March 15, 2022 -- InvestorsHub NewsWire --

via pennymillions --

iQSTEL Inc.

(IQST)

Summary

- iQSTEL is very close to achieving profitability.

- iQSTEL’s telecom revenue is growing rapidly and gross margins

are improving.

- iQSTEL’s higher margin technology products are nearing

fruition.

- I see the current fair market value at $1.07.

iQSTEL (OTCQX:OTCQB:IQST) is a microcap holding company that I have

covered here at Seeking Alpha. The company’s primary revenue stream

comes from its telecom operations. But iQSTEL also has, or is

working on, several innovative technology products such as

Blockchain, Electric Vehicle (EV), EV batteries, Fintech services,

and Internet of Things [IOT] smart devices.

In my last article I rated iQSTEL as a “Speculative Buy” and I

saw a fair market value of $.71 for the telecom business alone.

Since then, the stock has reached over $1.00, before drifting back

to prices near where they were before. No new financial results

have been filed yet since Q3 21 and those results are not expected

until the 10-K is released, presumably after March 31 of this year.

But the company has provided several updates, and I believe the

company is stronger since I wrote about it last. I see the dip in

price as only adding support to the speculative buy opinion. I see

a current fair market value of $1.07.

Financial Recap

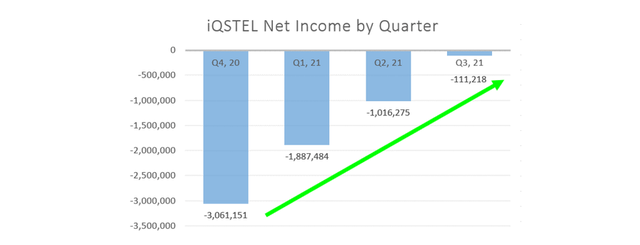

I covered some key financial points in my previous article that

I will include here as a re-cap. To begin, iQSTEL’s net income

showed improvement with substantial gains three quarters in a row.

The loss in Q3 21 was negligible at just over $100,000, and the

trend clearly points to a reasonable path towards profitability.

See graph below.

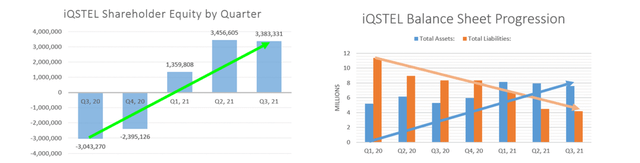

Shareholder equity held well in that it dropped just a bit less

than the small amount of negative net income. The company

maintained a positive balance of total assets to total

liabilities.

Cash decreased by about 66% during the third quarter to

approximately $1.2 million, likely in part due to the small

negative net income. The current cash position appeared to provide

enough to finish out the year, even if the company’s net income did

not improve.

iQSTEL decreased its general and administration expenses

slightly year-over-year and continued to see the benefit of

becoming “debt-free” of toxic debts such as convertible notes and

warrants. Interest expenses were less than 1% of 2020’s Q3 at

$6,802 for Q3 21 vs $913,592 for Q3 20.

Telecom gross margins showed much needed improvement but needs

to show further improvement to really bring in profitability. This

is especially true for what I label “SMS Austin” when looking at

the breakdown. SMS Austin is the largest contributor to revenue but

has a low gross margin performance at just 3.06%. SMS Austin is the

newest of their telecom business, and company guidance in general

is that it takes some time for new telecom business to grow

margins. It will be interesting to see if margins improved in Q4,

and now even into Q1 of 2022 as small % gains in gross margins on

large blocks of revenue can make an enormous difference to net

income.

Improvements to financials were validated as iQSTEL moved up the

OTC ladder of tiers in 2021. iQSTEL advanced to the OTCQB level

earlier in the year, and quickly was upgraded again later to the

OTCQX level. OTCQX is the highest level available in the OTC, and

it is only available to companies that meet their financial

requirements.

Recent Developments

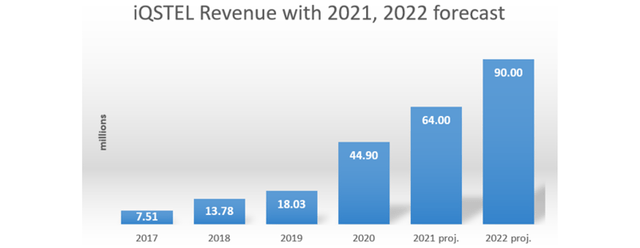

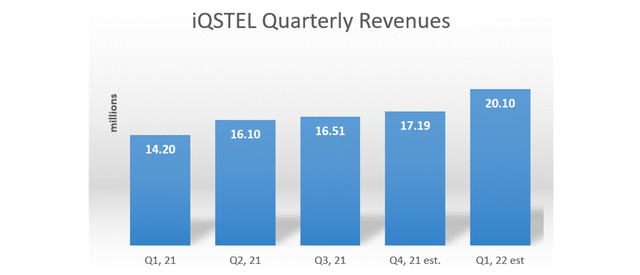

In my prior article I included a graph that showed iQSTEL’s

revenue gains since 2017. The graph included the company’s then FY

21 revenue forecast of $60.5 million. Since that time iQSTEL

informed that full year 2021 revenue will be reported at, or very

near, $64 million, or about a 6% upgrade in that short timeframe.

