Airbnb's Loss Widens as IPO Costs Add to Pandemic Hit -- 2nd Update

February 25 2021 - 5:37PM

Dow Jones News

By Preetika Rana

Airbnb Inc. posted a steep fourth-quarter loss in its first

earnings as a public company, as costs tied to its market debut

capped a year in which the coronavirus pandemic ravaged the travel

industry.

The home-sharing company reported a $3.9 billion loss in the

three months through December, which included a charge of $2.8

billion for stock compensation tied to its initial public offering

during the quarter. That compared with a loss of $351 million in

the same period a year earlier. The latest loss brought the

company's full-year deficit to $4.6 billion, more than its losses

in the previous four years combined. The loss exceeded the average

forecast of analysts surveyed by FactSet.

Revenue exceeded Wall Street's expectations. Airbnb saw revenue

evaporate in the early months of the health crisis, but that

started to change as scores of people used the platform to plan

nearby trips in the summer. Fourth-quarter revenue fell 22%

year-over-year to $859 million. Full-year revenue fell 30% to $3.3

billion. Analysts polled by FactSet had expected fourth-quarter

revenue to decline 33% and full-year revenue to drop 32%.

Airbnb has been the outlier in an otherwise battered travel

industry. Chief Executive Brian Chesky successfully pivoted the

company's strategy to focus on rural stays while hotels in big

cities suffered. At the same time, he cut a quarter of staff,

paused noncore operations and slashed the company's hefty marketing

budget to keep expenses down.

The uptick in revenue, combined with deep cost cuts, helped

Airbnb turn a third-quarter profit, boosting investor confidence

ahead of its IPO in December. Airbnb shares have climbed nearly

twofold from their IPO price. The company's market capitalization

of more than $100 billion makes it more valuable than Marriott

International Inc., Hilton Worldwide Holdings Inc. and Hyatt Hotels

Corp. combined.

Airbnb's full-year expenses rose 31% to $6.97 billion on the

back of stock IPO-related expenses in the fourth quarter. But

expenses in each category -- ranging from product development to

operations and support -- were lower before accounting for stock

compensation. For example, Airbnb's sales and marketing costs

declined 66% in 2020 compared with the year earlier excluding

stock-based compensation for employees in that division. They

climbed 44% including those costs.

Companies often point to an adjusted metric that strips the

business of such costs. Airbnb's adjusted loss before interest,

taxes, depreciation and amortization narrowed to $251 million from

$253 million in the previous year. Its fourth-quarter loss on that

basis narrowed to $21 million from a loss of $276 million a year

earlier.

While the third quarter is the busiest for Airbnb -- the company

has turned a profit in that period since 2018, including during the

pandemic -- the first quarter is the slowest. Airbnb said it

expects bookings in the three months through March to be better

than in the same period last year, when the health crisis first

struck, but below 2019 levels.

The company said it expects to spend more on marketing and

product development as a percentage of revenue in the first half of

this year than in the second half, but intends to keep costs from

soaring to pre-pandemic levels.

Airbnb's rapid growth has come with its share of challenges.

Homeowners from Arizona to Florida and Massachusetts are

campaigning for laws to govern short-term rentals amid concerns

about noise, crime and plummeting property values.

Write to Preetika Rana at preetika.rana@wsj.com

(END) Dow Jones Newswires

February 25, 2021 17:22 ET (22:22 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

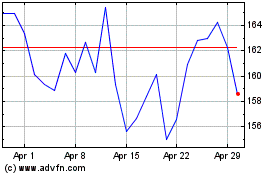

Airbnb (NASDAQ:ABNB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Airbnb (NASDAQ:ABNB)

Historical Stock Chart

From Apr 2023 to Apr 2024