SYDNEY—The chief executive of BHP Billiton Ltd., the world's

biggest miner by market value, sounded a more positive tone on

world commodity markets, saying there are early indications the

glut in some sectors is easing.

A global oversupply of everything from iron ore and copper to

oil dragged prices early this year to lows many resources

executives said they had never expected, and for BHP, pushed it to

its worst-ever annual loss. The global mining sector responded to

weak prices by paring output for some commodities and shelving big

new projects, which may be starting to pay off.

"We have seen early signs of markets rebalancing," BHP Chief

Executive Andrew Mackenzie said on Wednesday, as the miner reported

that its own production of commodities was mostly lower in recent

months on the same time a year ago.

The price of iron ore is up 35% so far this year, as the pace of

growth in supplies has slowed, while metallurgical coal prices have

tripled because of curbs to production in China, both a major

producer and consumer of the steelmaking fuel. Prices for oil and

many metals have also improved.

So far, mining executives have been coy on calling a nadir for

commodities, which have been largely spiraling lower since 2011.

Markets were pummeled by large increases to supplies, encouraged by

the high prices of a China-led commodities boom.

BHP as recently as August raised concerns about persistent

abundant supplies of crude oil and metals such as copper, while

rival Rio Tinto PLC at the same time cautioned on the threat from

low global growth and what it called an unsustainable credit-fueled

bounce in China.

On Wednesday, BHP signaled confidence that world petroleum

markets are on the road to recovery. Prices in recent times have

been buoyed by promises of an output cut from the Organization of

the Petroleum Exporting Countries, which could help draw down the

vast oversupply of oil that has flooded world markets.

"Fundamentals suggest both oil and gas markets will improve over

the next 12 to 18 months," Mr. Mackenzie said.

"Iron ore and metallurgical coal prices have been stronger than

expected" already, he said, "although we continue to expect supply

to grow more quickly than demand in the near term" for those

commodities.

While miners including Glencore PLC have made substantial cuts

to production at existing operations, BHP's own output of many

resources has slowed as deposits are depleted and it holds back on

new projects, waiting for signs of an upturn.

BHP said its petroleum division produced 55 million barrels of

oil equivalent in the three months through September. That was down

15% on-year after it pulled back on drilling in the U.S. because of

weak prices.

Thermal coal output was down 4% while copper output was down 6%.

BHP separately signaled it may have to downgrade its projections

for the large Olympic Dam copper mine in southern Australia after

the operation was halted by a blackout late last month.

Meantime, BHP reported iron-ore production of 58 million tons,

unchanged on the year-earlier period when excluding the Samarco

Mineraç ã o operation in Brazil, which it owns with Vale SA and

which was halted in November after a catastrophic dam failure. Iron

ore accounts for the biggest portion of BHP's sales.

Production of metallurgical coal was just 1% higher, the company

said.

Some brokers have raised concerns about how quickly miners like

BHP will be able to respond to a recovery in prices.

BHP has only four major projects under way, two of which are

virtually completed, versus 17 developments under way this time

three years ago. "BHP remains ex-growth," meaning it is no longer

increasing in size, Deutsche Bank said in an Oct. 17 note.

BHP has singled out oil-and-gas, a newly favored sector for the

Anglo-Australian company, as one area in which it has the

capability to ramp up drilling quickly, though, in line with

prices.

The miner also hasn't ruled out buying growth. Mr. Mackenzie has

previously described the miner as "very active" in looking for

possible acquisitions, particularly of copper mines or oil fields,

but so far no large deals have been made.

The company has argued that its focus is on increasing value by

working existing operations harder, over investing in new projects

with the aim of simply increasing total output of the group, which

shrank last year with the spinoff of a suite of unwanted mines and

smelters into South32 Ltd.

For now, better prices are a welcome boon. "The combination of

steadier markets, continued capital discipline, improved

productivity" and higher production generally than in the past

should underpin a strong flow of cash this fiscal year, Mr.

Mackenzie said on Wednesday.

In August, BHP estimated it could double free cash flow in the

year through June, 2017, if commodity prices remained stable.

Write to Rhiannon Hoyle at rhiannon.hoyle@wsj.com

(END) Dow Jones Newswires

October 18, 2016 23:05 ET (03:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

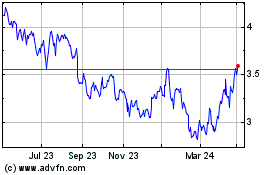

South32 (ASX:S32)

Historical Stock Chart

From Mar 2024 to Apr 2024

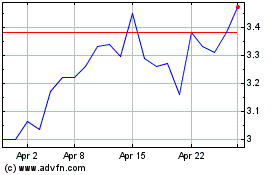

South32 (ASX:S32)

Historical Stock Chart

From Apr 2023 to Apr 2024