Dollar Trading Mixed As Investors Await Fed Announcement

January 26 2016 - 9:40AM

RTTF2

The dollar is turning in a mixed performance against its major

rivals Tuesday afternoon. The U.S. currency is slightly higher

against the Euro and the Japanese Yen, but is losing ground against

the British pound.

Investors are playing it cautious ahead of Wednesday's

announcement from the Federal Reserve. The Fed will release a

statement upon the conclusion of its 2-day policy meeting tomorrow

afternoon. While other central banks have hinted at further

stimulus measures in the last few weeks, the Fed has remained

silent.

The Fed raised interest rates for the first time in a decade

back in December and many investors were under the impression that

the central bank would announce another 4 rate hikes in 2016.

However, that was before the sharp sell-off in global equity

markets on concerns over the health of the global economy that has

plagued January.

Investors will be watching tomorrow's Fed announcement closely

for clues about when the Fed plans to tighten again. Many believe

the Fed will announce a delay to its interest rate hikes, given the

current market environment.

Global economic data was rather sparse Tuesday, but there were a

pair of U.S. economic reports this morning. With home prices in

major U.S. metropolitan areas rising more than expected on a

monthly basis, Standard & Poor's released a report on Tuesday

showing a notable acceleration in the annual rate of home price

growth in November.

The report said the S&P/Case-Shiller 20-City Composite Home

Price Index was up by 5.8 percent year-over-year in November

compared to the 5.5 percent annual growth reported in October.

Economists had expected the pace of growth to accelerate to 5.7

percent.

Consumer confidence in the U.S. has unexpectedly improved in the

month of January, according to a report released by the Conference

Board on Tuesday. The Conference Board said its consumer confidence

index climbed to 98.1 in January from a downwardly revised 96.3 in

December.

Economists had expected the index to edge down to 96.0 from the

96.5 originally reported for the previous month.

The dollar is currently trading around $1.0850 against the Euro,

which is nearly flat for the session. The U.S. currency reached a

high of $1.0817 and a low of $1.0874.

The buck rose to an early high of $1.4172 against the pound

sterling Tuesday, but has since pulled back to around $1.4360.

The greenback slipped to a low of Y117.649 against the Japanese

Yen Tuesday morning, but has since rebounded to around

Y118.485.

Producer prices in Japan were up 0.4 percent on year in

December, the Bank of Japan said on Tuesday. That exceeded

forecasts for an increase of 0.2 percent, which would have been

unchanged from the November reading. On a monthly basis, prices

ticked up 0.1 percent following the 0.2 percent gain in the

previous month.

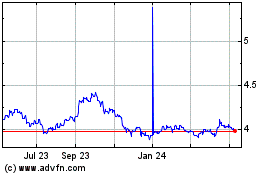

US Dollar vs PLN (FX:USDPLN)

Forex Chart

From Mar 2024 to Apr 2024

US Dollar vs PLN (FX:USDPLN)

Forex Chart

From Apr 2023 to Apr 2024