UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rules 13a-16 or 15d-16 under

the Securities Exchange Act of 1934

Dated July 1, 2021

Commission File Number: 001-10086

VODAFONE GROUP

PUBLIC LIMITED COMPANY

(Translation of registrant’s name into English)

VODAFONE HOUSE, THE CONNECTION, NEWBURY, BERKSHIRE,

RG14 2FN, ENGLAND

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F

¨

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Indicate by check mark whether the registrant

by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under

the Securities Exchange Act of 1934.

Yes ¨ No x

If “Yes” is marked, indicate below

the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- .

|

|

|

This Report on Form 6-K contains the following:-

|

|

|

1.

|

A

Stock Exchange Announcement dated 1 June 2021 entitled ‘TOTAL VOTING RIGHTS

AND CAPITAL’.

|

|

|

2.

|

A Stock Exchange Announcement dated 17

June 2021 entitled ‘VODAFONE FOUNDATION

AND UNHCR EXPAND CONNECTED EDUCATION PROGRAMME FOR REFUGEES AND HOST COMMUNITIES INTO MOZAMBIQUE’.

|

|

|

3.

|

A Stock Exchange Announcement dated 23

June 2021 entitled ‘VODAFONE'S EUROPEAN NETWORK 100% POWERED BY ELECTRICITY FROM

RENEWABLE SOURCES’.

|

|

|

4.

|

A Stock Exchange Announcement dated 30

June 2021 entitled ‘NOTIFICATION OF TRANSACTIONS OF DIRECTORS, PERSONS DISCHARGING

MANAGERIAL RESPONSIBILITY OR CONNECTED PERSONS’.

|

RNS Number : 2063A

Vodafone Group Plc

01 June 2021

VODAFONE GROUP PLC

TOTAL VOTING RIGHTS AND CAPITAL

In conformity with Disclosure

Guidance and Transparency Rule 5.6.1R, Vodafone Group Plc ("Vodafone") hereby notifies the market that, as at 31

May 2021:

Vodafone's

issued share capital consists of 28,816,884,728 ordinary shares of US$0.20 20/21 of

which 843,796,400 ordinary shares are held in Treasury.

Therefore, the total number

of voting rights in Vodafone is 27,973,088,328. This figure may be used by shareholders as the denominator for the calculations

by which they will determine if they are required to notify their interest in, or a change to their interest in, Vodafone under the FCA's

Disclosure Guidance and Transparency Rules.

This announcement does not

constitute, or form part of, an offer or any solicitation of an offer for securities in any jurisdiction.

END

RNS Number : 1654C

Vodafone Group Plc

17 June 2021

17 June 2021

VODAFONE FOUNDATION AND UNHCR

EXPAND CONNECTED EDUCATION PROGRAMME FOR REFUGEES AND

HOST COMMUNITIES INTO MOZAMBIQUE

|

|

·

|

Instant

Network Schools launches in Mozambique to provide nearly 9,000 asylum seekers, refugees and

local students with access to quality, connected education.

|

|

|

·

|

One

school will serve the Maratane Refugee Settlement, a camp hosting a third of the country's

refugees, and another is the biggest secondary public school in Nampula city.

|

|

|

·

|

The

programme will support asylum seekers, refugees and Mozambican students who have been disproportionally

affected by COVID-19. An estimated 50% of primary age and 60% of secondary age children in the

Maratane Refugee Settlement are now outside of the education system.

|

Ahead of World Refugee Day (June 20),

Vodafone Foundation and UNHCR, the UN Refugee Agency, have expanded their Instant Network Schools (INS) programme - which supports over

94,000 refugee students and communities in four African countries - into Mozambique. Two new INS, in the Maratane Refugee Settlement

and the city of Nampula, will benefit nearly 9,000 students in the 7th-12th grades, 25,000 family members and over 200 teachers.

INS transforms existing classrooms

into multimedia hubs for learning, complete with internet connectivity, sustainable solar power and a robust teacher training programme.

The content is localised and aligned to national curriculums, which supports disadvantaged learners to study core subjects in the classroom,

and crucially, increases access to opportunities for both study and future work opportunities.

The Maratane Refugee Settlement

is located in Nampula Province and hosts one third of Mozambique's 28,000 refugees. As of March 2021, more than 50% of the refugee

primary school-aged children in the settlement were outside the primary education system, and more than 60% outside the secondary education

system. UNHCR supports a primary and a secondary school run by the Ministry of Education in Maratane Refugee Settlement for both refugee

and host community children to promote social cohesion and peaceful coexistence. Vodafone Foundation and UNHCR have also established

an INS in a public school in the provincial capital city, Nampula - 35km from the camp. It is the first time that the programme will

be situated within an urban public school environment, maximising benefits to refugee and young learners.

Andrew

Dunnett, Director SDGs, Sustainable Business and Foundations, Vodafone Group, said: "Prior to 2020, refugee children

were twice as likely to be out of school as a non-refugee child. COVID-19's onslaught of school closures, health needs, and loss of family

livelihoods has exacerbated the risks of refugee children - and secondary school-age refugee girls in particular - not returning to school.

Refugee students in Mozambique - where Maratane used to be called the forgotten camp - have faced particularly dire conditions and consequences

to their continued safety, wellbeing, and learning."

Samuel

Chakwera, UNHCR's representative in Mozambique, said: "Fostering quality learning in refugee settlements and camps

remains a constant challenge as most of the time educational resources are not available in those settings. Through the Instant Network

Schools programme in secondary schools in Maratane and Nampula, an innovation hub will be created in the classroom, bringing together

education, innovation and protection. I am incredibly proud to see the programme expand into Mozambique where I hope it will have the

same success that we've experienced in other countries."

At the heart of an INS is a 'school

in a box' that includes tablets for students, a laptop for the teacher, a projector, speaker, internet connectivity, solar charging and

a library of digital educational resources. The programme was established by Vodafone Foundation and UNHCR in 2013 to give young refugees,

host community members and their teachers access to digital devices, resources and tools, including the internet which assist in improving

the quality of education in some of the most marginalised communities in Africa.

The launch in Mozambique brings

the total number of INS centres to 38, with schools already rolled out across the Democratic Republic of Congo, Kenya, Tanzania and South

Sudan. Vodafone Foundation and UNHCR are committed to expand the programme to benefit 500,000 young refugees and their communities by

2025.

An evaluation of existing INS

programmes showed a significant positive impact including an increase in ICT literacy of 61% for students and 125% for teachers, and

improved confidence, motivation and academic performance by students.

Longevity, self-sufficiency and

scalability are central to the success of the INS programme. Post-launch, Vodafone Foundation and UNHCR will work closely with the Mozambique

Ministry of Education to ensure the long-term sustainability of the programme to 2025, and beyond.

