As filed with the Securities and Exchange Commission on December 9,

2019

Registration No.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF

1933

Premier Biomedical, Inc.

(Exact name of registrant as specified in its charter)

|

Nevada

|

2836

|

27-2635666

|

|

(State

or other jurisdiction of incorporation or organization

|

(Primary

Standard Industrial Classification Code Number)

|

(I.R.S.

Employer Identification No.)

|

|

P.O.

Box 25

Jackson

Center, PA 16133

|

(814)

786-8849

|

|

(Address,

including zip code, of registrant’s principal executive

offices)

|

(Telephone

number, including area code)

|

William

A. Hartman

Chief

Executive Officer

Premier

Biomedical, Inc.

P.O.

Box 25

Jackson

Center, PA 16133

(814)

786-8849

(Name,

address, including zip code, and telephone number, including

area code, of agent for service)

COPIES

TO:

Brian

A. Lebrecht, Esq.

Clyde

Snow & Sessions, PC

201 S.

Main Street, 13th Floor

Salt

Lake City, UT 84111

(801)

322-2516

Approximate

date of commencement of proposed sale to the public:

From

time to time after this registration statement becomes

effective.

If any

of the securities being registered on this Form are to be offered

on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, check the following box. [ X ]

If this

Form is filed to register additional securities for an offering

pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same

offering. [ ]

If this

Form is a post-effective amendment filed pursuant to Rule 462(c)

under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier

effective registration statement for the same offering. [

]

If this

Form is a post-effective amendment filed pursuant to Rule 462(d)

under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier

effective registration statement for the same offering. [

]

Indicate

by check mark whether the registrant is a large accelerated filer,

an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See definitions of “large accelerated

filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act. (Check

one):

|

Large

accelerated filer

|

☐

|

Accelerated

filer

|

☐

|

|

Non-accelerated

filer

|

☐

|

Smaller

reporting company

|

☑

|

|

(Do not

check if a smaller reporting company)

|

|

Emerging growth

company

|

☐

|

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended

transition period for complying with any new or revised financial

accounting standards provided to Section 7(a)(2)(B) of the

Securities Act. [ ]

CALCULATION

OF REGISTRATION FEE

|

Title of Each

Class of Securities to be Registered

|

Amount to be

Registered (1)

|

Proposed Maximum

Offering Price Per Share (2)

|

Proposed Maximum

Aggregate Offering Price

|

Amount of

Registration Fee (3)

|

|

Shares of Common

Stock, par value $0.00001 per share

|

1,000,000,000

|

$0.0006

|

$600,000

|

$77.88

|

(1)

We are registering

1,000,000,000 shares of our common

stock that we will sell to Green Coast Capital International SA

pursuant to an Equity Purchase Agreement dated October 3, 2019,

which together shall have an aggregate initial offering price not

to exceed $5,000,000.

In the

event the maximum aggregate offering price is reached, any

remaining unsold shares shall be removed from

registration. The proposed maximum offering price per

share will be determined by the registrant in connection with the

issuance by the registrant of the securities registered

hereunder.

(2)

Estimated solely

for the purpose of computing the registration fee pursuant to Rule

457(c) of the Securities Act of 1933, as amended. Price per share

is based on the average of the high and low prices per share of our

common stock reported in the consolidated reporting system as

reported on the Pink Sheets Current Marketplace maintained by OTC

Markets, Inc. on December 3, 2019.

(3)

Calculated pursuant

to Rule 457(o) based on an estimate of the proposed maximum

aggregate offering price.

The

registrant hereby amends this registration statement on such date

or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states

that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933 or

until the registration statement shall become effective on such

date as the Commission, acting pursuant to said Section 8(a), may

determine.

The information in this Prospectus is not complete and may be

changed. We may not sell these securities until the registration

statement filed with the SEC is effective. This Prospectus is not

an offer to sell and it is not soliciting an offer to buy these

securities in any state where the offer or sale is not

permitted.

|

Preliminary Prospectus

|

Subject to Completion

|

Dated [•], 2019

|

PROSPECTUS

Up to

1,000,000,000 shares of common stock

We are

hereby registering 1,000,000,000 shares, representing 50% of our

authorized common stock1, for sale by Green

Coast Capital International SA, a Panama corporation and an

underwriter in this offering, pursuant to an Equity Purchase

Agreement. The agreement allows us to require Green Coast to

purchase up to $5,000,000 of our common stock.

We are

not selling any shares of common stock in the resale

offering. We, therefore, will not receive any proceeds

from the sale of the shares by the selling

shareholder. We will, however, receive proceeds from the

sale of securities to Green Coast pursuant to Put Notice(s) under

the Equity Purchase Agreement.

This

offering will terminate on the earlier of (i) when all

1,000,000,000 shares are sold, (ii) when the maximum offering

amount of $5,000,000 has been achieved, or (iii) on January

[•], 2022, unless we terminate it

earlier.

Investing

in the common stock involves risks. Premier Biomedical, Inc. has

limited operations, limited income, and limited assets, and you

should not invest unless you can afford to lose your entire

investment. See “Risk Factors” beginning on page 5.

Neither the Securities and Exchange Commission nor any state

securities commission has approved or disapproved of these

securities or determined if this Prospectus is truthful or

complete. Any representation to the contrary is a criminal offense.

Our common stock is governed under The Securities Enforcement and

Penny Stock Reform Act of 1990, and as a result you may be limited

in your ability to sell our stock.

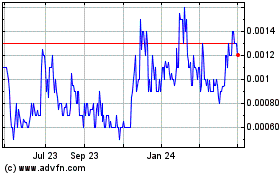

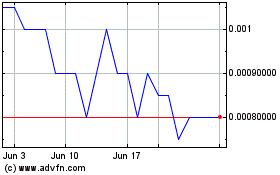

Our

common stock is registered under Section 12(g) of the Securities

Exchange Act of 1934 and is quoted on the Pink Sheets Current

Marketplace maintained by OTC Markets, Inc. under the symbol

“BIEI.” The closing price of our common stock as

reported on the Pink Sheets Current on December 3, 2019 was

$0.0006.

These

shares will be sold by Green Coast from time to time whenever the

person or persons who exercise voting control over Green Coast deem

it appropriate and for whatever reason the person or persons

who exercise voting control over Green Coast deem it appropriate in

the over-the-counter market or other national securities exchange

or automated interdealer quotation system on which our common stock

is then listed or quoted, through negotiated transactions or

otherwise at market prices prevailing at the time of sale or at

negotiated prices. We provide more information about how the

Selling Shareholders may sell their shares of common stock in the

section of this prospectus entitled “Plan of Distribution” beginning

on page 25.

We will

bear all costs associated with this registration

statement.

