FLOTEK INDUSTRIES, INC. 401(k) PLAN

|

|

|

|

|

|

|

|

|

|

|

|

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

ii/iii

|

|

|

|

|

|

Financial Statements and Supplemental Schedule:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental Schedule*:

|

|

|

|

|

|

|

|

Form 5500 Schedule H, Part IV, Line 4(i)--Schedule of Assets (Held at End of Year) as of December 31, 2020

|

8

|

|

|

|

|

|

Exhibit Index:

|

9

|

|

|

|

|

|

|

Exhibit 23.1 – Consent of Ham, Langston & Brezina, LLP

|

|

|

|

|

|

|

|

Exhibit 23.2 – Consent of Dixon Hughes Goodman LLP

|

|

|

|

|

|

|

|

10

|

|

|

|

|

|

*

|

All other schedules required by 29 CFR 2520.103-10 of the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974 are omitted as the schedules are not applicable or required.

|

Report of Independent Registered Public Accounting Firm

To the Plan Administrator and Participants of

Flotek Industries, Inc. 401(k) Plan

Opinion on the Financial Statements

We have audited the accompanying statement of net assets available for benefits of the Flotek Industries, Inc. 401(k) Plan (the “Plan”) as of December 31, 2020, the related statement of changes in net assets available for benefits for the year ended December 31, 2020, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2020, and the changes in net assets available for benefits for the year ended December 31, 2020 in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on the Plan’s financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Plan is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audit we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Plan’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audit included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures to respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audit provides a reasonable basis for our opinion.

Opinion on the Supplemental Schedule

The supplemental schedule included in Schedule H, line 4(i) - Schedule of Assets (Held at End of Year) as of December 31, 2020 has been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental schedule is the responsibility of the Plan's management. Our audit procedures included determining whether the supplemental schedule reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental schedule. In forming our opinion on the supplemental information in the accompanying schedule, we evaluated whether the supplemental schedule, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental information in the accompanying schedule is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ Dixon Hughes Goodman LLP

We have served as the Plan’s auditor since 2021.

Asheville, North Carolina

June 29, 2021

Report of Independent Registered Public Accounting Firm

To the Plan Administrator and Participants of

Flotek Industries, Inc. 401(k) Plan

Opinion on the Financial Statements

We have audited the accompanying statement of net assets available for benefits of the Flotek Industries, Inc. 401(k) Plan (the “Plan”) as of December 31, 2019 and the related notes. In our opinion, the financial statement presents fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2019, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on the Plan’s financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Plan is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audit we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Plan’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audit included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures to respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audit provides a reasonable basis for our opinion.

/s/ Ham, Langston & Brezina, LLP

Houston, Texas

August 13, 2020

We served as the Plan’s auditor from 2020 to 2021.

FLOTEK INDUSTRIES, INC. 401(k) PLAN

STATEMENTS OF NET ASSETS AVAILABLE FOR BENEFITS

DECEMBER 31, 2020 AND 2019

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31,

|

|

|

2020

|

|

2019

|

|

Investments, at fair value:

|

|

|

|

|

Money market

|

$

|

706

|

|

|

$

|

11

|

|

|

Common/collective trust fund

|

1,234,110

|

|

|

989,786

|

|

|

|

|

|

|

|

Mutual funds

|

15,349,774

|

|

|

13,971,550

|

|

|

Total investments, at fair value

|

16,584,590

|

|

|

14,961,347

|

|

|

Notes receivable from participants

|

214,999

|

|

|

249,520

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net assets available for benefits

|

$

|

16,799,589

|

|

|

$

|

15,210,867

|

|

See accompanying Notes to Financial Statements.

