TIDMROO

RNS Number : 3012U

Deliveroo PLC

02 December 2021

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR

INDIRECTLY, IN WHOLE OR IN PART, INTO OR IN THE UNITED STATES,

CANADA, AUSTRALIA, SOUTH AFRICA OR JAPAN OR ANY OTHER JURISDICTION

IN WHICH OFFERS OR SALES WOULD BE PROHIBITED BY APPLICABLE LAW.

THIS ANNOUNCEMENT DOES NOT CONSTITUTE OR FORM AN OFFER OF

SECURITIES IN ANY JURISDICTION IN WHICH ANY SUCH OFFER WOULD BE

UNLAWFUL.

2 December 2021

Deliveroo plc

(the "Company")

Results of placing of Class A Ordinary Shares in the Company

Notifications of transactions by Persons Discharging Managerial

Responsibility ("PDMR")

Vesting of RSU Awards, Sale of Shares to Satisfy Tax Liabilities

from Vesting of RSU Awards and Overall Increase in Shareholding

As set out in the Company's prospectus dated 22 March 2021 and

pricing statement dated 31 March 2021 (together, the "Prospectus"),

between 2018 and 2021 Will Shu and Adam Miller were granted

restricted stock unit awards ("RSUs") with certain vesting

timelines and conditions, with portions of these RSUs vesting

according to a fixed schedule (i) at the date of admission of the

Company's Class A Shares to the London Stock Exchange's main market

for listed securities on 7 April 2021 ("Admission"), (ii) on 1

December 2021 (the "December 2021 Vesting"), (iii) on a monthly

basis (until December 2021 for Will Shu, and until November 2024

for Adam Miller), and (iv) on an annual basis (starting in April

2023 for Will Shu only). Details of the December 2021 Vesting for

each of Will Shu and Adam Miller are set out in the tables

below.

Further to the announcement made by the Company on 1 December

2021, the Company has been informed that following the December

2021 Vesting, each of Will Shu and Adam Miller has sold the number

of Class A Ordinary Shares at the price per Class A Ordinary Share

set out in the tables below solely to satisfy tax liabilities

arising on the vesting of RSUs since Admission by way of an

accelerated book building process and placing to institutional

investors, led by Goldman Sachs International (the "Transaction").

As Will Shu's RSUs vest into Class B Ordinary Shares, the same

number of Class B Ordinary Shares were converted into Class A

Ordinary Shares in accordance with the Company's articles of

association in order to effect his sale. Neither Will Shu nor Adam

Miller will retain any net proceeds as a result of the

Transaction.

The Transaction was permitted in accordance with an exemption to

the lock-up arrangements disclosed in the Prospectus, which allows

Directors, employees and option holders to sell shares during the

lock-up period to satisfy tax liabilities or option exercise

amounts pursuant to the vesting and exercise of any awards pursuant

to an employee share or share option scheme or the RSUs as

described in the Prospectus. Following the Transaction, all

remaining shares in the Company held by Will Shu and Adam Miller

(including the newly-received shares) continue to be subject to the

lock-up arrangements for 365 days from the date of Admission,

including the exemption to sell shares to satisfy tax liabilities

arising out of the vesting of RSUs.

Following the December 2021 Vesting and the Transaction, Will

Shu's holding of Class B Ordinary Shares (each carrying twenty

votes) has increased to 100,128,842, compared to 94,551,841 on 30

November 2021; Will Shu holds no Class A Ordinary Shares. Following

the December 2021 Vesting and the Transaction, Adam Miller's

holding of Class A Ordinary Shares (each carrying one vote) has

increased to 561,767, compared to 401,800 on 30 November 2021.

The attached notifications by Will Shu and Adam Miller as PDMRs,

have been made in accordance with the requirements of the EU Market

Abuse Regulation (as it forms part of UK law pursuant to the

European Union (Withdrawal) Act 2018).