Green

Coast, and any participating broker-dealers, will be deemed to be

“underwriters” within the meaning of the Securities Act

of 1933, as amended, or the “Securities Act,” and any

commissions or discounts given to any such broker-dealer may be

regarded as underwriting commissions or discounts under the

Securities Act. Green Coast will purchase the shares of our common

stock for ninety percent (90%) of the

lowest closing trade price of the common stock during the five (5)

trading days immediately following the date Green Coast receives

shares of our common stock pursuant to a put notice issued under

the Equity Purchase Agreement. Green Coast has informed us

that they do not have any agreement or understanding, directly or

indirectly, with any person to distribute their common

stock.

Neither

the Securities and Exchange Commission nor any state securities

commission has approved or disapproved of these securities or

determined if this Prospectus is truthful or complete. Any

representation to the contrary is a criminal offense. Our common

stock is governed under The Securities Enforcement and Penny Stock

Reform Act of 1990, and as a result you may be limited in your

ability to sell our stock.

The date of this Prospectus is [•], 2019.

Table of Contents

|

|

|

Page

|

|

Part

I

|

|

Prospectus

Summary

|

|

1

|

|

Risk

Factors

|

|

4

|

|

Use of

Proceeds

|

|

20

|

|

Determination

of Offering Price

|

|

|

|

Dilution

|

|

|

|

Selling

Security Holders

|

|

21

|

|

Plan of

Distribution

|

|

22

|

|

Description

of Securities to be Registered

|

|

24

|

|

Interests

of Named Experts and Counsel

|

|

25

|

|

Description

of Business

|

|

26

|

|

Description

of Property

|

|

35

|

|

Legal

Proceedings

|

|

35

|

|

Selected

Financial Data

|

|

36

|

|

Management’s

Discussion and Analysis

|

|

37

|

|

Changes

in and Disagreements with Accountants on Accounting and Financial

Disclosure

|

|

48

|

|

Directors,

Executive Officers, Promoters, and Control Persons

|

|

49

|

|

Executive

Compensation

|

|

52

|

|

Security

Ownership of Certain Beneficial Owners and Management

|

|

55

|

|

Certain

Relationships and Related Transactions

|

|

56

|

|

Disclosure

of Commission Position on Indemnification for Securities Act

Liabilities

|

|

58

|

|

Where

You Can Find More Information

|

|

59

|

|

Experts

|

|

60

|

|

Index

to Financial Statements

|

|

F-1

|

ABOUT THIS PROSPECTUS

This

prospectus is part of a registration statement that we filed on

behalf of the Selling Shareholders with the Securities and Exchange

Commission (the “Commission”) to permit the Selling

Shareholders to sell the shares described in this prospectus in one

or more transactions. The Selling Shareholders and the plan of

distribution of the shares being offered by them are described in

this prospectus under the headings “Selling Shareholders” and

“Plan of

Distribution.”

You

should rely only on the information that is contained in this

prospectus. We and the Selling Shareholders have not authorized

anyone to provide you with information that is in addition to or

different from that contained in this prospectus. If anyone

provides you with different or inconsistent information, you should

not rely on it.

The

shares of common stock offered by this prospectus are not being

offered in any jurisdiction where the offer or sale of such common

stock is not permitted. You should not assume that the information

contained in this prospectus is accurate as of any date other than

the date of this prospectus regardless of the date of delivery of

this prospectus or any sale of the common stock offered by this

prospectus. Our business, financial condition, liquidity, results

of operations and prospects may have changed since those dates. The

rules of the Commission may require us to update this prospectus in

the future.

PROSPECTUS SUMMARY

PREMIER BIOMEDICAL, INC.

This

summary highlights selected information contained in greater detail

elsewhere in this prospectus. This summary does not contain all the

information you should consider before investing in our common

stock. You should read the entire prospectus, including our

financial statements and related notes and the information set

forth under the heading “Risk Factors” and

“Management’s Discussion and Analysis of Financial

Condition and Results of Operations” before investing in our

common stock. In this prospectus, the “Company,”

“we,” “us,” and “our” refer to

Premier Biomedical, Inc.

We were

strictly a research-based company that intended to discover cures

for PTSD, cancer and various other diseases. In order to fund

on-going research and development in these areas, we developed a

line of topical hemp oil pain relief products. We began selling

these pain relief products in January of 2017 with a single product

and currently have eight topical pain relief products.

Through

our continued development and expansion of proprietary drugs and

treatments, we have reorganized the company into six technology

centers: (1) extra-corporeal treatment of disease, (2) PTSD

treatment, (3) anti-breast cancer drugs, (4) hemp oil/CBD pain

relief products, (5) anti-aging treatments, and (6) chemical and

alcohol addiction treatment.

Pain Management Products

We have

developed and are now marketing all-natural, hemp-oil based

products that are pesticide and solvent free. These products

provide generalized, neuropathic and localized topical pain

relief.

We

offer alternatives to dangerous and addictive opioid pain killers,

which are currently the principal contributors to roughly 200 drug

overdose deaths per day in the United States. In the past year we

have rapidly expanded our product offerings, and we now offer eight

pain relief products that are leaders in the pain-relief

field:

1.

96-hour pain relief

patch with 50 mg of hemp oil extract, the highest level of pain

relief ingredient available in the industry;

2.

120 mg/ 10 ml

water-based roll-on applicator;

3.

150 mg/ 10 ml

oil-based roll-on applicator;

4.

150 mg/ 30 ml

oil-based pump spray applicator;

5.

150 mg/ 2 oz.

ointment;

6.

200 mg/10 ml

oil-based roll-on applicator;

7.

500 mg/ 30 ml

oil-based pump spray applicator; and

8.

500 mg/ 1 oz.

ointment.

We

believe that this eight-product array positions us favorably in the

topical pain relief marketplace. The topical pain relief market is

expected to grow rapidly in the next few years, due to the focus on

reduction of opioid pain medication use, and we intend to be a

major player in that expanding market.

Now

that we have completed the product design and development phase, we

are aggressively embarking on the product distribution and sales

phase by:

1.

Expanding our

online sales beyond our web site at:

www.painreliefmeds.com;

2.

Securing the

services of a social media coordinator to ensure that we optimize

that promotional tool;

3.

Recruiting a

National Sales Director to coordinate our growing field of sales

representatives and distributors;

4.

Securing the

services of a sales organization with expertise in marketing to the

government and senior care facilities;

5.

Engaging an

investor relations firm to facilitate television appearances

designed to gain optimum exposure for our company and its

products;

6.

Appearing in radio

and television broadcasts, and podcasts, via Uptick Newswire

periodically to ensure that our story gets out to the public;

and

7.

Retaining the

services of marketing firms to promote the Company and its products

through social media.

8.

Establishing

relationships with major distributors who will blanket specialized

sales outlets such as pharmacies, doctors’ offices,

convenience stores, long-term care facilities, large retail

facilities, etc.