1

FLOTEK INDUSTRIES, INC. 401(k) PLAN

STATEMENT OF CHANGES IN NET ASSETS AVAILABLE FOR BENEFITS

YEAR ENDED DECEMBER 31, 2020

|

|

|

|

|

|

|

|

Additions to net assets attributed to:

|

|

|

Investment income:

|

|

|

|

|

|

Dividends

|

$

|

385,155

|

|

|

Net appreciation in fair value of investments

|

1,742,926

|

|

|

Total investment income

|

2,128,081

|

|

|

|

|

|

Contributions:

|

|

|

Employer matching contributions

|

167,812

|

|

|

Participant contributions

|

1,117,024

|

|

|

Rollovers

|

638,479

|

|

|

Total contributions

|

1,923,315

|

|

|

|

|

|

Interest income on notes receivable from participants

|

15,891

|

|

|

Total additions to net assets

|

4,067,287

|

|

|

|

|

|

Deductions from net assets attributed to:

|

|

|

Benefits paid to participants

|

(3,674,401)

|

|

|

|

|

|

Administrative fees

|

(19,696)

|

|

|

|

|

|

Total deductions from net assets

|

(3,694,097)

|

|

|

|

|

|

Net increase in net assets

|

373,190

|

|

|

Assets transferred to Fidelity

|

1,215,532

|

|

|

Net assets available for benefits, beginning of year

|

15,210,867

|

|

|

Net assets available for benefits, end of year

|

$

|

16,799,589

|

|

See accompanying Notes to Financial Statements.

2

FLOTEK INDUSTRIES, INC. 401(k) PLAN

NOTES TO FINANCIAL STATEMENTS

Note 1 — Description of the Plan

The following description of Flotek Industries, Inc. 401(k) Plan (the “Plan”) is provided for general informational purposes only. Plan participants (“Participants”) should refer to the Plan document for a complete description of Plan provisions.

General

Effective June 1, 2002, Flotek Industries, Inc. (the “Company”) established a defined 401(k) contribution plan with voluntary employee participation available on the first day of employment and attainment of 18 years of age. The Plan does not meet the requirements of a safe harbor 401(k) plan.

The Board of Directors and the Company coordinate and manage the administration of the Plan. On March 14, 2011, the Company’s Board of Directors approved the formation of the Investment Committee of the Flotek Industries, Inc. 401(k) Plan (the “Investment Committee”). The role of the Investment Committee is to oversee the investment management, policies, and guidelines of the Plan. The Investment Committee’s responsibilities include the review of the Plan’s investment manager selection, investment benchmarks, investment performance, and investment risk management policies. The Investment Committee monitors the management of the Plan for compliance with the investment policies and guidelines and for meeting investment performance objectives over time.

During the second quarter of 2020, the Company acquired 100% ownership of JP3 Measurement, LLC (“JP3”), a privately-held data and analytics technology company, in a cash-and-stock transaction. Effective December 1, 2020, the JP3 Measurement LLC 401(k) Plan merged into the Flotek Industries, Inc. 401(k) Plan.

Plan Trustee

Effective October 1, 2012 through June 30, 2019, the Company engaged Merrill Lynch as the Trustee and starting July 1, 2019 engaged Fidelity Investments as the Trustee (collectively the “Trustee”), and investment custodian of the Plan for the dates, respectively. Concurrently, the Company appointed Fidelity Investments 401(k) Plan Recordkeeping and Trust Services as the Plan’s recordkeeper. The Trustee holds all property received and invests and reinvests Plan assets pursuant to Participant investment selections and Plan documents.

Contributions

Participants have the option to elect to contribute from 1% to 100% (in increments of 1%) of qualified compensation. Qualified compensation is defined within the Plan document and is subject to restrictions of the Internal Revenue Code of 1986, as amended (“IRC”). Participant contributions are withheld on a pro rata basis from each payroll as either pre-tax or Roth contributions. Eligible employees are automatically enrolled in 4% withholding of the Participant’s qualified compensation if they do not elect a withholding percentage within 30 days of their hire or qualifying date. The Participant may modify his or her election or opt out of the Plan at any time.

With the IRC, Participant contributions were limited to $19,500 during 2020. Participants 50 years of age or older prior to December 31, 2020 were eligible to make catch-up contributions of up to $26,000 during 2020.

In March 2020, amid the ongoing volatility due to the oil and gas market disruption and COVID-19 pandemic, the Company temporarily suspended matching contributions to the Plan. The intent is to reinstate this benefit in the future.

Vesting

Both Company matching and Company profit sharing contributions are fully vested upon contribution. Participant contributions are always fully vested upon contribution.

