UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

The Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

|

|

☐

|

Preliminary Proxy Statement

|

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

☐

|

Definitive Proxy Statement

|

|

|

☒

|

Definitive Additional Materials

|

|

|

☐

|

Soliciting Material Under Rule 14a-12

|

|

Adamis Pharmaceuticals Corporation

|

|

(Name of Registrant as Specified in Its Charter)

|

|

|

|

JERALD A. HAMMANN

|

|

(Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on

which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

☐

|

Fee paid previously with preliminary materials:

|

☐ Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of

its filing.

|

|

(1)

|

Amount previously paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

June 2, 2021

Below please find the full text of a blog post dated June 2, 2020, posted at https://noticepapers.com/adamis/f/exploring-adamis-allegation-of-an-untimely-proxy-solicitation relating to the Adamis Pharmaceuticals Corporation 2021 Annual Stockholder Meeting:

***

Exploring Adamis' Allegation of an Untimely Proxy Solicitation

-

Adamis claims without explanation that a Proxy Solicitation Notice was untimely

-

Adamis' claim relies on an alternate calculation not employed in the prior eleven years

-

Adamis does not disclose its role in triggering the alternate calculation

Greetings Adamis Pharmaceuticals Corporation shareholders:

My name is Jerry Hammann and I would like to share with you information you may not know about Adamis Pharmaceuticals Corporation ("Adamis" or the "Company," NASDAQ: ADMP). I will also be sharing some opinions.

Many of you saw the preliminary proxy statement filed by Adamis on June 1, 2021. I want to highlight a statement made in this filing:

"Mr. Hammann, who claims to own 1,000 shares of Common Stock, or less than 0.00067% of our outstanding Common Stock, notified the Company that he desired to nominate four individuals, including himself, for election as directors of the Board at the Meeting and to propose three proposals at the Meeting for approval by stockholders on his own proxy statement and form of proxy. The Company has informed Mr. Hammann that pursuant to our Amended and Restated Bylaws (the "Bylaws"), his notice was untimely and failed to comply with the Bylaws and that, as a result, he will not be entitled to make lawful nominations for election to the Board or lawfully submit proposals for consideration by stockholders at the Meeting."

I would like shareholders to focus on the Company's conclusion that my "notice was untimely" and to share with you how this allegation of "untimeliness" came about. Timeliness is a factor determined by the Company's Bylaws, specifically its Section 5(b):

"To be timely, a stockholder's notice shall be delivered . . . not later than the close of business on the 90th day . . . prior to the first anniversary of the preceding year's annual meeting; provided, however, that in the event that the date of the annual meeting is advanced more than 30 days prior to or delayed by more than 30 days after the anniversary of the preceding year's annual meeting, notice by the stockholder to be timely must be so delivered . . . not later than the close of business on the later of the 90th day prior to such annual meeting or the 10th day following the day on which public announcement of the date of such meeting is first made. In no event shall the public announcement of an adjournment of an annual meeting commence a new time period for the giving of a stockholder's notice as described above."

As can be seen, there are two timeliness calculations, the ordinary one and a second alternate one if a certain set of events occurs, one of which is a "public announcement of the date of such [advanced or delayed] meeting."

Since the facts regarding the first of these two timeliness calculations are not in dispute, I will simply disclose to you that the deadline based on this calculation was May 22, 2021. Adamis acknowledges receiving my shareholder nominations and shareholder proposals on May 6, 2021, May 7, 2021, and May 20, 2021. The May 7, 2021, amended notice was to amend the May 6, 2021, notice to add materials for the fourth director nominee. The May 20, 2021, amended notice was to resolve certain deficiencies in the notice alleged by Adamis. Since the original notice and all of its amendments were made before May 22, 2021, to the best of my knowledge, Adamis does not dispute that my notice was timely under the first of the two timeliness calculations.

Adamis, however, contends that the second of the two timeliness calculations applies. It further contends that its "public announcement of the date of such [advanced] meeting" took place on April 15, 2021, when it filed its Form 10-K with the SEC. In this 10-K, at Section 9B, titled "OTHER INFORMATION," Adamis disclosed:

"The Board of Directors of the Company has determined that the Company's 2021 annual meeting of stockholders will be held July 16, 2021 (the "2021 Annual Meeting")."