The company has also added that their revenue projection for FY 22

is $90 million. See graph below.

With 2021 completed iQSTEL has an impressive (projected) 70.86%

revenue CAGR since 2017. If you add forecasted data for 2022 the

CAGR is 64.33%. And it’s worth noting that iQSTEL has a history of

forecasting below actuals. A lot of revenue has been added since

2017, but even the expected growth rate from 2021 to 2022 is

projected at 40.63%.

M&A activity could increase the 2022 projected revenue

amount, and iQSTEL just recently advised that they are currently

drafting two separate acquisition agreements for which they expect

to close on soon. Clarification was included that each acquisition

is expected to augment the telecom projection of $80 million

revenue for 2022. Note that the other $10 million in the forecast

to make $90 million is what is projected, thus far, to non-telecom

business.

iQSTEL has indicated that it plans to fund M&A activity with

investment from a banking firm. No specific details on a name of a

firm, or definitive closure information has yet been provided. But

the company last reported work on a $60 million deal to fund growth

objectives over the next three years.

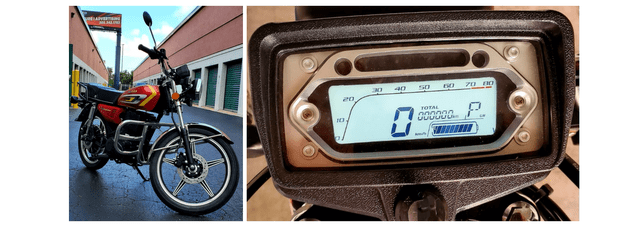

Information on iQSTEL’s non-telecom divisions has been provided,

but again not in a lot of detail yet. The company has shared photos

and other information regarding its EV motorcycle. It appears that

a small number, maybe over 10, motorcycles have been manufactured

to specifications. Shipments from that batch were sent to the U.S.,

Panama, Venezuela, and Spain. The unit sent to Miami, Florida is

being tested presumably as among the final steps prior to full

scale production and sales. iQSTEL plans to provide more details

soon, but they have disclosed that Panama was selected as a

regional distribution center for Latin America, as Panama is well

suited to serve in that purpose. Of course, Panama is a major

shipping center with the Panama Canal.

iQSTEL announced that they won the 2022 IoT

Breakthrough Award for the second year running for “Smart

Appliance Product of the Year”. This is a noteworthy award as other

category winners and participants include names of large or notable

companies such as Bosch, GE, Apple, Lenovo, Tile, Ring, Cisco, and

Nvidia. Last year iQSTEL won this award for their IoT Smart Tank

product. They were awarded this year for their IoT Smart Gas

product.

iQSTEL advised recently that their IoT Smart Tank product, that

was sold to an unnamed Fortune 500 Company, is deployed, and

operating with the planned 2,500 units. These units should be

providing monthly recurring revenue according to prior information

from the company. I assume that a big corporation like this would

have many, many more tanks available to furnish the product. There

is no word of expansion yet, but I believe that it seems reasonable

that the customer would want to use the product for several months

or so before deciding to do a full rollout. If for no other reason,

perhaps just to see if any changes or upgrades to the product are

needed before making the larger investment.

I’m not sure if or when they will name the Fortune 500 company,

but iQSTEL did advise that they see potential to sell the product

to 8 to 9 other big corporations. They further advised that they

see the same potential for 8 to 9 big corporations to target for

their IoT Smart Gas device. I assume there could be many other

small or regional companies to target as well.

It’s hard to say this early just how well these products may

perform for iQSTEL or how many companies may choose the products. I

would think that if the first big company likes it then that could

speak well for gaining other big customers. Sometimes a first

established leader in the product category looks like the one to go

with. Also, it may help to keep in mind that each of these iQSTEL

products are award winners from a major IoT competition. That alone

is selling point, implying a superior level of utility, and one

that may create a perception of the product being “the best”.

iQSTEL’s Blockchain offering “MNPA” has not been covered a lot

by the company in recent months. This product allows mobile phone

users to easily retain their existing phone number when switching

providers. I have not seen any data on sales, but it may be

possible that the product was not as ready as they first thought. A

recent announcement advised that “MNPA version 2” will be released

soon. It’s unclear to me if MNPA has already had some sales and

getting upgraded, or if the version 2 was needed for rollout. I

assume more information is forthcoming. Also, iQSTEL added that the

same engineers are working on a new project with global reach for

SoHo and Medium shops that includes Token and NFT’s.

