|

|

|

|

|

|

|

|

|

ISSUER FREE WRITING PROSPECTUS

Filed Pursuant to Rule 433

Registration Statement No. 333-178960

Dated May 18, 2012

|

|

|

$

·

UBS AG Buffered Digital Optimization Securities

Linked to a Currency Basket Relative to the U.S. dollar

due on or about May 30, 2014

The Buffered Digital Optimization Securities Linked to a Currency Basket Relative to the U.S. Dollar (the “Securities”)

are unsubordinated, unsecured debt securities issued by UBS AG (“UBS”). The Securities provide exposure to the performance of an equally weighted basket consisting of the Australian dollar (“AUD”), the Brazilian real

(“BRL”) and the Canadian dollar (“CAD”) (each a “basket currency” and together the “basket”) relative to the U.S. dollar (the “reference currency”). If the basket return is zero or positive (meaning

that overall the basket currencies have held their value or strengthened against the U.S. dollar over the term of the Securities), UBS will repay your principal amount at maturity plus pay a digital return of 20.00% to 23.00% (to be determined on

the trade date). If the basket return is negative (meaning that overall the basket currencies have weakened against the U.S. dollar over the term of the Securities), but the percentage decline from the initial basket level to the final basket level

is equal to or less than the 10% buffer amount, UBS will repay the full principal amount at maturity. However, if the basket return is negative and the percentage decline from the initial basket level to the final basket level is greater than the

10% buffer amount, UBS will repay less than the full principal amount at maturity resulting in a loss on your investment that is equal to the percentage decline in the level of the basket in excess of the 10% buffer amount, however, in no event will

the amount payable by UBS at maturity be less than 10% of your principal amount. All spot rates in this free writing prospectus are expressed as the number of the applicable foreign currency per one U.S. dollar.

Investing in the Securities

involves significant risks. The Securities do not pay interest. You may lose up to 90% of your principal amount if the percentage decline from the initial basket level to the final basket level is greater than 10%. The downside market exposure to

the basket is buffered only at maturity. Any payment on the Securities, including any repayment of principal, is subject to the creditworthiness of UBS. If UBS were to default on its payment obligations you may not receive any amounts owed to you

under the Securities and you could lose your entire investment.

|

q

|

|

Digital Return at Maturity:

If the basket return is zero or positive on the final valuation date, at maturity UBS will pay the full principal amount of

the Securities and pay you a return equal to the digital return. If the basket return is negative you may be exposed to the downside performance of the basket resulting in a loss of up to 90% of your investment.

|

|

q

|

|

Buffered Downside Market Exposure:

If you hold the Securities to maturity and the basket return is negative, but the percentage decline from the initial

basket level to the final basket level is equal to or less than the 10% buffer amount, UBS will repay your initial investment in the Securities. However, if the percentage decline from the initial basket level to the final basket level is greater

than the 10% buffer amount, UBS will pay you less than your initial investment, resulting in a loss that is equal to the percentage decline in the basket in excess of the buffer amount, up to a 90% loss of your initial investment. The downside

market exposure to the basket is buffered only if you hold the Securities to maturity. Any payment on the Securities, including any repayment of your initial investment, is subject to the creditworthiness of UBS.

|

|

|

|

|

|

Trade Date

|

|

May 25, 2012

|

|

Settlement Date

|

|

May 31, 2012

|

|

Final Valuation Date**

|

|

May 27, 2014

|

|

Maturity Date**

|

|

May 30, 2014

|

|

*

|

Expected. See page 4 for additional details.

|

|

**

|

Subject to postponement in the event of a market disruption event. See “Maturity Date” and “Final Valuation Date” under “General Terms of the

Securities” in the product supplement.

|

NOTICE TO INVESTORS: THE SECURITIES ARE

SIGNIFICANTLY RISKIER THAN CONVENTIONAL DEBT INSTRUMENTS. UBS IS NOT NECESSARILY OBLIGATED TO REPAY THE FULL PRINCIPAL AMOUNT OF THE SECURITIES AT MATURITY. THE SECURITIES HAVE DOWNSIDE MARKET RISK SIMILAR TO THE BASKET, SUBJECT TO THE BUFFER

