardforce AI the right of first refusal to purchase the

remaining 28 companies within a period of 24 months from the date of the signing of the LOI. The purchase of the additional 28 companies

will be dependent on the Company’s operational plans. The Company expects to sign the definitive agreement for the phase one acquisitions

before the end of May.

The

purchase price for the eight phase one companies will be based upon a valuation that is equal to one-time (from 2022 to 2026) projected

average revenues for the eight companies estimated to be U.S. $30 million and will be paid in a mix of cash (10%) and Company restricted

shares (90%) at a price of U.S. $2.00 per share. The Company will be required to pay Kewei Group the 10% cash component ($3,000,000)

of the purchase price as a deposit and Kewei Group will deliver to the Company 100% of the outstanding share capital of the eight phase

one companies as a pledge, within 10 days of the signing of the LOI. The acquisition is subject to, among other things, the satisfactory

completion of due diligence by the Company, the entry into definitive agreements and any required third-party consents.

A

press release relating to the signing of the LOI was issued on March 21, 2022 and is attached as Exhibit 99.1 hereto.

EXHIBIT

INDEX

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| Date: March 21, 2022 |

Guardforce AI Co., Limited |

| |

|

| |

By: |

/s/ Lei Wang |

| |

|

Lei Wang |

| |

|

Chief Executive Officer |

3

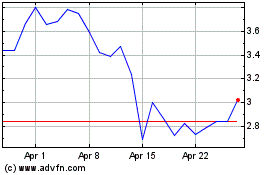

Guardforce AI (NASDAQ:GFAI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Guardforce AI (NASDAQ:GFAI)

Historical Stock Chart

From Apr 2023 to Apr 2024