Enerflex Ltd. (TSX:EFX) ("Enerflex" or "the Company"), a leading supplier of

products and services to the global energy industry, today reported its

financial and operating results for the three months ended March 31, 2014.

During the first quarter of 2014, there have been continuing positive market

developments in liquids-rich plays in Canada and the United States, in the

Alberta oil sands, and electric power opportunities. We have also seen

encouraging signs relative to liquefied natural gas projects in Canada, the

United States and AustralAsia. These market developments have materialized into

increased bookings in the first quarter of 2014 when compared to the same period

in 2013, and an increased backlog.

Revenue trends were generally positive in most markets compared to the first

quarter of 2013. The lower consolidated revenue in 2014 was attributable to the

International segment, where lower opening backlog, and large projects in Oman

and Australia that are nearing completion, contributed to a $54.5 million

reduction in revenue from Engineered Systems.

As expected and stated in prior communications, continuing cost increases in the

International segment in the first quarter of 2014 on a large project in Oman,

and the related impact on gross margin, resulted in overall financial results

for the Company that were below expectations. The cost increases were within the

range previously communicated. Where the cost increases have been customer

driven, variation claims have been submitted, and are being vigorously pursued.

Enerflex reported net earnings from continuing operations for the first quarter

of 2014 of $4.0 million, or $0.05 per share, which were $11.4 million lower than

the same period in 2013. The decrease in net earnings for the quarter was

primarily a result of lower gross margin and higher SG&A expenses, partially

offset by higher equity earnings and lower income tax expense.

Effective June 1, 2014, Enerflex has made a leadership change with the

appointment of Mr. Philip A. J. Pyle as President, International. Enerflex has a

strong regional business model and the location of this role is essential to the

Company's continued international growth. Based in Abu Dhabi, Mr. Pyle will be

responsible for overseeing and providing strategic and operational leadership

for the international business. He brings over 25 years of extensive

international operations experience through his leadership roles with

multi-national companies. To support Enerflex's global growth strategy, Mr.

William Moore has accepted the position of Senior Vice President, Business

Development and Strategy and will be responsible for the development and

execution of Enerflex's global growth objectives.

"The Company exited 2013 with strong backlog levels, and continued to see

excellent booking activity through the first quarter of 2014, with a first

quarter closing backlog almost $200 million higher than the first quarter of

2013. The improving market dynamics, coupled with our strong balance sheet,

position the Company well to capitalize on opportunities that may arise. After

first quarter results that were adversely affected by cost increases previously

anticipated and communicated, we would expect to deliver stronger results

through 2014, as the higher opening backlog is converted to revenue, and as the

Company continues to deliver improved recurring revenue from its Service

business. In addition, we are looking forward to leveraging the recent senior

leadership changes in the International business, and with respect to business

development."

(unaudited) Three months ended March 31,

($ millions, except per share

amounts and percentages) 2014 2013 Change ($)

----------------------------------------------------------------------------

Financial Highlights

Revenue $ 332.4 $ 353.3 $ (20.9)

Gross margin 51.3 61.0 (9.7)

Gross margin % 15.4% 17.3%

EBIT (1) 10.1 22.8 (12.7)

EBIT % 3.0% 6.4%

Net earnings (loss)

Continuing 4.0 15.4 (11.4)

Discontinued - (0.5) 0.5

Earnings (loss) per share

Continuing 0.05 0.20 (0.15)

Discontinued - (0.01) 0.01

Bookings (2) 237.9 189.3 48.6

Backlog (2) 801.9 603.2 198.7

(1) Earnings before Interest (Finance Costs) and Taxes ("EBIT") is

considered an additional GAAP measure, which may not be comparable with

similar additional GAAP measures used by other entities.

(2) Bookings and backlog are considered non-GAAP measures that do not have

standardized meanings as prescribed by GAAP, and are therefore unlikely

to be comparable to similar measures used by other entities.

As previously reported, work on an international project in Oman continued to

experience substantial customer driven scope and design variations during the

first quarter of 2014, which increased project costs by a further $16.2 million.

This resulted in a corresponding decrease in gross margin of $12.9 million.

These cost increases were within the range previously disclosed. With the

project 80% complete at the end of March 2014, the risk of further margin

deterioration is significantly reduced. The Company has submitted and continues

to pursue variation claims for cost increases on the project, but does not

expect resolution before the second half of 2014. Variation claims are filed

once forecast costs on a fixed price project exceed budgeted costs, as a result

of increased scope or design changes to the project, which are common for

engineering, procurement and construction contracts. To the extent that these

cost increases are subsequently recovered through approved variation claims from

customers, revenue will be recognized in the corresponding period. This results

in volatility in gross margins for the International segment as additional costs

are recognized as incurred on these projects, while revenue resulting from

variation claims is recognized in the period that claims are approved.

