Moody’s Analytics Launches New Front-Office Loan Pricing Solution

November 17 2021 - 8:00AM

Business Wire

Moody’s Analytics is pleased to announce the launch of

Relationship Pricing Analyzer, a new front-office pricing solution

that helps bankers more efficiently and effectively price

loans.

In a competitive lending environment, decision makers at

financial institutions have a growing need for deep insights around

margin and relationship profitability when determining loan

pricing. Net interest margin compression seen among US banks in the

third quarter of 2021 is driving executives to seek smart,

efficient relationships with their customers.

“Competition is intensifying for high-quality relationships, and

an optimized pricing structure can help lenders compete more

effectively,” said Anna Krayn, Global Head of Industry Practices.

“Relationship Pricing Analyzer streamlines income and expense

management, which helps drive consistency in the pricing process

and allows relationship managers to pursue new opportunities.”

Relationship Pricing Analyzer helps the front-office measure the

income that a relationship brings to a bank in the form of coupon,

fees, and derivative income against the associated credit,

financial, and operational costs that are incurred to support the

customer.

Using Relationship Pricing Analyzer, bank relationship managers

can win deals via competitive differentiation and speed to market,

while portfolio managers can effectively monitor relationship

profitability, capital at risk, expected loss, and portfolio

returns.

Relationship Pricing Analyzer is part of our ecosystem of

applications that provide extensive data resources for

benchmarking, portfolio monitoring and management, and performance

enhancement. All the applications are available within the Moody’s

Analytics CreditLensTM platform, an industry leading solution for

credit decisions and loan origination that helps banks, credit

unions, and other financial institutions make better lending

decisions faster.

About Moody’s Analytics

Moody’s Analytics provides financial intelligence and analytical

tools to help business leaders make better, faster decisions. Our

deep risk expertise, expansive information resources, and

innovative application of technology help our clients confidently

navigate an evolving marketplace. We are known for our

industry-leading and award-winning solutions, made up of research,

data, software, and professional services, assembled to deliver a

seamless customer experience. We create confidence in thousands of

organizations worldwide, with our commitment to excellence, open

mindset approach, and focus on meeting customer needs. For more

information about Moody’s Analytics, visit our website or connect

with us on Twitter and LinkedIn.

Moody's Analytics, Inc. is a subsidiary of Moody's Corporation

(NYSE: MCO). Moody's Corporation reported revenue of $5.4 billion

in 2020, employs more than 13,000 people worldwide, and maintains a

presence in more than 40 countries.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20211117005423/en/

TRACY FINE Moody’s Analytics Communications +1.415.874.6013

Moody’s Analytics Media Relations moodysanalytics.com

twitter.com/moodysanalytics

linkedin.com/company/moodysanalytics

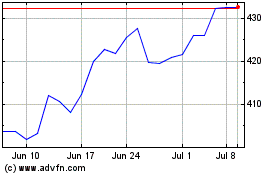

Moodys (NYSE:MCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

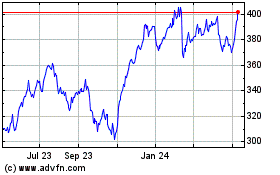

Moodys (NYSE:MCO)

Historical Stock Chart

From Apr 2023 to Apr 2024