UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

FOR ANNUAL AND TRANSITION REPORTS

PURSUANT TO SECTIONS 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

(Mark

One)

| x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014

OR

| ¨ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from

to

.

Commission file number 033-91744-02

Corporate

Asset Backed Corporation, on behalf of

CABCO Trust for J.C. Penney Debentures

(Exact name of registrant as specified in its charter)

|

|

|

| Delaware |

|

22-3281571 |

| (State or Other Jurisdiction

of Incorporation or Organization) |

|

(I.R.S. Employer

Identification No.) |

|

|

| 68 South Service Road, Suite 120, Melville, New York |

|

11747 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (631) 587-4700

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

| Title of class |

|

Name of each Exchange on which registered |

| $52,650,000 Trust Certificates for J.C. Penney Debentures |

|

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the

Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the

Act. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act

of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark

if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in

Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check

mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

| Large accelerated filer |

|

¨ |

|

Accelerated filer |

|

¨ |

|

|

|

|

| Non-accelerated filer |

|

x |

|

|

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the

Act). Yes ¨ No x

State the aggregate market value of voting and non-voting common stock held by non-affiliates of the registrant: All the common stock of Corporate Asset

Backed Corporation, the depositor of the trust, is held by UBS Americas Inc., its parent.

Indicate the number of shares outstanding of each of the

registrant’s classes of common stock, as of the latest practicable date: As of March 23, 2015, 100 shares of common stock of Corporate Asset Backed Corporation, the depositor of the trust, par value $1.00 per share, were outstanding.

INTRODUCTORY NOTE

The Registrant is a trust (the “Trust”) created by the Amended and Restated Trust Agreement, dated as of March 25, 1999,

between Corporate Asset Backed Corporation, as depositor (the “Depositor”), and U.S. Bank Trust National Association as successor trustee to The Bank of New York (the “Trustee”), providing for the issuance of

$52,650,000 Trust Certificates for J.C. Penney Debentures (the “Certificates”). The Certificates do not represent obligations of or interests in the Depositor or the Trustee. The Certificates represent beneficial interests in the

Trust. The Trust’s assets consist primarily of $52,650,000 principal amount of 7-5/8% J.C. Penney Company, Inc. Debentures due 2097. J.C. Penney Company, Inc. is subject to the informational requirements of the Securities Exchange Act of 1934,

and in accordance with those requirements files periodic and current reports and other information (including financial information) with the Securities and Exchange Commission (“SEC”) (File No. 001-00777). You may read and copy any

reports, statements and other information filed by J.C. Penney Company, Inc. with the SEC (a) over the Internet at the SEC website at http://www.sec.gov containing reports, proxy statements and other information regarding registrants that file

electronically with the SEC; and (b) the SEC’s public reference room at 450 Fifth Street, N.W., Washington, D.C. 20549. You can also request copies of these documents upon payment of a copying fee, by writing to the SEC’s public

reference room at 450 Fifth Street, N.W., Washington, D.C. 20549. Please call the SEC at (800) SEC-0330 for further information on the operation of the public reference facilities. For information regarding J.C. Penney Company, Inc., please

refer to these periodic and current reports filed with the SEC.

Part I

Item 1. Business

Not Applicable.

Item 1A. Risk Factors

Not Applicable.

Item 1B. Unresolved Staff Comments

Not Applicable.

Item 2. Properties

Not Applicable.

Item 3. Legal Proceedings

None.

Item 4. Submission of Matters to a Vote of Security Holders

None.

Part II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

The Trust Certificates issued by CABCO Trust for J.C. Penney Debentures representing investors’ interest in the Trust are represented by

one or more physical Certificates registered in the name of Cede & Co., the nominee of The Depository Trust Company.

The

Certificates are listed on the New York Stock Exchange.

Item 6. Selected Financial Data

Not Applicable.

Item 7. Management’s Discussion and

Analysis of Financial Condition and Results of Operations.

Not Applicable.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

Not Applicable.

Item 8. Financial Statements and Supplementary Data

Not

Applicable.

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

None.

Item 9A. Controls and Procedures

Not Applicable.

Item 9B. Other Information

None.

Part III

Item 10. Directors and Executive Officers of the Registrant

Not Applicable.

