New Zealand Energy Production and Operational Update

March 04 2014 - 7:17AM

Marketwired

New Zealand Energy Production and Operational Update

VANCOUVER, BRITISH COLUMBIA--(Marketwired - Mar 4, 2014) - New

Zealand Energy Corp. (TSX-VENTURE:NZ)(OTCQX:NZERF) today announced

that at the end of February 2014, the Company was producing light,

high-quality oil from nine wells in the Taranaki Basin of New

Zealand's North Island. Consistent with guidance in the Company's

previous production update, no new wells were added in February but

substantial progress was made in order to prepare four existing

wells to further add to oil production. As a result of optimization

efforts on existing wells, production for February 2014 increased

11% over January's average, with an average of 228 barrels of oil

per day ("bbl/d") in February compared to 202 bbl/d in January. In

addition, the Company's Waitapu-2 well re-commenced production on

March 3.

"NZEC remains focused on its primary objectives of increasing

production and cash flow while reducing costs," said John Proust,

Chief Executive Officer and Director of NZEC. "The Company is

committed to providing monthly updates so that investors can track

our progress. While production rates continue to fluctuate as a

result of optimization and workover activities on the wells,

monthly production averages are the best representation of our

corporate production. During March and early April NZEC will

systematically complete workover activities on a number of existing

wells that are expected to add to the Company's oil

production."

Workover activities at existing wells on the Eltham Permit and

TWN Licenses are on track as outlined in the February 4, 2014 press

release. Following the mobilization of a service rig on February

17, NZEC completed workover activities on the Waitapu-2 well as

well as wireline activities on the Waihapa-1B well. Waitapu-2 has

been pumping since February 27 and produced load fluid (water that

was pumped into the well during workover activities) for a number

of days. On March 3 the well started to produce oil along with load

fluid and is expected to finish cleaning up the load fluid in the

next few days. The TWN Joint Arrangement ("TWN JA") (NZEC and

L&M Energy, joint owners of the TWN Licenses) also identified a

cost savings opportunity on the Waihapa-8 well. Initially expected

to require installation of a dedicated downhole pump for artificial

lift, further review determined that the well can likely be

produced by heating gas at the wellhead and using existing gas

lift. If successful, this should result in savings of approximately

NZ$200,000 net to NZEC and accelerate Waihapa-8 production to March

2014.

The TWN JA also advanced the Waihapa-1B well in February by

removing a plug from the well and commencing evaluation of the

potential to produce oil from the Tikorangi Formation. If

successful, Tikorangi production could resume in March 2014, with

the alternative of an uphole completion in the Mt. Messenger

Formation. The TWN JA also commenced installation of artificial

lift on the Waihapa-2 well with the expectation of achieving

production from the Mt. Messenger Formation in April 2014.

During February the TWN JA entered into an agreement with a gas

marketing counterparty to transport gas along a section of the TAW

gas pipeline for a term of four years with a five-year right of

renewal. The arrangement is expected to generate between NZ$250,000

and NZ$1million revenue per year (net to NZEC). First gas is

expected to flow during Q2-2014.

Third-party revenue at the Waihapa Production Station year to

date totals approximately NZ$346,000 net to NZEC.

Upcoming Catalysts

- Waitapu-2: Contributing oil production as of March 3

- Waihapa-8: Production from Mt. Messenger Formation anticipated

in March 2014 using existing gas lift

- Waihapa-1B: Continuing to evaluate production potential from

Tikorangi Formation. If successful, Tikorangi production could

resume in March 2014. If unsuccessful, the TWN JA will proceed to

complete the well uphole in Mt. Messenger Formation

- Waihapa-2: Artificial lift installation underway with

production anticipated from Mt. Messenger Formation in April

2014

- Toko-2B: ESP installation targeted for March 2014, with a

production increase anticipated in April 2014

NZEC and L&M Energy applied to New Zealand Petroleum &

Minerals and were granted an extension to drill the Alton Permit

Horoi commitment well by June 22, 2014.

Management Changes

Further to NZEC's commitment to reduce costs, two of NZEC's

senior executives, Bruce McIntyre and Ian Brown, have taken early

retirement from their paid employment positions. Bruce McIntyre

will remain on the Board of Directors and Ian Brown will act as an

advisor to NZEC.

"On behalf of the Board of Directors and NZEC employees, I thank

Bruce and Ian for their significant contributions to NZEC," said

John Proust, Chief Executive Officer and Director of NZEC. "They

remain committed to the Company's success and I look forward to

their continued input.