If one presumes that this information contained under a non-descript heading on page 67 of the 2020 10-K constitutes a "public announcement," then one can determine whether the second calculation disclosed applies and its timeliness deadline. First, was the meeting " advanced more than 30 days prior to . . . the anniversary of the preceding year's annual meeting?" Yes, the anniversary of the preceding year's annual meeting is August 20, 2021. July 16, 2021, is 35 days prior to the anniversary of the preceding year's annual meeting. Second, what is "the later of the 90th day prior to such annual meeting or the 10th day following the day on which public announcement of the date of such meeting is first made?" The 90th day prior to July 16, 2021, was April 17, 2021. The "10th day following the day on which public announcement of the date of such meeting is first made" was April 25, 2021. The "later of" these two dates is April 25, 2021.

Because Adamis contends that the second of the two timeliness calculations applies, it also contends that the April 25, 2021, timeliness calculation applies to my notice. But is Adamis' contention correct? Does disclosing material facts regarding shareholder electoral rights on page 67 of the 2020 10-K under the heading "OTHER INFORMATION" constitute a "public announcement?" And even if this first contention is correct, did the Board of Directors of Adamis violate its fiduciary duties to shareholders either by changing the date of the meeting by 35 days, thereby triggering (intentionally, I suspect) the second timeliness calculation, or by not more publicly disclosing (again intentionally, I suspect) its potential impact on shareholder electoral rights?

Addressing the first of these two questions of whether this disclosure constitutes a "public announcement," if the phrase "public announcement" is ambiguous, case law suggests that "ambiguities in advance notice bylaws are construed 'in favor of the stockholders' electoral rights.'" See Sherwood v. Ngon, Del: Court of Chancery 2011 (C.A. No. 7106-VCP, December 20, 2011). Section 9B of an SEC Form 10-K is intended to be used for "any information that was required to be reported on a Form 8-K during the fourth quarter of the year covered by the 10-K, but was not yet reported." See https://www.sec.gov/fast-answers/answersreada10khtm.html. While SEC General Guidance does permit companies to disclose certain information at Section 9B which was not "required to be reported on a Form 8-K during the fourth quarter of the year covered by the 10-K," this is only a permitted option. Indeed, the SEC agrees that "Item 9B of Form 10-K appear[s] to be limited to events that were required to be disclosed during the period covered by those reports." See https://www.sec.gov/divisions/corpfin/guidance/8-kinterp.htm Question 101.01.

It is my personal belief that burying material information relating to stockholders' electoral rights on page 67 of an SEC document under a nondescript heading normally reserved for events occurring more than four-and-one-half months prior to the time of Adamis' filing does not constitute a "public announcement." I further contend that Adamis has historically treated "public announcements" quite differently. By way of example, at the end of this post is a list of 32 "public announcements made by Adamis' in the seven-year period from Aug 6, 2013, to August 5, 2020, There are numerous "public announcements" made after July 1, 2020, as well, including a "public announcement" made on April 15, 2021, that fails to mention the change in the date of the annual shareholder meeting. See https://www.globenewswire.com/search/keyword/Adamis%252520Pharmaceuticals%252520Corporation. Each of these 32 "public announcements" was made over a newswire. None of these "public announcements" were buried on page 67 of an SEC document under a nondescript heading normally reserved for events occurring at a completely different time period from the event being announced.

It is my personal belief that the phrase "public announcement" as used in Adamis' Bylaws is not ambiguous, especially in light of Adamis' long-standing practices in the manner of making public announcements. However, even if it were ambiguous, to any extent that "ambiguities in advance notice bylaws are construed 'in favor of the stockholders' electoral rights,'" I would hope that if this issue were tried in a court of law, a judge would resolve any ambiguity in favor of stockholders' electoral rights.

Moving now to the second of the two questions raised above, of whether the Board of Directors of Adamis violated its fiduciary duties to shareholders either by changing the date of the meeting by 35 days, thereby triggering the second timeliness calculation, or by not more publicly disclosing its potential impact on shareholder electoral rights, I will for the moment leave this question for shareholders to consider on your own. However, I will share some additional facts to aid your consideration.

