UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

6-K

Report

of Foreign Private Issuer

Pursuant

to Rules 13a-16 or 15d-16 under

the

Securities Exchange Act of 1934

Dated

November 10, 2021

Commission

File Number: 001-10086

VODAFONE

GROUP

PUBLIC

LIMITED COMPANY

(Translation

of registrant’s name into English)

VODAFONE

HOUSE, THE CONNECTION, NEWBURY, BERKSHIRE, RG14 2FN, ENGLAND

(Address

of principal executive offices)

Indicate by

check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form

20-F x Form

40-F ¨

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): _____

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ____

Indicate by

check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to

the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes

¨ No

x

If “Yes”

is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-____.

This Report

on Form 6-K contains a Stock Exchange Announcement dated 10 November 2021 entitled ‘VODAFONE AGREES TO TRANSFER ITS 55% INTEREST

IN VODAFONE EGYPT TO VODACOM IN EXCHANGE FOR CASH AND NEW ORDINARY SHARES IN VODACOM’.

RNS

Number : 9159R

Vodafone

Group Plc

10

November 2021

10

November 2021

VODAFONE

AGREES TO TRANSFER ITS 55% INTEREST IN VODAFONE EGYPT TO VODACOM

IN EXCHANGE FOR CASH AND NEW ORDINARY SHARES IN VODACOM

Vodafone

Group Plc1 ("Vodafone") announces today that it has agreed to transfer its 55% shareholding in Vodafone Egypt

to Vodacom Group Limited ("Vodacom"), its sub-Saharan African subsidiary. This transfer simplifies the management of Vodafone's

African holdings and further strengthens the delivery of connectivity and financial services in Africa.

Transaction

rationale

The

transaction is expected to generate clear benefits for Vodafone, Vodacom and Vodafone Egypt:

|

|

•

|

Vodafone

simplifies the management of its African holdings;

|

|

|

•

|

Vodacom

gains exposure to another leading business in an attractive market, diversifying its portfolio

and accelerating its growth profile; and

|

|

|

•

|

Vodafone

Egypt will benefit from closer co-operation with Vodacom, enabling it to accelerate growth

in financial services and IoT.

|

Transaction

details

The

transaction values Vodafone's 55% shareholding in Vodafone Egypt at €2,722 million on a debt free, cash free basis, implying a multiple

for the last twelve month period ended 30 September 2021 of 7.3x Adjusted EBITDAaL and 12.2x Adjusted OpFCF2. Based on Vodafone's

55% share of the net debt in Vodafone Egypt as at 30 September 2021 the total equity consideration is €2,365 million (the "Purchase

Consideration"). Approximately 80% of the Purchase Consideration (€1,892 million) will be settled by the issue of 242 million

new ordinary Vodacom shares to Vodafone at an issue price of ZAR 135.75 per share. As a result, Vodafone's ownership in Vodacom will

increase from 60.5% to 65.1%.

The

remaining 20% of the Purchase Consideration (€473 million) will be settled in cash3.

Under

the terms of the sale and purchase agreement, the cash element of the Purchase Consideration will be adjusted for any movement in the

net debt and agreed working capital of Vodafone Egypt between signing and closing. As such, Vodafone will be entitled to its 55% share

of the cash generated by Vodafone Egypt between signing and closing.

The

Johannesburg Stock Exchange ("JSE") has taken note that Vodacom's JSE defined free float will be below 20% as a result of Vodafone's

increased ownership. Given the scale of Vodacom's current liquidity on the JSE, the JSE has not asked for any remedial steps to be taken.

Vodafone confirms that is has no current intention to dispose of any of its shares in the market to increase Vodacom's free float.

Conditions

to completion and indicative timetable

A

committee of Vodacom's independent non-executive directors has unanimously approved the transaction. Vodacom has appointed an independent

expert, PricewaterhouseCoopers Inc., to provide a fairness opinion on the proposed transaction which will be included in the circular.

The circular and notice of a general meeting will be posted to Vodacom Group shareholders in due course. Given the transaction represents

a related party transaction per the listing requirements of the JSE, Vodafone will not vote on the transaction and the transaction will

require approval by ordinary resolution from the minority shareholders representing 39.5% of the Vodacom shares.

Vodacom

has received an irrevocable undertaking to vote in favour of the transaction from YeboYethu Investment Company (RF) Proprietary Limited

which owns 6.2% of the Vodacom shares in issue and 15.8% of the Vodacom shares in issue outside those held by Vodafone. Vodacom has also

received an in-principle letter of support to vote in favour of the proposed transaction from Public Investment Corporation which owns

14.3% of the Vodacom shares in issue and 36.1% of the Vodacom shares in issue outside those held by Vodafone as at the date of their

letter. The Public Investment Corporation's in-principle support is subject to it conducting an assessment and evaluation process upon

receipt of the circular.

The

sale of Vodafone's shareholding in Vodafone Egypt constitutes a Class 2 transaction for the purposes of the UK Financial Conduct Authority's

Listing Rules, and, as such does not require Vodafone shareholders' approval.

Completion

of the transaction is subject to a number of additional conditions, including but not limited to: approval from the Financial Surveillance

Department of the South African Reserve Bank and approval from the National Telecom Regulatory Authority of Egypt. Vodacom has committed

to Vodafone that they will sign a deed of adherence to the shareholders' agreement with Telecom Egypt. The transaction is expected to

close before 31 March 2022.