- ends -

For further information:

|

Vodafone

Group

|

|

Media

Relations

|

|

www.vodafone.com/media/contact

|

Notes to Editors

Videos and images of people whose lives

have been improved as a result of the INS programme can be found here: https://www.flickr.com/photos/vodafonegroup/sets/72157719466187485/

About Mozambique

As of March 2021, Mozambique

was host to 27,722 refugees and asylum seekers, the majority of whom are from the DRC (36.8%) and Burundi (32.2%). Mozambique is also

host to 668,000 internally displaced persons (IDPs), who are predominantly located in the northern provinces of Cabo Delgado, Nampula,

and Niassa. Internal displacement has risen in Mozambique since October 2017, when Cabo Delgado began facing an ongoing conflict

with extreme violence by non-state armed groups. The needs are growing rapidly: in March 2021 these provinces had almost five times

more IDPs as than the number registered in March 2020.

About Vodafone Foundation

Vodafone Foundation's

strategy of 'Connecting for Good' combines Vodafone's charitable giving and technology to address some of the world's most pressing problems.

Established in 1991, Vodafone Foundation is at the centre of a network of global and local social investment programmes. Vodafone Foundation

is an independent UK registered charity, registered charity number 1089625. For more information, visit: www.vodafonefoundation.org

About Instant Network Schools

Vodafone Foundation and UNHCR's

Instant Network Schools (INS) programme aims to connect refugee students in a quality digital education and improve ICT literacy and

digital skills. Vodafone Foundation and the UN Refugee Agency (UNHCR) have worked together since 2013 to enhance the quality of education

in refugee contexts. The INS programme was co-designed by the Vodafone Foundation Instant Network team and UNHCR's Innovation and Education

teams leveraging Vodafone's technical expertise and core capabilities. Vodafone Foundation's Instant Classroom - the equipment used for

INS - is a digital 'school in a box' that can be set up in a matter of minutes. It includes 25 tablets, a laptop for the teacher, a projector,

speakers, 3G modem and a library of digital educational resources. The INS programme has had a significant impact within the schools

in refugee contexts by ensuring that refugees, and the communities that host them, have access to accredited, quality, and relevant learning

opportunities.

About UNHCR

UNHCR, the UN Refugee Agency,

is a global organisation dedicated to saving lives, protecting rights and building a better future for people forced to flee their homes

because of conflict and persecution. We deliver life-saving assistance like shelter, food and water, help safeguard fundamental human

rights, and develop solutions that ensure people have a safe place to call home. We work in over 130 countries, using our expertise to

protect and care for millions of people.

RNS Number : 7673C

Vodafone Group Plc

23 June 2021

23 June 2021

VODAFONE'S EUROPEAN NETWORK 100% POWERED

BY ELECTRICITY FROM RENEWABLE SOURCES

Vodafone today confirmed that its entire European

operations - including mobile and fixed networks, data centres, retail and offices - will be 100% powered by electricity from renewable

sources from 1 July 2021, marking a key step towards Vodafone's goal of reducing its own carbon emissions to 'net zero' by 2030

and across the company's entire value chain by 2040.1

Vodafone will celebrate the milestone across Europe

and raise awareness of its green network with a simultaneous consumer campaign that will include Vodafone's iconic brand turning 'green'

across key digital and social channels in 12 markets.

In the last year, Vodafone has continued to make

significant progress towards ensuring the greening of the company's own activities, whilst accelerating the role that Vodafone's digital

networks and technologies play in helping to address climate change. In July 2020,

Vodafone brought forward its plan to purchase 100% renewable electricity in Europe to July 2021 from its previous target of 2025

and is committed to achieving the same step-change in Africa by 2025.

Vodafone Group CEO Nick Read said: "From

1 July 2021, Vodafone's customers across Europe can be reassured that the connectivity they use is entirely powered by electricity

from renewable sources. This is a major milestone towards our goal of reducing our own global carbon emissions to net zero by 2030,

helping our customers reduce their own environmental footprint and continuing to build an inclusive and sustainable digital society in

all of our markets."

96% of Vodafone's total energy use during FY21

was in the form of purchased electricity. Following today's announcement, 100% of Vodafone's purchased electricity in Europe is

now from renewable generation sources including where Vodafone is a tenant on other landlord's sites.

Vodafone's Planet Actions

Reducing carbon emissions and driving energy

efficiency

In 2020, Vodafone set an approved 2030 Science-Based

Target in line with carbon reductions required to keep global warming to 1.5oc, becoming the first major telecoms operator

to follow the emission reduction pathway developed for the ICT sector.

During the last year, Vodafone reduced

its total Scope 1 and 2 greenhouse gas emissions by 30% year on year, to 1.37 million tonnes of CO2e (carbon dioxide equivalent),

driven by Vodafone's ongoing focus on energy efficiency and an increase in the proportion of renewable electricity purchased in Europe

from 33% in FY20 to 80% in FY21.

Vodafone's energy

use has remained broadly flat during the last year, despite a 47% year-on-year increase in mobile data traffic over the

same period from 7,983 petabytes (PB) in FY20 to 11,714 PB in FY21. This is due to increased use of more energy efficient

mobile technology and analytics, including M-MIMO that is approximately 70% more efficient than 4G.

Vodafone has invested €65 million during

the last year in energy efficiency and on-site renewable projects, leading to annual energy savings of 135 GWh. Key energy efficiency

initiatives have also included sourcing and deploying more efficient network equipment, gradually switching off the relatively less energy

efficient 3G network and decommissioning legacy equipment in our core network.

From October 2020, Vodafone introduced

a 20% weighting for environmental and social criteria when suppliers tender for new work. Vodafone's updated process now examines

whether suppliers have environmental policies to address carbon reduction, renewable energy, plastic reduction, circular economy and

product life cycle.

Vodafone's efforts have been recognised

by global environmental non-profit organisation CDP for its decisive actions and transparency on environmental impact, securing

a place on CDP's climate change 'A List'.

Enabling Vodafone's customers to reduce their

own emissions

In July 2020, Vodafone committed to helping

its business customers reduce their own carbon emissions by a cumulative total of 350 million tonnes globally over ten years between

2020 and 2030 - equivalent to Italy's total annual carbon emissions for 2019. Most of this saving will be made through Vodafone's

Internet of Things (IoT) service, which improves the efficiency of logistics and fleet management, smart meters, manufacturing and other

activities.

The Carbon Trust has calculated that Vodafone

enabled its customers to avoid an estimated 7.1 million tonnes of CO2e during FY21, with more than 54% of Vodafone's 123

million IoT connections directly enabling customers to reduce their own emissions.