Contacts

Investor Relations

David Hancock, VP Investor Relations - +44 7966 930716 or

investors@deliveroo.co.uk

Tim Warrington, Investor Relations Director - +44 7921 576395 or

investors@deliveroo.co.uk

Media Relations

Joe Carberry, VP Communications - +44 7787 561905

Romilly Dennys, Head of Corporate Communications, UKI - +44 7786

221309

Tulchan Communications, James Macey White, Jessica Reid, Mark

Burgess - deliveroo@tulchangroup.com

1a) Will Shu RSU Vesting

1. Details of the person discharging managerial responsibilities

/ person closely associated

(a) Name Will Shu

------------------------- -----------------------------------------

2. Reason for the notification

--------------------------------------------------------------------

(a) Position/status Chief Executive Officer

------------------------- -----------------------------------------

(b) Initial notification/ Initial notification

Amendment

------------------------- -----------------------------------------

3. Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

--------------------------------------------------------------------

(a) Name Deliveroo plc

------------------------- -----------------------------------------

(b) LEI 984500F6537F74DDEE77

------------------------- -----------------------------------------

4. Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type of

transaction; (iii) each date; and (iv) each place where

transactions have been conducted

--------------------------------------------------------------------

(a) Description of Class B Ordinary Shares of 0.5p each

the financial

instrument, type

of instrument

------------------------- -----------------------------------------

(b) Identification N/A

code

------------------------- -----------------------------------------

(c) Nature of the The vesting of restricted stock unit

transaction awards under the Restricted Stock Units

Contracts

------------------------- -----------------------------------------

(d) Price(s) and volume(s) Price(s) Volume(s)

GBP2.78 22,485,200

-----------

------------------------- -----------------------------------------

(e) Aggregated information

* Aggregated volume

Not applicable

* Price

GBP62,508,856

------------------------- -----------------------------------------

(f) Date of the transaction 1 December 2021

------------------------- -----------------------------------------

(g) Place of the transaction Outside a trading venue

------------------------- -----------------------------------------

1b) Will Shu Share Sale

1. Details of the person discharging managerial responsibilities/person

closely associated

(a) Name Will Shu

---------------------------- -----------------------------------------

2. Reason for the notification

-----------------------------------------------------------------------

(a) Position/status Chief Executive Officer

---------------------------- -----------------------------------------

(b) Initial notification/ Initial notification

Amendment

---------------------------- -----------------------------------------

3. Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

-----------------------------------------------------------------------

(a) Name Deliveroo plc

---------------------------- -----------------------------------------

(b) LEI 984500F6537F74DDEE77

---------------------------- -----------------------------------------

4. Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type of

transaction; (iii) each date; and (iv) each place where

transactions have been conducted

-----------------------------------------------------------------------

(a) Description of Class A Ordinary Shares of 0.5p each

the financial

instrument, type

of instrument

---------------------------- -----------------------------------------

(b) Identification ISIN: GB00BNC5T391

code

---------------------------- -----------------------------------------

(c) Nature of the Sale of Class A ordinary shares

transaction

---------------------------- -----------------------------------------

(d) Price(s) and volume(s) Price(s) Volume(s)

GBP2.78 16,908,199

-----------

---------------------------- -----------------------------------------

(e) Aggregated information

* Aggregated volume

Not applicable

* Price GBP47,004,793.22

---------------------------- -----------------------------------------

(f) Date of the transaction 1 December 2021

---------------------------- -----------------------------------------

(g) Place of the transaction London Stock Exchange, Main Market

(XLON)