Here are the announced dates of the annual shareholder meeting over the last 11 years: September 12, 2011; October 10, 2012; October 15, 2013; November 6, 2014; May 14, 2015; May 25, 2016; June 7, 2017; July 6, 2018; July 24, 2019; August 20, 2020; and July 16, 2021. On November 6, 2014, the Board of Directors of the Company approved a change in the Company's fiscal year-end from March 31 to December 31. The May 14, 2015, annual shareholder meeting therefore related to the nine-month period ending on December 31, 2014. With this exception, the present 35-day change in the date of the annual meeting is the first time over this time period that Adamis has ever changed the date of the meeting by more than 30 days from its anniversary. It is also the first time over this time period that Adamis has ever advanced the date of the meeting from its anniversary date. In the Proxy Statement for the 2014 annual shareholder meeting, shareholders were advised to submit nominations or proposals "no later than August 8, 2015, but no earlier than July 9, 2015" for the 2015 annual shareholder meeting. Despite the fact that this meeting took place on May 14, 2015, I can find no public announcement and no other form of notice in SEC filings that shareholders were ever informed of a change in the deadlines for filing shareholder nominations and proposals for the 2015 annual shareholder meeting.

I will also disclose to shareholders that I have been in contact with Adamis since February 2021, discussing the possibility of effecting mutually agreeable change in the Company without resorting to a proxy contest. I can therefore attest that Adamis was not surprised when my director nominations and shareholder proposals were submitted to it. Adamis had been previously informed by me that these nominations and proposals were coming. It even had and has attorneys designated to whom I was and am directed to send all communications, including the nominations and proposals.

There will be plenty of additional facts presented over the next six weeks, providing ample opportunity for shareholders to reach their own conclusions about whether the Board of Directors of Adamis violated its fiduciary duties to shareholders.

I will at this time, however, offer two additional questions I think shareholders should consider: "Given Adamis' long-standing standardized practice of making public announcements through newswire articles, given its placing of a material stockholders' electoral rights notice on page 67 of an SEC document under a nondescript heading normally reserved for events occurring at a completely different time period from the timing of the notice, and given its current contention that this represents a "public announcement," do you think that the Board of Directors of Adamis is currently fulfilling its fiduciary duty to protect shareholders' rights? Do you think that the Board of Directors of Adamis is serving the interests of the Company's shareholders?

Now, here is that list of 32 public announcements made by Adamis in the seven-year period from Aug 6, 2013, to August 5, 2020. The first sentence(s) is/are provided:

"SAN DIEGO, CA--(Marketwired - Aug 6, 2013) - Adamis Pharmaceuticals Corporation (OTCQB:ADMP) announced today that it has entered into an agreement to exclusively license and, with additional payment, fully acquire 3M Company's (NYSE:MMM) Taper Dry Powder Inhaler (DPI) technology under development for the treatment of asthma and chronic obstructive pulmonary disease (COPD)."

"SAN DIEGO, CA--(Marketwired - Sep 9, 2013) - Adamis Pharmaceuticals Corporation (OTCQB: ADMP) today announced that a recently published study conducted by university researchers found that the company's antimicrobial and spermicidal agent, C31G, was effective in treating Herpes Simplex Virus (HSV) in an eye infection (ocular keratitis) animal model."

"SAN DIEGO, CA--(Marketwired - Jan 7, 2014) - Adamis Pharmaceuticals Corporation (NASDAQ: ADMP) announced today that at a closing held on December 27, 2013, it made a final payment of $7 million to fully acquire from 3M Company and 3M Innovative Properties Company certain intellectual property and assets relating to 3M's Taper Dry Powder Inhaler technology under development for the treatment of asthma and chronic obstructive pulmonary disease (COPD)."

"SAN DIEGO, CA--(Marketwired - May 29, 2014) - Adamis Pharmaceuticals Corporation (NASDAQ: ADMP) today announced the submission of a New Drug Application (NDA) to the U.S. Food and Drug Administration for its epinephrine pre-filled single dose syringe (PFS) product."

