Can the U.S. Economy Lead the World Economy in 2013? - Real Time Insight

October 08 2012 - 9:55AM

Zacks

This week, investors

get supplied with new IMF global GDP growth data. I am quite

interested to see this data. I think it will give us a

refresh on the global growth situation. These are the first

global growth numbers to come out after the latest Draghi moves to

buy debt and the announcement of Bernanke’s QE3.

The IMF’s World

Economic Outlook comes out on Tuesday, October

9.

The IMF’s Global

Financial Stability Report comes out on Wednesday, Oct

10.

Here are IMF GDP data

I pulled out of last quarter’s reports, done in July

2012.

All data will

be updated:

Advanced

Economies 2011

+1.6%

2012

+1.4% 2013

+1.9%

United States

2011 +1.7%

2012 +2.0%

2013

+2.3%

Euro Area

2011 +1.5%

2012 (-0.3%)

2013 +0.7%

China

2011 +9.2%

2012 +8.0%

2013

+8.5%

Open this nice IMF

tool to view the long-term global GDP growth

picture…

http://www.imf.org/external/datamapper/index.php

For its part, the

World Bank reported Monday, Oct. 8th that China should expand +7.7%

in 2012 and +8.1% in 2013. For China, this weaker World Bank

GDP data argues for a reduction in the coming IMF GDP growth

numbers.

My debate

questions?

(1) Is the U.S.

economy still going to show stronger real GDP growth in 2013?

Why or why not?

(2) Does U.S. GDP

growth push new macro support on China and

Europe?

(3) Can the U.S.

economy lead the major parts of the world economy in

2013?

AND

(4) Did (U.S. and

non-U.S.) equity markets already price in the new

data?

ISHARS-EAFE (EFA): ETF Research Reports

ISHARS-1500 IDX (ISI): ETF Research Reports

ISHARS-MS CH IF (MCHI): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

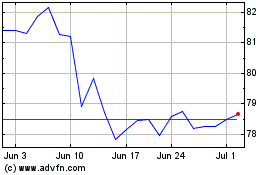

iShares MSCI EAFE (AMEX:EFA)

Historical Stock Chart

From Mar 2024 to Apr 2024

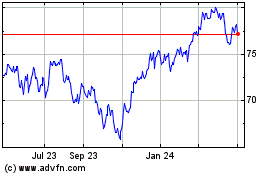

iShares MSCI EAFE (AMEX:EFA)

Historical Stock Chart

From Apr 2023 to Apr 2024