In

addition, we are in the process of seeking potential partnerships

outside the United States to manufacture and market our products

worldwide. We anticipate that these partnerships will make new

markets available to us and allow us to rapidly increase our sales

and profitability through favorable manufacturing

arrangements.

Customers indicate

that they were able to achieve pain relief from our products and

stop the use of opioid painkillers. Public awareness of the harmful

side effects of opioid painkillers has grown significantly, and

many states have initiated litigation against drug makers claiming

they misrepresented the risks of opioid painkillers.2 As patients seek to

cut back their use of opioid painkillers and look for alternatives,

we believe demand for our products will see a significant increase.

We intend to petition national insurance agencies to urge them to

consider covering the use of our all-natural pain relief products

as a safe alternative to opioid painkillers.

Corporate Information

We

were incorporated on May 10, 2010 in the State of Nevada. We have

two wholly-owned subsidiaries, Premier Biomedical Pain Relief Meds,

LLC, a Nevada limited liability company organized on September 14,

2017, and Health Stations, LLC, a Nevada limited liability company

organized on August 28, 2019.

Our

corporate headquarters are located in Jackson Center, PA. Our

mailing address is P.O. Box 25, Jackson Center, PA 16133,

and our telephone number is (724) 633-7033. We have offices

virtually in the homes of our management team who

reside in Pennsylvania, Michigan and various other states. Our

websites are www.premierbiomedical.com and

www.painreliefmeds.com.

Information contained on our website is not incorporated into, and

does not constitute any part of, this Prospectus.

The Offering

We are

registering up to 1,000,000,000 shares of our common stock for

resale by Green Coast Capital International SA, a Panama

corporation and an underwriter in this offering, pursuant to an

Equity Purchase Agreement. The agreement allows us to require Green

Coast to purchase up to $5,000,000 of our common

stock.

These

shares will be sold by Green Coast from time to time whenever and

for whatever reason the person or persons who exercise voting

control over Green Coast deem it appropriate in the

over-the-counter market or other national securities exchange or

automated interdealer quotation system on which our common stock is

then listed or quoted, through negotiated transactions or otherwise

at market prices prevailing at the time of sale or at negotiated

prices.

Green

Coast will purchase the shares of our common stock for ninety

percent (90%) of the lowest closing

bid price of the common stock during the five consecutive trading

days immediately following following the Clearing Date

associated with our Put Notice. Green Coast received a convertible

promissory note in the principal amount of $150,000, for which they

paid $25,000 cash, as a commitment for the investment. The shares

of our common stock issuable upon conversion of the note are not

included in this registration statement. Green Coast has informed

us that they do not have any agreement or understanding, directly

or indirectly, with any person to distribute our common

stock.

We will

not be permitted to submit a Put Notice to Green Coast, or draw

down any funds from the financing arrangement, if the shares issued

to Green Coast would cause them to beneficially own more than 4.99%

of our outstanding common stock on the date of the issuance of the

shares. The 1,000,000,000 shares being registered represent a good

faith estimate of the number of shares of common stock that will be

issuable pursuant to the agreement.

On

any Closing Date, we shall deliver to Green Coast the number of

shares of the Common Stock registered in the name of Green Coast as

specified in the Put Notice. In addition, we must deliver the other

required documents, instruments and writings required. Green Coast

is not required to purchase the shares unless:

●

Our Registration

Statement with respect to the resale of the shares of Common Stock

delivered in connection with the applicable put shall have been

declared effective;

●

We shall have

obtained all material permits and qualifications required by any

applicable state for the offer and sale of the Registrable

Securities; and

●

We shall have filed

with the SEC in a timely manner all reports, notices and other

documents required.

Green

Coast has agreed that neither it nor its affiliates will engage in

any short selling of the common stock.

All of

the common stock registered by this Prospectus will be sold by

Green Coast at the prevailing market prices at the time they are

sold. We currently have 186,961,480 shares of common stock

outstanding, and if all of the shares included in the registration

statement of which this Prospectus is a part are issued, and all

outstanding warrants are exercised, we will have over 1.2 billion

shares of common stock outstanding.

RISK FACTORS

Any

investment in our common stock involves a high degree of risk. You

should consider carefully the following information, together with

the other information contained in this Annual Report, before you

decide to buy our common stock. If one or more of the following

events actually occurs, our business will suffer, and as a result

our financial condition or results of operations will be adversely

affected. In this case, the market price, if any, of our common

stock could decline, and you could lose all or part of your

investment in our common stock.

Currently, our

focus is on the development and distribution of our pain products.

We are also developing medical treatments for Alzheimer’s

disease, multiple sclerosis, amyotrophic lateral sclerosis,

fibromyalgia, traumatic brain injury, blood sepsis and viremia, and

cancer. We face risks in developing our product candidates and

services and eventually bringing them to market. We also face risks

that our business model may become obsolete. The following risks

are material risks that we face. If any of these risks occur, our

business, our ability to achieve revenues, our operating results

and our financial condition could be seriously harmed.

Risk Factors Related to the Offering

Existing stockholders may experience significant dilution from the

sale of our common stock pursuant to the Green Coast Equity

Purchase Agreement.

The

sale of our common stock to Green Coast Capital International SA in

accordance with the Equity Purchase Agreement may have a dilutive

impact on our shareholders. As a result, our net income per share

could decrease in future periods and the market price of our common

stock could decline. In addition, the lower our stock price is at

the time we exercise our put options, the more shares of our common

stock we will have to issue to Green Coast in order to exercise a

put under the Equity Purchase Agreement. If our stock price

decreases, then our existing shareholders would experience greater

dilution for any given dollar amount raised through the

Offering.

The

perceived risk of dilution may cause our stockholders to sell their

shares, which may cause a decline in the price of our common stock.

Moreover, the perceived risk of dilution and the resulting downward

pressure on our stock price could encourage investors to engage in

short sales of our common stock. By increasing the number of shares

offered for sale, material amounts of short selling could further

contribute to progressive price declines in our common

stock.

The issuance of shares pursuant to the Green Coast Equity Purchase

Agreement may have a significant dilutive effect.

Depending

on the number of shares we issue pursuant to the Green Coast Equity

Purchase Agreement, it could have a significant dilutive effect

upon our existing shareholders. Although the number of shares that

we may issue pursuant to the Equity Purchase Agreement will vary

based on our stock price (the higher our stock price, the less

shares we have to issue) the information set out below indicates

the potential dilutive effect to our shareholders, based on

different potential future stock prices, if the full amount of the

Equity Purchase Agreement is realized.