Item 11. Executive Compensation

Not Applicable.

Item 12. Security Ownership of Certain

Beneficial Owners and Management

None.

Item 13.

Certain Relationships and Related Transactions

None.

Item 14. Principal Accounting Fees and Services

Not

Applicable.

Part IV

Item 15. Exhibits

and Financial Statement Schedules

(b) (1) Certification pursuant to Rule 13a-14 of the Securities Exchange Act of 1934 is filed herewith as Exhibit

31.1.

(2) The Trustee’s statement of compliance with respect to the Trust Agreement is filed herewith as Exhibit 99.1.

(3) Report of Aston Bell, CPA, is filed herewith as Exhibit 99.2.

(4) Disclosure Pursuant to Section 13(r) of the Securities Exchange Act of 1934 is filed herewith as Exhibit 99.3.

(5) The reports on Form 8-K filed by Corporate Asset Backed Corporation during the Fiscal Year on

behalf of CABCO Trust for J.C. Penney Debentures that included distribution reports to the respective Certificate holders, are incorporated herein as Exhibits 99.4 and 99.5.

(c) Not Applicable.

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to

be signed on its behalf by the undersigned, thereunto duly authorized on this 30th day of March 2015.

CORPORATE ASSET BACKED

CORPORATION

as Depositor of the

CABCO Trust for J.C. Penney Debentures

By: /s/ Lee Thompson

Name: Lee Thompson

Title: Vice President

EXHIBIT INDEX

|

|

|

| Exhibit No. |

|

Description of Document |

|

|

| 31.1 |

|

Rule 13a-14 Certification. |

|

|

| 99.1 |

|

Trustee Statement of Compliance with respect to CABCO Trust for J.C. Penney Debentures. |

|

|

| 99.2 |

|

Report of Aston Bell, Certified Public Accountant. |

|

|

| 99.3 |

|

Disclosure Pursuant to Section 13(r) of the Securities Exchange Act of 1934. |

|

|

| 99.4-99.5* |

|

Reports on Form 8-K filed by Corporate Asset Backed Corporation during the Fiscal Year on behalf of CABCO Trust for J.C Penney Debentures that included distribution reports to the

Certificate holders: Form 8-K Reports filed on March 19, 2014; and September 8, 2014. |

| * |

Previously filed with the Securities and Exchange Commission. |

Exhibit No. 31.1

CERTIFICATION UNDER RULE 13a-14 OF THE SECURITIES EXCHANGE ACT OF 1934 FOR

CABCO TRUST FOR J.C. PENNEY DEBENTURES ANNUAL REPORT ON FORM 10-K FOR

THE FISCAL YEAR ENDED DECEMBER 31, 2014

I, Lee Thompson, certify that:

1. I have

reviewed this annual report on Form 10-K, and all reports on Form 8-K containing distribution or servicing reports filed in respect of the periods included in the year covered by this annual report, filed by Corporate Asset Backed Corporation, on

behalf of CABCO Trust for J.C. Penney Debentures;

2. Based on my knowledge, the information in these reports, taken as a whole, does not

contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading as of the last day of the period covered by

this annual report;

3. Based on my knowledge, the distribution or servicing information required to be provided to the depositor by the

trustee under the pooling and servicing, or similar, agreement, for inclusion in these reports is included in these reports; and

4. I am

responsible for reviewing the activities performed by the depositor and the trustee under the pooling and servicing, or similar, agreement and based upon my knowledge and the annual compliance review required under that agreement, and except as

disclosed in the reports, the depositor and trustee have each fulfilled its obligations under that agreement.

In giving the certifications above, I have

reasonably relied on information provided to me by the following unaffiliated parties: U.S. Bank Trust National Association, as successor trustee.

Date:

March 30, 2015

By: /s/ Lee Thompson

Name:

Lee Thompson

Title: Vice President

Corporate Asset

Backed Corporation

Exhibit No. 99.1

TRUSTEE STATEMENT OF COMPLIANCE

I, David

J. Kolibachuk, acting on behalf of U.S. Bank Trust National Association (the “Trustee”), hereby certify that the Trustee has fulfilled its obligations as successor trustee under the trust agreement, dated March 25, 1999, between

Corporate Asset Backed Corporation, as depositor, and the prior trustee, with respect to the CABCO Trust for J.C. Penney Debentures during the period from January 1, 2014 to December 31, 2014.