AMOUNT, WHICH CAN RESULT IN A LOSS OF UP TO 90% OF YOUR INVESTMENT AT MATURITY. THIS MARKET RISK IS IN ADDITION TO THE CREDIT RISK INHERENT IN PURCHASING A DEBT OBLIGATION OF UBS. YOU SHOULD NOT PURCHASE THE SECURITIES IF YOU DO NOT UNDERSTAND OR

ARE NOT COMFORTABLE WITH THE SIGNIFICANT RISKS INVOLVED IN INVESTING IN THE SECURITIES.

YOU SHOULD CAREFULLY CONSIDER THE RISKS DESCRIBED UNDER

“KEY RISKS” BEGINNING ON PAGE 11 AND UNDER “RISK FACTORS” BEGINNING ON PAGE PS-8 OF THE PRODUCT SUPPLEMENT BEFORE PURCHASING THE SECURITIES. EVENTS RELATING TO ANY OF THOSE RISKS, OR OTHER RISKS AND UNCERTAINTIES, COULD ADVERSELY

AFFECT THE MARKET VALUE OF, AND THE RETURN ON, YOUR SECURITIES. YOU MAY LOSE SOME OR ALL OF YOUR INITIAL INVESTMENT IN THE SECURITIES.

These preliminary terms relate to the Buffered Digital Optimization Securities Linked to a Currency Basket Relative to the U.S. Dollar.

The return of the Securities will depend upon the performance of the basket currencies relative to the U.S. dollar. The Securities are offered at a minimum investment of $1,000, or 100 Securities at $10.00 per Security, and integral multiples of

$10.00 in excess thereof. The initial spot rate for each basket currency and the digital return will be set on the trade date.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basket Currencies

|

|

Currency

Weighting

|

|

Initial Spot

Rate

|

|

Initial Basket

Level

|

|

Digital Return

|

|

Buffer

Amount

|

|

CUSIP

|

|

ISIN

|

|

Australian dollar (“AUD”)

|

|

AUD 1/3

|

|

•

|

|

|

|

|

|

|

|

|

|

|

|

Brazilian real (“BRL”)

|

|

BRL 1/3

|

|

•

|

|

100

|

|

Between 20.00% and

23.00%

|

|

10%

|

|

902669472

|

|

US9026694722

|

|

Canadian dollar (“CAD”)

|

|

CAD 1/3

|

|

•

|

|

|

|

|

|

|

|

|

|

|

See “Additional Information about UBS and the Securities” on page 3. The Securities will have the terms specified in

the accompanying product supplement, the accompanying currency and commodity supplement, the accompanying prospectus and this free writing prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the Securities or passed upon the accuracy or

the adequacy of this free writing prospectus, the accompanying product supplement, the accompanying currency and commodity supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense. The Securities are not

deposit liabilities of UBS AG and are not FDIC insured.

|

|

|

|

|

|

|

|

|

|

|

Issue Price to Public

|

|

Underwriting Discount

|

|

Proceeds to UBS

|

|

Per Security

|

|

$10.00

|

|

$0.20

|

|

$9.80

|

|

Total

|

|

•

|

|

•

|

|

•

|

|

|

|

|

|

UBS Financial Services Inc.

|

|

UBS Investment Bank

|

Additional Information about UBS and the Securities

UBS has filed a registration statement (including a prospectus, as supplemented by a product supplement and a currency and commodity supplement for the various

securities we may offer, including the Securities) with the Securities and Exchange Commission, or SEC, for this offering. Before you invest, you should read these documents and any other documents relating to the Securities that UBS has filed with

the SEC for more complete information about UBS and this offering. You may obtain these documents for free from the SEC web site at www.sec.gov. Our Central Index Key, or CIK, on the SEC Web site is 0001114446. Alternatively, UBS will arrange to

send you these documents if you so request by calling toll-free 877-387-2275.

