VIRBAC: Exceptional growth in annual revenue of +18.4% at

comparable exchange rates and scope (+14.9% at constant rates and

real scope), driven by remarkable performance in a very buoyant

market

|

KEY FIGURES |

|

AnnualRevenue

2021€1064.1

million |

Growth at constant exchange rates and

scope 1+18.4% including

companion animals

+21.5%

food producing animals

+13.4% |

Growth adjusted at constant exchange

rates+14.9% |

Overall

change+13.9%+17.4%

excl. Sentinel |

1 Change at constant exchange rates and scope

corresponds to organic growth of sales, excluding exchange rate

variations, by calculating the indicator for the financial year in

question and the indicator for the previous financial year on the

basis of identical exchange rates (the exchange rate used is the

previous financial year’s), and excluding change in scope, by

calculating the indicator for the financial year in question on the

basis of the scope of consolidation for the previous financial

year, and excluding sales of Sentinel, a product that was sold on

July 1, 2020, over the first two half-years in question.

Quarterly consolidated

revenueOur fourth-quarter revenue reached €246.4 million,

or a steep 11.8% increase with respect to the same period in 2020.

At constant exchange rates, growth was +10.1%, mainly driven by the

remarkable performance of Europe, Latin America, which benefited in

particular from Chile’s rebound over the quarter, and the United

States. In Europe, the majority of the quarter's growth was driven

by France, Germany, Benelux and the area’s export activity, which

achieved very good sales in the companion animal segment (specialty

products including Suprelorin, vaccines, dermatology), as well as

in the bovine products range. Only the United Kingdom was down due

to an unfavorable baseline effect compared to the same period in

2020, which had benefited from a Brexit-related anticipation of

purchases. Latin America was buoyed by Mexico's performance in the

vaccine, petfood and bovine products range, and Chile’s in

antibiotics for salmon. The United States posted very strong growth

over the quarter, particularly in the specialty ranges, dermatology

and contributions from recently-launched products (Clomicalm,

Itrafungol, iVet petfood, etc.), which account for more than half

of the quarter's growth. Lastly, in Asia-Pacific, growth was driven

by our performance in Japan, China, Vietnam and South Korea, which

offset the downturn in India and Australia over the period,

negatively affected by an unfavorable baseline effect compared to

2020.

Annual cumulative consolidated

revenueOur annual revenue was €1064.1 million, compared

with €934.2 million, representing an overall increase of 17.4%

excluding Sentinel (+13.9% at real scope) compared with the same

period in 2020. Excluding the unfavorable impact of exchange rates,

revenue rose by 18.4% excluding Sentinel (+14.9% at real

scope).

All areas had double-digit organic growth for

the year, reflecting both the sector’s momentum and the very

successful execution of our strategic plan, thanks to the ongoing

commitment of our teams. In Europe, revenue grew by 16.3% at real

rates (+16.1% at constant rates). All countries in the area, except

Portugal, showed double-digit annual growth. The main contributors

to this performance were France, Export activities, the United

Kingdom, Germany, Benelux, Italy and Spain, driven by strong

momentum in the companion animal ranges (particularly the specialty

ranges, petfood, and the rebound in vaccines). In Asia-Pacific,

real-rate growth was up 14.9% (+14.7% at constant exchange rates),

India continues to drive the area’s growth, accounting for over

half; Australia, New Zealand, South Africa, Vietnam, and China also

contributed to the area’s very strong growth. In the United States,

business excluding Sentinel grew by 34.6% (+41.2% at constant

exchange rates). It benefited from sustained sales across all

product lines, including specialty products, the dental and

dermatology ranges, recently launched products (Clomicalm, Senergy,

Itrafungol and Stelfonta) and, lastly, the manufacturing of the

Sentinel Spectrum for Merck. In Latin America, apart from Chile,

business grew by 20.7% at real rates (+24.2% at constant exchange

rates), thanks in particular to contributions from Brazil and

Mexico. Lastly, in Chile, the good second-half performance allowed

us to show organic growth over the year (-0.4% at real rates and

+2.6% at constant rates).

