Prospectus Filed Pursuant to Rule 424(b)(3) (424b3)

July 30 2021 - 9:03AM

Edgar (US Regulatory)

|

Prospectus Supplement No. 1 dated July 30, 2021

(to Prospectus dated June 17, 2021)

|

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-256441

|

BARCLAYS BANK PLC

OFFER TO EXCHANGE

each of the iPath® S&P

GSCI® Crude Oil Total Return Index ETNs due August 14, 2036 (the “Old Notes”)

for

six iPath® Pure Beta Crude

Oil ETNs due April 18, 2041 (the “New Notes”)

and

CONSENT SOLICITATION

relating to any and all outstanding Old Notes

This Prospectus Supplement No. 1 dated July 30,

2021 (this “prospectus supplement”) updates certain statements and information and supersedes any inconsistent statement

or information contained in the Prospectus dated June 17, 2021 (the “prospectus”) of Barclays Bank PLC (“we,”

“us” or the “Issuer”), including, without limitation, an extension of the Expiration Deadline from

5:00 p.m., New York City time, on July 29, 2021 to 5:00 P.M., New York City time, on August 13, 2021. This prospectus supplement and the

prospectus, taken together, constitute a current prospectus relating to the Issuer’s offer to exchange any and all outstanding iPath®

S&P GSCI® Crude Oil Total Return Index ETNs due August 14, 2036 (CUSIP: 06738C760 / ISIN: US06738C7609) (the “Old

Notes”) for iPath® Pure Beta Crude Oil ETNs due April 18, 2041 (CUSIP: 06740P221 / ISIN: US06740P2213) (the “New

Notes”) (the “Exchange Offer”) and consent solicitation relating to any and all outstanding Old Notes (the

“Consent Solicitation”).

This prospectus supplement contains important

changes and should be read carefully and in its entirety in conjunction with the prospectus. Unless otherwise defined in this prospectus

supplement, capitalized terms used in this prospectus supplement shall have the same meanings as set forth in the prospectus.

Before making a decision with respect to the

Exchange Offer, Noteholders should carefully consider all of the information in the prospectus (as modified by this prospectus supplement)

and, in particular, the risk factors beginning on page 23 of the prospectus and the risk factors contained in our Annual Report on Form

20-F for the fiscal year ended December 31, 2020, which is incorporated by reference into the prospectus.

Neither the Securities and Exchange Commission

(the “SEC”), any state securities commission nor any other regulatory body has approved or disapproved of the Exchange Offer

or of the securities to be issued in the Exchange Offer or determined if this prospectus supplement or the prospectus is truthful or complete.

Any representation to the contrary is a criminal offense.

The New Notes are not deposit liabilities of

Barclays Bank PLC and are not covered by the U.K. Financial Services Compensation Scheme or insured by the U.S. Federal Deposit Insurance

Corporation or any other governmental agency or deposit insurance agency of the United States, the United Kingdom or any other jurisdiction.

Barclays PLC, our parent, has not guaranteed or assumed any obligations in respect of the New Notes.

The Dealer Manager for the Exchange Offer is:

Barclays Capital Inc.

The date of this prospectus supplement is July

30, 2021

CHANGES TO THE

PROSPECTUS AND THE TERMS OF THE EXCHANGE OFFER AND CONSENT SOLICITATION

We are modifying the terms of the Exchange Offer

and Consent Solicitation and the contents of the prospectus as described below. Accordingly, references in the prospectus to the matters

described herein shall be deemed to reflect such modifications.

Extension of Expiration Deadline

The Exchange Offer and Consent Solicitation commenced

on June 17, 2021, had originally been set to expire on July 29, 2021 and has been extended until 5:00 p.m., New York City time, on August

13, 2021, unless further extended or early terminated by us. All references to the following capitalized terms in the prospectus are hereby

amended as follows:

|

|

i.

|

“Expiration Date” will be August 13, 2021;

|

|

|

ii.

|

“Expiration Deadline” will be 5:00 p.m., New York City time, on August 13, 2021; and

|

|

|

iii.

|

“Settlement Date” will be August 18, 2021;

|

Accordingly, any request for information should

be made by 5:00 p.m., New York City time, on August 6, 2021 to ensure timely delivery of the documents prior to the Expiration Date.

The indicative timetable showing one possible

outcome for the timing of the Exchange Offer and Consent Solicitation is hereby amended as follows:

|

Time

and Date

|

Event

|

|

June 17, 2021

|

Commencement of Exchange Offer and Consent Solicitation

Exchange Offer and Consent Solicitation announced. The Exchange

Ratio per Old Note is equal to six New Notes.

Final prospectus made available to Noteholders.

|

|

5:00 p.m. (New York City time) on August 13, 2021

|

Expiration Deadline

The deadline for Noteholders to validly tender (and not validly

withdraw) their Old Notes in order to participate in the Exchange Offer and to be eligible to receive a number of New Notes equal to the

Exchange Ratio, plus a cash amount in lieu of any fractional New Notes. Noteholders who validly tender (and do not validly withdraw) their

Old Notes will be deemed to have consented to the Proposed Amendment under the Consent Solicitation.