Date: February 17, 2015

|

| U.S. BANK TRUST NATIONAL ASSOCIATION, as

Trustee of |

|

| CABCO Trust for J.C. Penney Debentures |

|

| By: /s/ David J. Kolibachuk |

| Name: David J. Kolibachuk |

| Title: Vice President |

Exhibit No. 99.2

[On Letterhead of Aston Bell, Certified Public Accountant]

Independent Accountant’s Report

Corporate Asset Backed Corporation, (as Depositor)

68 South

Service Road, Suite 120

Melville, NY 11747

U.S. Bank Trust

National Association

Corporate Trust Services

100 Wall

Street, Suite 1600

New York, NY 10005

| Re: |

CABCO Trust for J.C. Penney Debentures (the “Trust”) |

Ladies and Gentlemen:

We have examined assertions of Corporate Asset Backed Corporation (the “Depositor”) and U.S. Bank Trust National Association, (the

“Trustee” and, together with the Depositor, the “Management”) that the Depositor and the Trustee have complied, in all material respects, with the provisions of the Amended and Restated Trust Agreement dated as of March 25,

1999, (the “Series Trust Agreement”) in respect of the CABCO Trust for J.C. Penney Debentures (the “Trust”), during the periods covered by the annual report on Form 10-K filed by the Depositor on behalf of the Trust for the year

ended December 31, 2014 (the “Annual Report”). Management is responsible for compliance with the Series Trust Agreement. Our responsibility is to express an opinion on Management’s assertions based on our examination.

Our examination was made in accordance with attestation standards established by the American Institute of Certified Public Accountants and, accordingly,

included examining, on a test basis, evidence about the Depositor’s and the Trustee’s compliance with the Series Trust Agreement and performing such other procedures as considered necessary in the circumstances. We believe that our

examination provides a reasonable basis for our opinion.

In our opinion, the Depositor and the Trustee have complied, in all material respects, with the

Series Trust Agreement during the period covered by the Annual Report and Management’s assertions with respect to such compliance are fairly stated, in all material respects, for the year ended December 31, 2014.

/s/ Aston Bell, CPA

New York, New York

March 25, 2015

Exhibit No. 99.3

Disclosure Pursuant to Section 13(r) of the Securities Exchange Act of 1934

The disclosure below does not relate to any activities conducted by Corporate Asset Backed Corporation (the “Depositor”) or CABCO Trust for J.C.

Penney Debentures (the “Trust”) and does not involve the Depositor or the Trust. The disclosure relates solely to activities conducted by UBS AG as disclosed in its Annual Report on Form 20-F for the year ended December 31, 2014,

which was filed with the Securities and Exchange Commission on March 13, 2015.

Section 219 of the U.S. Iran Threat Reduction and Syria Human

Rights Act of 2012 (“ITRA”) added new Section 13(r) to the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”) requiring each SEC reporting issuer to disclose in its annual and, if applicable, quarterly

reports whether it or any of its affiliates have knowingly engaged in certain activities, transactions or dealings relating to Iran or with the Government of Iran or certain designated natural persons or entities involved in terrorism or the

proliferation of weapons of mass destruction during the period covered by the report. The required disclosure includes disclosure of activities not prohibited by U.S. or other law even if conducted outside the U.S. by non-U.S. affiliates in

compliance with local law.

UBS AG is the indirect parent of the Depositor and may be deemed an “affiliate” of the Trust as defined in Rule

12b-2 of the Exchange Act. UBS AG has made disclosure pursuant to Section 219 of ITRA and Section 13(r) of the Exchange Act in its Annual Report on Form 20-F for the year ended December 31, 2014. As a result, the Depositor is

providing the disclosure set forth below pursuant to those provisions. It should therefore be noted that the Annual Report on Form 20-F for the year ended December 31, 2014, filed by UBS AG with the Securities and Exchange Commission on

March 13, 2015, contained the disclosure set forth below.