In March 2021, Vodafone became a

founding member of the European Green Digital Coalition, which brings together ICT sector companies to work with EU policymakers

and experts to drive investment in, and implementation of, digital solutions in action against climate change.

Reducing waste and helping to build a circular

economy

Vodafone has pledged to reuse, resell or recycle

100% of the company's network waste by 2025. Vodafone has implemented resource efficiency and waste disposal management programmes

across every market to minimise the environmental impact of network waste and redundant IT equipment.

98.7% of Vodafone's

network waste, excluding hazardous waste, was sent for reuse and recycling during FY21, with an overall reduction

in network waste year-on-year of 22.5% to 6,307 tonnes from 8,138 tonnes in FY20.

In 2020, Vodafone launched an internal asset marketplace

that encourages Vodafone's markets to re-sell and re-purpose excess stock or large decommissioned electrical items like masts and antennae.

This has avoided over 1,250 tonnes of CO2e, saving more than €10 million in the process. Vodafone is currently assessing

the possibility of expanding the solution to partner markets and other operators.

Vodafone supports the move towards a fully circular

economy for devices sold to customers and has accelerated initiatives to extend the lifespan of devices through repair, refurbishment

and resale before encouraging the responsible recycling of devices at the end of their useful life.

Most Vodafone markets already operate trade-in

and device buyback schemes and repair services to encourage customers to repair or return their old devices. Vodafone is striving

to refurbish and reuse fixed-line equipment multiple times, with significant associated environmental and cost savings.

In 2021, Vodafone joined the Circular

Electronics Partnership, which brings together leaders across the value chain - from manufacturing, reverse logistics, material recovery,

to e-waste management - to drive circularity solutions for electronics.

In May 2021, Vodafone joined forces

with four of Europe's leading network operators to launch a new pan-industry Eco Rating

labelling scheme to help consumers identify and compare the most sustainable mobile phones and encourage suppliers to reduce

the environmental impact of their devices.

- ends -

Notes for Editors

1. 100% of the grid electricity that Vodafone uses in its European network is certified to be from renewable sources like wind, solar or

hydro. Vodafone has direct Power Purchase Agreements in the UK and Spain. In Italy, Germany, Ireland, Hungary, Romania,

Spain, Greece, Turkey and Czech Republic, Vodafone has sourced Renewable Energy Certificates ('RECs') or tariffs. In Albania, approximately

67% of electricity consumption is sourced from local renewable sources, and Vodafone has purchased the equivalent of the remaining annual

consumption in the form of RECs through our partner in Italy.

Data is calculated using local market actual or

estimated data sources from invoices, purchasing requisitions, direct data measurement and estimations. Carbon emissions calculated in

line with GHG Protocol standards. Scope 2 emissions are reported using the market-based methodology. For the full methodology see our

ESG Addendum 2021.

|

For further information:

Vodafone Group

|

|

Media

Relations

|

Investor

Relations

|

|

GroupMedia@vodafone.com

|

IR@vodafone.co.uk

|

About Vodafone

Vodafone is a leading telecommunications company

in Europe and Africa. Our purpose is to "connect for a better future" enabling an inclusive and sustainable digital society.

Our expertise and scale give us a unique opportunity to drive positive change for society. Our networks keep family, friends, businesses

and governments connected and - as COVID-19 has clearly demonstrated - we play a vital role in keeping economies running and the functioning

of critical sectors like education and healthcare.

Vodafone is the largest mobile and fixed network

operator in Europe and a leading global IoT connectivity provider. Our M-Pesa technology platform in Africa enables over 48m people to

benefit from access to mobile payments and financial services. We operate mobile and fixed networks in 21 countries and partner with

mobile networks in 49 more. As of 31 March 2021, we had over 300m mobile customers, more than 27m fixed broadband customers, over

22m TV customers and we connected more than 123m IoT devices.

We support diversity and inclusion through our

maternity and parental leave policies, empowering women through connectivity and improving access to education and digital skills for

women, girls, and society at large. We are respectful of all individuals, irrespective of race, ethnicity, disability, age, sexual orientation,

gender identity, belief, culture or religion.

Vodafone is also taking significant steps to reduce

our impact on our planet by reducing our greenhouse gas emissions by 50% by 2025 and becoming net zero by 2040, purchasing 100% of our

electricity from renewable sources by 2025 and by July 2021 in Europe, and reusing, reselling or recycling 100% of our redundant

network equipment.

For more information, please visit www.vodafone.com,

follow us on Twitter at @VodafoneGroup or connect with us on LinkedIn at www.linkedin.com/company/vodafone.

RNS Number : 6773D

Vodafone Group Plc

30 June 2021

VODAFONE GROUP PLC

(the "Company")

NOTIFICATION OF TRANSACTIONS OF DIRECTORS, PERSONS

DISCHARGING MANAGERIAL RESPONSIBILITY OR CONNECTED PERSONS

Acquisition of shares

The below individuals acquired shares under the Vodafone

Global Incentive Plan. The vesting of the share awards was conditional on continued employment with the Vodafone Group and on the

satisfaction of the performance conditions approved by the Remuneration Committee. For further details of the Global Incentive

Plan, please see the Company's 2021 Annual Report, available at www.vodafone.com/ar2021.

|

1

|

Details of the person discharging managerial responsibilities/person closely associated

|

|

a)

|

Name

|

Nick Read

|

|

2

|

Reason for the notification

|

|

a)

|

Position/status

|

Vodafone Group Chief Executive Officer

|

|

b)

|

Initial notification/ Amendment

|

Initial notification

|

|

3

|

Details of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

Vodafone Group Plc

|

|

b)

|

LEI

|

549300MSQV80HSATBG53

|

|

4

|

Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each date; and (iv) each place where transactions have been conducted

|

|

a)

|

Description of the financial instrument, type of instrument and identification code

|

Ordinary shares of US$0.20 20/21 each in Vodafone Group Plc (ISIN: GB00BH4HKS39)

|

|

b)

|

Nature of the transaction

|

Vesting of conditional award of shares subject

to performance conditions under the Global Incentive Plan (1).

Sale of shares to satisfy tax withholding obligations

(2).