Dilution based upon common stock put to Green

Coast and the stock price discounted to Green Coast’s

purchase price of 90% of the lowest closing bid price of the common

stock during the five consecutive trading days immediately

following the Clearing Date associated with our Put

Notice. The example below illustrates

dilution based upon a $0.0006 market price/$0.00054 purchase price

and other increased/decreased prices (without regard to Green

Coast’s 4.99% ownership limit):

$5,000,000 Put

|

Stock Price (Green Coast Purchase Price)

|

|

Percentage of Outstanding Shares (1)

|

|

$0.00075

($0.000675) +25%

|

7.4 billion

|

97%

|

|

$0.0006

($0.00054)

|

9.3 billion

|

98%

|

|

$0.00045

($0.000405) -25%

|

12.3 billion

|

99%

|

|

(1)

|

Based on 200,000,000 shares outstanding before the first Put, as of

December 3, 2019.

|

Green Coast Capital Group, LLC will pay less than the

then-prevailing market price of our common stock which could cause

the price of our common stock to decline.

Our common stock to be issued to Green Coast under

the Equity Purchase Agreement will be purchased at a ten percent

(10%) discount or ninety percent (90%) of the lowest closing bid

price of the common stock during the five consecutive trading days

immediately following the Clearing Date associated with our

Put Notice.

Green

Coast has a financial incentive to sell our shares immediately upon

receiving the shares to realize the profit between the discounted

price and the market price. If Green Coast sells our shares, the

price of our common stock may decrease. If our stock price

decreases, Green Coast may have a further incentive to sell such

shares. Accordingly, the discounted sales price in the Equity

Purchase Agreements may cause the price of our common stock to

decline.

Green Coast Capital International SA has entered into similar

agreements with other public companies and may not have sufficient

capital to meet our put notices.

Green

Coast has entered into similar investment agreements with other

public companies, and some of those companies have filed

registration statements with the intent of registering shares to be

sold to Green Coast pursuant to investment agreements. We do not

know if management at any of the companies who have or will have

effective registration statements intend to raise funds now or in

the future, what the size or frequency of each put request would

be, if floors will be used to restrict the amount of shares sold,

or if the investment agreement will ultimately be cancelled or

expire before the entire amount of shares are put to Green Coast.

Since we do not have any control over the requests of these other

companies, if Green Coast receives significant requests, it may not

have the financial ability to meet our requests. If so, the amount

of available funds may be significantly less than we

anticipate.

We are registering an aggregate of 1,000,000,000 shares of common

stock to be issued under the Green Coast Equity Purchase Agreement.

The sale of such shares could depress the market price of our

common stock.

We

are registering an aggregate of 1,000,000,000 shares of common

stock under the registration statement of which this Prospectus

forms a part for issuance pursuant to the Green Coast Equity

Purchase Agreement. The sale of these shares into the public market

by Green Coast could depress the market price of our common

stock.

Risk Factors Related to the Business of the Company

We have a limited operating history and our financial results are

uncertain.

We have

a limited history and face many of the risks inherent to a new

business. As a result of our limited operating history, it is

difficult to accurately forecast our potential revenue. We were

incorporated in Nevada in 2010. Our revenue and income potential is

unproven and our business model is still emerging. Therefore,there

can be no assurance that we will provide a return on investment in

the future. An investor in our common stock must consider the

challenges, risks and uncertainties frequently encountered in the

establishment of new technologies, products and processes in

emerging markets and evolving industries. These challenges include

our ability to:

●

execute our

business model;

●

create brand

recognition;

●

manage growth in

our operations;

●

create a customer

base in a cost-effective manner;

●

access additional

capital when required; and

●

attract and retain

key personnel.

There

can be no assurance that our business model will be successful or

that it will successfully address these and other challenges, risks

and uncertainties.

We will need additional funding in the future, and if we are unable

to raise capital when needed, we may be forced to delay, reduce or

eliminate our product candidate development programs, commercial

efforts, or sales efforts.

Developing products

and methods and procedures of treatment and marketing developed

products is costly. We will need to raise substantial additional

capital in the future in order to execute our business plan and

help us and our collaboration partners fund the development and

commercialization of our product candidates.

In 2014

and through 2019, we raised funds through public and private equity

offerings. We may need to finance future cash needs through public

or private equity offerings, debt financings or strategic

collaboration and licensing arrangements. To the extent that we

raise additional funds by issuing equity securities, our

shareholders may experience additional dilution, and debt

financing, if available, may involve restrictive covenants and may

result in high interest expense. If we raise additional funds

through collaboration and licensing arrangements, it may be

necessary to relinquish some rights to our product candidates,

processes and technologies or our development projects or to grant

licenses on terms that are not favorable to us. We cannot be

certain that additional funding will be available on acceptable

terms, or at all. If adequate funds are not available from the

foregoing sources, we may consider additional strategic financing

options, including sales of assets, or we may be requiredto delay,

reduce the scope of, or eliminate one or more of our research or

development programs or curtail some of our commercialization

efforts of our operations. We may seek to access the public or

private equity markets whenever conditions are favorable, even if

we do not have an immediate need for additional

capital.

Negative public perception of hemp and cannabis-related businesses,

misconceptions about the nature of our business and regulatory

uncertainties could have a material adverse effect on our business,

financial condition, and results of operations.

The hemp plant

and the cannabis/marijuana plant are both part of the

same cannabis sativa

genus species of plant, except that hemp, by

definition, has less than 0.3% tetrahydrocannabinol

(“THC”) content and is legal under federal and state

laws, but the same plant with a higher THC content is

cannabis/marijuana, which is legal under certain state laws, but

which is not legal under federal law. The similarities between

these plants can cause confusion, and our activities with

legal hemp may be incorrectly perceived as us being

involved in federally illegal cannabis/marijuana. Also, despite

growing support for the cannabis/marijuana industry and

legalization of cannabis/marijuana in certain U.S. states, many

individuals and businesses remain opposed to the cannabis/marijuana

industry. Any negative press resulting from any incorrect

perception that we have entered into the cannabis/marijuana space

could result in a loss of current or future business. It could also

adversely affect the public’s perception of us and lead to

reluctance by new parties to do business with us or to own our

common stock.

Certain

retailers, like Amazon, do not allow the sale of products

containing CBD. Other platforms such as Facebook and Google have

policies that restrict advertising of CBD products. Until

regulators provide more definitive and consistent rules for CBD

products, many retailers, distributors and business partners tend

to avoid getting involved in CBD businesses because of the

uncertainty of what regulators may do. Misunderstandings about the

legal nature of our business and the difference between CBD and

marijuana may also discourage some business partners and customers

from working with us or purchasing our products.

We

cannot assure you that additional business partners, including but

not limited to online retailers, distributors, financial

institutions and customers, will not attempt to end or curtail

their relationships with us. Any such negative press or cessation

of business could have a material adverse effect on our business,

financial condition, and results of operations.

U.S. federal, state and foreign regulation and enforcement of laws

relating to cannabis and its derivatives may adversely affect our

ability to sell our products and our revenue.