Contribution and Investment Elections

Salary contribution percentages are determined by the Participant, except where the Plan’s automatic contribution percentage applies. The investment of a Participant’s account is Participant directed, except where the Participant does not elect timely his or her withholding contributions following a qualifying event, in which case the Participant is automatically enrolled in 4% withholding of his or her compensation. Contribution percentage elections, investment allocations, and modifications to either, may be made by the Participant at any time by contacting Fidelity or via the internet, with such selections or modifications becoming effective within a reasonable period of time thereafter. Participants may discontinue participation in the Plan and may later re-enroll in the Plan.

FLOTEK INDUSTRIES, INC. 401(k) PLAN

NOTES TO FINANCIAL STATEMENTS

Notes Receivable from Participants

A Participant may borrow up to 50 percent of his or her account balance, ranging from a minimum of $500 to a maximum of $50,000. A Participant may have only one loan outstanding at any one time. A loan is required to be repaid through payroll deductions over a period not to exceed five years, with the exception of loans for the purchase of a primary residence which may be repaid over a period of up to 30 years. Early payoff of Participant loans is permitted by the Plan. The loan interest rate applied to Participant loans is fixed on the date the loan is requested at the prime rate published in the Wall Street Journal on the last business day of the previous month plus 2%. Participant loans are limited to Participants who are active employees. At December 31, 2020, interest rates on participant loans ranged from 5.25% to 7.50%.

Notes receivable from Participants are measured at the Participant’s unpaid principal balance plus any accrued but unpaid interest. Delinquent loans are treated as Plan distributions in accordance with the terms of the Plan document. No allowance for credit losses has been recorded as of December 31, 2020 or 2019.

Form of Benefits

A Participant may withdraw the total amount in his or her account upon either (i) termination of employment, (ii) reaching age 59½, (iii) disability, or (iv) death. The full value of the Participant’s account may be distributed to the Participant upon retirement or permanent disability, if elected by the Participant, and is subject to income taxation upon distribution. If death occurs before termination of employment, the Participant’s account is fully distributed to his or her designated beneficiary(ies). If the value of the Participant’s account is less than or equal to $5,000, the beneficiary(ies) will receive a lump sum payment of the entire account balance within a reasonable time after the Participant’s death regardless of whether the beneficiary(ies) elect distribution of the benefit. If the value of the Participant’s account is greater than $5,000, the beneficiary(ies) may elect distributions from the account in a lump sum payment or installment payments and such distributions may generally begin when elected by the beneficiary(ies).

Participants may elect to have benefits distributed as soon as administratively feasible following the termination of employment. If the value of the Participant’s benefit is less than or equal to $5,000, however, a lump-sum distribution will be made within a reasonable time after the Participant terminates employment regardless of whether the Participant elects distribution of the benefit.

Forfeitures

Forfeitures are first applied to reduce administrative costs of the Plan. Forfeitures are then used to reduce employer contributions. Any remaining forfeitures are then allocated to Participants. Forfeitures for the year ended December 31, 2020 were not material.

Rollover Contributions

Generally, when a Participant receives a qualified total distribution from another qualified plan as defined in the IRC, the Participant is permitted to rollover those funds into the Plan.

Participant Accounts

Each Participant account is credited with the Participant’s contributions, Company matching, and Company profit sharing contributions, if any, and charged with benefit payments and fees related to notes receivable from participants and distributions and allocations of administrative expenses.

COVID-19 Impact

In March 2020, the World Health Organization declared the outbreak of COVID-19, a global pandemic that spread throughout

the U.S. and the world. In late 2020, major pharmaceutical companies developed vaccines and received approval for wide-scale

distribution in the U.S. and other countries.

There is significant uncertainty in the nature and degree of its continued effects on the Plan. The extent to which it will impact the Plan going forward will depend on a variety of factors including the duration and continued spread of the outbreak, impact on the Company’s customers, employees and vendors, as well as governmental, regulatory and private sector responses.

On March 27, 2020, the Coronavirus Aid, Relief, and Economic Security ("CARES") Act was passed by Congress. The CARES Act, among other things, includes several relief provisions available to tax qualified retirement plans and their participants. Plan management evaluated the impact of the CARES Act on the Plan and adopted several of the provisions

FLOTEK INDUSTRIES, INC. 401(k) PLAN

NOTES TO FINANCIAL STATEMENTS

regarding the expansion of allowed Plan distributions, the repayment of loans and the suspension of required minimum distributions.