“Disclosure Pursuant To Section 219 of the Iran Threat Reduction And Syrian

Human Rights Act

Section 219 of the U.S. Iran Threat Reduction and Syria Human Rights Act of 2012 (“ITRA”) added new

Section 13(r) to the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”) requiring each SEC reporting issuer to disclose in its annual and, if applicable, quarterly reports whether it or any of its affiliates have

knowingly engaged in certain activities, transactions or dealings relating to Iran or with the Government of Iran or certain designated natural persons or entities involved in terrorism or the proliferation of weapons of mass destruction during the

period covered by the report. The required disclosure includes disclosure of activities not prohibited by U.S. or other law even if conducted outside the U.S. by non-U.S. affiliates in compliance with local law. Pursuant to Section 13(r) of the

Exchange Act, we note the following for the period covered by this annual report:

UBS has a Group Sanctions Policy that prohibits transactions involving

sanctioned countries, including Iran, and sanctioned individuals and entities. However, UBS maintains one account involving the Iranian government under the auspices of the United Nations in Geneva after agreeing with the Swiss government that it

would do so only

under certain conditions. These conditions include that payments involving the account must: (1) be made within Switzerland; (2) be consistent with paying rent, salaries, telephone and

other expenses necessary for its operations in Geneva; and (3) not involve any Specially Designated Nationals blocked or otherwise restricted under U.S. or Swiss law. In 2014, the gross revenues for this UN related account were approximately

USD 9,697 which were generated by fees charged to the account; the net profit was approximately USD 6,704 after deductions were taken for UBS internal costs for maintaining the account. UBS AG intends to continue maintaining this account pursuant to

the conditions it has established and consistent with its Group Sanctions Policy.

As previously reported, there were also certain outstanding trade

finance arrangements that had been issued on behalf of Swiss client exporters in favor of their Iranian counterparties, which involve four Iranian designated banks (WMD). At the time these trade finance arrangements were initiated in or about 2000,

none of the Iran banks involved were WMD-designated. In February 2012 UBS ceased accepting payments on these outstanding export trade finance arrangements and worked with the Swiss government who insured these contracts (Swiss Export Risk Insurance

“SERV”). On December 21, 2012, UBS and the SERV entered into certain Transfer and Assignment Agreements under which SERV purchased all of UBS’s remaining receivables under or in connection with Iran-related export finance

transactions. Hence, the SERV is the sole beneficiary of said receivables. Contractually UBS remains creditor and thus accordingly it is not yet in the position to write off these receivables. There was no financial activity involving Iran in

connection with these trade finance arrangements in 2014.

In connection with these trade finance arrangements, UBS has maintained one existing account

relationship with an Iranian bank that is currently WMD designated. This account was established prior to the U.S. designation and maintained due to the existing trade finance arrangements. In 2007, following the designation of the bank pursuant to

sanctions issued by the U.S., UN and Switzerland, the account was blocked under Swiss law and has remained blocked since then. Client assets as of December 2014 were USD 3,189. We intend to terminate these legacy arrangements and relationships in

accordance with the nature of these instruments and applicable law. As there have been no transactions involving this account in 2014 other than general account fees, there are no gross profits/net revenues to report for 2014.

In 1993, a non-Iranian individual opened a private banking relationship at a predecessor institution of UBS AG in Switzerland. In 2001, this individual was

designated under Executive Order 13224. In 2001, the individual’s accounts at UBS AG were blocked by order of the Swiss authorities. The Swiss authorities lifted the blocking of the individual’s UBS accounts in October 2012, and the US

authorities lifted the blocking in 2014. UBS AG froze the client’s remaining account in 2012 and has taken steps to exit this client relationship in a matter consistent with applicable law. In 2014, the gross revenues for this client

relationship were approximately USD -2,775 and the net loss was approximately USD -3,904.”

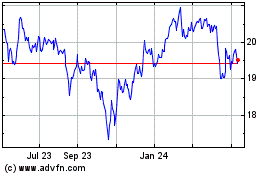

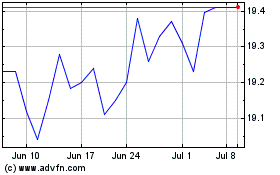

Prudential Financial (NYSE:PFH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Prudential Financial (NYSE:PFH)

Historical Stock Chart

From Apr 2023 to Apr 2024