BASF and Clayton, Dubilier & Rice to Sell Solenis for $5.25 Billion Enterprise Value

July 06 2021 - 8:00AM

Dow Jones News

By Olivia Bugault

Germany's BASF SE and the U.S.'s Clayton, Dubilier & Rice

LLC have signed an agreement for the sale of water-treatment

company Solenis to private equity firm Platinum Equity LLC for an

enterprise value of $5.25 billion.

The German chemicals company holds a 49% stake in Solenis while

the remaining 51% is held by private-equity company Clayton,

Dubilier & Rice and Solenis management via funds, BASF said

Tuesday.

The enterprise value includes a net debt of roughly $2.5

billion, BASF said.

"The transaction does not affect any of the existing mid- to

long-term supply agreements and commercial relationships between

BASF and Solenis," BASF said. "BASF will continue to supply

products to or source products from Solenis under these

agreements."

The deal is expected to close before the end of the year.

In its fiscal year 2020 ending on Sept. 30, Solenis posted $2.8

billion in sales.

Write to Olivia Bugault at olivia.bugault@wsj.com

(END) Dow Jones Newswires

July 06, 2021 07:49 ET (11:49 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

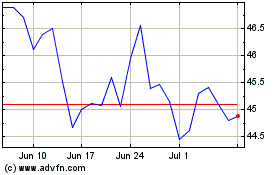

BASF (TG:BAS)

Historical Stock Chart

From Mar 2024 to Apr 2024

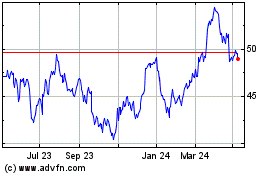

BASF (TG:BAS)

Historical Stock Chart

From Apr 2023 to Apr 2024