Noteholders may validly withdraw tenders of their Old Notes

at any time prior to the Expiration Deadline, but not thereafter. Noteholders who validly withdraw tenders of their Old Notes will be

deemed to have withdrawn their consents to the Proposed Amendment under the Consent Solicitation. Noteholders may not consent to the Proposed

Amendment in the Consent Solicitation without tendering the Old Notes and may not revoke consents without withdrawing the previously tendered

|

|

|

Old Notes to which such consents relate.

Noteholders should carefully review the specific procedures

for tendering Old Notes in the section entitled “The Exchange Offer and Consent Solicitation—Procedures for Tendering Old

Notes” in the prospectus.

|

|

August 16, 2021

|

Announcement of Results of Exchange Offer and Consent

Solicitation

We will announce our decision whether to accept valid tenders

of Old Notes for exchange pursuant to the Exchange Offer (including, if applicable, the expected Settlement Date for the Exchange Offer)

and the results of the Exchange Offer and the Consent Solicitation in accordance with the methods set out in “The Exchange Offer

and Consent Solicitation—Announcements” in the prospectus.

|

|

August 18, 2021

|

Settlement

Expected Settlement Date. New Notes will be issued in exchange

for any Old Notes validly tendered (and not validly withdrawn) prior to the Expiration Deadline and accepted by us based on the Exchange

Ratio. Payment of any cash amounts in lieu of any fractional New Notes.

We expect that delivery of the New Notes will be made against

exchange of the Old Notes for the New Notes on the Settlement Date specified herein, which is expected to be more than two business days

following the Expiration Date. Under Rule 15c6-1 of the Securities Exchange Act of 1934, as amended, trades in the secondary market generally

are required to settle in two business days, unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who

wish to trade the New Notes on any date prior to two business days before delivery will be required, by virtue of the fact that the New

Notes will initially settle in more than two business days, to specify alternative settlement arrangements to prevent a failed settlement.

|

This timetable is subject to change and times

and dates may be further extended or amended by us in accordance with the terms of the Exchange Offer and Consent Solicitation as described

in the prospectus. Accordingly, the actual timetable may differ significantly from the timetable above.

Except as set forth in this prospectus supplement,

the terms and conditions of the Exchange Offer and Consent Solicitation remain as set forth in the prospectus.

If a Noteholder has already validly tendered and

not withdrawn its Old Notes pursuant to the Exchange Offer set forth in the prospectus, such Noteholder is not required to take any further

action with respect to such Old Notes and such tender constitutes a valid tender for purposes of the Exchange Offer, as amended and restated

hereby.

If a Noteholder has already validly tendered its

Old Notes pursuant to the Exchange Offer set forth in the prospectus, but wishes to withdraw its tender, such Noteholder may do so at

any time prior to the Expiration Deadline (as extended hereby) in accordance with the withdrawal procedures described in “The

Exchange Offer and Consent Solicitation—Extension, Withdrawal, Termination and Amendment” in the prospectus.

Any questions or requests for assistance in

connection with the prospectus may be directed to the Dealer Manager at its toll-free telephone number or e-mail address as set forth

below. Any questions or requests for assistance in connection with the delivery of an Exchange Instruction may be directed to the Exchange

Agent at its toll-free telephone number or e-mail address as set forth below. Any requests for additional copies of the prospectus or

related documents, which may be obtained free of charge, may be directed to the Information Agent at its toll-free telephone number or

e-mail address as set forth below. Any Noteholder whose Old Notes are held on its behalf by a broker, dealer, bank, custodian, trust

company, nominee or other Intermediary should promptly contact such entity if it wishes to tender or withdraw tenders of its Old Notes

in the Exchange Offer. Such Intermediaries may have deadlines for participating in the Exchange Offer prior to the Expiration Deadline.

The Dealer Manager is:

Barclays Capital Inc.

745 Seventh Avenue

New York, New York 10019

Telephone: +1 212-528-7990

Attention: Barclays ETN Desk

Email: etndesk@barclays.com

The Exchange Agent is:

The Bank of New York Mellon

One Canada Square, 40th Floor

London E14 5AL

United Kingdom

Attention: Debt Restructuring Services

Telecopy no. +44 20 7964 2536

Email: debtrestructuring@bnymellon.com

The Information Agent is:

D.F. King & Co., Inc.

48 Wall Street, 22nd Floor

New York, New York 10005

Telephone: +1 212-269-5550

U.S. Toll Free Number: +1 866-342-4883

Attention: Michael Horthman

Email: barclays@dfking.com

Fax: 212-709-3328

Fax for Confirmation (for eligible institutions

only): 212-232-3233

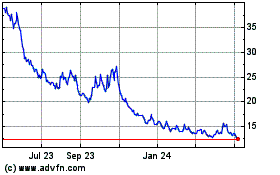

iPath Series B S&P 500 V... (AMEX:VXX)

Historical Stock Chart

From Mar 2024 to Apr 2024

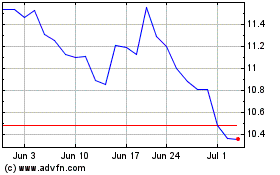

iPath Series B S&P 500 V... (AMEX:VXX)

Historical Stock Chart

From Apr 2023 to Apr 2024