ASML Missed 2Q Expectations, But Says 2020 Outlook Is Unchanged by Pandemic -- Update

July 15 2020 - 7:28AM

Dow Jones News

--ASML Holding's second-quarter net profit rose but missed

expectations

--The Dutch company said its growth expectations for 2020

haven't changed despite the pandemic

--ASML said the impact of the recession triggered by the

coronavirus pandemic is unclear

By Adria Calatayud

ASML Holding NV said Wednesday that net profit for the second

quarter rose sharply, but missed forecasts, and that its growth

expectations for 2020 haven't changed despite the coronavirus

pandemic.

The Dutch maker of semiconductor equipment said the rollout of

its most advanced chip-making technology, called extreme

ultraviolet lithography or EUV, has continued during the pandemic.

However, analysts said a fall in new orders and cautious comments

on the outlook for next year suggest ASML's customers may take

longer to confirm deliveries as they adapt to the economic

difficulties caused by the pandemic.

"We don't know what the impact of the recession will exactly

be," ASML President and Chief Executive Peter Wennink said.

For the second quarter, the company made a net profit of 751

million euros ($856.2 million) compared with EUR476 million for the

year-earlier period. Analysts expected a profit of EUR863.1

million, according to a FactSet-provided consensus.

ASML said net sales for the second quarter rose to EUR3.33

billion from EUR2.57 billion a year before, but this fell short of

analysts' expectations. The company had previously said revenue it

wasn't able to recognize in the first quarter would shift to the

second and third quarters.

ASML shipped nine extreme ultraviolet lithography, or EUV,

systems--its most advanced technology--in the quarter, but booked

revenue from seven.

"The miss essentially stems from a delay in revenue recognition

for two EUV shipments that ASML expects to recognize in the second

half of 2020," Frederic Yoboue, analyst at investment bank Bryan

Garnier, said in a note to clients.

The company said its operational capabilities are now largely

back to normal. In the second quarter, ASML received new orders

worth EUR1.1 billion, down from EUR3.09 billion in the previous

quarter, it said.

The company, which hadn't provided guidance for the second

quarter in light of uncertainty caused by the pandemic, said it

expects sales for the third quarter to be between EUR3.6 billion

and EUR3.8 billion, with a gross margin of between 47% and 48%. In

the second quarter, ASML's gross margin was 48.2%.

"Our 2020 growth expectations are largely unchanged relative to

our view at the start of the year," Mr. Wennink said.

ASML said it has agreed to acquire Berliner Glas, a privately

held manufacturer of ceramic and optical modules. Financial details

of the deal won't be disclosed, it said.

Shares at 1010 GMT were down 0.6% at EUR341.20.

Write to Adria Calatayud at adria.calatayud@dowjones.com

(END) Dow Jones Newswires

July 15, 2020 07:13 ET (11:13 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

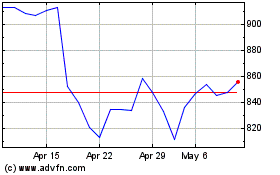

ASML Holding NV (EU:ASML)

Historical Stock Chart

From Mar 2024 to Apr 2024

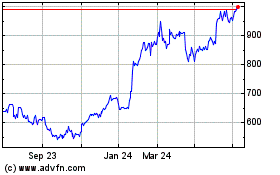

ASML Holding NV (EU:ASML)

Historical Stock Chart

From Apr 2023 to Apr 2024