---------------------------- -----------------------------------------

2a) Adam Miller RSU Vesting

5. Details of the person discharging managerial responsibilities/person

closely associated

(a) Name Adam Miller

--------------------------- ------------------------------------------

6. Reason for the notification

-----------------------------------------------------------------------

(a) Position/status Chief Financial Officer

--------------------------- ------------------------------------------

(b) Initial notification/ Initial notification

Amendment

--------------------------- ------------------------------------------

7. Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

-----------------------------------------------------------------------

(a) Name Deliveroo plc

--------------------------- ------------------------------------------

(b) LEI 984500F6537F74DDEE77

--------------------------- ------------------------------------------

8. Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type of

transaction; (iii) each date; and (iv) each place where

transactions have been conducted

-----------------------------------------------------------------------

(a) Description of Class A Ordinary Shares of 0.5p each

the financial

instrument, type

of instrument

--------------------------- ------------------------------------------

(b) Identification ISIN: GB00BNC5T391

code

--------------------------- ------------------------------------------

(c) Nature of the The vesting of restricted stock unit

transaction awards under the Restricted Stock Units

Contracts

--------------------------- ------------------------------------------

(d) Price(s) and volume(s) Price(s) Volume(s)

GBP2.78 854,200

----------

--------------------------- ------------------------------------------

(e) Aggregated information

* Aggregated volume

Not applicable

GBP2,374,676

* Price

--------------------------- ------------------------------------------

(f) Date of the transaction 1 December 2021

--------------------------- ------------------------------------------

(g) Place of the transaction London Stock Exchange, Main Market

(XLON)

--------------------------- ------------------------------------------

2b) Adam Miller Share Sale

9. Details of the person discharging managerial responsibilities/person

closely associated

(a) Name Adam Miller

---------------------------- -----------------------------------------

10. Reason for the notification

-----------------------------------------------------------------------

(a) Position/status Chief Financial Officer

---------------------------- -----------------------------------------

(b) Initial notification/ Initial notification

Amendment

---------------------------- -----------------------------------------

11. Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

-----------------------------------------------------------------------

(a) Name Deliveroo plc

---------------------------- -----------------------------------------

(b) LEI 984500F6537F74DDEE77

---------------------------- -----------------------------------------

12. Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type of

transaction; (iii) each date; and (iv) each place where

transactions have been conducted

-----------------------------------------------------------------------

(a) Description of Class A Ordinary Shares of 0.5p each

the financial

instrument, type

of instrument

---------------------------- -----------------------------------------

(b) Identification ISIN: GB00BNC5T391

code

---------------------------- -----------------------------------------

(c) Nature of the Sale of Class A Ordinary Shares

transaction

---------------------------- -----------------------------------------

(d) Price(s) and volume(s) Price(s) Volume(s)

GBP2.78 694,233

----------

---------------------------- -----------------------------------------

(e) Aggregated information

* Aggregated volume

Not applicable

GBP1,929,967.74

* Price

---------------------------- -----------------------------------------

(f) Date of the transaction 1 December 2021

---------------------------- -----------------------------------------

(g) Place of the transaction London Stock Exchange, Main Market

(XLON)

---------------------------- -----------------------------------------

IMPORTANT NOTICE

The publication or distribution or release of this announcement

and the Transaction as set out in this announcement in certain

jurisdictions may be restricted by law. This announcement is for

information purposes only and shall not constitute or form part of

an offer to buy, sell, issue, acquire or subscribe for, or the

solicitation of an offer to buy, sell, issue, acquire or subscribe

for any securities, nor shall there be any sale of securities in

any jurisdiction in which such offer, solicitation or sale would be

unlawful. No action has been taken that would permit an offering of

the securities referred to in this announcement or possession or

distribution of this announcement or any other offering or

publicity material relating to the securities referred to in this

announcement in any jurisdiction where action for that purpose is

required. Persons into whose possession this announcement comes are

required to inform themselves about, and to observe, such

restrictions. Any failure to comply with these restrictions may

constitute a violation of the securities laws of such

jurisdictions.