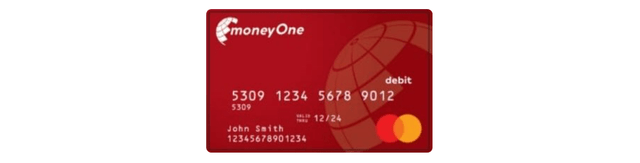

iQSTEL’s Fintech service offerings have apparently needed some

extra work to be ready. The recent guidance is that the Mastercard

debit card, U.S. Bank account, and mobile app/website will be

launched in March of 2022. I would think they would like to get

this product started very soon as it fits in with their plans to

provide a means to facilitate iQSTEL’s EV product sales. The

Fintech product is marketed as “Global Money One”.

Valuation

As I mentioned, iQSTEL’s primary revenue stream comes from its

telecom business. Their technology divisions contributed to revenue

in FY 21 but up through Q3 21 there is not much information from

the company in the way of a breakout of divisions. For example, the

company stated that the IoT Smart Tank devices were already

delivering on revenue, but no amount was provided.

With the unofficial FY 21 total revenue of $64 million, we can

assume the greatest part of it is telecom, as the technology

products are just coming to fruition. I noted that gross margins

had improved as of Q3 21, and the overall telecom margin was 5.09%.

I also mentioned that small improvements in gross margins, applied

to millions in revenue can quicky contribute to net income.

According to Aswath

Damodaran the average telecom-services gross margin is

currently 20.75%. I assume that is a range we should expect iQSTEL

to aspire to reach. If iQSTEL reached the average and it was

applied to $64 million in revenue, then that would generate over

$10 million extra available towards net income. Disregarding other

expenses, such as taxes, that could amount to about $.07 in EPS. If

you consider an average telecom-services trailing

P/E of 37.30, then that $.07 could add $2.61 to iQSTEL’s

share value based on its current margin.

Achieving a gross margin comparable to the industry average

could take a little while, as iQSTEL is some distance away from

that now. But the company has merged its telecom operations under

one banner, and they advise that they see synergies and are making

improvements to margins. The takeaway is that any improvement in

gross margins puts them closer to profitability, or if

profitability is achieved then better margins will add to it. Also,

a 20.75% margin is a reasonable goal, as it is an industry average.

The idea is supported when considering that certain of iQSTEL’s

more mature telecom operations like SMS Miami and Swisslink

achieved gross margins from 16% to over 19% in Q3 21.

On a price to sales basis we can look at the industry average

telecom-services price to

sales ratio of 1.27, and apply that to iQSTEL’s sales of

$64 million. iQSTEL’s outstanding share count is 147,357,358. Using

the average price to sales ratio and FY 21 forecasted sales the

market cap could be $81.2 million, and the fair value for shares

based on telecom could be $.55. That is just a little over today’s

share price of $.485. That valuation may help explain the current

market price, but it overlooks key points which are the rest of

iQSTEL’s business divisions, and the current size of the

company.

iQSTEL provided FY 22 guidance late in 2021. The projected

revenue for 2022 included a gain from $64 million to $80 million in

telecom revenue. In addition, iQSTEL provided its first projection

for its non-telecom services, with a $10 million forecast.

Altogether iQSTEL is forecasting $90 million in revenue for FY 22.

An interesting development though is that January sales are

reported at $6.7 million, and the guidance is to expect comparable

results for February and March. When you annualize $6.7 million you

can see that iQSTEL is already an $80 million revenue company.

While revenue can fluctuate, iQSTEL’s typical pattern is to grow

quarterly sales as seen in the graph below (including my Q4 21 and

Q1 22 estimates).

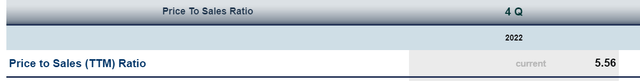

If you apply the average price to sales ratio to $80 million in

(presumed) telecom sales, you can see a fair value for telecom at

$.69. The other $10 million in sales could be a mix of Fintech and

Technology, but with technology products either already in use or

about to be, I will apply a CSI

Market technology price to sales ratio of 5.56x to the $10

million. That brings another $.38 in fair value.

It is not clear to me if the current revenue gains are owed

partly to the Smart Biz acquisition that was thought that it would

be completed in January. I have not seen a definitive confirmation.

