Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

May 03 2021 - 9:24AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2021

Commission File Number: 001-38397

Farmmi, Inc.

(Translation of registrant’s name into English)

Fl

1, Building No. 1, 888 Tianning Street, Liandu District

Lishui,

Zhejiang Province

People’s

Republic of China 323000

(Address of principal

executive offices)

Indicate by check mark whether the registrant files

or will file annual reports under cover Form 20-F or Form 40-F.

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

EXPLANATORY NOTE

On April 28, 2021, Farmmi,

Inc., a Cayman Islands corporation (the “Company”), entered into an underwriting agreement (the “Underwriting Agreement”)

with Aegis Capital Corp. (the “Underwriter”), pursuant to which the Company agreed to sell to the Underwriter, in a firm commitment

public offering (the “Offering”), 140,000,000 ordinary shares of the Company, par value $0.001 per share, at a public offering

price of $0.30 per share. Under the terms of the Underwriting Agreement, the Company granted the Underwriter a 45-day option to purchase

up to an additional 21,000,000 ordinary shares solely to cover over-allotments, if any. The Company expected to receive approximately

$44.1 million in net proceeds from the Offering (including the net proceeds from the exercise of the over-allotment option in full), after

deducting underwriting discounts and commissions and estimated offering expenses payable by the Company. The Offering was conducted pursuant

to the Company’s registration statement on Form F-1 (File No. 333-255387) declared effective by the Securities and Exchange Commission

on April 28, 2021, an abbreviated registration statement on Form F-1 pursuant to Rule 462(b) under the Securities Act of 1933, as amended (the “Securities Act”) (File No. 333-255590)

effective upon filing on April 28, 2021, and a prospectus dated April 28, 2021.

The Underwriting Agreement

contains customary representations, warranties and covenants of the Company, customary conditions to closing, indemnification obligations

of the Company and the Underwriter, including liabilities under the Securities Act, and termination and other provisions

customary for transactions of this nature. All of the Company’s executive officers and directors have also agreed not to sell or

transfer any securities of the Company held by them for a period of 60 days, from the closing of the Offering, subject to limited exceptions.

The above description of the

Underwriting Agreement is qualified in its entirety by the Underwriting Agreement, which is attached to this report as Exhibit 1.1 and

is incorporated herein by reference. A copy of the opinion of Campbells LLP, as legal counsel to the Company, relating to the legality

of the issuance and sale of the shares in the Offering is attached hereto as Exhibit 5.1.

On April 28, 2021, the Company

issued a press release announcing that it had priced the Offering, which press release is filed as Exhibit 99.1 to this report and is

incorporated herein by reference.

On May 3, 2021, the Company

closed its previously announced underwritten public Offering of 161,000,000 ordinary shares, including 21,000,000 ordinary shares issued

upon the Underwriter’s exercise of the over-allotment option in full. In connection with the closing, the Company issued a press

release announcing the closing of the Offering. A copy of the press release is included as Exhibit 99.2 to this report and is incorporated

herein by reference.

This report on Form 6-K is

incorporated by reference into the Company’s Registration Statements on Form F-3 (File No. 333-254036, No. 254397 and No. 333-228677)

and Form S-8 (File No. 333-224463).

EXHIBIT INDEX

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

|

|

Farmmi, Inc.

|

|

|

|

|

|

Date: May 3, 2021

|

By:

|

/s/ Yefang Zhang

|

|

|

|

Yefang Zhang

|

|

|

|

Chief Executive Officer

|

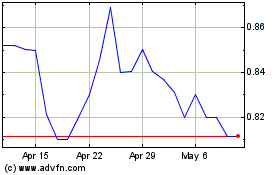

Farmmi (NASDAQ:FAMI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Farmmi (NASDAQ:FAMI)

Historical Stock Chart

From Apr 2023 to Apr 2024