Additional sale of shares (3).

|

|

c)

|

Price(s) and volume(s)

|

|

|

|

|

|

|

|

|

|

|

Price(s)

|

Volume(s)

|

|

|

|

|

|

(1)

|

GBP nil

|

733,953

|

|

|

|

|

|

(2)

|

GBP 1.209775

|

346,515

|

|

|

|

|

|

(3)

|

GBP 1.220662

|

193,719

|

|

|

|

|

|

|

|

|

|

|

d)

|

Aggregated information: volume, Price

|

Aggregated volume of shares acquired (1): 733,953

Ordinary shares

Aggregated price of shares acquired (1): GBP nil

Aggregated volume of shares sold (2): 346,515 Ordinary

shares

Aggregated price of shares sold (2): GBP 419,205.18

Aggregated volume of shares sold (3): 193,719 Ordinary

shares

Aggregated price of shares sold (3): GBP 236,465.42

|

|

e)

|

Date of the transaction

|

2021-06-28 (1 and 2)

2021-06-29 (3)

|

|

f)

|

Place of the transaction

|

London Stock Exchange (XLON)

|

|

1

|

Details

of the person discharging managerial responsibilities/person closely associated

|

|

a)

|

Name

|

Margherita

Della Valle

|

|

2

|

Reason

for the notification

|

|

a)

|

Position/status

|

Vodafone

Group Chief Financial Officer

|

|

b)

|

Initial

notification/ Amendment

|

Initial

notification

|

|

3

|

Details

of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

Vodafone

Group Plc

|

|

b)

|

LEI

|

549300MSQV80HSATBG53

|

|

4

|

Details

of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each

date; and (iv) each place where transactions have been conducted

|

|

a)

|

Description

of the financial instrument, type of instrument and identification code

|

Ordinary

shares of US$0.20 20/21 each

in Vodafone Group Plc (ISIN: GB00BH4HKS39)

|

|

b)

|

Nature

of the transaction

|

Vesting of conditional award of shares subject

to performance conditions under the Global Incentive Plan.

Sale of shares to satisfy tax withholding

obligations.

|

|

c)

|

Price(s) and volume(s)

|

|

|

|

|

|

|

|

|

Price(s)

|

Volume(s)

|

|

|

|

|

|

GBP nil

|

446,754

|

|

|

|

|

|

GBP 1.209775

|

210,922

|

|

|

|

|

|

|

|

|

|

d)

|

Aggregated

information: volume, Price

|

Aggregated volume of shares acquired: 446,754

Ordinary shares

Aggregated price of shares acquired: GBP nil

Aggregated volume of shares sold: 210,922 Ordinary

shares

Aggregated price of shares sold: GBP 255,168.16

|

|

e)

|

Date

of the transaction

|

2021-06-28

|

|

f)

|

Place

of the transaction

|

London

Stock Exchange (XLON)

|

|

1

|

Details

of the person discharging managerial responsibilities/person closely associated

|

|

a)

|

Name

|

Hannes

Ametsreiter

|

|

2

|

Reason

for the notification

|

|

a)

|

Position/status

|

Vodafone

Germany Chief Executive Officer

|

|

b)

|

Initial

notification/ Amendment

|

Initial

notification

|

|

3

|

Details

of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

Vodafone

Group Plc

|

|

b)

|

LEI

|

549300MSQV80HSATBG53

|

|

4

|

Details

of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each

date; and (iv) each place where transactions have been conducted

|

|

a)

|

Description

of the financial instrument, type of instrument and identification code

|

Ordinary

shares of US$0.20 20/21 each

in Vodafone Group Plc (ISIN: GB00BH4HKS39)

|

|

b)

|

Nature

of the transaction

|

Vesting of conditional award of shares subject

to performance conditions under the Global Incentive Plan.

Sale of shares to satisfy tax withholding

obligations.

|

|

c)

|

Price(s) and volume(s)

|

|

|

|

|

|

|

|

|

Price(s)

|

Volume(s)

|

|

|

|

|

|

GBP nil

|

556,453

|

|

|

|

|

|

GBP 1.209775

|

288,006

|

|

|

|

|

|

|

|

|

|

d)

|

Aggregated

information: volume, Price

|

Aggregated volume of shares acquired: 556,453

Ordinary shares

Aggregated price of shares acquired: GBP nil

Aggregated volume of shares sold: 288,006 Ordinary

shares

Aggregated price of shares sold: GBP 348,422.46

|

|

e)

|

Date

of the transaction

|

2021-06-28

|

|

f)

|

Place

of the transaction

|

London

Stock Exchange (XLON)

|

|

1

|

Details

of the person discharging managerial responsibilities/person closely associated

|

|

a)

|

Name

|

Aldo

Bisio

|

|

2

|

Reason

for the notification

|

|

a)

|

Position/status

|

Vodafone

Italy Chief Executive Officer

|

|

b)

|

Initial

notification/ Amendment

|

Initial

notification

|

|

3

|

Details

of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

Vodafone

Group Plc

|

|

b)

|

LEI

|

549300MSQV80HSATBG53

|

|

4

|

Details

of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each

date; and (iv) each place where transactions have been conducted

|

|

a)

|

Description

of the financial instrument, type of instrument and identification code

|

Ordinary

shares of US$0.20 20/21 each

in Vodafone Group Plc (ISIN: GB00BH4HKS39)

|

|

b)

|

Nature

of the transaction

|

Vesting of conditional award of shares subject

to performance conditions under the Global Incentive Plan.

Sale of shares to satisfy tax withholding

obligations.

|

|

c)

|

Price(s) and volume(s)

|

|

|

|

|

|

|

|

|

Price(s)

|

Volume(s)

|

|

|

|

|

|

GBP nil

|

460,454

|

|

|

|

|

|

GBP 1.209775

|

224,162

|

|

|

|

|

|

|

|

|

|

d)

|

Aggregated

information: volume, Price

|

Aggregated volume of shares acquired: 460,454

Ordinary shares

Aggregated price of shares acquired: GBP nil

Aggregated volume of shares sold: 224,162 Ordinary

shares

Aggregated price of shares sold: GBP 271,185.58

|

|

e)

|

Date

of the transaction

|

2021-06-28

|

|

f)

|

Place

of the transaction

|

London

Stock Exchange (XLON)

|

|

1

|

Details

of the person discharging managerial responsibilities/person closely associated

|

|

a)

|

Name

|

Colman

Deegan

|

|

2

|

Reason

for the notification

|

|

a)

|

Position/status

|

Vodafone

Spain Chief Executive Officer

|

|

b)

|

Initial

notification/ Amendment

|

Initial

notification

|

|

3

|

Details

of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

Vodafone

Group Plc

|

|

b)

|

LEI

|

549300MSQV80HSATBG53

|

|

4

|

Details

of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each

date; and (iv) each place where transactions have been conducted

|

|

a)

|

Description

of the financial instrument, type of instrument and identification code

|

Ordinary

shares of US$0.20 20/21 each

in Vodafone Group Plc (ISIN: GB00BH4HKS39)

|

|

b)

|

Nature

of the transaction

|

Vesting of performance and retention shares

as part of the Global Long Term Incentive (GLTI) and Global Long Term Retention (GLTR) plans for Senior Leadership Team members.

