BT 1st Half Pretax Profit Fell, Brings Forward Savings Target

November 04 2021 - 3:50AM

Dow Jones News

By Joe Hoppe

BT Group PLC said Thursday that pretax profit for the first half

of fiscal 2022 fell slightly together with revenue, but maintained

its outlook and brought forward its cost-savings target.

The U.K. telecommunications company said that for the six months

ended Sept. 30, pretax profit slipped to 1.01 billion pounds ($1.38

billion) from GBP1.06 billion, on the back of higher finance

expenses.

Revenue fell 3% to GBP10.31 billion, largely due to revenue

decline in its enterprise and global divisions though partially

offset by growth in Openreach.

Adjusted earnings before interest, taxes, depreciation and

amortization--the company's preferred profit metric, which strips

out exceptional and other one-off items--were GBP3.75 billion, up

from GBP3.72 billion for the same period a year earlier.

The company brought forward its fiscal 2025 savings target of

GBP2 billion in gross annualized savings to fiscal 2024 with

further savings planned in fiscal 2025, within the expected cost of

GBP1.3 billion. Peak capital expenditure from fiscal 2023 is

expected at GBP4.8 billion, from GBP5 billion.

The board declared an interim dividend of 2.31 pence a

share.

BT said that it was in-line with its fiscal 2022 and fiscal 2023

expectations.

Write to Joe Hoppe at joseph.hoppe@wsj.com

(END) Dow Jones Newswires

November 04, 2021 03:35 ET (07:35 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

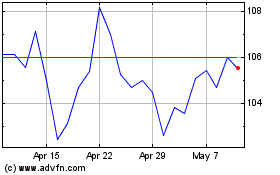

Bt (LSE:BT.A)

Historical Stock Chart

From Mar 2024 to Apr 2024

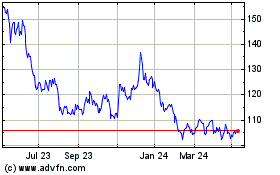

Bt (LSE:BT.A)

Historical Stock Chart

From Apr 2023 to Apr 2024