There

are (i) thirty-three (33) states in the United States, the District

of Columbia, Guam and Puerto Rico have approved comprehensive

public medical marijuana/cannabis programs. Approved Efforts in

another thirteen (13) states allow use of low THC, high CBD

products for medical reasons in limited situations or as a legal

defense. Ten (10) of these states and the District of Columbia have

legalized cannabis/marijuana for adult recreational

use. This leaves only

four states (Idaho, Kansas, Conversely, under the federal

Controlled Substances Act (the “CSA”), the policies and

regulations of the federal government and its agencies are that

cannabis/marijuana has no medical benefit and a range of activities

are prohibited, including cultivation, possession, personal use,

and interstate distribution of cannabis/marijuana. In the event the

U.S. Department of Justice (the “DOJ”) begins strict

enforcement of the CSA in states that have laws legalizing medical

and/or adult recreational cannabis/marijuana, there may be a direct

and adverse impact to any future business or prospects that we may

have in the cannabis/marijuana business. Even in those

jurisdictions in which the manufacture and useof medical

cannabis/marijuana has been legalized at the state level, the

possession, use, and cultivation of cannabis/marijuana all remain

violations of federal law that are punishable by imprisonment and

substantial fines. Moreover, individuals and entities may violate

federal law if they intentionally aid and abet another in violating

these federal controlled substance laws, or conspire with another

to violate them.

For

example, the California Bureau of Cannabis Control sent nine

hundred (900) warning letters to marijuana shops suspected of

operating without a state license. The Bureau also issued a

cease-and-desist letter to the operator of an online directory of

marijuana dispensaries, products, and delivery services. The letter

threatened fines and criminal penalties if the company did not

remove the listings for unlicensed marijuana businesses. Likewise,

if we unknowingly do business with unlicensed entities or list them

on our website, we may be subject to similar regulatory action that

would halt our operations and affect our financial

performance.

Local,

state, federal, and international hemp and

cannabis/marijuana laws and regulations are broad in scope and

subject to evolving interpretations, which could require us to

incur substantial costs associated with compliance requirements. In

addition, violations of these laws, or allegations of such

violations, could disrupt our business and result in a material

adverse effect on our operations. In addition, it is possible that

cannabinoid-related regulations may be enacted in the future that

will be directly applicable to our business. It is also possible

that the federal government will begin strictly enforcing existing

laws, which may limit the legal uses of the hemp plant and its

derivatives and extracts, such as cannabinoids. However, our work

in hemp would continue since hemp research, development, and

commercialization activities are permitted under applicable federal

and state laws, rules, and regulations. Until Congress amends the

CSA or the executive branch deschedules or reschedules cannabis

under it, there is a risk that federal authorities may enforce

current federal law. Enforcement of the CSA by federal authorities

could impair the Company’s revenue and profit, and it could

even force the Company to cease manufacturing its products. The

risk of strict federal enforcement of the CSA in light of

congressional activity, judicial holdings, and stated federal

policy, including enforcement priorities, remains

uncertain.

Until

such time as the federal government reclassifies marijuana from a

Schedule 1 narcotic, we do not intend to pursue any

involvement in the marijuana business. At this time, we intend to

continue only in the federally legal hemp product business. When

Congress approved the 2018 Farm Bill, it defined hemp as an

agricultural product and differentiated it from marijuana. This

means hemp is not a controlled substance, and may be more broadly

cultivated. Hemp-derived products may now be transferred across

state lines for commercial purposes. The new law also allows for

the sale, transport, or possession of hemp-derived products, so

long as those items are produced in a manner consistent with the

law. There are several restrictions that apply to those who

cultivate hemp and produce hemp-derived products. Key among these

restrictions is that hemp cannot contain more than 0.3 percent

THC.

While

the 2018 Farm Bill legalized the cultivation of hemp and removed

hemp-derived substances from Schedule 1 of the CSA, it does not

legalize CBD generally. The FDA and DOJ continue to exercise

control over CBD and there is still some lack of clarity as to

exactly how CBD will be regulated going forward.

CBD has

been deemed relatively safe and, from now on, should not be subject

to international illicit drug scheduling according to a World

Health Organization (“WHO”) comprehensive review

published in July 2018. The WHO has formally submitted its

conclusion to United Nations Secretary-General António

Guterres, a prelude to this officially becoming the

case.

On June

25, 2018, the U.S. Food and Drug Administration (“FDA”)

approved CBD-based Epidiolex to treat severe forms of epilepsy.

This marked the groundbreaking admission by the FDA that cannabis

has medical value. On October 1, 2018, the DOJ placed

“FDA-approved drugs that contain CBD derived from cannabis

and no more than 0.1 percent THC” to Schedule 5 of the CSA.

This action is narrowly tailored to reschedule Epidiolex off of

Schedule 1 because the DOJ’s ability to remove all

restrictions from cannabis extracts, including CDB, is restricted

by the Single Convention on Narcotic Drugs, 1961.

Our product candidates are not approved by the FDA or other

regulatory authority, and we face risks of unforeseen medical

problems, and up to a complete ban on the sale of our product

candidates.

The

efficacy and safety of pharmaceutical products is established

through a process of clinical testing under FDA oversight. Our

products have not gone through this process because we believe that

the topical products we sell are not subject to this process.

However, if an individual were to use one of our products in an

improper manner, we cannot predict the potential medical harm to

that individual. If such an event were to occur, the FDA or similar

regulatory agency might impose a complete ban on the sale or use of

our products.

The FDA might not approve

our product candidates for marketing and sale.

We

intend to enter into agreements with larger pharmaceutical

companies as collaboration partners, in part to help cover the cost

of seeking regulatory approvals for our pharmaceutical and medical

product candidates. We believe that FDA approval of some of our

product candidates will need to undergo a full investigational new

drug (IND) application with the FDA, including clinical trials.

There can be no assurance that the FDA will approve our IND

application or any other applications. Failure to obtain the

necessary FDA approval will have a material negative affect on our

operations. While we intend to license our Feldetrex®

product to a larger pharmaceutical company, they in turn, may not

be able to obtain the necessary approval to market and sale the

product.

New regulations governing the introduction, marketing and sale of

our products to consumers could harm our business.

Our

pain management products have not been approved by the FDA or any

other regulatory agency, and the FDA does not have a

pre-market approval system for our pain management

products. However, our operations could be harmed if new laws or

regulations are enacted that restrict our ability to market or

distribute our products or impose additional burdens or

requirements on us in order to continue selling our products. In

addition, the adoption of new regulations or changes in the

interpretations of existing regulations may result in significant

compliance costs or discontinuation of product sales and may impair

the marketability of our products, resulting in significant loss of

net sales.

We have

observed a general increase in regulatory activity and activism in

the United States and the regulatory landscape is becoming more

complex with increasingly strict requirements. If this trend

continues, we may find it necessary to alter some of the ways we

have traditionally marketed our products in order to stay in

compliance with a changing regulatory landscape and this could add

to the costs of our operations and/or have an adverse impact on our

business.