Sale of shares to satisfy tax withholding

obligations.

|

|

c)

|

Price(s) and volume(s)

|

|

|

|

|

|

|

|

|

Price(s)

|

Volume(s)

|

|

|

|

|

|

GBP nil

|

367,137

|

|

|

|

|

|

GBP 1.209775

|

173,334

|

|

|

|

|

|

|

|

|

|

d)

|

Aggregated

information: volume, Price

|

Aggregated volume of shares acquired: 367,137

Ordinary shares

Aggregated price of shares acquired: GBP nil

Aggregated volume of shares sold: 173,334 Ordinary

shares

Aggregated price of shares sold: GBP 209,695.14

|

|

e)

|

Date

of the transaction

|

2021-06-28

|

|

f)

|

Place

of the transaction

|

London

Stock Exchange (XLON)

|

|

1

|

Details

of the person discharging managerial responsibilities/person closely associated

|

|

a)

|

Name

|

Ahmed

Essam Aboushelbaya

|

|

2

|

Reason

for the notification

|

|

a)

|

Position/status

|

Vodafone

UK Chief Executive Officer

|

|

b)

|

Initial

notification/ Amendment

|

Initial

notification

|

|

3

|

Details

of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

Vodafone

Group Plc

|

|

b)

|

LEI

|

549300MSQV80HSATBG53

|

|

4

|

Details

of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each

date; and (iv) each place where transactions have been conducted

|

|

a)

|

Description

of the financial instrument, type of instrument and identification code

|

Ordinary

shares of US$0.20 20/21 each

in Vodafone Group Plc (ISIN: GB00BH4HKS39)

|

|

b)

|

Nature

of the transaction

|

Vesting

of conditional award of shares subject to performance conditions under the Global Incentive Plan.

Sale of shares to satisfy tax withholding

obligations.

|

|

c)

|

Price(s) and

volume(s)

|

|

|

|

|

|

|

|

|

Price(s)

|

Volume(s)

|

|

|

|

|

|

GBP nil

|

254,072

|

|

|

|

|

|

GBP 1.209775

|

119,953

|

|

|

|

|

|

|

|

|

|

d)

|

Aggregated

information: volume, Price

|

Aggregated volume of shares acquired: 254,072

Ordinary shares

Aggregated price of shares acquired: GBP nil

Aggregated volume of shares sold: 119,953 Ordinary

shares

Aggregated price of shares sold: GBP 145,116.14

|

|

e)

|

Date

of the transaction

|

2021-06-28

|

|

f)

|

Place

of the transaction

|

London

Stock Exchange (XLON)

|

|

1

|

Details

of the person discharging managerial responsibilities/person closely associated

|

|

a)

|

Name

|

Alexandre

Froment-Curtil

|

|

2

|

Reason

for the notification

|

|

a)

|

Position/status

|

Vodafone

Group Chief Commercial Officer

|

|

b)

|

Initial

notification/ Amendment

|

Initial

notification

|

|

3

|

Details

of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

Vodafone

Group Plc

|

|

b)

|

LEI

|

549300MSQV80HSATBG53

|

|

4

|

Details

of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each

date; and (iv) each place where transactions have been conducted

|

|

a)

|

Description

of the financial instrument, type of instrument and identification code

|

Ordinary

shares of US$0.20 20/21 each

in Vodafone Group Plc (ISIN: GB00BH4HKS39)

|

|

b)

|

Nature

of the transaction

|

Vesting of performance and retention shares

as part of the Global Long Term Incentive (GLTI) and Global Long Term Retention (GLTR) plans for Senior Leadership Team members.

Sale of shares to satisfy tax withholding

obligations.

|

|

c)

|

Price(s) and

volume(s)

|

|

|

|

|

|

|

|

|

Price(s)

|

Volume(s)

|

|

|

|

|

|

GBP nil

|

253,845

|

|

|

|

|

|

GBP 1.209775

|

119,846

|

|

|

|

|

|

|

|

|

|

d)

|

Aggregated

information: volume, Price

|

Aggregated volume of shares acquired: 253,845

Ordinary shares

Aggregated price of shares acquired: GBP nil

Aggregated volume of shares sold: 119,846 Ordinary

shares

Aggregated price of shares sold: GBP 144,986.69

|

|

e)

|

Date

of the transaction

|

2021-06-28

|

|

f)

|

Place

of the transaction

|

London

Stock Exchange (XLON)

|

|

1

|

Details

of the person discharging managerial responsibilities/person closely associated

|

|

a)

|

Name

|

Shameel

Joosub

|

|

2

|

Reason

for the notification

|

|

a)

|

Position/status

|

Vodacom

Group Chief Executive Officer

|

|

b)

|

Initial

notification/ Amendment

|

Initial

notification

|

|

3

|

Details

of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

Vodafone

Group Plc

|

|

b)

|

LEI

|

549300MSQV80HSATBG53

|

|

4

|

Details

of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each

date; and (iv) each place where transactions have been conducted

|

|

a)

|

Description

of the financial instrument, type of instrument and identification code

|

Ordinary

shares of US$0.20 20/21 each

in Vodafone Group Plc (ISIN: GB00BH4HKS39)

|

|

b)

|

Nature

of the transaction

|

Vesting

of conditional award of shares subject to performance conditions under the Global Incentive Plan.

|

|

c)

|

Price(s) and

volume(s)

|

|

|

|

|

|

|

|

|

Price(s)

|

Volume(s)

|

|

|

|

|

|

GBP nil

|

89,134

|

|

|

|

|

|

|

|

|

|

d)

|

Aggregated

information: volume, Price

|

Aggregated volume of shares acquired: 89,134

Ordinary shares

Aggregated price of shares acquired: GBP nil

|

|

e)

|

Date

of the transaction

|

2021-06-28

|

|

f)

|

Place

of the transaction

|

London

Stock Exchange (XLON)

|

|

1

|

Details

of the person discharging managerial responsibilities/person closely associated

|

|

a)

|

Name

|

Rosemary

Martin

|

|

2

|

Reason

for the notification

|

|

a)

|

Position/status

|

Vodafone

Group General Counsel and Company Secretary

|

|

b)

|

Initial

notification/ Amendment

|

Initial

notification

|

|

3

|

Details

of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

Vodafone

Group Plc

|

|

b)

|

LEI

|

549300MSQV80HSATBG53

|

|

4

|

Details

of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each

date; and (iv) each place where transactions have been conducted

|

|

a)

|

Description

of the financial instrument, type of instrument and identification code

|

Ordinary

shares of US$0.20 20/21 each

in Vodafone Group Plc (ISIN: GB00BH4HKS39)

|

|

b)

|

Nature

of the transaction

|

Vesting of conditional award of shares subject

to performance conditions under the Global Incentive Plan.

