BlackRock Expands ETF Footprint in Europe - ETF News And Commentary

January 11 2013 - 6:45AM

Zacks

The world’s largest asset manager, BlackRock

(BLK), announced the acquisition of Europe’s fifth largest

exchange traded fund business unit of Credit Suisse

(CS). The price of the deal, which is expected to close by

the end of second quarter, was not disclosed by BlackRock.

This business unit purchase is yet another addition to

BlackRock’s plans to bring together smaller asset managers. The

acquisition further aims at strengthening its position in

Switzerland and Europe overall, hopefully providing a boost to its

overall growth after losing a portion of its market share in the

U.S. to Vanguard (Vanguard Ends 2012 with a Bang, Cuts Fees on 22

ETFs).

On the other hand, the purpose of Credit Suisse to sell the unit

entails the raising of $16.5 billion in capital, which it announced

in July. This also included issuing convertible bonds and prime

Zurich real estate and other assets sales.

However, Credit Suisse through Private Banking and Wealth

Management division will continue to be a large player in the ETF

world. The firm will assist BlackRock in expanding the ETF product

offering.

The Credit Suisse unit has $17.6 billion assets under management

spread across 58 ETFs on five exchanges. BlackRock currently has

approximately 42% share in $331 billion European ETF market (see

Three European ETFs with Incredible 2012 Gains).

With this purchase, BlackRock share in the European ETF market

will increase over 47%, and cement its dominant position in that

region of the world as well. The acquisition would result in

widening the ETF base in Europe to the largest ETF platform

offering products across different classes and commodities.

In the coming years, the European ETF market is expected to show

strength attributable to the fact that more financial advisors are

shifting from charging commissions toward fee-based businesses.

BlackRock is a leader in the ETF industry and its track record

appears to be quite impressive. This is BlackRocks’s second attempt

to expand its footprint and ETF offering in the international ETF

market in the last year.

Before Credit Suisse’s unit purchase, BlackRock had acquired a

Canadian ETF operation. It was a Toronto-based Claymore

Investments, and was from Guggenheim Partners LLC. The acquisition

was made in March by BlackRock and included 34 ETFs with more than

C$6.9 billion assets under management (BlackRock to Buy ETF firm

Claymore).

Exchange traded funds are low margin business and its growth is

highly dependent on adding scale to the business. These

acquisitions by asset managers assist in scaling the business

platform. In fact, the ETF industry could see similar acquisitions

made by bigger asset houses in order to scale their business.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

BLACKROCK INC (BLK): Free Stock Analysis Report

CREDIT SUISSE (CS): Free Stock Analysis Report

ISHARS-EAFE (EFA): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

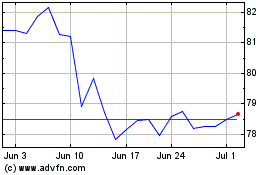

iShares MSCI EAFE (AMEX:EFA)

Historical Stock Chart

From Mar 2024 to Apr 2024

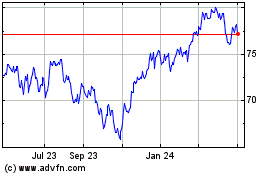

iShares MSCI EAFE (AMEX:EFA)

Historical Stock Chart

From Apr 2023 to Apr 2024