Note 2 — Summary of Significant Accounting Policies

Basis of Presentation

The accompanying financial statements have been prepared on the accrual basis of accounting in conformity with accounting principles generally accepted in the United States of America (“U.S.GAAP”).

Administrative Expenses

Administrative expenses consist of all expenses incidental to the administration, termination, or protection of the Plan, including, but not limited to, legal, accounting, investment manager, and trustee fees.

Certain administrative fees are incurred by Participants such as loan management fees, guided investment fund advice, and account liquidation fees as a result of early distribution penalties or due to unqualified account withdrawals or distributions. Effective August 2019, all other administrative fees to active participants changed from 100% paid by the Plan Sponsor, the Company, to 50% paid by the Company and 50% by the participant.

Risks and Uncertainties

The Plan provides for various investment options offered by the Trustee. Investment securities are exposed to various risks, such as market and credit risk. Due to the level of risk associated with certain investment securities, it is likely that changes in the values of investment securities will occur in the near term and such changes could materially affect the amounts reported in the statements of net assets available for benefits.

Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of net assets available for benefits at the date of the financial statements and the reported amounts of changes in net assets available for benefits during the reporting period. Actual results could differ from those estimates.

Payment of Benefits

Benefits are recorded when paid.

Valuation of Investments

The fair value of assets is determined using various methods, which are impacted by a number of factors, including the availability of observable market data over the contractual term of the underlying assets. For some of the Plan’s assets, fair value is determined based on directly observable market data or data available for similar assets in similar markets. For other assets, the fair value may be determined based on these inputs as well as other assumptions related to estimates of these assets, such as the creditworthiness of the issuer. Changes in net unrealized appreciation or depreciation are captured in the carrying value of the underlying investments in the statements of net assets available for benefits. Dividends are recorded on the ex-dividend date.

Plan investments in mutual funds are stated at fair value based upon quoted market prices. Investments in the Company’s common stock fund are reported at fair value based upon the quoted market price of the shares held in the fund. Shares of common/collective trust funds are valued at net asset value, as determined by the Plan’s Trustee.

Subsequent Events

The Plan has evaluated subsequent events through June 29, 2021, the date the financial statements were available to be issued.

Note 3 — Fair Value of Investments

Fair value is defined as the price that would be received from the sale of an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. Inputs utilized in determining fair value are based on a three level valuation hierarchy that prioritizes these inputs based on the degree to which they are observable. Following is a description of the three input levels of the fair value hierarchy:

FLOTEK INDUSTRIES, INC. 401(k) PLAN

NOTES TO FINANCIAL STATEMENTS

•Level 1 — unadjusted, quoted prices for identical assets or liabilities in active markets;

•Level 2 — quoted prices for similar assets and liabilities in active markets, quoted prices for identical or similar assets or liabilities in markets that are not active, and inputs other than quoted market prices that are observable or that can be corroborated by observable market data;

•Level 3 — unobservable inputs based upon the reporting entity’s internally developed assumptions that market participants would use in pricing the asset or liability.

Assets and liabilities are classified in their entirety based on the lowest level of input that is significant to the fair value measurement. The Plan’s assessment of the significance of a particular input to the fair value measurement requires judgment, and may affect the valuation of fair value assets and liabilities and their placement within the fair value hierarchy levels.

There have been no changes in the methodologies used at December 31, 2020 and 2019.The following is a description of the valuation methodologies used for assets measured at fair value:

Mutual Funds and Common Stock Fund

Plan investments include mutual funds and the Company’s own stock. The Company determined that valuation measurement inputs of these equity securities required no adjustment from quoted prices in the market. As such, the Plan’s investment in mutual funds and the Company’s own stock reflect unadjusted quoted prices from active markets. Accordingly, the Company classified these Plan investments within Level 1 of the fair value hierarchy.