We

cannot predict the nature of any future laws, regulations,

interpretations, or applications, nor can we determine what effect

additional governmental regulations or administrative orders, when

and if promulgated, would have on our business. Future changes

could include requirements to make certain changes to our products

to meet new standards, the recall or discontinuation of certain

products that cannot be changed, additional record keeping,

expanded documentation of the properties of certain products,

expanded or different labeling, and additional scientific

substantiation. Any or all of these requirements could have a

material adverse effect on our business, financial condition, and

operating results.

We may fail to deliver commercially successful new product

candidates, methods and procedures of treatment, and

treatments.

Our

technology is at an early stage of research and development. We are

also actively engaged in research and development of new

products.

The

development of commercially viable new products and methods and

procedures of treatment, as well as the development of additional

uses for existing products and methods and procedures of treatment,

is critical to our ability to generate sales and/or sell the rights

to manufacture and distribute our product and process candidates to

another firm. Developing new products and methods and procedures of

treatment is a costly, lengthy and uncertain process. A new product

or process candidate can fail at any stage of the development or

commercialization, and one or more late-stage product or process

candidates could fail to receive regulatory approval.

New

product and process candidates may appear promising in development,

but after significant investment, fail to reach the market or have

only limited commercial success. This, for example, could be as a

result of efficacy or safety concerns, inability to obtain

necessary regulatory approvals, difficulty or excessive costs to

manufacture, erosion of patent term as a result of a lengthy

development period, infringement of third-party patents or other

intellectual property rights of others or inability to

differentiate the product or process adequately from those with

which it competes.

The commercialization of product and process candidates under

development may not be profitable.

In

order for the commercialization of our product candidates to be

profitable, our product and process candidates must be

cost-effective and economical to manufacture on a commercial scale.

Furthermore, if our product candidates and methods and procedures

of treatment do not achieve market acceptance, we may not be

profitable. Subject to regulatory approval, we expect to incur

significant development, sales and marketing expenses in connection

with the commercialization of our new product and process

candidates. Even if we receive additional financing, we may not be

able to complete planned development and marketing of any or all of

our product or process candidates. Our future profitability may

depend on many factors, including, but not limited to:

●

the terms and

timing of any collaborative, licensing and other arrangements that

we may establish;

●

the costs of

filing, prosecuting, defending and enforcing any patent claims and

other intellectual property rights;

●

the costs of

establishing manufacturing and production, sales, marketing and

distribution capabilities; and

●

the effect of

competing technological and market developments.

Even if

our collaboration partners receive regulatory approval for our

product and process candidates, we may not earn significant

revenues from such product or process candidates. With respect to

the product and methods and procedures of treatment candidates in

our development pipeline that are being developed by or in close

conjunction with third parties, our ability to generate revenues

from such product and process candidates will depend in large part

on the efforts of such third parties. To the extent that our

collaboration partners are not successful in commercializing our

product or process candidates, our revenues will suffer, we will

incur significant additional losses and the price of our common

stock will be negatively affected.

We may engage in strategic transactions that fail to enhance

shareholder value.

From

time to time, we may consider possible strategic transactions,

including the potential acquisitions or licensing of products or

technologies or acquisition of companies, and other alternatives

with the goal of maximizing shareholder value. We may never

complete a strategic transaction, and in the event that we do

complete a strategic transaction, implementation of such

transactions may impair shareholder value or otherwise adversely

affect our business. Any such transaction may require us to incur

non-recurring or other charges and may pose significant integration

challenges and/or management and business disruptions, any of which

could harm our results of operation and business

prospects.

Our business is heavily regulated by governmental authorities, and

failure to comply with such regulation or changes in such

regulations could negatively impact our financial

results.

We must

comply with a broad range of regulatory controls on the testing,

approval, manufacturing and marketing of our product candidates,

procedures and other treatments, particularly in the United States

and countries of the European Union, that affect not only the cost

of product development but also the time required to reach the

market and the uncertainty of successfully doing so. Health

authorities have increased their focus on safety when assessing the

benefit risk/balance of drugs in the context of not only initial

product approval but also in the context of approval of additional

indications and review of information regarding marketed products.

Stricter regulatory controls also heighten the risk of changes in

product profile or withdrawal by regulators on the basis of

post-approval concerns over product safety, which could reduce

revenues and can result in product recalls and product liability

lawsuits. There is also greater regulatory scrutiny, especially in

the United States, on advertising and promotion and in particular

on direct-to-consumer advertising.

The

regulatory process is uncertain, can take many years, and requires

the expenditure of substantial resources. In particular, proposed

human pharmaceutical therapeutic product requirements set by the

FDA in the United States, and similar health authorities in other

countries, require substantial time and resources to satisfy. We

may never obtain regulatory approval for our product and process

candidates.

We may not be able to gain or sustain market acceptance for our

services and product candidates.

Failure

to establish a brand and presence in the marketplace on a timely

basis could adversely affect our financial condition and results of

operations. Moreover, there can be no assurance that we will

successfully complete our development and introduction of new

products or product enhancements, or methods and procedures of

treatment or that any such product candidates or methods and

procedures of treatment will achieve acceptance in the marketplace.

We may also fail to develop and deploy new products and product

enhancements on a timely basis.

The market for pain management products is highly competitive, and

we may not be able to compete successfully.

We

intend to operate in highly competitive markets. We will likely

face competition both from proprietary products of large

international manufacturers and producers of generic pain

management products. Most of the competitors in the industry have

longer operating histories and significantly greater financial,

technical, marketing and other resources than us, and may be able

to respond more quickly than we can to new or changing

opportunities and customer requirements. Also, many competitors

have greater name recognition and more extensive customer bases

that they can leverage to gain market share. Such competitors are

able to undertake more extensive promotional activities, adopt more

aggressive pricing policies and offer more attractive terms to

purchasers than we can.

Significant product

innovations, technical advances or the intensification of price

competition by competitors could adversely affect our operating

results. We cannot predict the timing or impact of competitive

products or their potential impact on sales of our products under

development.

If any

of our major pain management products were to become subject to a

problem such as unplanned loss of patent protection, unexpected

side effects, regulatory proceedings, publicity affecting doctor or

consumer confidence or pressure from competitive products, or if a

new, more effective alternative should be introduced, the adverse

impact on our revenues and operating results could be

significant.

The market for products, methods and procedures of treatment and

services in the pharmaceuticals industry is highly competitive, and

we may not be able to compete successfully.

We

intend to operate in highly competitive markets. We will likely

face competition both from proprietary products of large

international manufacturers and producers of generic

pharmaceuticals. Most of the competitors in the industry have

longer operating histories and significantly greater financial,

technical, marketing and other resources than us, and may be able

to respond more quickly than we can to new or changingopportunities

and customer requirements. Also, many competitors have greater name

recognition and more extensive customer bases that they can

leverage to gain market share. Such competitors are able to

undertake more extensive promotional activities, adopt more

aggressive pricing policies and offer more attractive terms to

purchasers than we can.

