South32 Drops Plan to Buy Peabody Mine

April 17 2017 - 7:19PM

Dow Jones News

By David Winning

SYDNEY--South32 Ltd. (S32.AU) said competition concerns had

scuttled a US$200 million deal to buy a metallurgical coal mine in

the southern coalfields of Australia's New South Wales state,

together with a stake in a coal port, from Peabody Energy Corp.

(BTU).

South32, the coal and metals miner spun out of BHP Billiton Ltd.

(BHP.AU) in 2015, agreed in November to buy Peabody's Metropolitan

Colliery and an associated 17% stake in the Port Kembla Coal

Terminal, located south of Sydney.

On Tuesday, South32 said the deal won't proceed following the

Australian Competition and Consumer Commission's concerns that the

proposed deal may substantially reduce competition in coal supply

to Australian steelmakers.

"South32 has always maintained that metallurgical coal is a

globally traded commodity," the company said in a regulatory

filing. "Given this, South32 is not prepared to make significant

concessions in favor of Australian steelmakers that would likely be

required to mitigate the competition concerns."

Write to David Winning at david.winning@wsj.com

(END) Dow Jones Newswires

April 17, 2017 19:04 ET (23:04 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

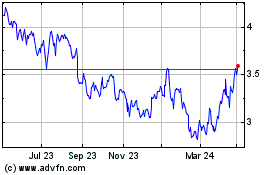

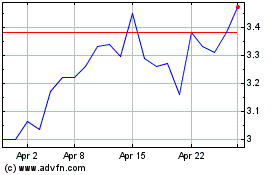

South32 (ASX:S32)

Historical Stock Chart

From Mar 2024 to Apr 2024

South32 (ASX:S32)

Historical Stock Chart

From Apr 2023 to Apr 2024