Canadian Natural Resources Limited Announces The Acquisition of Certain Canadian Assets of Devon Canada

February 19 2014 - 4:00AM

Marketwired Canada

Canadian Natural Resources Limited (TSX:CNQ)(NYSE:CNQ) ("Canadian Natural" or

the "Company") announces entering into an agreement relating to the acquisition

of Devon Canada's Canadian conventional assets, excluding Horn River and the

heavy oil properties, for an aggregate cash consideration of $3.125 billion,

effective January 1, 2014, with a targeted closing date of April 1, 2014. The

acquired lands and production base are all located in Western Canada in areas

adjacent or proximal to Canadian Natural's current operations and are high

quality, concentrated liquids-rich natural gas weighted assets, with additional

light crude oil exposure. The current estimated production, before royalties,

from the acquired properties is approximately 383 mmcf/d of natural gas, 10,800

bbl/d of light crude oil and 12,000 bbl/d of NGLs and is approximately 72%

operated. Along with the production are associated key strategic facilities

including 6 major owned and operated natural gas plants, with gross processing

capacity in excess of 1,000 mmcf/d, and 4 major owned and operated oil

batteries. Finally, the assets also include a high quality land base of

approximately 2.2 million net acres of undeveloped land and 2.7 million net

acres of royalty and fee simple lands. Company Gross proved reserves (excluding

the royalty lands) associated with the acquisition, as evaluated by an

independent qualified reserves evaluator as at December 31, 2013 using forecast

prices and costs, were 272.2 million BOE.

The acquired asset package includes a royalty revenue stream which is targeted

to earn approximately $75 million in cash flow during 2014. Canadian Natural is

reviewing the options to combine the acquired royalty revenue stream with its

own royalty revenue portfolio for either the creation of a new vehicle to

provide steady cash flow to current shareholders or monetization through a sale

package later in 2014. The targeted cash flow from the combined royalty revenue

streams is expected to be between $140 million and $150 million in 2014.

Commenting on the acquisition, Canadian Natural's President Steve Laut stated,

"This acquisition fits our strategy of opportunistically adding to our existing

core areas, where we can provide immediate value, with the opportunity to add

value in the future. The acquired assets are largely operated, as are the owned

facilities and infrastructure; and are a very good fit with Canadian Natural's

existing assets and infrastructure. The combined assets and infrastructure

provide synergies to more effectively and efficiently operate once fully

integrated.

Additionally, this acquisition provides significant upside in liquids-rich

natural gas and light crude oil properties where we already operate and have a

strong understanding of the geology and operating performance. The acquisition

provides immediate value to shareholders through production and cash flow, is

accretive in earnings, cash flow and returns, and maintains our strong financial

capacity to effectively execute our well defined plan."

The following table summarizes key metrics included in the acquisition properties:

Forecast

Proved current

(Before Royalties) reserves(1) production

--------------------------------------------------

Natural gas 1,130 bcf 383 mmcf/d

Natural gas liquids 47.2 million bbl 12,000 bbl/d

Light crude oil 36.8 million bbl 10,800 bbl/d

BOE 272.2 million BOE 86,633 BOED

----------------

(1) Company Gross proved reserves using forecast pricing and costs, as

evaluated by Deloitte, an independent qualified reserves evaluator

retained by Devon Canada as at December 31, 2013.

Approximately 900 Devon Canada employees will be joining the Canadian Natural

team, comprised of both field and head office personnel.

Upon completion of the acquisition, Canadian Natural will maintain its strong

financial position with sufficient balance sheet flexibility to accommodate the

acquisition. In addition, the Company has negotiated an additional $1 billion

committed term facility with the Bank of Montreal, which is available upon

closing. Balance sheet metrics, based upon current strip pricing, are targeted

to exit 2014 with debt to book capitalization at approximately 30-31% (at low

end of internal target) and debt to EBITDA at approximately 1.05-1.15x (below

internal target range).

The transaction is subject to normal closing conditions and government approval.

Canadian Natural is a senior oil and natural gas production company, with

continuing operations in its core areas located in Western Canada, the U.K.

portion of the North Sea and Offshore Africa.

CONFERENCE CALL

A conference call will be held at 7:00 a.m. Mountain Time, 9:00 a.m. Eastern

Time on Wednesday, February 19, 2014. The North American conference call number

is 1-800-766-6630 and the outside North American conference call number is

001-416-340-8527. Please call in about 15 minutes before the starting time in

order to be patched into the call.

A taped rebroadcast will be available until 6:00 p.m. Mountain Time, Wednesday,

February 26, 2014. To access the rebroadcast in North America, dial

1-800-408-3053. Those outside of North America, dial 001-905-694-9451. The pass

code to use is 9119434.

WEBCAST

This call is being webcast and can be accessed on Canadian Natural's website at

www.cnrl.com. Presentation slides will be available on Canadian Natural's

website in PDF format shortly before the live conference call webcast.

Certain information regarding the Company contained herein may constitute

forward-looking statements under applicable securities laws. Such statements,

including but not limited to statements regarding reserves, forecast current

production, cash flow from royalty revenue assets and future plans related

thereto, are subject to known or unknown risks and uncertainties that may cause

actual results to differ materially from those anticipated or implied in the

forward-looking statements. Refer to our website for complete forward-looking

statements www.cnrl.com

FOR FURTHER INFORMATION PLEASE CONTACT:

Steve W. Laut

President

Corey B. Bieber

Chief Financial Officer & Senior Vice-President, Finance

Douglas A. Proll

Executive Vice-President

Canadian Natural Resources Limited

2500, 855 - 2nd Street S.W.

Calgary, Alberta, T2P 4J8

Telephone: (403) 514-7777

(403) 514-7888 (FAX)

ir@cnrl.com

www.cnrl.com

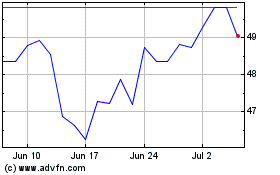

Canadian Natural Resources (TSX:CNQ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Canadian Natural Resources (TSX:CNQ)

Historical Stock Chart

From Apr 2023 to Apr 2024