Black Iron Inc. and Metinvest B.V. Close Strategic Investment and Development Arrangement

July 15 2014 - 8:01AM

Marketwired Canada

- FINAL US$5 MILLION INSTALLMENT PAYMENT HAS BEEN RECEIVED BY BLACK IRON,

COMPLETING THE INITIAL US$20 MILLION COMMITMENT

- ADDITIONAL POTENTIAL INVESTMENT BY METINVEST COULD REACH AS MUCH AS US$536

MILLION TO FINANCE HALF OF THE CONSTRUCTION COST

Black Iron Inc. ("Black Iron" or the "Company") (TSX:BKI)(FRANKFURT:BIN) has

received the fourth and final installment payment of US$5 million from Metinvest

B.V. ("Metinvest") as part of the previously announced closing schedule (see

press release dated April 15, 2014) for the strategic investment and development

arrangement (the "Arrangement") (see press release dated July 23, 2013)

pertaining to Black Iron (Cyprus) Ltd. ("BKI Cyprus").

In conjunction with the closing of the Arrangement and receipt of the US$20

million, Metinvest has been issued common shares in BKI Cyprus representing an

aggregate total of 49% of the share capital of BKI Cyprus. No common shares in

Black Iron have been issued as part of the Arrangement. Black Iron remains the

operator and developer of the Shymanivske Project and the Zelenivske Project

(collectively, the "Projects").

Each of Metinvest and Black Iron will have the option to participate in the

funding of the development of the Shymanivske Iron Ore Project based on their

proportionate interest in BKI Cyprus or be diluted down. Using the projected

total capital investment requirements as outlined in the Company's Bankable

Feasibility Study (as filed under the Company's profile on SEDAR on January 27,

2014) of US$1097 million, Metinvest's future capital contribution could be up to

US$536 million (being 49% of US$1097 million) for the development of the

Projects. The Arrangement contains strict dilution provisions designed to create

a strong incentive for continued participation in any future equity financings

for the Projects.

Yuriy Ryzhenkov, General Director and CEO of Metinvest, commented, "Metinvest

and Black Iron remain committed to helping rebuild Ukraine's economy through the

development of the Shymanivske Iron Ore Project. Apart from the creation of

thousands of new jobs and tens of millions annually in tax revenues, Ukrainians

will also benefit from new world class iron ore processing, safety and

environmental technologies."

Matt Simpson, President and CEO of Black Iron, commented, "With this strategic

arrangement now closed, and our relationship with Metinvest formally in place,

once there is peace in Ukraine, we look forward to building the world-class iron

ore producing mine outlined in our January 2014 Feasibility Study that shows a

pre-tax 48% internal rate of return, two year payback and US$3.3 billion net

present value. We see tremendous opportunities ahead for all stakeholders in

Black Iron as this project is needed more than ever to help reinvigorate

Ukraine's economy as the country emerges from the current revolution."

About Metinvest

Metinvest is a vertically integrated steel and mining group of companies,

managing every link of the value chain, from mining and processing iron ore and

coal to making and selling semi-finished and finished steel products. The Group

comprises steel and mining production facilities located in Ukraine, Europe and

the USA and has a sales network covering all key markets. Metinvest is the

largest employer in Ukraine and accounts directly for 2.3% of the country's

Gross Domestic Product (GDP) growing to 6.3% of Ukraine's GDP on an indirect

basis. Metinvest's Strategic Vision: Metinvest strives to become the leading

integrated steel maker in Europe demonstrating sustainable growth and

profitability independently from the phases of economic cycle and providing the

return on investment above the average industry levels. Metinvest Group is

structured into two operating divisions: Metallurgical Division and Mining

Division. Metinvest is made up of over 100,000 employees globally and in 2013

produced 36.9 million tonnes of iron ore, 11.4 million tonnes of coal and 12.4

million tonnes of steel.

The major shareholder of Metinvest Group is Metinvest B.V., a holding company

owned by System Capital Management Group (71.25%) and Smart-Holding (23.75%).