Sale of shares to satisfy tax withholding

obligations.

|

|

c)

|

Price(s) and

volume(s)

|

|

|

|

|

|

|

|

|

Price(s)

|

Volume(s)

|

|

|

|

|

|

GBP nil

|

297,380

|

|

|

|

|

|

GBP 1.209775

|

140,400

|

|

|

|

|

|

|

|

|

|

d)

|

Aggregated

information: volume, Price

|

Aggregated volume of shares acquired: 297,380

Ordinary shares

Aggregated price of shares acquired: GBP nil

Aggregated volume of shares sold: 140,400 Ordinary

shares

Aggregated price of shares sold: GBP 169,852.41

|

|

e)

|

Date

of the transaction

|

2021-06-28

|

|

f)

|

Place

of the transaction

|

London

Stock Exchange (XLON)

|

|

1

|

Details

of the person discharging managerial responsibilities/person closely associated

|

|

a)

|

Name

|

Joakim

Reiter

|

|

2

|

Reason

for the notification

|

|

a)

|

Position/status

|

Vodafone

Group External and Corporate Affairs Officer

|

|

b)

|

Initial

notification/ Amendment

|

Initial

notification

|

|

3

|

Details

of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

Vodafone

Group Plc

|

|

b)

|

LEI

|

549300MSQV80HSATBG53

|

|

4

|

Details

of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each

date; and (iv) each place where transactions have been conducted

|

|

a)

|

Description

of the financial instrument, type of instrument and identification code

|

Ordinary

shares of US$0.20 20/21 each

in Vodafone Group Plc (ISIN: GB00BH4HKS39)

|

|

b)

|

Nature

of the transaction

|

Vesting of conditional award of shares subject

to performance conditions under the Global Incentive Plan.

Sale of shares to satisfy tax withholding

obligations.

|

|

c)

|

Price(s) and

volume(s)

|

|

|

|

|

|

|

|

|

Price(s)

|

Volume(s)

|

|

|

|

|

|

GBP nil

|

195,567

|

|

|

|

|

|

GBP 1.209775

|

92,332

|

|

|

|

|

|

|

|

|

|

d)

|

Aggregated

information: volume, Price

|

Aggregated volume of shares acquired: 195,567

Ordinary shares

Aggregated price of shares acquired: GBP nil

Aggregated volume of shares sold: 92,332 Ordinary

shares

Aggregated price of shares sold: GBP 111,700.95

|

|

e)

|

Date

of the transaction

|

2021-06-28

|

|

f)

|

Place

of the transaction

|

London

Stock Exchange (XLON)

|

|

1

|

Details

of the person discharging managerial responsibilities/person closely associated

|

|

a)

|

Name

|

Serpil

Timuray

|

|

2

|

Reason

for the notification

|

|

a)

|

Position/status

|

Vodafone

Chief Executive Officer Europe Cluster

|

|

b)

|

Initial

notification/ Amendment

|

Initial

notification

|

|

3

|

Details

of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

Vodafone

Group Plc

|

|

b)

|

LEI

|

549300MSQV80HSATBG53

|

|

4

|

Details

of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each

date; and (iv) each place where transactions have been conducted

|

|

a)

|

Description

of the financial instrument, type of instrument and identification code

|

Ordinary

shares of US$0.20 20/21 each

in Vodafone Group Plc (ISIN: GB00BH4HKS39)

|

|

b)

|

Nature

of the transaction

|

Vesting of conditional award of shares subject

to performance conditions under the Global Incentive Plan.

Sale of shares to satisfy tax withholding

obligations.

|

|

c)

|

Price(s) and

volume(s)

|

|

|

|

|

|

|

|

|

Price(s)

|

Volume(s)

|

|

|

|

|

|

GBP nil

|

317,590

|

|

|

|

|

|

GBP 1.209775

|

79,160

|

|

|

|

|

|

|

|

|

|

d)

|

Aggregated

information: volume, Price

|

Aggregated volume of shares acquired: 317,590

Ordinary shares

Aggregated price of shares acquired: GBP nil

Aggregated volume of shares sold: 79,160 Ordinary

shares

Aggregated price of shares sold: GBP 95,765.79

|

|

e)

|

Date

of the transaction

|

2021-06-28

|

|

f)

|

Place

of the transaction

|

London

Stock Exchange (XLON)

|

|

1

|

Details

of the person discharging managerial responsibilities/person closely associated

|

|

a)

|

Name

|

Johan

Wibergh

|

|

2

|

Reason

for the notification

|

|

a)

|

Position/status

|

Vodafone

Group Technology Officer

|

|

b)

|

Initial

notification/ Amendment

|

Initial

notification

|

|

3

|

Details

of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

Vodafone

Group Plc

|

|

b)

|

LEI

|

549300MSQV80HSATBG53

|

|

4

|

Details

of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each

date; and (iv) each place where transactions have been conducted

|

|

a)

|

Description

of the financial instrument, type of instrument and identification code

|

Ordinary

shares of US$0.20 20/21 each

in Vodafone Group Plc (ISIN: GB00BH4HKS39)

|

|

b)

|

Nature

of the transaction

|

Vesting of conditional award of shares subject

to performance conditions under the Global Incentive Plan.

Sale of shares to satisfy tax withholding

obligations.

|

|

c)

|

Price(s) and

volume(s)

|

|

|

|

|

|

|

|

|

Price(s)

|

Volume(s)

|

|

|

|

|

|

GBP nil

|

294,493

|

|

|

|

|

|

GBP 1.209775

|

139,037

|

|

|

|

|

|

|

|

|

|

d)

|

Aggregated

information: volume, Price

|

Aggregated volume of shares acquired: 294,493

Ordinary shares

Aggregated price of shares acquired: GBP nil

Aggregated volume of shares sold: 139,037 Ordinary

shares

Aggregated price of shares sold: GBP 168,203.49

|

|

e)

|

Date

of the transaction

|

2021-06-28

|

|

f)

|

Place

of the transaction

|

London

Stock Exchange (XLON)

|

|

1

|

Details

of the person discharging managerial responsibilities/person closely associated

|

|

a)

|

Name

|

Leanne

Wood

|

|

2

|

Reason

for the notification

|

|

a)

|

Position/status

|

Vodafone

Group Chief Human Resources Officer

|

|

b)

|

Initial

notification/ Amendment

|

Initial

notification

|

|

3

|

Details

of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

Vodafone

Group Plc

|

|

b)

|

LEI

|

549300MSQV80HSATBG53

|

|

4

|

Details

of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each

date; and (iv) each place where transactions have been conducted

|

|

a)

|

Description

of the financial instrument, type of instrument and identification code

|

Ordinary

shares of US$0.20 20/21 each

in Vodafone Group Plc (ISIN: GB00BH4HKS39)

|

|

b)

|

Nature

of the transaction

|

Vesting of conditional award of shares subject

to performance conditions under the Global Incentive Plan.

