South32 to Cut Costs Amid Commodity Market Downturn -- Update

August 23 2015 - 8:49PM

Dow Jones News

By Rhiannon Hoyle

SYDNEY--South32 Ltd. (S32.AU) said it intends to cut operating

costs to safeguard profit amid a downturn in world commodity

markets.

The mining company, spun out of BHP Billiton Ltd. (BHP.AU)

earlier this year, said it aimed to cut annual costs by US$350

million or more by mid-2018.

"South32 has already made strong inroads in reducing costs but

there is more to be done," the company said in a statement

Monday.

It will also reduce sustaining capital expenditure this fiscal

year by 9% to US$650 million. The company aims to maintain that

rate of project spending for the forseeable future, it said.

In its maiden fiscal report, South32 reported a pro forma net

profit of US$28 million, which it said compared to a profit of

US$64 million a year earlier. It reported a statutory loss of

US$919 million.

It said net profit was knocked by writedowns against some mining

operations. Pro forma underlying earnings were up 41% at US$575

million, it added.

Still, South32 cautioned it faced challenging market conditions.

Mining company earnings have been squeezed by falling commodity

prices, as China's economy slows. The price of industrial metals

and other commodities such as coal and manganese have fallen

sharply.

"This is likely to persist for some time," Chief Executive

Graham Kerr said on a conference call.

Shares in the company have been falling since it listed in May,

weighed by uncertainty over its outlook, following one of the

largest corporate breakups in mining history. South32 was down 2.6%

in early Sydney trading.

Write to Rhiannon Hoyle at rhiannon.hoyle@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

August 23, 2015 20:34 ET (00:34 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

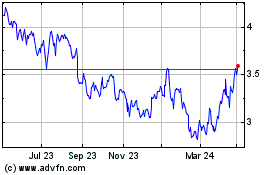

South32 (ASX:S32)

Historical Stock Chart

From Mar 2024 to Apr 2024

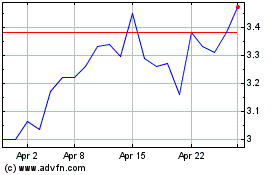

South32 (ASX:S32)

Historical Stock Chart

From Apr 2023 to Apr 2024