Current Report Filing (8-k)

July 12 2021 - 6:04AM

Edgar (US Regulatory)

false

0001209028

0001209028

2021-07-07

2021-07-07

0001209028

us-gaap:CommonClassAMember

2021-07-07

2021-07-07

0001209028

ai:SevenPointZeroZeroPercentSeriesBCumulativePerpetualRedeemablePreferredStockMember

2021-07-07

2021-07-07

0001209028

ai:EightPointTwoFiftyPercentSeriesCFixedToFloatingRateCumulativeRedeemablePreferredStockMember

2021-07-07

2021-07-07

0001209028

ai:SixPointSixTwentyFivePercentageSeniorNotesDueTwoThousandTwentyThreeMember

2021-07-07

2021-07-07

0001209028

ai:SixPointSeventyFivePercentageSeniorNotesDueTwoThousandTwentyFiveMember

2021-07-07

2021-07-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (date of earliest event reported): July 7, 2021

ARLINGTON ASSET INVESTMENT CORP.

(Exact name of Registrant as specified in its charter)

|

Virginia

|

|

54-1873198

|

|

001-34374

|

|

(State or Other Jurisdiction

of Incorporation or Organization)

|

|

(I.R.S. Employer Identification No.)

|

|

(Commission File Number)

|

6862 Elm Street, Suite 320

McLean, VA 22101

(Address of principal executive offices) (Zip code)

(703) 373-0200

(Registrant’s telephone number including area code)

N/A

(Former name or former address, if changed from last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Class A Common Stock

|

AAIC

|

NYSE

|

|

7.00% Series B Cumulative Perpetual Redeemable Preferred Stock

|

AAIC PrB

|

NYSE

|

|

8.250% Series C Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock

|

AAIC PrC

|

NYSE

|

|

6.625% Senior Notes due 2023

|

AIW

|

NYSE

|

|

6.75% Senior Notes due 2025

|

AIC

|

NYSE

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01.

|

Entry Into a Material Definitive Agreement.

|

On July 7, 2021, Arlington Asset Investment Corp. (the “Company”), a Virginia corporation, entered into an underwriting agreement (the “Underwriting Agreement”) with Ladenburg Thalmann & Co. Inc., as representative of the several underwriters listed on Schedule I attached thereto, relating to the underwritten public offering (the “Offering”) of $33,500,000 aggregate principal amount of the Company’s 6.000% Notes due 2026 (the “Notes”). In addition, the Underwriting Agreement provides the Underwriters a 30-day option to purchase up to an additional $5,000,000 aggregate principal amount of the Notes to cover over-allotments, if any. The Offering is expected to close on July 15, 2021, subject to customary closing conditions.

The Notes will be issued pursuant to the Company’s Registration Statement on Form S-3 (File No. 333-235885) (the “Registration Statement”). The Offering was made pursuant to the prospectus supplement, dated July 7, 2021, and the accompanying prospectus, dated February 20, 2020, filed with the Securities and Exchange Commission pursuant to Rule 424(b) of the Securities Act of 1933, as amended (the “Securities Act”).

The Underwriting Agreement contains customary representations, warranties and covenants by the Company. It also provides for customary indemnification by the Company for losses and damages arising out of or in connection with the sale of the Notes.

A copy of the Underwriting Agreement is filed herewith as Exhibit 1.1 to this Current Report on Form 8-K and is hereby incorporated herein by reference. The summary of the Underwriting Agreement set forth above is qualified in its entirety by reference to Exhibit 1.1.

|

Item 7.01.

|

Regulation FD Disclosure.

|

On July 7, 2021, the Company issued a press release (the “Press Release”) announcing the redemption set forth under Item 8.01 of this Current Report on Form 8-K. The Company hereby furnishes the information set forth in the Press Release attached hereto as Exhibit 99.1, which is incorporated herein by reference.

The Press Release is being furnished pursuant to Item 7.01, and the information contained therein shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

On July 7, 2021, the Company announced the redemption of all of the Company’s 6.625% Senior Notes due 2023 (the “2023 Notes”), at a redemption price equal to 100% of the principal amount of the 2023 Notes to be redeemed plus unpaid interest accrued thereon to, but excluding, the redemption date, which is August 6, 2021.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

104Cover Page Interactive Data File (embedded within the Inline XBRL document).

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

ARLINGTON ASSET INVESTMENT CORP.

|

|

|

|

|

Date: July 9, 2021

|

By:

|

/s/ D. Scott Parish

|

|

|

Name:

|

D. Scott Parish

|

|

|

Title:

|

Senior Vice President, Chief Administrative Officer and Corporate Secretary

|

Arlington Asset Investment (NYSE:AAIC)

Historical Stock Chart

From Mar 2024 to Apr 2024

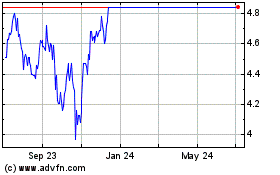

Arlington Asset Investment (NYSE:AAIC)

Historical Stock Chart

From Apr 2023 to Apr 2024