Sale of shares to satisfy tax withholding

obligations.

|

|

c)

|

Price(s) and

volume(s)

|

|

|

|

|

|

|

|

|

Price(s)

|

Volume(s)

|

|

|

|

|

|

GBP nil

|

470,813

|

|

|

|

|

|

GBP 1.209775

|

222,281

|

|

|

|

|

|

|

|

|

|

d)

|

Aggregated

information: volume, Price

|

Aggregated volume of shares acquired: 470,813

Ordinary shares

Aggregated price of shares acquired: GBP nil

Aggregated volume of shares sold: 222,281 Ordinary

shares

Aggregated price of shares sold: GBP 268,910.00

|

|

e)

|

Date

of the transaction

|

2021-06-28

|

|

f)

|

Place

of the transaction

|

London

Stock Exchange (XLON)

|

Acquisition of shares

The below individuals acquired shares under the Vodafone

Global Incentive Plan. The conditional share award was granted on 26 June 2019 by the Company and vesting of the award was conditional

on continued employment with the Vodafone Group.

|

1

|

Details

of the person discharging managerial responsibilities/person closely associated

|

|

a)

|

Name

|

Rosemary

Martin

|

|

2

|

Reason

for the notification

|

|

a)

|

Position/status

|

Vodafone

Group General Counsel and Company Secretary

|

|

b)

|

Initial

notification/ Amendment

|

Initial

notification

|

|

3

|

Details

of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

Vodafone

Group Plc

|

|

b)

|

LEI

|

549300MSQV80HSATBG53

|

|

4

|

Details

of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each

date; and (iv) each place where transactions have been conducted

|

|

a)

|

Description

of the financial instrument, type of instrument and identification code

|

Ordinary

shares of US$0.20 20/21 each

in Vodafone Group Plc (ISIN: GB00BH4HKS39)

|

|

b)

|

Nature

of the transaction

|

Vesting of retention shares under the Global

Long Term Retention (GLTR) plan.

Sale of shares to satisfy tax withholding

obligations.

|

|

c)

|

Price(s) and

volume(s)

|

|

|

|

|

|

|

|

|

Price(s)

|

Volume(s)

|

|

|

|

|

|

GBP nil

|

236,505

|

|

|

|

|

|

GBP 1.209775

|

111,659

|

|

|

|

|

|

|

|

|

|

d)

|

Aggregated

information: volume, Price

|

Aggregated volume of shares acquired: 236,505

Ordinary shares

Aggregated price of shares acquired: GBP nil

Aggregated volume of shares sold: 111,659 Ordinary

shares

Aggregated price of shares sold: GBP 135,082.27

|

|

e)

|

Date

of the transaction

|

2021-06-28

|

|

f)

|

Place

of the transaction

|

London

Stock Exchange (XLON)

|

|

1

|

Details

of the person discharging managerial responsibilities/person closely associated

|

|

a)

|

Name

|

Joakim

Reiter

|

|

2

|

Reason

for the notification

|

|

a)

|

Position/status

|

Vodafone Group External and Corporate Affairs Officer

|

|

b)

|

Initial

notification/ Amendment

|

Initial

notification

|

|

3

|

Details

of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

Vodafone

Group Plc

|

|

b)

|

LEI

|

549300MSQV80HSATBG53

|

|

4

|

Details

of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each

date; and (iv) each place where transactions have been conducted

|

|

a)

|

Description

of the financial instrument, type of instrument and identification code

|

Ordinary

shares of US$0.20 20/21 each

in Vodafone Group Plc (ISIN: GB00BH4HKS39)

|

|

b)

|

Nature

of the transaction

|

Vesting of retention shares under the Global Long Term Retention (GLTR) plan.

Sale

of shares to satisfy tax withholding obligations.

|

|

c)

|

Price(s) and

volume(s)

|

|

|

|

|

|

|

|

|

Price(s)

|

Volume(s)

|

|

|

|

|

|

GBP nil

|

172,310

|

|

|

|

|

|

GBP 1.209775

|

81,352

|

|

|

|

|

|

|

|

|

|

d)

|

Aggregated

information: volume, Price

|

Aggregated

volume of shares acquired: 172,310 Ordinary shares

Aggregated price of shares acquired: GBP nil

Aggregated

volume of shares sold: 81,352 Ordinary shares

Aggregated

price of shares sold: GBP 98,417.62

|

|

e)

|

Date

of the transaction

|

2021-06-28

|

|

f)

|

Place

of the transaction

|

London

Stock Exchange (XLON)

|

Purchase

of shares

The

below individuals purchased shares on 28 June 2021. The individuals increased their shareholding levels as part of their requirements

under the Vodafone Global Incentive Plan and/or annual bonus deferral arrangements. For further details of the Vodafone Global

Incentive Plan, please see the Company's 2021 Annual Report, available at www.vodafone.com/ar2021.

|

1

|

Details

of the person discharging managerial responsibilities/person closely associated

|

|

a)

|

Name

|

Margherita

Della Valle

|

|

2

|

Reason

for the notification

|

|

a)

|

Position/status

|

Vodafone Group Chief Financial Officer

|

|

b)

|

Initial

notification/ Amendment

|

Initial

notification

|

|

3

|

Details

of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

Vodafone

Group Plc

|

|

b)

|

LEI

|

549300MSQV80HSATBG53

|

|

4

|

Details

of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each

date; and (iv) each place where transactions have been conducted

|

|

a)

|

Description

of the financial instrument, type of instrument and identification code

|

Ordinary

shares of US$0.20 20/21 each

in Vodafone Group Plc (ISIN: GB00BH4HKS39)

|

|

b)

|

Nature

of the transaction

|

Purchase of shares in connection with the Vodafone annual bonus deferral

arrangements.