About Black Iron

Black Iron is an iron ore exploration and development company, advancing its 51%

owned Shymanivske project located in Kryviy Rih, Ukraine. This project contains

an NI 43-101 compliant resource estimated to be 645.8 Mt Measured and Indicated

mineral resources, consisting of 355.1 Mt Measured mineral resources grading

32.0% Total iron and 19.5% Magnetic iron, and Indicated mineral resources of

290.7 Mt grading 31.1% Total iron and 17.9% Magnetic iron, using a cut-off grade

of 10% Magnetic iron. Additionally, the project contains 188.3 Mt of Inferred

mineral resources grading 30.1% Total iron and 18.4% Magnetic iron. Full mineral

resource details can be found in the National Instrument 43-101 compliant

technical report dated January 24, 2014 titled "Feasibility Study of the

Shymanivske Iron Ore Deposit for Black Iron Inc." under the Company's profile on

SEDAR at www.sedar.com. The project is surrounded by five other operating mines,

including ArcelorMittal's iron ore complex. The Company believes that existing

infrastructure, including access to power, rail and port facilities, will allow

for a quick development timeline to production. Further, the Company holds an

exploration permit for the adjacent Zelenivske project, which it intends to

further explore to determine its potential. Please visit the Company's website

at www.blackiron.com, or write us at info@blackiron.com for more information.

The technical and scientific contents of this press release have been prepared

under the supervision of and have been reviewed and approved by Matt Simpson,

P.Eng, President and CEO of Black Iron Inc., who is a Qualified Person as

defined by NI 43-101. For further information, please see the technical report

of the Company, which is available on SEDAR at www.sedar.com.

Forward-Looking Information

This press release contains forward-looking information. Forward-looking

information is based on what management believes to be reasonable assumptions,

opinions and estimates of the date such statements are made based on information

available to them at that time, including those factors discussed in the section

entitled "Risk Factors" in the Company's annual information form for the year

ended December 31, 2013 (and dated March 14, 2013) or as may be identified in

the Company's public disclosure from time to time, as filed under the Company's

profile on SEDAR at www.sedar.com. Forward-looking information may include, but

is not limited to, statements with respect to the closing of the Arrangement,

the impact of the Arrangement on the local economy, the future financial or

operating performance of the Company, its subsidiaries and its projects, the

development of and the anticipated timing with respect to the Shymanivske

project, the ability to obtain financing on commercially reasonable terms; and

the impact of concerns relating to permitting, regulation, governmental and

local community relations. Generally, forward looking information can be

identified by the use of forward-looking terminology such as "plans", "expects"

or "does not expect", "is expected", "budget", "scheduled", "estimates",

"forecasts", "intends", "anticipates" or "does not anticipate", or "believes",

or variations of such words and phrases or state that certain actions, events or

results "may", "could", "would", "might" or "will be taken", "occur" or "be

achieved". Forward-looking information is subject to known and unknown risks,

uncertainties and other factors that may cause the actual results, level of

activity, performance or achievements of the Company to be materially different

from those expressed or implied by such forward-looking information, including

but not limited to: general business, economic, competitive, geopolitical and

social uncertainties; the actual results of current exploration activities;

other risks of the mining industry and the risks described in the annual

information form of the Company. Although the Company has attempted to identify

important factors that could cause actual results to differ materially from

those contained in forward-looking information, there may be other factors that

cause results not to be as anticipated, estimated or intended. There can be no

assurance that such information will prove to be accurate, as actual results and

future events could differ materially from those anticipated in such statements.

Accordingly, readers should not place undue reliance on forward looking

information. The Company does not undertake to update any forward-looking

information, except in accordance with applicable securities laws.

FOR FURTHER INFORMATION PLEASE CONTACT:

Black Iron Inc.

Michael McAllister

Manager, Investor Relations

+1 (416) 309-2950

info@blackiron.com

Black Iron Inc.

Matt Simpson

President & CEO

+1 (416) 309-2138

Metinvest Holdings LLC

Alexey Komlyk

Head of Media and Marketing Communications

+380623881703

press@metinvestholding.com

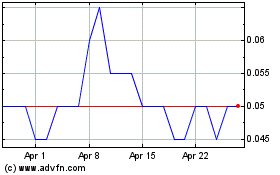

Black Iron (TSX:BKI)

Historical Stock Chart

From Mar 2024 to Apr 2024

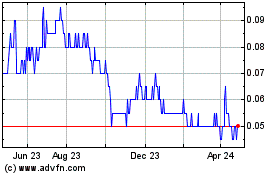

Black Iron (TSX:BKI)

Historical Stock Chart

From Apr 2023 to Apr 2024