Significant product

innovations, technical advances or the intensification of price

competition by competitors could adversely affect our operating

results. We cannot predict the timing or impact of competitive

products or their potential impact on sales of our product

candidates.

If any

of our major product candidates or methods and procedures of

treatment were to become subject to a problem such as unplanned

loss of patent protection, unexpected side effects, regulatory

proceedings, publicity affecting doctor or patient confidence or

pressure from competitive products and methods and procedures of

treatment, or if a new, more effective treatment should be

introduced, the adverse impact on our revenues and operating

results could be significant.

We are dependent on the services of key personnel and failure to

attract qualified management could limit our growth and negatively

impact our results of operations.

We are

highly dependent on the principal members of our management and

scientific staff and certain key consultants, including our Chief

Executive Officer and the Chairman of our Board of Directors. We

will continue to depend on operations management personnel with

pharmaceutical and scientific industry experience. At this time, we

do not know of the availability of such experienced management

personnel or how much it may cost to attract and retain such

personnel. The loss of the services of any member of senior

management or the inability to hire experienced operations

management personnel could have a material adverse effect on our

financial condition and results of operations.

If physicians and patients do not accept our current or future

product candidates or methods and procedures of treatment, we may

be unable to generate significant additional revenue, if

any.

The

products and methods and procedures of treatment that we may

develop or acquire in the future may fail to gain market acceptance

among physicians, health care payors, patients and the medical

community. Physicians may elect not to recommend these treatments

for a variety of reasons, including:

●

timing of market

introduction of competitive drugs;

●

lower demonstrated

clinical safety and efficacy compared to other drugs or

treatments;

●

lack of

cost-effectiveness;

●

lack of

availability of reimbursement from managed care plans and other

third-party payors;

●

lack of convenience

or ease of administration;

●

prevalence and

severity of adverse side effects;

●

other potential

advantages of alternative treatment methods; and

●

ineffective

marketing and distribution support.

If our

product candidates and processes fail to achieve market acceptance,

we would not be able to generate significant revenue.

We are exposed to the risk of liability claims, for which we may

not have adequate insurance.

Since

we participate in the CBD, pain management and pharmaceutical

industries, we may be subject to liability claims by employees,

customers, end users and third parties. We do not currently have

product liability insurance. We intend to have proper insurance in

place; however, there can be no assurance that any liability

insurance we purchase will be adequate to cover claims asserted

against us or that we will be able to maintain such insurance in

the future. We intend to adopt prudent risk management programs to

reduce these risks and potential liabilities; however, we have not

taken any steps to create these programs and have no estimate as to

the cost or time required to do so and there can be no assurance

that such programs, if and when adopted, will fully protect us. We

may not be able to put risk management programs in place, or obtain

insurance, if we are unable to retain the necessary expertise

and/or are unsuccessful in raising necessary capital in the future.

Adverse rulings in any legal matters, proceedings and other matters

could have a material adverse effect on our business.

Pre-clinical and

clinical trials are conducted during the development of potential

products and other treatments to determine their safety and

efficacy for use by humans. Notwithstanding these efforts, when our

treatments are introduced into the marketplace, unanticipated side

effects may become evident. Manufacturing, marketing, selling and

testing our product candidates under development or to be acquired

or licensed, entails a risk of product liability claims. We could

be subject to product liability claims in the event that our

product candidates, processes, or products under development fail

to perform as intended. Even unsuccessful claims could result in

the expenditure of funds in litigation and the diversion of

management time and resources, and could damage our reputation and

impair the marketability of our product candidates and processes.

While we plan to maintain liability insurance for product liability

claims, we may not be able to obtain or maintain such insurance at

a commercially reasonable cost. If a successful claim were made

against us, and we don’t have insurance or the amount of

insurance was inadequate to cover the costs of defending against or

paying such a claim or the damages payable by us, we would

experience a material adverse effect on our business, financial

condition and results of operations.

Other companies may claim that we have infringed upon their

intellectual property or proprietary rights.

We do

not believe that our product candidates and methods and procedures

violate third-party intellectual property rights; however, we have

not had an independent party conduct a study of possible patent

infringements. Nevertheless, we cannot guarantee that claims

relating to violation of such rights will not be asserted by third

parties. If any of our product candidates or methods and procedures

of treatment are found to violate third-party intellectual property

rights, we may be required to expend significant funds to

re-engineer or cause to be re-engineered one or more of those

product candidates or methods and procedures of treatment to avoid

infringement, or seek to obtain licenses from third parties to

continue offering our product candidates or methods and procedures

of treatment without substantial re-engineering, and such efforts

may not be successful.

In

addition, future patents may be issued to third parties upon which

our product candidates and methods and procedures of treatment may

infringe. We may incur substantial costs in defending against

claims under any such patents. Furthermore, parties making such

claims may be able to obtain injunctive or other equitable relief,

which effectively could block our ability to further develop or

commercialize some or all of our products or methods and procedures

of treatment in the United States or abroad, and could result in

the award of substantial damages against us. In the event of a

claim of infringement, we may be required to obtain one or more

licenses from third parties. There can be no assurance that we will

be able to obtain such licenses at a reasonable cost, if at all.

Defense of any lawsuit or failure to obtain any such license could

be costly and have a material adverse effect on our

business.

Our success depends on our ability to protect our proprietary

technology.

Our

success depends, to a significant degree, upon the protection of

our proprietary technology, and that of any licensors. Legal fees

and other expenses necessary to obtain and maintain appropriate

patent protection could be material. Insufficient funding may

inhibit our ability to obtain and maintain such protection.

Additionally, if we must resort to legal proceedings to enforce our

intellectual property rights, the proceedings could be burdensome

and expensive, and could involve a high degree of risk to our

proprietary rights if we are unsuccessful in, or cannot afford to

pursue, such proceedings.

Our

licensors have been granted three U.S. patents: Sequential

Extracorporeal Treatment of Bodily Fluids, U.S. Patent No.

9,216,386; Utilization of Stents for the Treatment of Blood Borne

Carcinomas, U.S. Patent No. 8,758,287; and Medication and

Treatmentfor Disease, U.S. Patent No. 8,865,733, in the areas of

cancer, sepsis, and multiple sclerosis. We expect these patents to

cover the medical treatments for multiple sclerosis, blood sepsis,

and cancer and be effective until 2029. Our licensors have licensed

these technologies to us pursuant to the terms of the license

agreements. We anticipate that other technologies that derive from

these patents will also belong to us and are covered by the license

agreements. However, we have not conducted thorough prior art or

novelty studies, but we are not aware of existing prior art that

would prevent us from obtaining patents on our product candidates

or methods and procedures of treatment. Prior art preventing us

from obtaining broad patent protection is a possibility. Inability

to obtain valid and enforceable patent protection would have a

material negative impact on our business opportunities and success.