Additional

financial information

Contribution

of Vodafone Egypt to Vodafone financial statements

12-month

period to September 2021 (€ million)4:

|

|

|

Vodafone Group

reported

|

|

|

Adjustment to reflect

intercompany charges5

|

|

|

Adjusted financials

|

|

|

Revenue

|

|

|

1,638

|

|

|

|

-

|

|

|

|

1,638

|

|

|

Adjusted EBITDAaL

|

|

|

729

|

|

|

|

(49

|

)

|

|

|

680

|

|

|

Capex

|

|

|

(275

|

)

|

|

|

-

|

|

|

|

(275

|

)

|

|

Adjusted OpFCF2

|

|

|

454

|

|

|

|

(49

|

)

|

|

|

405

|

|

12-month

period to March 2021 (€ million)6:

|

|

|

Vodafone Group

reported

|

|

|

Adjustment to reflect

intercompany charges5

|

|

|

Adjusted financials

|

|

|

Revenue

|

|

|

1,537

|

|

|

|

-

|

|

|

|

1,537

|

|

|

Adjusted EBITDAaL

|

|

|

652

|

|

|

|

(48

|

)

|

|

|

604

|

|

|

Capex

|

|

|

(258

|

)

|

|

|

-

|

|

|

|

(258

|

)

|

|

Adjusted OpFCF2

|

|

|

394

|

|

|

|

(48

|

)

|

|

|

346

|

|

For

the financial year ended 31 March 2021 Vodafone Egypt reported €346 million of profit before tax, and at 31 March 2021 the value

of Vodafone Egypt's Gross Assets was €2,405 million.

About

Vodafone

Vodafone

is a leading telecommunications company in Europe and Africa. Our purpose is to "connect for a better future" enabling an inclusive

and sustainable digital society. Our expertise and scale gives us a unique opportunity to drive positive change for society. Our

networks keep family, friends, businesses and governments connected and - as COVID-19 has clearly demonstrated - we play a vital role

in keeping economies running and the functioning of critical sectors like education and healthcare.

Vodafone

is the largest mobile and fixed network operator in Europe and a leading global IoT connectivity provider. Our M-Pesa technology platform

in Africa enables 50m people to benefit from access to mobile payments and financial services. We operate mobile and fixed networks in

21 countries and partner with mobile networks in 49 more. As of 30 June 2021, we had over 300m mobile customers, more than 28m fixed

broadband customers, over 22m TV customers and we connected 130m IoT devices.

We

support diversity and inclusion through our maternity and parental leave policies, empowering women through connectivity and improving

access to education and digital skills for women, girls, and society at large. We are respectful of all individuals, irrespective of

race, ethnicity, disability, age, sexual orientation, gender identity, belief, culture or religion.

Vodafone

is also taking significant steps to reduce our impact on our planet by reducing our greenhouse gas emissions by 50% by 2025 and becoming

net zero by 2040, purchasing 100% of our electricity from renewable sources in Europe and across our entire operations by 2025, and reusing,

reselling or recycling 100% of our redundant network equipment.

For

more information, please visit www.vodafone.com, follow us on Twitter at @VodafoneGroup or connect with us on LinkedIn at www.linkedin.com/company/vodafone.

About

Vodacom

Vodacom

is a leading and purpose-led African connectivity, digital and financial services company. From our roots in South Africa, we have grown

our business to include operations in Tanzania, the Democratic Republic of the Congo (the DRC), Mozambique, Lesotho and Kenya. Our mobile

networks cover a population of over 295.8 million people. Through Vodacom Business Africa (VBA), we offer business-managed services to

enterprises in 48 countries. Vodacom is majority owned by Vodafone (60.5% holding), one of the world's largest communications companies

by revenue.

Notes

|

|

1.

|

The

selling entities are Vodafone Europe B.V. and Vodafone International Holdings B.V., which

are 100% owned indirect subsidiaries of Vodafone Group Plc.

|

|

|

2.

|

Adjusted

OpFCF defined as Adjusted EBITDAaL less Capex.

|

|

|

3.

|

The

cash proceeds from the transaction will be retained by Vodafone for general corporate purposes.

|

|

|

4.

|

Converted

from EGP to € at an average rate of 18.8 based on actual reported fx for the 12-month

period to 30 September 2021.

|

|

|

5.

|

Adjustment

to reflect intercompany charges below EBITDAaL. Existing intercompany arrangements will remain

in place after closing.

|

|

|

6.

|

Converted

from EGP to € at an average rate of 18.4 based on actual reported fx for the 12-month

period to 31 March 2021.

|

Goldman

Sachs acted as financial advisor to Vodafone.

-

ends -

For

more information, please contact:

|

Investor Relations

|

Media Relations

|

|

|

|

|

Investors.vodafone.com

|

Vodafone.com/media/contact

|

|

ir@vodafone.co.uk

|

GroupMedia@vodafone.com

|

Registered

Office: Vodafone House, The Connection, Newbury, Berkshire RG14 2FN, England. Registered in England No. 1833679

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorised.

|

|

VODAFONE GROUP

|

|

|

PUBLIC LIMITED COMPANY

|

|

|

(Registrant)

|

|

Dated: November 10, 2021

|

By:

|

/s/ R E S MARTIN

|

|

|

Name:

|

Rosemary E S Martin

|

|

|

Title:

|

Group General Counsel and Company Secretary

|

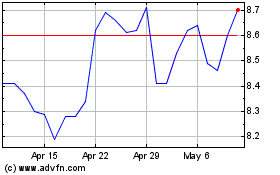

Vodafone (NASDAQ:VOD)

Historical Stock Chart

From Mar 2024 to Apr 2024

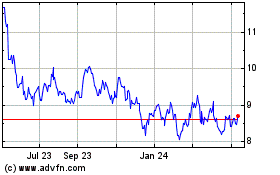

Vodafone (NASDAQ:VOD)

Historical Stock Chart

From Apr 2023 to Apr 2024