RELX 2018 Net Profit Fell 14%; Launches GBP600 Million Buyback

February 21 2019 - 2:56AM

Dow Jones News

By Adria Calatayud

RELX PLC (REL.LN) said Thursday that 2018 net profit fell 14% as

the company booked a lower gain from U.S. tax credits, and it

launched a smaller buyback than in prior years after increasing

acquisition spending.

The information-and-analytics company said it plans to buy back

shares worth 600 million pounds ($783.1 million) this year, having

completed annual share-repurchase programs of GBP700 million over

the last three years.

In 2018, the company behind medical journal the Lancet and the

London Book Fair made a net profit of GBP1.42 billion, or 71.9

pence a share, compared with GBP1.65 billion a year before, or 81.6

pence a share, it said.

Adjusted operating profit--excluding acquisitions and disposals

and other exceptional items--rose 6% on an underlying basis to

GBP2.35 billion in 2018, RELX said. Adjusted earnings per share

increased 7% at constant currency to 84.7 pence, the company

said.

Analysts expected an adjusted EPS of 84.4 pence, according to a

consensus provided by the company based on estimates by 17

analysts.

RELX's underlying revenue grew 4% last year, the company said.

Revenue totaled GBP7.49 billion last year, up 2% from GBP7.34

billion in 2017, RELX said.

The company last year simplified its corporate structure into a

single-parent structure and bought U.S. authentication company

ThreatMetrix for GBP580 million.

For 2019, RELX said it expects another year of underlying growth

in revenue and in adjusted operating profit, together with growth

in adjusted earnings per share on a constant currency basis.

Write to Adria Calatayud at

adria.calatayudvaello@dowjones.com

(END) Dow Jones Newswires

February 21, 2019 02:41 ET (07:41 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

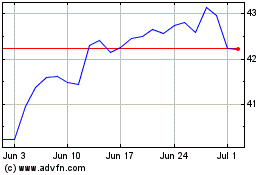

RELX (EU:REN)

Historical Stock Chart

From Mar 2024 to Apr 2024

RELX (EU:REN)

Historical Stock Chart

From Apr 2023 to Apr 2024