In terms of

species, the companion animal

business grew by 12.6% overall at real exchange rates and scope

(+21.5% at constant exchange rates and excluding Sentinel),

essentially driven by the remarkable double-digit growth of the

specialty ranges (including Clomicalm, Movoflex, Stelfonta),

petfood, parasiticides, dermatology, dental products, and by the

rebound of the vaccine range for dogs and cats, compared with the

same period in 2020. It should be noted that Clomicalm and

Itrafungol, which were acquired in March 2021, and the US petfood

range iVet, acquired in July 2021, represented approximately €14

million in sales (or 1.6 percentage points of revenue growth) over

the period. The food producing animals segment also posted

significant growth of 12.8% at real exchange rates (+13.4% at

constant rates), thanks to the ruminant sector (+16.9% at constant

rates), swine-poultry products (+4.8% at constant rates), and the

rebound in the aquaculture sector, which posted growth thanks to

its performance in the second half (+5.5% at constant rates), when

compared to the same period in 2020.

OutlookAs anticipated and in line

with our marketing plan, the ratio of “current operating profit

before depreciation of assets arising from acquisitions” to

“revenue” should benefit from the favorable impact of the activity

over the past year, and should be around 16% at constant exchange

rates. Furthermore, debt relief should be around €60 million for

the year at constant scope and exchange rates.

As we continue to execute our strategic plan,

and in a more normalized market, we anticipate in 2022 a growth in

revenue at constant rates and scope of between 5% and 8%. While the

ratio of “current operating income, before depreciation of assets

arising from acquisitions” to “revenue”, as previously announced,

should consolidate around 15% at constant exchange rates (with a

deliberate overinvestment in R&D of around 1 percentage point

of revenue compared to 2021).

Overall, the global pandemic has not had an

overly negative impact on the animal health sector to date, but we

continue to face significant logistical and supply constraints with

regard to certain intermediaries, and more recently, the impact of

inflation on our costs.

|

CONSOLIDATED FIGURESNon-audited figures in millions of euros |

2021 |

2020 |

Growth |

Growth at constant exchange rates 1 |

Growth at constant exchange rates and scope 1 |

|

First-quarter revenue |

266.5 |

247.7 |

+7.6% |

+12.3% |

+22.6% |

|

Second-quarter revenue |

262.9 |

230.6 |

+14.0% |

+15.8% |

+20.0% |

|

Third-quarter revenue |

288.2 |

235.6 |

+22.4% |

+21.0% |

+21.0% |

|

Fourth-quarter revenue |

246.4 |

220.3 |

+11.8% |

+10.1% |

+10.1% |

|

Annual revenue |

1064.1 |

934.2 |

+13.9% |

+14.9% |

+18.4% |

|

Revenue excluding Sentinel |

1056.4 |

899.5 |

+17.4% |

+18.4% |

+18.4% |

A lifelong commitment to animal

healthAt Virbac, we make innovative solutions available to

veterinarians, farmers and animal owners in more than 100 countries

around the world. Covering more than 50 species, our range of

products and services can diagnose, prevent and treat the majority

of pathologies. Every day, we are committed to improving the

quality of life of animals and to shaping the future of animal

health together.

Virbac: NYSE Euronext - compartment A – ISIN

code: FR0000031577 / MNEMO: VIRP

Financial Affairs Department: tel. 04 92 08 71

32 - email: finances@virbac.com - Website: corporate.virbac.com

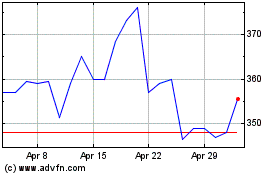

Virbac (EU:VIRP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Virbac (EU:VIRP)

Historical Stock Chart

From Apr 2023 to Apr 2024