If it does support the gain its still just as valid, and if Smart

Biz is not added in yet then it could mean just more revenue to

come. As mentioned, two acquisitions are expected to close soon and

both of those are expected to add more to the projected $80 million

revenue forecast. Also, it is reasonable that January sales could

have grown organically, as iQSTEL advised that they would be cross

selling products amongst their telecom offerings.

Markets are inefficient and they do what they do. I believe the

current market share price is just about right when only

considering last year’s sales, and if you totally disregard

everything the company is doing that is not in telecom. That may

even be fair for 2021, as non-telecom business was not much a

factor in revenue.

The share price did rise and pull back though. Currently it has

been consolidating around the $.50 level. But the company is

already bigger than it was in 2021, and per guidance, their

technology and Fintech products are ready for imminent rollout. I

see the current fair market value at $1.07 ($.69 + $.38).

Risks

The company provides a full list of risks in its annual filing.

I recommend reading that in its entirety, but I will add a few

notes.

I would reevaluate my investment thesis for iQSTEL if there was

significant loss of business, failure to achieve profitability in a

reasonable timeframe, and failure to achieve better margins. I

would also reevaluate my thesis if I saw significant dilution

occurring that does not bring in equal or better value to the

company. For an investment in iQSTEL, I expect shareholder equity

to continue to improve over time. At this point I believe the

company has made steps in the right direction regarding these

issues.

Final Thoughts

iQSTEL has shown determination for at least several months to up

list their stock into Nasdaq. They added independent board members,

cleaned up their balance sheet of all toxic debts and warrants, and

they have demonstrated a record of gains toward profitability.

Their up list in OTC tiers was both a sign of strength to

qualify and an effort to reach more investors to help meet what is

the only remaining criteria to achieve to list on Nasdaq, which is,

the minimum bid price qualification.

iQSTEL has continued to contend that they expect to reach all

Nasdaq qualifications, including minimum bid requirements through

organic growth efforts. They expect this to be accomplished in the

first half of 2022. The company did raise $2.75 million from equity

near the end of 2021, but this was toward meeting the equity

requirements for Nasdaq, and perhaps this is another sign that they

are so close to being ready.

My current fair value at $1.07 is based on what I can see today.

It can be easily and justifiably raised substantially with more

positive results including their achieving profitability. I already

mentioned that telecom alone could raise the fair value of the

stock with industry average margins. I could see that setting

conditions for over $3.00 in value just for the existing telecom

revenue alone, and it continues to grow. Even the 70% or so CAGR

revenue growth could warrant a much higher P/E, one well above the

industry average.

Also, the EV, IoT device, and Fintech divisions can bring

substantial more value. A large rollout of Smart Tank devices or a

popular customer response to the EV motorcycle could involve

substantial revenue forecast upgrades, and those are high margin

products.

iQSTEL recently expressed a goal of reaching a $1 billion

valuation and beyond. Most companies have dreams, but iQSTEL has

grown from a company with under $10 million in revenue in 2017 to

pushing $100 million in revenue by 2022. They may even make it

there, $90 million is just a forecast and they have over-delivered

in recent years. If they have their M&A funding in hand and

reach profitability then the potential is there for an even more

rapid growth phase, and maybe a chance at those valuation goals.

The current price to sales multiple, being under 1x sales, based on

current annualized sales revenues, may leave lots of room for

upgrade. A $1 billion valuation on current shares implies a share

price of $6.79 a share.

I believe there is interesting potential and I hold a

substantial position. It is an OTC stock, speculative, and subject

to pitfalls. But I believe that iQSTEL is undervalued on current

business and receiving no value in the market for some interesting

and potentially lucrative products.

Disclosure: I/we have a beneficial long

position in the shares of IQST either through stock ownership,

options, or other derivatives. I wrote this article myself,

and it expresses my own opinions. I am not receiving compensation

for it (other than from Seeking Alpha). I have no business

relationship with any company whose stock is mentioned in this

article.

Additional disclosure: Please note that I

am not a financial advisor. The article should not be considered as

a suggestion to buy or sell this or any other stocks. Consider this

one source of a full range of due diligence you should undertake

but is entirely my personal opinions. It is strongly recommended

that you consult an experienced, qualified, and registered

investment advisor before trading.

Source - https://seekingalpha.com/article/4495418-iqstel-readies-for-nasdaq-listing-bid

Other stocks on the move include

BKRKF, SPYR,

and

RYCEY

SOURCE: pennymillions

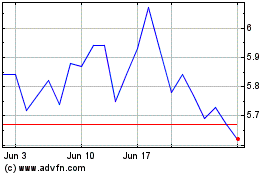

Rolls Royce (PK) (USOTC:RYCEY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Rolls Royce (PK) (USOTC:RYCEY)

Historical Stock Chart

From Apr 2023 to Apr 2024