Common/Collective Trust Fund

The Plan has investments in a common/collective trust funds composed of investment contracts that are valued at the net asset value of units of the bank collective trust. The net asset value is used as a practical expedient to estimate fair value. This practical expedient would not be used if it is determined to be probable that the fund will sell the investment for an amount different from the reported net asset value. Participant transactions (purchases and sales) may occur daily. If the Plan initiates a full redemption of the common/collective trust, the issuer reserves the right to require 12 months’ notification in order to ensure that securities liquidations will be carried out in an orderly business manner.

The fair values of the Plan’s investments by asset class and input level within the fair value hierarchy are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

At December 31, 2020

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Total

|

|

|

|

|

|

|

|

|

|

|

Money market

|

$

|

706

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

706

|

|

|

Mutual funds

|

15,349,774

|

|

|

—

|

|

|

—

|

|

|

15,349,774

|

|

|

Total assets in the fair value hierarchy

|

$

|

15,350,480

|

|

|

—

|

|

|

—

|

|

|

$

|

15,350,480

|

|

|

Common/collective trust fund *

|

|

|

|

|

|

|

1,234,110

|

|

|

Total investments, at fair value

|

|

|

|

|

|

|

$

|

16,584,590

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

At December 31, 2019

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Total

|

|

Money market

|

$

|

11

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

11

|

|

|

|

|

|

|

|

|

|

|

|

Mutual funds

|

13,971,550

|

|

|

—

|

|

|

—

|

|

|

13,971,550

|

|

|

Total assets in the fair value hierarchy

|

$

|

13,971,561

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

13,971,561

|

|

|

Common/collective trust fund *

|

|

|

|

|

|

|

989,786

|

|

|

Total investments, at fair value

|

|

|

|

|

|

|

$

|

14,961,347

|

|

* In accordance with Subtopic 820-10, the common/collective trust funds were measured at net asset value per share and have not been classified in the fair value hierarchy. The fair value amounts presented in this table are intended to permit reconciliation of the fair value hierarchy to the line items presented in the statement of net assets available for benefits.

The following table summarizes investments for which fair value is measured using the net asset value per share practical expedient as of December 31, 2020 and 2019. There are no participant redemption restrictions for those investment; the redemption period is applicable only to the Plan.

FLOTEK INDUSTRIES, INC. 401(k) PLAN

NOTES TO FINANCIAL STATEMENTS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fair Value December 31, 2020

|

|

Fair Value December 31, 2019

|

|

Unfunded Committments

|

|

Redemption Frequency

|

|

Redemption Notice Period

|

|

Common collective trust funds

|

$

|

1,234,110

|

|

|

$

|

989,786

|

|

|

None

|

|

Daily

|

|

13 months or less

|

The Plan recognizes transfers between the levels as of the actual date of the event or change in circumstances that caused the transfer. There were no gross transfers between the levels for the year ended December 31, 2020.

Note 4 — Plan Termination

Although it has not expressed any intent to do so, the Company has the right under the Plan to discontinue its contributions at any time and to terminate the Plan subject to the provisions of ERISA. In the event of plan termination, participants would become 100 percent vested in their accounts.

Note 5 — Federal Income Tax Exemption

The Plan uses a Fidelity Investments prototype 401(k) plan document which received a favorable opinion letter dated October 31, 2014, from the Internal Revenue Service (“IRS”). The Plan has been amended since the most recent opinion letter; however, the Company believes that both the Plan design and operation remain compliant with applicable requirements of the IRC.

U.S. GAAP requires Plan management to evaluate Plan tax positions and recognize a tax liability (or asset) if the Plan has entered into an uncertain position that more likely than not would not be sustained upon examination by the IRS. The Company analyzed the tax positions taken by the Plan, and concluded that as of December 31, 2020 and 2019, there were no uncertain positions taken or expected to be taken that require recognition of a liability (or asset) or disclosure in the financial statements. Additionally, the Plan has not incurred any penalties or interest on penalties by any taxing jurisdictions for any reason. The Plan is subject to routine audits by taxing jurisdictions; however, there are currently no audits in progress for any tax periods.

Note 6 — Party-in-Interest Transactions

Investments in the Company’s own stock are considered party-in-interest investments because the Company is the Plan sponsor. Effective September 15, 2012, all investments in the Flotek Industries, Inc. Common Stock Fund (the “Common Stock Fund”) were frozen and new investments in the Common Stock Fund are no longer permitted. Participants are allowed to transfer all or a portion of their balance in the Common Stock Fund to one or more funds available within the Plan but are not allowed to transfer amounts into the Common Stock Fund.

