Mutual Fund Summary Prospectus (497k)

April 23 2020 - 5:31PM

Edgar (US Regulatory)

KRANE SHARES TRUST

KFA Dynamic Fixed Income ETF

(the “Fund”)

Supplement dated April 23, 2020 to the

currently effective Summary Prospectus and Statutory Prospectus, as each may be supplemented, for the Fund

This

supplement provides new and additional information beyond that contained in the currently effective Summary Prospectus and Statutory

Prospectus for the Fund (together, the “Prospectus”) and should be read in conjunction with the Prospectus.

Effective May 1, 2020, the Fund’s

Underlying Index, the FTSE US High-Yield Treasury Rotation Index, will be changing its methodology to reconstitute the Underlying

Index on a monthly basis. Prior to this date the Underlying Index was reconstituted on a quarterly basis. Accordingly, effective

May 1, 2020, the following changes apply to the Fund’s Prospectus:

|

|

1.

|

In the “Principal Investment Strategies” section of the Fund’s Prospectus,

the first paragraph is deleted in its entirety and replaced with the following:

|

Under normal circumstances, the

Fund will invest at least 80% of its total assets in components of the Underlying Index, to-be-announced transactions representing

such components, and investment companies that seek to track the performance of a subset of the Underlying Index or of an index

that is correlated to one of the three sub-indexes. As of each monthly reconstitution, the Underlying Index will be fully invested

in one of the three following sub-indexes: FTSE US Treasury 1-5 Years Index; FTSE US Treasury 7-10 Years Index; and FTSE US High-Yield

Market BB/B-Rated Capped Custom Index. The FTSE US Treasury 1-5 Years Index includes fixed-rate U.S. Treasury bonds with remaining

maturities of 1 to 5 years. The FTSE US Treasury 7-10 Years Index includes fixed-rate U.S. Treasury bonds with remaining maturities

of 7 to 10 years. The FTSE High-Yield Market BB/B-Rated Capped Custom Index includes high-yield debt (commonly referred to as “junk

bonds”) with remaining maturities of at least one year. The Underlying Index will invest in the sub-index with the highest

prior three-month returns as of the time of the monthly reconstitution, accordingly, at times, the Underlying Index may be invested

only in the FTSE High-Yield Market BB/B-Rated Capped Custom Index.

|

|

2.

|

In the “Principal Investment Strategies” section of the Fund’s Prospectus,

the sixth, seventh, and eighth paragraphs are deleted in their entirety and replaced with the following:

|

As of November 12, 2019, the

FTSE US Treasury 1-5 Years Index included 145 issues. As of November 12, 2019, the credit ratings for the rated components in the

FTSE US Treasury 1-5 Years Index ranged from AA+ to AA+, as determined by S&P or Moody’s. The FTSE US Treasury 1-5 Years

Index is rebalanced monthly.

As of November 12, 2019, the

FTSE US Treasury 7-10 Years Index included 18 issues. As of November 12, 2019, the credit ratings for the rated components in the

FTSE US Treasury 7-10 Years Index ranged from AA+ to AA+, as determined by S&P or Moody’s. The FTSE US Treasury 7-10

Years Index is rebalanced monthly.

As of November 12, 2019, the

FTSE US High-Yield Market BB/B-Rated Capped Custom Index included 794 issues. As of November 12, 2019, the credit ratings for the

rated components in the FTSE US High-Yield Market BB/B-Rated Capped Custom Index ranged from BB to B, as determined by S&P

or Moody’s. The FTSE US High-Yield Market BB/B-Rated Capped Custom Index is rebalanced monthly.

|

|

3.

|

In the “Additional Information about the Funds - Underlying Index” section of the

Fund’s Statutory Prospectus, the first paragraph is deleted in its entirety and replaced with the following:

|

As of each monthly reconstitution,

the Underlying Index will be fully invested in one of the three following sub-indexes: FTSE US Treasury 1-5 Years Index; FTSE US

Treasury 7-10 Years Index; and FTSE High-Yield Market BB/B-Rated Capped Custom Index. The FTSE US Treasury 1-5 Years Index includes

fixed-rate U.S. Treasury bonds with remaining maturities of 1 to 5 years. The FTSE US Treasury 7-10 Years Index includes fixed-rate

U.S. Treasury bonds with remaining maturities of 7 to 10 years. The FTSE High-Yield Market BB/B-Rated Capped Custom Index includes

high-yield debt with remaining maturities of at least one year. The Underlying Index will invest in the sub-index with the highest

prior three-month returns as of the time of the monthly reconstitution, accordingly, at times, the Underlying Index may be invested

only in the FTSE High-Yield Market BB/B-Rated Capped Custom Index.

PLEASE RETAIN THIS SUPPLEMENT FOR FUTURE

REFERENCE.

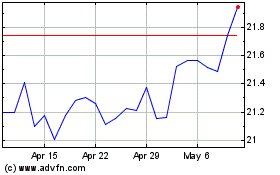

Kraneshares Msci One Bel... (AMEX:OBOR)

Historical Stock Chart

From Mar 2024 to Apr 2024

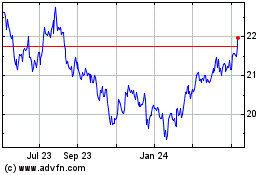

Kraneshares Msci One Bel... (AMEX:OBOR)

Historical Stock Chart

From Apr 2023 to Apr 2024