Segmented Financial Results

Revenue for the first quarter of 2014 was $332.4 million, representing a

decrease of $20.9 million compared to the same period in 2013. Revenue was lower

in the International segment, partially offset by higher revenue from the Canada

and Northern U.S., and Southern U.S. and Latin America segments.

International segment revenue decreased by $46.2 million in the first quarter of

2014 due to lower Engineered Systems revenue driven by lower opening backlog,

and large projects nearing completion in the MENA and AustralAsia regions, and

due to the impact on revenue of the cost increases on the Oman project. This was

partially offset by higher Service revenue on increased activity in the

AustralAsia and MENA regions.

Canada and Northern U.S. segment revenue increased by $22.0 million during the

first quarter of 2014 on account of increased Engineered Systems revenue due to

higher backlog, and higher Service revenue coming from increased parts and

engine sales, which was partially offset by lower Rental revenue resulting from

lower rental unit sales.

Southern U.S. and Latin America segment revenue increased by $3.3 million in the

first quarter of 2014 as a result of higher Service revenue on increased service

calls and part sales, compared to the same period of 2013. Despite higher

opening backlog to start 2014, Engineered Systems revenue was lower as a result

of the timing of backlog conversion to revenue as deliveries have been pushed

out, as a result of customer requirements. The associated revenue will be

recognized in subsequent periods.

Gross margin for the first quarter ended March 31, 2014 was $51.3 million or

15.4% of revenue compared to $61.0 million or 17.3% of revenue for the same

period in 2013. The decrease in gross margin was attributable to lower margin in

the International segment partially offset by higher margins in the Canada and

Northern U.S., and Southern U.S. and Latin America segments.

The increase in gross margin in Canada and the Northern U.S. in the first

quarter of 2014 was due to the positive impact of higher revenue, lower warranty

expense and stronger plant utilization, partially offset by less favourable

project cost adjustments. The higher gross margin in the Southern U.S. and Latin

America segment in the first quarter of 2014 was due to improved project margins

and lower warranty expense. In the International segment, gross margin decreased

primarily due to the impact of scope and design variations on the Oman project,

which resulted in additional cost increases, and a corresponding erosion of

gross margin.

The Company recorded bookings of $237.9 million during the first quarter of

2014, which were $48.6 million higher than the comparable period in 2013. This

was due to a $30.3 million increase in bookings for the Canada and Northern U.S.

segment as a result of improving market fundamentals, and the expansion into the

Alberta oil sands and the electric power market, and a $33.9 million increase in

International segment bookings due to increased activity in the AustralAsia

region. This was partially offset by bookings for the Southern U.S. and Latin

America segment that were $15.7 million lower in the first quarter of 2014 as

the decline in bookings destined for international markets more than offset the

increase in domestic bookings resulting from strong activity in liquids-rich

U.S. gas basins. Enerflex finished the first quarter with a backlog of $801.9

million, compared to $603.2 million at the end of the first quarter of 2013, an

increase of $198.7 million or 32.9%. Sequentially, backlog has increased by $7.9

million since December 31, 2013.

Subsequent to the end of the first quarter of 2014, Enerflex declared a

quarterly dividend of $0.075 per share, payable on July 3, 2014, to shareholders

of record on May 27, 2014.

Quarterly Results Material

Enerflex's interim condensed financial statements for the three months ended

March 31, 2014, and the accompanying Management's Discussion and Analysis, will

be available on the Enerflex website at www.enerflex.com under the Investors

section and on SEDAR at www.sedar.com.

Conference Call and Webcast Details

Enerflex will host a conference call for analysts, investors, members of the

media and other interested parties on Tuesday, May 13, 2014 at 9:00 a.m. MDT

(11:00 a.m. EDT) to discuss the first quarter 2014 financial results and

operating highlights. The call will be hosted by Mr. J. Blair Goertzen,

President and Chief Executive Officer and Mr. D. James Harbilas, Executive Vice

President and Chief Financial Officer of Enerflex Ltd.

If you wish to participate in this conference call, please call 1.800.618.8682.

Please dial in 10 minutes prior to the start of the call. No passcode is

required. The live audio webcast of the conference call will be available on the

Enerflex website at www.enerflex.com under the Investors section on May 13, 2014

at 9:00 a.m. MDT (11:00 a.m. EDT). Approximately one hour after the call, a

recording of the event will be available on the Company's website. A replay of

the teleconference will be available one hour after the conclusion of the call

until midnight, May 20, 2014. Please call 1.800.558.5253 or 1.416.626.4100 and

enter passcode 21715349.

About Enerflex

Enerflex Ltd. is a single source supplier of natural gas compression, oil and

gas processing, refrigeration systems and electric power equipment - plus

in-house engineering and mechanical service expertise. The Company's broad

in-house resources provide the capability to engineer, design, manufacture,

construct, commission and service hydrocarbon handling systems. Enerflex's

expertise encompasses field production facilities, compression and natural gas

processing plants, CO2 processing plants, refrigeration systems and electric

power equipment servicing the natural gas production industry.