The Common Stock Fund was liquidated on December 16, 2019. This liquidation was deemed to be in the best interest of Plan participants in light of (1) the increased costs to administer the employer stock through Fidelity, (2) the administrative complexities of continuing to hold employer stock in the Plan, and (3) the overall volatility of the stock price.

Certain Plan investments are in accounts managed by the Trustee which include various mutual funds and other funds. The Plan has notes receivable from certain of its Participants. Such investments would be considered party-in-interest transactions. However, investments in these funds and participant notes receivable are permitted under the provisions of the Plan and would be exempt from the prohibition of party-in-interest transactions under ERISA. Fees paid by the Plan for investment management services were included as a reduction of the return earned on each fund. Fees paid to Lockton Investment Advisors for investment management services were $14,351 for the year ended December 31, 2020. Fees paid to the trustee by the Plan for administrative services were $16,199 for the year ended December 31, 2020.

FLOTEK INDUSTRIES, INC. 401(k) PLAN

NOTES TO FINANCIAL STATEMENTS

Note 7 — Subsequent Events

Reinstatement of Matching Contributions

Beginning May 31, 2021, the 401(k) match was restated at 100% of employee contributions up to 2% of eligible compensation. Employees can contribute 1% to 100% of eligible compensation inclusive of pre-tax and/or ROTH deferrals with employee and employer contributions vesting at 100% immediately.

FLOTEK INDUSTRIES, INC. 401(k) PLAN

SCHEDULE H, PART IV, LINE 4i — SCHEDULE OF ASSETS (HELD AT END OF YEAR)

DECEMBER 31, 2020

|

|

|

|

|

|

|

|

|

|

|

|

|

Identity of Issue, Borrower,

Lessor, or Similar Party

|

Description of Investment, including Maturity Date,

Rate of Interest, Collateral, Par or Majority Value

|

Cost**

|

Current

Value

|

|

|

Money Market

|

|

|

|

|

|

|

|

|

Fidelity Investments Inc.*

|

Fidelity Government Money Market Fund - Class K6

|

|

$

|

706

|

|

|

|

Mutual Funds

|

|

|

|

Capital Research and Management Company

|

American Funds EuroPacific Growth R6

|

|

181,852

|

|

|

Eagle Asset Management, Inc.

|

Carillon Eagle Small Cap Growth R6

|

|

843

|

|

|

Goldman Sachs Asset Management, LP

|

Goldman Sachs Small Cap Value Fund R6

|

|

38,054

|

|

|

|

|

|

|

|

Janus Capital Management LLC

|

Janus Henderson Enterprise Fund Class N

|

|

374,544

|

|

|

MFS Investment Management

|

MFS Total Return Bond Fund R6

|

|

29,037

|

|

|

|

|

|

|

|

The Hartford Financial Services Group Inc.

