Dragon Capital Group, Inc. Reports Financial Results for the First Quarter of 2013 Ended March 31, 2013

June 11 2013 - 9:00AM

Marketwired

Dragon Capital Group Corp. (OTC Pink: DRGV), a leading holding

company of emerging high-tech companies in China, announced today

our financial results for the first quarter of 2013 ended March 31,

2013.

Financial Highlights

For the first quarter of 2013, total revenues were $4.3 million

compared to revenues of $5.2 million recorded in the first quarter

of 2012. The decline in revenue was mainly attributable to a shift

in our business mix away from sales of low margin office equipment

at our Shanghai Zhaoli Technology Development Co., Ltd. ("Zhaoli")

and toward our higher margin software subsidiaries. This shift in

our business mix resulted in gross margins improving to 9%, an

increase of 114% compared to gross margins of 4.2% in the first

quarter of 2012. Net income attributable to Dragon Capital Group in

the first quarter of 2013 increased more than tenfold to $94,000

compared to net income of $9,200 recorded in the first quarter of

2012. Earnings per basic and diluted share rounded to$0.00 in both

periods on 492.7 million weighted average shares.

Management continues to see improving performance trends for the

remainder of 2013 through a rebound in sales at Zhaoli as

uncertainties associated with China's governmental succession which

took place in November of 2012 begins to abate as well as new

business coming from our software related subsidiaries. Our 2013

year will include the full marketing launch of the Gas GIS system

from our Shanghai Yazheng Information Technology Company

("Yazheng") subsidiary as well as the first full year of operations

from our Shanghai Zhiye Software Development Company ("Zhiye")

subsidiary which the Company acquired in December of 2012. Zhiye

offers mobile solutions for Android, Windows Mobile and Apple's

iOS. Zhiye has been working to develop a mobile programming

solutions platform to enable application developers in China to

easily and efficiently develop and modify applications to work

across the most popular mobile operating systems in China.

Balance Sheet

At March 31, 2013, total assets were $9.3 million and

shareholder equity was $7.2 million with 492,735,578 common shares

outstanding. At December 31, 2012, total assets were $9.1 million

and shareholder equity was $7.0 million with 492,735,578 common

shares outstanding. Working capital was $7.5 million at March 31,

2013 compared to $7.5 million at December 31, 2012.

Commenting on our results for the first quarter of 2013, Mr.

Lawrence Wang, Chairman and CEO of Dragon Capital Group, "We are

very pleased with our overall performance for the first quarter of

2013 as our efforts to increase margins and profitability have

begun to surface. In 2012 we returned to profitability and with our

new acquisitions and pending software launches we see further gains

in our performance in 2013 paving the way for a bright future ahead

for our company. While sales declined sharply at Zhaoli, in the

first quarter we anticipate a rebound in the coming quarters. With

the addition of our new higher margin software subsidiaries we

believe our performance in 2013 will build upon 2012 and set us up

for consistent improvement in the coming years as we grow our

company for the benefit of our stockholders."

About Dragon Capital Group Corporation

Dragon Capital Group Corp. (OTC Pink: DRGV) is doing business in

China through its subsidiaries. Dragon was established to serve as

a conduit between Chinese high-growth companies and Western

investors. DRGV functions as an incubator of high-tech companies in

China, offering support in the critical functions of general

business consulting, formation of joint ventures, access to

capital, merger & acquisition, business valuation, and revenue

growth strategies. DRGV has developed a portfolio of high-tech

companies operating in China. For more information about DRGV,

please visit http://www.dragoncapital.us

Safe Harbor Statement

Certain statements set forth in this press release constitute

"forward-looking statements." Forward-looking statements include,

without limitation, any statement that may predict, forecast,

indicate, or imply future results, performance or achievements, and

may contain the word expressions of similar meaning. Such

statements are not guarantees of future performance and are subject

to risks and uncertainties that could cause the company's actual

results and financial position to differ materially from those

included within the forward-looking statements. Forward-looking

statements involve risks and uncertainties, including those

relating to the Company's ability to grow its business. Actual

results may differ materially from the results predicted and

reported results should not be considered as an indication of

future performance.

Contact: Dore Perler U.S. Representative Telephone: (954)

232-5363 Facsimile: (954) 726-2022 Email:

Dore@PearlGroupAdvisors.com

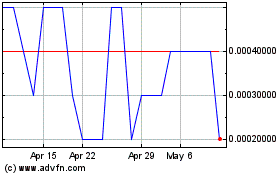

Dragon Capital (PK) (USOTC:DRGV)

Historical Stock Chart

From Mar 2024 to Apr 2024

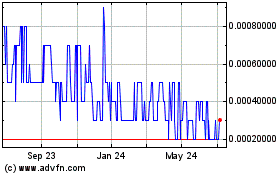

Dragon Capital (PK) (USOTC:DRGV)

Historical Stock Chart

From Apr 2023 to Apr 2024