This announcement and any offer of securities to which it

relates are only addressed to and directed at (1) in the United

Kingdom and in any member state of the European Economic Area,

persons who are qualified investors in such member state within the

meaning of the Prospectus Regulation (Regulation (EU) 2017/1129)

(the "Prospectus Regulation") or in the United Kingdom within the

meaning of the Prospectus Regulation as it forms part of retained

EU law by virtue of the European Union (Withdrawal) Act 2018

("Qualified Investors"); and (2) in the United Kingdom, Qualified

Investors who (a) have professional experience in matters relating

to investments who fall within article 19(5) of the Financial

Services and Market Act 2000 (Financial Promotion) Order 2005 (as

amended) (the "Order") or (b) fall within article 49(2)(a) to (d)

of the Order or (c) are persons to whom an offer of securities may

otherwise lawfully be made ("relevant persons"). The information

regarding the Transaction set out in this announcement must not be

acted on or relied on by persons in the European Economic Area who

are not Qualified Investors or by persons in the United Kingdom who

are not relevant persons. Any investment or investment activity to

which this announcement relates is available in the European

Economic Area only to Qualified Investors and in the United Kingdom

only to relevant persons and will be engaged in only with such

persons.

In particular, this announcement does not constitute or form

part of any offer to buy, sell, issue, acquire or subscribe for, or

the solicitation of an offer to buy, sell, issue, acquire, or

subscribe for any securities in any jurisdiction into which such

offer or solicitation would be unlawful.

The securities referred to in this announcement have not been

and will not be registered under the United States Securities Act

of 1933, as amended (the "Securities Act"), and may not be offered,

sold or transferred, directly or indirectly, within the United

States, except pursuant to an exemption from, or in a transaction

not subject to, the registration requirements of the Securities Act

and the securities laws of any state or other jurisdiction of the

United States.

The offer and sale of securities referred to herein has not been

and will not be registered under the Securities Act or under the

applicable securities laws of Australia, Canada, Japan or South

Africa. Subject to certain exceptions, the securities referred to

herein may not be offered or sold in Australia, Japan or South

Africa or to, or for the account or benefit of, any national,

resident or citizen of Australia, Japan or South Africa.

No public offering of the securities referred to herein is being

made in the United Kingdom, the United States, Australia, Canada,

Japan, South Africa or any other jurisdiction. No prospectus or

offering document has been or will be prepared by the Company in

connection with the Transaction.

Goldman Sachs International ("GSI") is only acting for Will Shu

and Adam Miller (the "Sellers") in connection with the transaction

referred to in this release, and no one else, and will not be

responsible to anyone other than the Sellers for providing the

protections offered to clients of GSI, nor will GSI be responsible

for providing advice in relation to the transaction referred to in

this release. In connection with the transaction referenced herein,

GSI will receive a fee from the Sellers for the services provided

to them.

Goldman Sachs makes no representation or warranty of any kind

with respect to the accuracy or completeness of any information

contained in this release. Goldman Sachs has not independently

verified such information and has relied on such information being

complete and accurate in all material respects. Nothing contained

herein constitutes or should be construed as (i) investment, tax,

accounting or legal advice; (ii) a representation that any

investment or strategy is suitable or appropriate to your

individual circumstances; or (iii) a personal recommendation to

you.

GSI is authorised by the Prudential Regulation Authority and

regulated by the Financial Conduct Authority and the Prudential

Regulation Authority.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DSHEAAAFELXFFAA

(END) Dow Jones Newswires

December 02, 2021 01:59 ET (06:59 GMT)

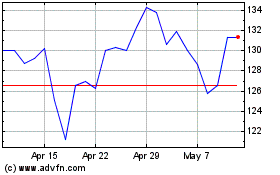

Deliveroo (LSE:ROO)

Historical Stock Chart

From Mar 2024 to Apr 2024

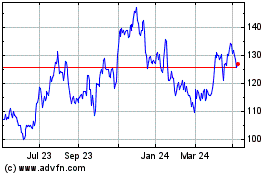

Deliveroo (LSE:ROO)

Historical Stock Chart

From Apr 2023 to Apr 2024