"SAN DIEGO, CA--(Marketwired - Jul 29, 2014) - Adamis Pharmaceuticals Corporation (NASDAQ: ADMP) announced today that the U.S. Food and Drug Administration (FDA) has accepted for review its New Drug Application (NDA) for the product, EPINEPHRINE INJECTION, USP, 1:1000 (0.3 mg Pre-filled single dose syringe) (PFS), for the emergency treatment of allergic reactions (Type I) including anaphylaxis."

"SAN DIEGO, CA--(Marketwired - Aug 26, 2014) - Adamis Pharmaceuticals Corporation (NASDAQ:ADMP) today announced the appointment of Richard C. Williams, Robert B. Rothermel and William C. Denby to its Board of Directors. Mr. Williams was also appointed as Chairman of the Board."

"SAN DIEGO, Oct. 15, 2014 (GLOBE NEWSWIRE) -- Adamis Pharmaceuticals Corporation (Nasdaq:ADMP) today announced key additions to its medical and product marketing management teams. These new employees position the company for further development of its product pipeline and the preparation of a sales and marketing plan for the anticipated launch of its epinephrine pre-filled syringe for treatment of allergic reactions (Type I) including anaphylaxis."

"SAN DIEGO, Feb. 24, 2015 (GLOBE NEWSWIRE) -- Adamis Pharmaceuticals Corporation (Nasdaq:ADMP) ("Company") today announced the results of its pharmacokinetic (PK) study for its beclomethasone dipropionate HFA product, APC-1000."

"SAN DIEGO, March 3, 2015 (GLOBE NEWSWIRE) -- Adamis Pharmaceuticals Corporation (Nasdaq:ADMP) ("Company") today announced the results of its pharmacokinetic (PK) study for its dry powder inhaler product, APC-5000."

"SAN DIEGO, March 27, 2015 (GLOBE NEWSWIRE) -- Adamis Pharmaceuticals Corporation (Nasdaq:ADMP) ("Company") announced that today it received a Complete Response Letter (CRL) from the U.S. Food and Drug Administration (FDA) regarding its New Drug Application (NDA) Epinephrine Injection USP 1:1000 0.3mg Pre-filled Single Dose Syringe (PFS) product, for the emergency treatment of acute anaphylaxis, which is a severe allergic reaction."

"SAN DIEGO, March 27, 2015 (GLOBE NEWSWIRE) -- Adamis Pharmaceuticals Corporation (Nasdaq:ADMP) ("Company") announced that today it received a Complete Response Letter (CRL) from the U.S. Food and Drug Administration (FDA) regarding its New Drug Application (NDA) Epinephrine Injection USP 1:1000 0.3mg Pre-filled Single Dose Syringe (PFS) product, for the emergency treatment of acute anaphylaxis, which is a severe allergic reaction."

"SAN DIEGO, April 15, 2015 (GLOBE NEWSWIRE) -- Adamis Pharmaceuticals Corporation (Nasdaq:ADMP) today announced key additions to its commercial sales team. These appointments reflect the company's continuing preparations for a sales launch of its epinephrine pre-filled syringe (PFS) for the treatment of allergic reactions (Type I) including anaphylaxis."

"SAN DIEGO, Dec. 07, 2015 (GLOBE NEWSWIRE) -- Adamis Pharmaceuticals Corporation (NASDAQ:ADMP) ("Company" or "Adamis") today announced the resubmission of the Company's New Drug Application ("NDA") to the U.S. Food and Drug Administration ("FDA") for its Epinephrine Pre-filled Syringe ("PFS") product candidate for the emergency treatment of anaphylaxis."

"SAN DIEGO, Dec. 07, 2015 (GLOBE NEWSWIRE) -- Adamis Pharmaceuticals Corporation (NASDAQ:ADMP) ("Company" or "Adamis") today announced the resubmission of the Company's New Drug Application ("NDA") to the U.S. Food and Drug Administration ("FDA") for its Epinephrine Pre-filled Syringe ("PFS") product candidate for the emergency treatment of anaphylaxis."

