Turkish Lira Off 2-day Low Against U.S. Dollar After Turkey Rate Cut

May 21 2020 - 5:31AM

RTTF2

The Turkish Lira trimmed its early losses against the U.S.

dollar in the European session on Thursday, after Turkey's central

bank reduced its interest rates by 50 basis points as widely

expected, as coronavirus pandemic dampened exports, domestic demand

and tourism.

The Monetary Policy Committee of the Central Bank of the

Republic of Turkey, led by Governor Murat Uysal, cut the policy

rate, which is the one-week repo auction rate, to 8.25 percent from

8.75 percent.

The decision came in line with expectations.

The bank observed that despite the recent weakness in the

Turkish lira due to global developments, international commodity

prices, especially crude oil and metal prices, affect inflation

outlook favorably.

The Turkish Lira recovered to 6.7808 against the greenback, from

a 2-day low of 6.8109 hit at 6:00 am ET. If the Lira rises further,

5.9 is seen as its next resistance level.

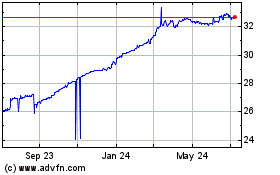

US Dollar vs TRY (FX:USDTRY)

Forex Chart

From Mar 2024 to Apr 2024

US Dollar vs TRY (FX:USDTRY)

Forex Chart

From Apr 2023 to Apr 2024