|

|

c)

|

Price(s) and

volume(s)

|

|

|

|

|

|

|

|

|

Price(s)

|

Volume(s)

|

|

|

|

|

|

GBP 1.216200

|

93,831

|

|

|

|

|

|

|

|

|

|

d)

|

Aggregated

information: volume, Price

|

Aggregated

volume: 93,831 Ordinary shares

Aggregated

price: GBP 114,117.26

|

|

e)

|

Date

of the transaction

|

2021-06-28

|

|

f)

|

Place

of the transaction

|

London

Stock Exchange (XLON)

|

|

1

|

Details

of the person discharging managerial responsibilities/person closely associated

|

|

a)

|

Name

|

Ahmed

Essam Aboushelbaya

|

|

2

|

Reason

for the notification

|

|

a)

|

Position/status

|

Vodafone

UK Chief Executive Officer

|

|

b)

|

Initial

notification/ Amendment

|

Initial

notification

|

|

3

|

Details

of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

Vodafone

Group Plc

|

|

b)

|

LEI

|

549300MSQV80HSATBG53

|

|

4

|

Details

of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each

date; and (iv) each place where transactions have been conducted

|

|

a)

|

Description

of the financial instrument, type of instrument and identification code

|

Ordinary

shares of US$0.20 20/21 each

in Vodafone Group Plc (ISIN: GB00BH4HKS39)

|

|

b)

|

Nature

of the transaction

|

Purchase of shares in connection with the Vodafone annual bonus deferral arrangements and the Vodafone Global Incentive Plan.

|

|

c)

|

Price(s) and

volume(s)

|

|

|

|

|

|

|

|

|

Price(s)

|

Volume(s)

|

|

|

|

|

|

GBP 1.216200

|

80,684

|

|

|

|

|

|

|

|

|

|

d)

|

Aggregated

information: volume, Price

|

Aggregated

volume: 80,684 Ordinary shares

Aggregated

price: GBP 98,127.88

|

|

e)

|

Date

of the transaction

|

2021-06-28

|

|

f)

|

Place

of the transaction

|

London

Stock Exchange (XLON)

|

|

1

|

Details

of the person discharging managerial responsibilities/person closely associated

|

|

a)

|

Name

|

Alexandre Froment-Curtil

|

|

2

|

Reason

for the notification

|

|

a)

|

Position/status

|

Vodafone Group Chief Commercial Officer

|

|

b)

|

Initial

notification/ Amendment

|

Initial

notification

|

|

3

|

Details

of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

Vodafone

Group Plc

|

|

b)

|

LEI

|

549300MSQV80HSATBG53

|

|

4

|

Details

of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each

date; and (iv) each place where transactions have been conducted

|

|

a)

|

Description

of the financial instrument, type of instrument and identification code

|

Ordinary

shares of US$0.20 20/21 each

in Vodafone Group Plc (ISIN: GB00BH4HKS39)

|

|

b)

|

Nature

of the transaction

|

Purchase of shares in connection with the Vodafone annual bonus deferral

arrangements.

|

|

c)

|

Price(s) and

volume(s)

|

|

|

|

|

|

|

|

|

Price(s)

|

Volume(s)

|

|

|

|

|

|

GBP 1.216200

|

51,020

|

|

|

|

|

|

|

|

|

|

d)

|

Aggregated

information: volume, Price

|

Aggregated volume: 51,020 Ordinary shares

Aggregated price: GBP 62,050.52

|

|

e)

|

Date

of the transaction

|

2021-06-28

|

|

f)

|

Place

of the transaction

|

London

Stock Exchange (XLON)

|

|

1

|

Details

of the person discharging managerial responsibilities/person closely associated

|

|

a)

|

Name

|

Vinod

Kumar

|

|

2

|

Reason

for the notification

|

|

a)

|

Position/status

|

Vodafone Business Chief Executive Officer

|

|

b)

|

Initial

notification/ Amendment

|

Initial

notification

|

|

3

|

Details

of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

Vodafone

Group Plc

|

|

b)

|

LEI

|

549300MSQV80HSATBG53

|

|

4

|

Details

of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each

date; and (iv) each place where transactions have been conducted

|

|

a)

|

Description

of the financial instrument, type of instrument and identification code

|

Ordinary

shares of US$0.20 20/21 each

in Vodafone Group Plc (ISIN: GB00BH4HKS39)

|

|

b)

|

Nature

of the transaction

|

Purchase of shares in connection with the Vodafone

annual bonus deferral arrangements.

|

|

c)

|

Price(s) and

volume(s)

|

|

|

|

|

|

|

|

|

Price(s)

|

Volume(s)

|

|

|

|

|

|

GBP 1.216200

|

72,247

|

|

|

|

|

|

|

|

|

|

d)

|

Aggregated

information: volume, Price

|

Aggregated

volume: 72,247 Ordinary shares

Aggregated

price: GBP 87,866.80

|

|

e)

|

Date

of the transaction

|

2021-06-28

|

|

f)

|

Place

of the transaction

|

London

Stock Exchange (XLON)

|

|

1

|

Details

of the person discharging managerial responsibilities/person closely associated

|

|

a)

|

Name

|

Joakim

Reiter

|

|

2

|

Reason

for the notification

|

|

a)

|

Position/status

|

Vodafone Group External and Corporate Affairs Officer

|

|

b)

|

Initial

notification/ Amendment

|

Initial

notification

|

|

3

|

Details

of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

Vodafone

Group Plc

|

|

b)

|

LEI

|

549300MSQV80HSATBG53

|

|

4

|

Details

of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each

date; and (iv) each place where transactions have been conducted

|

|

a)

|

Description

of the financial instrument, type of instrument and identification code

|

Ordinary

shares of US$0.20 20/21 each

in Vodafone Group Plc (ISIN: GB00BH4HKS39)

|

|

b)

|

Nature

of the transaction

|

Purchase of shares in connection with the Vodafone annual bonus deferral

arrangements and the Vodafone Global Incentive Plan.

|

|

c)

|

Price(s) and

volume(s)

|

|

|

|

|

|

|

|

|

Price(s)

|

Volume(s)

|

|

|

|

|

|

GBP 1.216200

|

113,474

|

|

|

|

|

|

|

|

|

|

d)

|

Aggregated

information: volume, Price

|

Aggregated

volume: 113,474 Ordinary shares

Aggregated

price: GBP 138,007.08

|

|

e)

|

Date

of the transaction

|

2021-06-28

|

|

f)

|

Place

of the transaction

|

London

Stock Exchange (XLON)

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorised.

|

|

|

VODAFONE

GROUP

|

|

|

|

PUBLIC

LIMITED COMPANY

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

|

|

Dated:

July 1, 2021

|

|

By:

|

/s/ R E S MARTIN

|

|

|

|

|

Name: Rosemary E S Martin

|

|

|

|

|

Title: Group General Counsel and Company Secretary

|

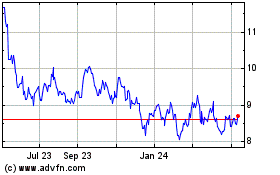

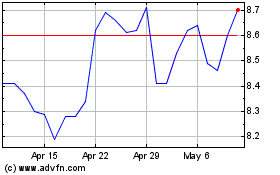

Vodafone (NASDAQ:VOD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Vodafone (NASDAQ:VOD)

Historical Stock Chart

From Apr 2023 to Apr 2024