You may access these documents on the SEC web site at www.sec.gov as

follows:

|

¨

|

|

Product supplement dated January 13, 2012:

|

http://www.sec.gov/Archives/edgar/data/1114446/000119312512011545/d282615d424b2.htm

|

¨

|

|

Currency and commodity supplement dated January 11, 2012:

|

http://www.sec.gov/Archives/edgar/data/1114446/000119312512009002/d279580d424b2.htm

|

¨

|

|

Prospectus dated January 11, 2012:

|

http://www.sec.gov/Archives/edgar/data/1114446/000119312512008669/d279364d424b3.htm

References to “UBS,” “we,” “our” and “us” refer only to UBS AG and not to its consolidated subsidiaries. In this document,

the “Securities” refers to the Buffered Digital Optimization Securities Linked to a Currency Basket Relative to the U.S. Dollar that are offered hereby. Also, references to the “product supplement” mean the UBS product

supplement titled “Medium Term Securities Linked to a Currency or Commodity or a Basket Comprised of Currencies or Commodities,” dated January 13, 2012, references to the “currency and commodity supplement” mean the UBS

Currency and Commodity Supplement Debt Securities and Warrants, dated January 11, 2012, and references to “accompanying prospectus” mean the UBS prospectus titled “Debt Securities and Warrants,” dated January 11, 2012.

This free writing prospectus, together with the documents listed above, contains the terms of the Securities and supersedes all other prior or

contemporaneous oral statements as well as any other written materials including preliminary or indicative pricing terms, correspondence, trade ideas, structures for implementation, sample structures, brochures or other educational materials of

ours. You should carefully consider, among other things, the matters set forth in “Key Risks” beginning on page 11 and in “Risk Factors” in the accompanying product supplement, as the Securities involve risks not associated with

conventional debt securities. We urge you to consult your investment, legal, tax, accounting and other advisers before deciding to invest in the Securities.

2

The Securities may be suitable for you if, among other considerations:

|

¨

|

|

You fully understand the risks inherent in an investment in the Securities, including the risk of loss of up to 90% of your initial investment.

|

|

¨

|

|

You can tolerate a loss of up to 90% of your investment and are willing to make an investment that has similar downside market risk as the basket currencies

relative to the U.S. dollar, subject to the buffer amount at maturity.

|

|

¨

|

|

You are willing to make an investment with a return linked to the performance of the basket currencies relative to the U.S. dollar and believe that the basket

return will be zero or positive over the term of the Securities (meaning that overall the basket currencies have held their value or strengthened against the U.S. dollar).

|

|

¨

|

|

You are willing to invest in the Securities if the digital return is set to the bottom of the range specified herein (the actual digital return will be set on

the trade date).

|

|

¨

|

|

You can tolerate fluctuations in the price of the Securities prior to maturity that may be similar to or exceed the downside fluctuations in the level of the

basket.

|

|

¨

|

|

You do not seek current income from your investment.

|

|

¨

|

|

You are willing and able to hold the Securities to maturity, a term of approximately two years, and you are aware that there may be little or no secondary market

for the Securities.

|

|

¨

|

|

You understand the increased volatility and other risks associated with investments in currencies generally and with the basket currencies specifically.

|

|

¨

|

|

You are willing to invest in Securities with exposure to emerging market risks.

|

|

¨

|

|

You are willing to assume the credit risk of UBS AG for all payments under the Securities, and understand that if UBS defaults on its obligations you may not

receive any amounts due to you including any repayment of principal.

|

The Securities may not be suitable for you if, among other considerations:

|

¨

|

|

You do not fully understand the risks inherent in an investment in the Securities, including the risk of loss of up to 90% of your initial investment.

|

|

¨

|

|

You require an investment designed to guarantee a full return of principal at maturity.

|

|

¨

|

|

You cannot tolerate a loss of up to 90% of your investment and are unwilling to make an investment that has similar downside market risk as the basket currencies

relative to the U.S. dollar, subject to the buffer amount at maturity.