|

Hartford Schroders International Multi-Cap Value Fund

|

|

46,825

|

|

|

Victory Capital

|

Victory Sycamore Established Value Fund

|

|

78,528

|

|

|

Virtus

|

Virtus KAR Small-Cap Growth Fund Class 1

|

|

39,662

|

|

|

Prudential Investment Management

|

PGIM Jennison Growth Z

|

|

444,637

|

|

|

Fidelity Investments Inc.*

|

Fidelity Freedom Fund Index 2005 - Investor Class

|

|

11,685

|

|

|

Fidelity Investments Inc.*

|

Fidelity Freedom Fund Index 2010 - Investor Class

|

|

283,171

|

|

|

Fidelity Investments Inc.*

|

Fidelity Freedom Fund Index 2020 - Investor Class

|

|

1,008,407

|

|

|

Fidelity Investments Inc.*

|

Fidelity Freedom Fund Index 2025 - Investor Class

|

|

1,273,507

|

|

|

Fidelity Investments Inc.*

|

Fidelity Freedom Fund Index 2030 - Investor Class

|

|

2,028,070

|

|

|

Fidelity Investments Inc.*

|

Fidelity Freedom Fund Index 2035 - Investor Class

|

|

1,506,648

|

|

|

Fidelity Investments Inc.*

|

Fidelity Freedom Fund Index 2040 - Investor Class

|

|

1,820,987

|

|

|

Fidelity Investments Inc.*

|

Fidelity Freedom Fund Index 2045 - Investor Class

|

|

3,103,205

|

|

|

Fidelity Investments Inc.*

|

Fidelity Freedom Fund Index 2050 - Investor Class

|

|

1,251,794

|

|

|

Fidelity Investments Inc.*

|

Fidelity Freedom Fund Index 2015 - Investor Class

|

|

92,405

|

|

|

Fidelity Investments Inc.*

|

Fidelity Freedom Fund Index 2055 - Investor Class

|

|

705,625

|

|

|

Fidelity Investments Inc.*

|

Fidelity Freedom Fund Index 2060 - Investor Class

|

|

115,292

|

|

|

Vanguard Group Inc.

|

Vanguard 500 Index Fund Admiral Shares

|

|

394,737

|

|

|

Vanguard Group Inc.

|

Vanguard Total Bond Market Index Fund Admiral Shares

|

|

22,221

|

|

|

Vanguard Group Inc.

|

Vanguard Equity Income Fund Investor Shares

|

|

84,247

|

|

|

Vanguard Group Inc.

|

Vanguard Small Cap Index Admiral

|

|

107,094

|

|

|

Vanguard Group Inc.

|

Vanguard Mid Cap Index Admiral

|

|

93,913

|

|

|

Vanguard Group Inc.

|

Vanguard Total International Stock Index Admiral

|

|

107,808

|

|

|

|

|

|

|

|

|

|

|

|

|

Vanguard Group Inc.

|

Vanguard Inflation Protected Securities Fund (Admiral)

|

|

104,976

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Mutual Funds

|

|

15,349,774

|

|

|

|

|

|

|

|

|

Common/Collective Trust

|

|

|

|

Putnam Investments

|

Putnam Stable Value Fund

|

|

1,234,110

|

|

|

|

|

|

|

|

|

Total Common/Collective Trust

|

|

1,234,110

|

|

|

|

Common Stock

|

|

|

|

Flotek Industries, Inc.*

|

Flotek Industries, Inc. Common Stock Fund

|

|

—

|

|

|

Total investments

|

|

16,584,590

|

|

|

|

Participant Loans

|

|

|

|

Participant loans*

|

Notes receivable from participants (interest rates from 5.25% to 7.50% with various maturity dates through November 16, 2023)

|

|

214,999

|

|

|

Total assets held at end of year

|

|

$

|

16,799,589

|

|

* Party-in-interest.

** Cost not required for participant-directed investments.

See accompanying Report of Independent Registered Public Accounting Firm.

EXHIBIT INDEX

|

|

|

|

|

|

|

|

|

|

Exhibit

Number

|

|

Description of Exhibit

|

|

23.1

|

*

|

|

|

|

|

|

|

23.2

|

*

|

|

|

|

|

|

|

*

|

|

Filed herewith.

|

SIGNATURE

Flotek Industries, Inc. 401(k) Plan. Pursuant to the requirements of the Securities Exchange Act of 1934, the trustees (or other persons who administer the employee benefit plan) has duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FLOTEK INDUSTRIES, INC. 401(k) PLAN

(Name of Plan)

|

|

|

|

|

|

|

Date: June 29, 2021

|

By:

|

|

/s/ Michael E. Borton

|

|

|

|

|

|

|

|

|

|

Chief Financial Officer

|

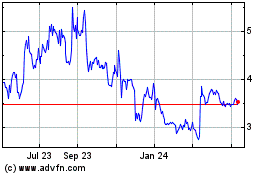

Flotek Industries (NYSE:FTK)

Historical Stock Chart

From Mar 2024 to Apr 2024

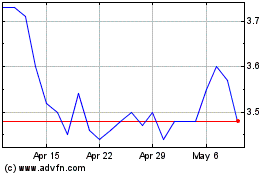

Flotek Industries (NYSE:FTK)

Historical Stock Chart

From Apr 2023 to Apr 2024