Vodafone 1Q Revenue Rebounds After Pandemic Hit -- Update

July 23 2021 - 4:10AM

Dow Jones News

By Adria Calatayud

Vodafone Group PLC said Friday that revenue rebounded in the

first quarter of fiscal 2022, recovering from the hit caused by the

coronavirus pandemic last year, and said it is on track to meet its

expectations for the full year.

The U.K.-based telecommunications group said service revenue--a

key metric in the telecom sector--returned to growth in Europe for

the three months to June 30 and continued its positive trend in

Africa, as both its consumer and business-facing segments

contributed to the rise.

Revenue for the quarter was 11.10 billion euros ($13.07 billion)

compared with EUR10.51 billion for the same period last year. On an

organic basis, Vodafone's first-quarter revenue grew 5.6% on

year.

Vodafone's organic service revenue grew 3.3% in the quarter,

accelerating from a 0.8% increase in the previous quarter. In

Germany, Vodafone's largest market, service revenue was up

1.4%.

Shares at 0724 GMT were up 2.9% at 119.44 pence ($1.64).

The company said European commercial activity hasn't yet

returned to pre-pandemic conditions, and that lower international

travel maintained its roaming revenue below levels experienced

before Covid-19 struck.

"In Europe, the operating and retail environment has not yet

returned to normal conditions, but we are delivering a good service

revenue performance," Chief Executive Nick Read said.

Vodafone's first-quarter organic service revenue fell in Italy

by 3.6% amid intense competition, but returned to growth in the

U.K. and Spain.

The company said roaming and visitor revenue grew 56% on year,

but is still sharply below pre-pandemic levels.

Interactive Investor Head of Markets Richard Hunter said the

reduction in roaming and visitor revenue has been a thorn in the

side of late for Vodafone and that it is unlikely to go away

soon.

"The improvement is likely to continue, but there is clearly

some way to go before the issue can be eliminated from dragging on

profits," Mr. Hunter said.

Vodafone said it is on track to deliver its guidance for

adjusted earnings before interest, taxes, depreciation and

amortization--the company's preferred profit metric, which strips

out exceptional and other one-off items--for fiscal 2022 of between

EUR15.0 billion and EUR15.4 billion, with an adjusted free cash

flow of at least EUR5.2 billion.

Write to Adria Calatayud at adria.calatayud@dowjones.com

(END) Dow Jones Newswires

July 23, 2021 03:57 ET (07:57 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

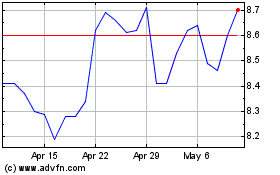

Vodafone (NASDAQ:VOD)

Historical Stock Chart

From Mar 2024 to Apr 2024

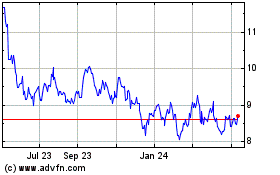

Vodafone (NASDAQ:VOD)

Historical Stock Chart

From Apr 2023 to Apr 2024