"SAN DIEGO, March 29, 2016 (GLOBE NEWSWIRE) -- Adamis Pharmaceuticals Corporation (NASDAQ:ADMP) ("Company" or "Adamis") announced today that it has entered into a definitive merger agreement (the "Agreement") to acquire US Compounding, Inc. ("USC"), a privately held company registered as a drug compounding outsourcing facility under Section 503B of the U.S. Food, Drug & Cosmetic Act ("FD&C Act"), that provides prescription medications to patients, physician clinics, hospitals and surgery centers throughout most of the United States."

"DUBLIN, Ireland and SAN DIEGO, May 10, 2016 (GLOBE NEWSWIRE) -- Adamis Pharmaceuticals Corporation (NASDAQ:ADMP) ("Adamis") has entered into an exclusive licensing agreement with Allergan plc's wholly owned subsidiary, Watson Laboratories, Inc. ("Watson"), to commercialize Adamis' Epinephrine Pre-filled Syringe ("PFS") product candidate for the emergency treatment of anaphylaxis."

"SAN DIEGO, June 06, 2016 (GLOBE NEWSWIRE) -- Adamis Pharmaceuticals Corporation (NASDAQ:ADMP) ("Company") announced that after the close of the stock markets on June 3, 2016 it received a Complete Response Letter (CRL) from the U.S. Food and Drug Administration (FDA) regarding its New Drug Application (NDA) Epinephrine Injection USP 1:1000 0.3mg Pre-filled Single Dose Syringe (PFS) product."

"SAN DIEGO, Jan. 19, 2017 (GLOBE NEWSWIRE) -- Adamis Pharmaceuticals Corporation (NASDAQ:ADMP) ("Company" or "Adamis") today announced that the U.S. Food and Drug Administration ("FDA") has accepted for review the Company's New Drug Application ("NDA") for its Epinephrine Pre-filled Syringe ("PFS") product candidate for the emergency treatment of anaphylaxis."

"SAN DIEGO, June 15, 2017 (GLOBE NEWSWIRE) -- Adamis Pharmaceuticals Corporation (NASDAQ:ADMP) ("Adamis") today announced that the U.S. Food and Drug Administration ("FDA") has approved Adamis' EPINEPHRINE INJECTION, USP, 1:1000 (0.3 mg Pre-filled single dose syringe) ("PFS") for the emergency treatment of allergic reactions (Type I) including anaphylaxis."

"SAN DIEGO, Nov. 29, 2017 (GLOBE NEWSWIRE) -- Adamis Pharmaceuticals Corporation (NASDAQ:ADMP) today announced the submission of a prior approval supplement to the U.S. Food and Drug Administration ("FDA") for a pediatric version (0.15mg) of Symjepi."

"SAN DIEGO, Dec. 04, 2017 (GLOBE NEWSWIRE) -- Adamis Pharmaceuticals Corporation (NASDAQ:ADMP) ("Adamis") announced that it has submitted an investigational new drug (IND) application to the U.S. Food and Drug Administration (FDA) to begin testing the drug compound naloxone in human patients."

"SAN DIEGO, July 01, 2018 (GLOBE NEWSWIRE) -- Adamis Pharmaceuticals Corporation (NASDAQ:ADMP) ("Adamis") announced today that it has entered into an exclusive distribution and commercialization agreement with Sandoz Inc. ("Sandoz"), a division of the Novartis Group, to commercialize Adamis' Symjepi product for the emergency treatment of allergic reactions (Type I) including anaphylaxis."

"SAN DIEGO, Dec. 28, 2018 (GLOBE NEWSWIRE) -- Adamis Pharmaceuticals Corporation (NASDAQ: ADMP) today announced the submission of a New Drug Application (NDA) to the U.S. Food and Drug Administration (FDA) for its fast-dissolving sublingual tadalafil tablet. This product candidate is designed for the treatment of erectile dysfunction."

"SAN DIEGO, Dec. 31, 2018 (GLOBE NEWSWIRE) -- Adamis Pharmaceuticals Corporation (NASDAQ: ADMP) today announced the submission of a New Drug Application (NDA) to the U.S. Food and Drug Administration for its naloxone pre-filled single dose syringe (PFS) product candidate. This injection is designed for the treatment of an opioid overdose."

