By Annie Gasparro

The coronavirus pandemic achieved in a few weeks what the owners

of Folgers and Maxwell House have been trying to do for a decade:

get people to brew coffee at home again.

The morning coffee ritual is one of the toughest consumer habits

to change, food executives have long said. Once people got used to

stopping at Starbucks or Dunkin' on their way to work, they weren't

likely to switch things up, the thinking went.

That is, until a pandemic forced millions of people to work from

home.

As Americans suddenly changed the way they spent their days and

their dollars, a fierce sales battle emerged between cafes, coffee

brands and makers of home-brewing machines.

At first, consumers bought whatever coffee they could find as

they faced shortages at supermarkets. They got more picky as the

pandemic stretched on, improving the quality of their caffeine fix.

Many coffee drinkers invested in espresso machines, French presses

and pour-over brewers.

Retail coffee sales are up about 10% so far this year compared

with a 2% sales increase in many recent years, according to data

provided by coffee companies. Sales of all coffee makers, from

espresso machines to Chemex Corp.'s pour-over brewer, are up 28%

since the start of the pandemic, according to the market-research

firm NPD.

"Consumers are trying to replicate what they were getting in a

cafe at home," said Marty Thompson, president of Nestlé Coffee

Partners, a division of Nestlé SA, which makes Nescafe coffee as

well as Starbucks-branded packaged coffee. Mr. Thompson said the

packaged-coffee industry got about three years' worth of new

consumers in seven months during the pandemic.

"It's our work now to get them to stick," he said.

Starbucks Corp. last month reported a 9% decrease in

comparable-store sales at owned cafes in the Americas for its

latest quarter. The company did benefit from higher sales of the

Starbucks-branded packaged coffee that Nestlé makes.

Dunkin' Brands Group Inc. returned to growth at open stores, but

said it was closing hundreds of others where business was sapped by

the pandemic. Dunkin' is trying to sell more blended drinks such as

lattes, which are more complicated to make. The company was already

installing espresso machines at its stores before the pandemic.

"These are products that can't be easily made and replicated at

home," Dunkin' Chief Executive Dave Hoffmann told investors last

month.

Inspire Brands Inc., a private company that owns Arby's and

other chains, recently agreed to acquire Dunkin' Brands for $8.8

billion.

Sales of packaged coffee grew faster this year than in any since

Keurig machines for home use came onto the market more than a

decade ago.

Keurig Dr Pepper Inc. said last month that shipments of its

machines to retailers jumped 34% in the recent quarter and that it

expects to be in three million new households this year, compared

with two million in a typical year.

Italy-based coffee maker Lavazza Group said sales of new brewers

signal that people will likely continue making coffee at home even

after the pandemic.

"People are getting used to these new habits," said Lavazza's

head of its North America business, Davide Riboni. "We are trying

to capture this." People's barista skills have improved, he

added.

Nestlé said some customers have realized that they can make

good-quality coffee at home for less than they spent at cafes.

Nestlé plans next year to introduce some coffee products with a

lower price tag and some sold in bulk, at a lower cost per cup.

Christie Veitch, who lives near Boulder, Colo., said she is

making coffee at home much more often now and is unlikely to resume

frequent trips to Starbucks. "I miss the fanciness, but I don't

miss it from my budget," she said.

J.M. Smucker Co., which owns Folgers and makes Dunkin'-branded

ground coffee, is selling more dark-coffee roasts intended for

making latte-style drinks at home without an espresso machine.

"Employers are saying that people can work from home

indefinitely," said Tina Meyer-Hawkes, who leads coffee marketing

at Smucker, "so we expect this sales momentum to last at least for

the next two or three years."

The rise in sales for Folgers and Kraft Heinz Co.'s Maxwell

House, which are both more than a century old, has given their

owners an unexpected chance to win over younger coffee drinkers who

tend to prefer sweeter coffee drinks or higher-quality beans.

Folgers in recent years has tried to draw younger customers with

new espresso-style varieties under the name Folgers Noir, and a

pricier, premium line called 1850 by Folgers.

Folgers's ground coffee sales continued to decline. In February

Smucker said it expected modest sales volume declines to persist.

Maxwell House tried to appeal to younger people with an iced-coffee

concentrate and a higher-caffeine spinoff called MAX.

The pandemic turned things around for Smucker. In its most

recent quarter, Smucker's U.S. coffee retail sales rose 23% to $571

million, including double-digit growth for Folgers.

Kraft Heinz doesn't disclose sales of its coffee, but said in

September that it aims to stabilize the business as part of its

broader turnaround efforts.

--Heather Haddon contributed to this article.

Write to Annie Gasparro at annie.gasparro@wsj.com

(END) Dow Jones Newswires

November 10, 2020 05:44 ET (10:44 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

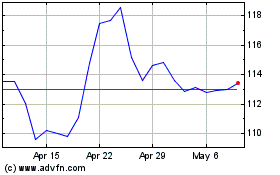

JM Smucker (NYSE:SJM)

Historical Stock Chart

From Mar 2024 to Apr 2024

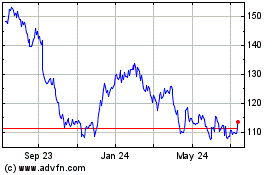

JM Smucker (NYSE:SJM)

Historical Stock Chart

From Apr 2023 to Apr 2024