Because the patent positions of pharmaceutical and biotechnology

companies are highly uncertain and involve complex legal and

factual questions, the patents may not be granted on our

applications, and any future patents owned and licensed by us may

not prevent other companies from developing competing products or

ensure that others will not be issued patents that may prevent the

sale of our products or require licensing and the payment of

significant fees or royalties. Furthermore, to the extent that:

(i) any of our future products or methods are not patentable;

(ii) such products or methods infringe upon the patents of

third parties; or (iii) our patents or future patents fail to

give us an exclusive position in the subject matter to which such

patents relate, our business will be adversely affected. We may be

unable to avoid infringement of third-party patents and may have to

obtain a license, or defend an infringement action and challenge

the validity of such patents in court. A license may be unavailable

on terms and conditions acceptable to us, if at all. Patent

litigation is costly and time consuming, and we may be unable to

prevail in any such patent litigation or devote sufficient

resources to even pursue such litigation. If we do not obtain a

license under such patents, are found liable for infringement and

are not able to have such patents declared invalid, we may be

liable for significant monetary damages, encounter significant

delays in bringing products to market or may be precluded from

participating in the manufacture, use or sale of products or

methods of treatment requiring such licenses.

We may

also rely on trademarks, trade secrets and contract law to protect

certain of our proprietary technology. There can be no assurance

that any trademarks will be approved, that such contract will not

be breached, or that if breached, we will have adequate remedies.

Furthermore, there can be no assurance that any of our trade

secrets will not become known or independently discovered by third

parties.

Additionally, we

may, from time to time, support and collaborate in research

conducted by universities and governmental research organizations.

There can be no assurance that we will have or be able to acquire

title or exclusive rights to the inventions or technical

information derived from such collaborations, or that disputes will

not arise with respect to rights in derivative or related research

programs conducted by us or such collaborators.

Our future growth may be inhibited by the failure to implement new

technologies.

Our

future growth is partially tied to our ability to improve our

knowledge and implementation of medical and pharmaceutical

technologies. The inability to successfully implement commercially

viable medical and pharmaceutical technologies in response to

market conditions in a manner that is responsive to our

customers’ requirements could have a material adverse effect

on our business.

We do not own certain of our technologies, they are owned by, and

licensed from, entities that are under the control of the Chairman

of our Board of Directors.

We do

not currently own the certain technologies necessary to conduct our

operations. The patents necessary to pursue our intended business

plan are under the control of our Chairman of the Board of

Directors. As consideration for the two licenses, we agreed to (i)

pay a royalty of five percent (5%) of any sales of products using

the technology, with no minimum royalty and (ii) reimburse the

licensor for any costs incurred in pursuing its proprietary rights

in the licensed technology and pay any costs incurred for

maintaining or obtaining the licensors’ proprietary rights in

the licensed technology in the U.S. and in extending the

intellectual property to other countries around the world. The

licensor has the sole discretion to select other countries into

which exclusive rights in the licensed technology may be pursued,

and if we decline to pay those expenses, then the licensor may pay

said expenses and our licensed rights in those countries will

revert to the licensor. The license agreements contain provisions

that require us to indemnify thelicensor for any claims, including

costs of litigation, brought against them related to the licenses,

and require us to maintain insurance that may be burdensome. In the

event of a breach of our obligations under the license agreements,

the licensors are entitled to various damages and remedies, up to

and including termination of said license agreements. The licensors

are entities under the control of Dr. Mitchell S. Felder, the

Chairman of our Board of Directors. While Dr. Felder is one of our

Company’s founders and the Chairman of our Board of

Directors, there can be no assurance that he will extend the offer

to license these technologies to us in the future as currently

contemplated.

We do not intend to take our Feldetrex® product candidate past

the development stage, but instead intend to enter into

collaboration agreements with collaboration partners. If we are

unable to enter into an agreement with collaboration partners, our

Feldetrex® product candidate cannot be marketed, and it will

not generate revenue for us.

We do

not intend to conduct clinical trials on our Feldetrex®

product candidate. We instead intend to enter into one or more

collaboration agreements with third parties to do so. However, we

have not entered into any such agreements, or discussions for any

such agreements, and we cannot guarantee that we will be successful

in doing so. If we do not find a collaboration partner, the

Feldetrex®

product candidate cannot be marketed, and it will not generate any

revenue for us.

The

failure to generate revenue from our Feldetrex®

product candidate will have a materially adverse effect on our

overall revenues, profitability.

Risks Related To Our Common stock

The market price of our common stock may be volatile and may be

affected by market conditions beyond our control.

The

market price of our common stock is subject to significant

fluctuations in response to, among other factors:

●

variations in our

operating results and market conditions specific to Biomedical

Industry companies;

●

changes in

financial estimates or recommendations by securities

analysts;

●

announcements of

innovations or new products or services by us or our

competitors;

●

the emergence of

new competitors;

●

operating and

market price performance of other companies that investors deem

comparable;

●

changes in our

board or management;

●

sales or purchases

of our common stock by insiders;

●

commencement of, or

involvement in, litigation;

●

changes in

governmental regulations; and

●

general economic

conditions and slow or negative growth of related

markets.

In

addition, if the market for stocks in our industry or the stock

market in general, experiences a loss of investor confidence, the

market price of our common stock could decline for reasons

unrelated to our business, financial condition or results of

operations. If any of the foregoing occurs, it could cause the

price of our common stock to fall and may expose us to lawsuits

that, even if unsuccessful, could be costly to defend and a

distraction to the board of directors and management.

If we default on our convertible notes and are unable to repay the

notes, we will not have the funds we need to operate our business

and may lose access to additional financing.

We are

currently in default on the Note issued on August 8, 2017 because

the Maturity Date has passed. Per the terms of the Notes, the

Selling Shareholders have the option to demand payment of 130% of

the outstanding principal amount of a Note and any accrued and

unpaid interest thereon. We are currently unable to pay these

amounts in full. If the Selling Shareholders elect to exercise this

right rather than convert the Notes, we could possibly face

litigation. If we repay the Notes or any part thereof, we may not

be able to satisfy the obligations we have to other business

partners and may be forced to cease our business operations. Any

action by the Selling Shareholders would adversely affect our

financial position and ability to operate.

If we are unable to pay the costs associated with being a public,

reporting company, we may be forced to discontinue

operations.

We

expect to have significant costs associated with being a public,

reporting company, which may raise substantial doubt about our

ability to continue as a going concern. Our ability to continue as

a going concern will depend on positive cash flow, if any, from

future operations and on our ability to raise additional funds

through equity or debt financing. If we are unable to achieve the

necessary product sales or raise or obtain needed funding to cover

the costs of operating as a public, reporting company, we may be