"SAN DIEGO, Jan. 16, 2019 (GLOBE NEWSWIRE) -- Adamis Pharmaceuticals Corporation (NASDAQ: ADMP) today announced that its marketing and commercial partner, Sandoz Inc. (Sandoz), a Novartis division, has launched SYMJEPI (epinephrine) 0.3 mg Injection in the US market for the emergency treatment of allergic reactions (Type 1), including anaphylaxis. Sandoz is launching this medicine as an affordable, single-dose, pre-filled syringe alternative to epinephrine auto-injectors."

"SAN DIEGO, Feb. 26, 2019 (GLOBE NEWSWIRE) -- Adamis Pharmaceuticals Corporation (NASDAQ: ADMP) today announced that it has received a Refusal to File letter from the United States Food and Drug Administration (FDA) regarding its New Drug Application (NDA) for its sublingual tadalafil product."

"SAN DIEGO, Aug. 26, 2019 (GLOBE NEWSWIRE) -- Adamis Pharmaceuticals Corporation (NASDAQ: ADMP) today announced the appointment of Howard C. Birndorf and Roshawn Blunt to its Board of Directors."

"SAN DIEGO, Nov. 25, 2019 (GLOBE NEWSWIRE) -- Adamis Pharmaceuticals Corporation (NASDAQ: ADMP) ("Adamis") today announced that after the close of U.S. markets on November 22nd, it received a Complete Response Letter (CRL) from the U.S. Food and Drug Administration (FDA) regarding its New Drug Application (NDA) for Adamis' ZIMHI high-dose naloxone injection product for the treatment of opioid overdose."

"SAN DIEGO, May 11, 2020 (GLOBE NEWSWIRE) -- Adamis Pharmaceuticals Corporation (NASDAQ: ADMP) today announced it is reacquiring from Sandoz Inc. the rights to its SYMJEPI (epinephrine) Injection 0.3mg, SYMJEPI (epinephrine) Injection 0.15mg products currently marketed and available in the United States. Adamis has simultaneously entered into an exclusive distribution and commercialization agreement with US WorldMeds, LLC for the United States commercial rights for the SYMJEPI products, as well as its ZIMHI (naloxone HCI Injection, USP) 5mg/0.5mL product candidate."

"SAN DIEGO, June 15, 2020 (GLOBE NEWSWIRE) -- Adamis Pharmaceuticals Corporation (NASDAQ: ADMP) ("Adamis") announced today a license to commercialize Tempol, a novel patented investigational drug for the treatment of Coronavirus (COVID-19). The license includes the worldwide use of Tempol for the treatment of all respiratory diseases including asthma, respiratory syncytial virus, influenza and COVID-19."

"SAN DIEGO, July 01, 2020 (GLOBE NEWSWIRE) -- Adamis Pharmaceuticals Corporation (NASDAQ: ADMP) today announced that, on July 1, 2020, USWM, LLC ("USWM" or "US WorldMeds") began promoting Adamis' SYMJEPI (epinephrine) Injection 0.3mg and SYMJEPI (epinephrine) Injection 0.15mg products through its field sales force."

"SAN DIEGO, Aug. 05, 2020 (GLOBE NEWSWIRE) -- Adamis Pharmaceuticals Corporation (NASDAQ: ADMP) announced today that it has received a letter from the NASDAQ Listing Qualifications Staff ("Nasdaq") notifying the company that as a result of the closing bid price of the company's common stock having been at $1.00 per share or greater for at least ten consecutive business days, the company has regained compliance with Nasdaq's minimum bid price requirement and the matter is now closed."

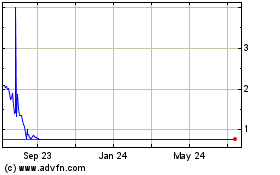

Adamis Pharmaceuticals (NASDAQ:ADMP)

Historical Stock Chart

From Mar 2024 to Apr 2024

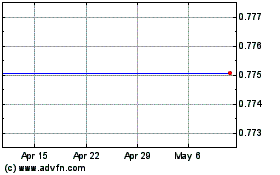

Adamis Pharmaceuticals (NASDAQ:ADMP)

Historical Stock Chart

From Apr 2023 to Apr 2024