To view Table 1 - NZEC's Production & Development Wells,

please visit the following link:

http://media3.marketwire.com/docs/931145_TABLE_1.pdf.

On behalf of the Board of Directors

John Proust, Chief Executive Officer & Director

About New Zealand Energy Corp.

NZEC is an oil and natural gas company engaged in the

production, development and exploration of petroleum and natural

gas assets in New Zealand. NZEC's property portfolio collectively

covers approximately 1.93 million acres of conventional and

unconventional prospects in the Taranaki Basin and East Coast Basin

of New Zealand's North Island. The Company's management team has

extensive experience exploring and developing oil and natural gas

fields in New Zealand and Canada, and takes a multi-disciplinary

approach to value creation with a track record of successful

discoveries. NZEC plans to add shareholder value by executing a

technically disciplined exploration and development program focused

on the onshore and offshore oil and natural gas resources in the

politically and fiscally stable country of New Zealand. NZEC is

listed on the TSX Venture Exchange under the symbol NZ and on the

OTCQX International under the symbol NZERF. More information is

available at www.newzealandenergy.com or by emailing

info@newzealandenergy.com.

Neither the TSX Venture Exchange nor its Regulation Services

Provider (as such term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

This document contains certain forward-looking information

and forward-looking statements within the meaning of applicable

securities legislation (collectively "forward-looking statements").

The use of the word "will", "anticipated", "expected", "targeted",

"evaluate", "should", "could", "prepare", "likely", "expectation",

"optimization", and similar expressions are intended to identify

forward-looking statements. These statements involve known and

unknown risks, uncertainties and other factors that may cause

actual results or events to differ materially from those

anticipated in such forward-looking statements including, without

limitation, the speculative nature of exploration, appraisal and

development of oil and natural gas properties; uncertainties

associated with estimating oil and natural gas reserves and

resources; uncertainties in both daily and long-term production

rates and resulting cash flow; volatility in market prices for oil

and natural gas; changes in the cost of operations, including costs

of extracting and delivering oil and natural gas to market, that

affect potential profitability of oil and natural gas exploration

and production; the need to obtain various approvals before

exploring and producing oil and natural gas resources; exploration

hazards and risks inherent in oil and natural gas exploration;

operating hazards and risks inherent in oil and natural gas

operations; the Company's ability to generate sufficient cash flow

from production to fund future development activities; market

conditions that prevent the Company from raising the funds

necessary for exploration and development on acceptable terms or at

all; global financial market events that cause significant

volatility in commodity prices; unexpected costs or liabilities for

environmental matters; competition for, among other things,

capital, acquisitions of resources, skilled personnel, and access

to equipment and services required for exploration, development and

production; changes in exchange rates, laws of New Zealand or laws

of Canada affecting foreign trade, taxation and investment; failure

to realize the anticipated benefits of acquisitions; and other

factors as disclosed in documents released by NZEC as part of its

continuous disclosure obligations. Such forward-looking statements

should not be unduly relied upon. The Company believes the

expectations reflected in those forward-looking statements are

reasonable, but no assurance can be given that these expectations

will prove to be correct. Actual results could differ materially

from those anticipated in these forward-looking statements. The

forward-looking statements contained in the document are expressly

qualified by this cautionary statement. These statements speak only

as of the date of this document and the Company does not undertake

to update any forward-looking statements that are contained in this

document, except in accordance with applicable securities

laws.

New Zealand Energy Corp.John ProustChief Executive Officer &

DirectorNorth American toll-free: 1-855-630-8997New Zealand Energy

Corp.Bruce McIntyreDirectorNorth American toll-free:

1-855-630-8997New Zealand Energy Corp.Rhylin BailieVice President

Communications & Investor RelationsNorth American toll-free:

1-855-630-8997info@newzealandenergy.comwww.newzealandenergy.com

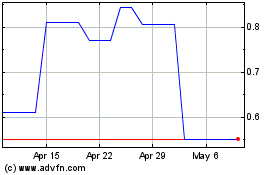

New Zealand Energy (PK) (USOTC:NZERF)

Historical Stock Chart

From Mar 2024 to Apr 2024

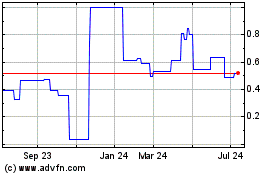

New Zealand Energy (PK) (USOTC:NZERF)

Historical Stock Chart

From Apr 2023 to Apr 2024