Headquartered in Calgary, Canada, Enerflex has approximately 2,900 employees

worldwide. Enerflex, its subsidiaries, interests in associates and

joint-ventures operate in Canada, the United States, Colombia, Australia, the

United Kingdom, Russia, the United Arab Emirates, Oman, Bahrain, Indonesia,

Malaysia and Singapore. Enerflex's shares trade on the Toronto Stock Exchange

under the symbol "EFX". For more information about Enerflex, go to

www.enerflex.com.

Advisory Regarding Forward-Looking Statements

To provide Enerflex shareholders and potential investors with information

regarding Enerflex, including management's assessment of future plans, Enerflex

has included in this news release certain statements and information that are

forward-looking statements or information within the meaning of applicable

securities legislation, and which are collectively referred to in this advisory

as "forward-looking statements". Information included in this news release that

is not a statement of historical fact may be forward-looking information. When

used in this document, words such as "plans", "expects", "will", "may" and

similar expressions are intended to identify statements containing

forward-looking information. Forward-looking statements and information

contained in this press release include, but are not limited to: (i) the

anticipated duration of weak natural gas prices and the effect thereof in Canada

and Northern U.S. markets; (ii) expected bookings in Southern U.S. and Latin

America; and (iii) the nature and scope of challenges and opportunities in the

International segment, including the nature and magnitude of cost estimates and

variation claims. In developing the forward-looking information in this news

release, the Company has made certain assumptions with respect to general

economic and industry growth rates, commodity prices, currency exchange and

interest rates, competitive intensity and regulatory approvals. Readers are

cautioned not to place undue reliance on forward-looking statements, as there

can be no assurance that the future circumstances, outcomes or results

anticipated in or implied by such forward-looking statements will occur or that

plans, intentions or expectations upon which the forward-looking statements are

based will occur.

Forward-looking information involves known and unknown risks and uncertainties

and other factors, which may cause or contribute to Enerflex achieving actual

results that are materially different from any future results, performance or

achievements expressed or implied by such forward-looking information. Such

risks and uncertainties include, among other things, the impact of general

economic conditions; industry conditions, including the adoption of new

environmental, taxation and other laws and regulations and changes in how they

are interpreted and enforced; volatility of oil and gas prices; oil and gas

product supply and demand; risks inherent in the ability to generate sufficient

cash flow from operations to meet current and future obligations, including

future dividends to shareholders of the Company; increased competition; the lack

of availability of qualified personnel or management; labour unrest; political

unrest; fluctuations in foreign exchange or interest rates; stock market

volatility; opportunities available to, or pursued by, the Company; obtaining

financing; and other factors, many of which are beyond its control. The

foregoing list of factors and risks is not exhaustive. For an augmented

discussion of the risk factors and uncertainties that affect or may affect

Enerflex, the reader is directed to the section entitled "Risk Factors" in

Enerflex's most recently filed Annual Information Form, as well as Enerflex's

other publicly filed disclosure documents, available on www.sedar.com. The

reader is cautioned that these factors and risks are difficult to predict and

that the assumptions used in the preparation of such information, although

considered reasonably accurate at the time of preparation, may prove to be

incorrect. Readers are cautioned that the actual results achieved will vary from

the information provided in this press release and that such variation may be

material. Consequently, Enerflex does not represent that actual results achieved

will be the same in whole, or in part, as those set out in the forward-looking

information. Furthermore, the statements containing forward-looking information

that are included in this news release are made as of the date of this news

release, and Enerflex does not undertake any obligation, except as required by

applicable securities legislation, to update publicly or to revise any of the

included forward-looking information, whether as a result of new information,

future events or otherwise. The forward-looking information contained in this

news release is expressly qualified by this cautionary statement.

FOR FURTHER INFORMATION PLEASE CONTACT:

Enerflex Ltd.

J. Blair Goertzen

President & Chief Executive Officer

403.236.6852

Enerflex Ltd.

D. James Harbilas

Executive Vice President & Chief Financial Officer

403.236.6857

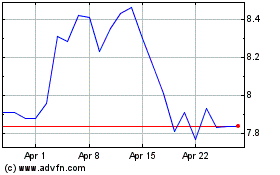

Enerflex (TSX:EFX)

Historical Stock Chart

From Mar 2024 to Apr 2024

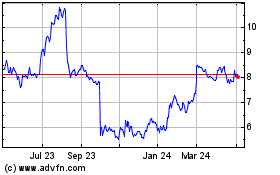

Enerflex (TSX:EFX)

Historical Stock Chart

From Apr 2023 to Apr 2024