|

|

¨

|

|

You are not willing to make an investment with a return linked to the performance of the basket currencies relative to the U.S. dollar and believe that the

basket return will be negative over the term of the Securities (meaning that overall the basket currencies will weaken relative to the U.S. dollar).

|

|

¨

|

|

You seek current income from this investment.

|

|

¨

|

|

You are not willing to invest in the Securities if the digital return is set to the bottom of the range specified herein (the actual digital return will be set

on the trade date).

|

|

¨

|

|

You cannot tolerate fluctuations in the price of the Securities prior to maturity that may be similar or exceed any downward fluctuations in the level of the

basket.

|

|

¨

|

|

You are unwilling or unable to hold the Securities to maturity, a term of approximately two years, or seek an investment for which there will be an active

secondary market.

|

|

¨

|

|

You do not understand the increased volatility and other risks associated with investments in currencies generally and with the basket currencies specifically.

|

|

¨

|

|

You are not willing to invest in Securities with exposure to emerging market risks.

|

|

¨

|

|

You are unwilling or unable to assume the credit risk of UBS AG for all payments under the Securities, including any repayment of principal.

|

The suitability considerations identified

above are not exhaustive. Whether or not the Securities are a suitable investment for you will depend on your individual circumstances and you should reach an investment decision only after you and your investment, legal, tax, accounting and other

advisors have carefully considered the suitability of an investment in the Securities in light of your particular circumstances. You should also review carefully the “Key Risks” on page 11 and more detailed “Risk Factors”

beginning on page PS-8 of the product supplement for risks related to an investment in the Securities.

3

|

|

|

|

|

|

|

Issuer

|

|

UBS AG, Jersey Branch

|

|

Principal Amount

|

|

$10.00 per Security (subject to a minimum purchase of 100 Securities).

|

|

Currency of the Issue

|

|

United States dollars

|

|

Term

|

|

Approximately 2 years. In the event we make any change to the expected trade date and settlement date, the final valuation date and

maturity date will be changed so that the stated term of the Securities remains the same.

|

|

Basket Currencies and Currency Weighting

|

|

Basket Currency

|

|

Currency

Weighting

|

|

|

Australian dollar (“AUD”)

|

|

1/3

|

|

|

Brazilian real (“BRL”)

|

|

1/3

|

|

|

|

Canadian dollar (“CAD”)

|

|

1/3

|

|

Reference Currency

|

|

U.S. Dollars

|

|

|

|

Digital Return

|

|

20.00% - 23.00% of the principal amount. The actual digital return will be set on the trade date.

|

|

Buffer Amount

|

|

10%

|

|

Payment at Maturity

(per Security)

|

|

If the basket return is zero or positive,

at maturity UBS will pay you a cash payment

per Security equal to:

$10.00 + ($10.00 x the digital return)

If the basket return is negative and the basket’s percentage decline is equal to or less than the buffer amount,

at maturity UBS will repay the principal amount, or $10.00 per Security.

If the basket return is negative and the basket’s percentage decline exceeds the buffer amount,

UBS will pay you an amount per Security that is less

than your principal amount resulting in a loss on your investment that is equal to the basket’s decline in excess of the buffer amount, but in no case will the amount payable by UBS at maturity be less than 10% of the principal

amount:

$10.00 + [$10.00 x (basket return + buffer amount)]

In this case you could lose up to 90% of your principal amount.

|

|

Initial Basket Level

|

|

Set to 100 on the trade date

|

|

Final Basket Level

|

|

The basket closing level as determined on the final valuation date, calculated as

follows:

100 x [1 + (AUD Currency Return x 1/3) + (BRL Currency Return x 1/3) + (CAD Currency Return x 1/3)]

The AUD currency return, BRL currency return and CAD currency return refer to the currency return for the Australian dollar, the Brazilian real and the Canadian

dollar, respectively, as described below.

|

|

Basket Return

|

|

The percentage change in the level of the basket from the initial basket level to the final

basket level, calculated as follows:

Final Basket Level – Initial Basket Level

Initial Basket Level

|

|

Currency Return

|

|

For AUD, CAD and BRL spot rate:

Initial Spot Rate – Final Spot Rate

Initial Spot Rate

Because the currency return is calculated pursuant to the formula above, the maximum

possible currency return will equal 100%. However, your return at maturity, if any, will be limited to the digital return. There is no comparable limit on the negative performance of a currency return or the basket return. However, in no case will

the amount payable at maturity by UBS be less 10% of the principal amount.

|

|

Final Spot Rate

|

|

The spot rate for each basket currency on the final valuation date as determined by the calculation agent under “Spot Rates” on

page 20 of this free writing prospectus.

|

|

Initial Spot Rate

|

|

The spot rate for each basket currency on the trade date as determined by the calculation agent under “Spot Rates” on

page 20 of this free writing prospectus.

|

|

Initial Spot Rates

|

|

USD/AUD

|

|

•

|

|

|

USD/BRL

|

|

•

|

|

|

|

USD/CAD

|

|

•

|

|

|

|

The USD/AUD spot rate will be the inverse value of the AUD/ USD reference rate as determined by the calculation agent (the inverse value is the result

of dividing 1 by the AUD/ USD reference rate)

|

|

|

|

|

|

|

|

|

|

Final Valuation Date

|

|

May 27, 2014, unless the calculation agent determines that a market disruption event (as set forth in the product supplement and the

currency and commodity supplement) has occurred or is continuing with respect to a basket currency on any such day. In the case of a market disruption event, or if the final valuation date is not a business day for a basket currency, the final

valuation date for the affected basket currency (and only for such basket currency) will be the first following business day for USD/AUD or USD/CAD spot rates or the first preceding or first following business day for the USD/BRL spot rate, on which

the calculation agent determines that a market disruption event does not occur and/or is not continuing with respect to the such basket currency. In no event however, will the final valuation date for such basket currency be postponed by more than

ten business days for the calculation of the USD/AUD and USD/CAD spot rates and 30 business days for the calculation of the USD/BRL spot rates. See “General Terms of the Securities — Market Disruption Event” on page PS-22 of the

product supplement and the descriptions of additional market disruption events applicable to USD/BRL spot rate, on pages CCS-11 of the currency and commodity supplement.

|

|

|

|

|

|

Trade

date

|

|

The initial spot rate for each basket currency is determined.

The initial basket level is set equal to 100.

The digital return is set.

|

|

|

|

|

Maturity Date

|

|

The final spot rates, currency returns, final basket level and basket return are determined.

If the basket return is zero or positive,

at maturity UBS will pay you a cash payment

per Security equal to:

$10.00 + ($10.00 x the digital return)

If the basket return is negative and the basket’s percentage decline is equal to or less than the buffer amount,

at maturity UBS will repay the principal amount, or $10.00 per Security.

If the basket return is negative and the basket’s percentage decline exceeds the buffer amount,

UBS will pay you an amount per Security that is less

than your principal amount resulting in a loss on your investment that is equal to the basket’s decline in excess of the buffer amount:

$10.00 + [$10.00 x (basket return + buffer amount)]

In this case, you will suffer a loss on your initial investment in an amount equal to the negative basket return in excess of the buffer amount, but in no

case will the amount payable at maturity by UBS be less than 10% of the principal amount. Accordingly, you could lose up to 90% of your principal amount.

|

INVESTING IN THE SECURITIES INVOLVES SIGNIFICANT RISKS. THE SECURITIES DO NOT PAY INTEREST. YOU MAY LOSE UP TO 90% OF YOUR

PRINCIPAL AMOUNT IF THE PERCENTAGE DECLINE FROM THE INITIAL BASKET LEVEL TO THE FINAL BASKET LEVEL IS GREATER THAN 10%. THE DOWNSIDE MARKET EXPOSURE TO THE BASKET IS BUFFERED ONLY AT MATURITY. ANY PAYMENT ON THE SECURITIES, INCLUDING ANY REPAYMENT

OF PRINCIPAL, IS SUBJECT TO THE CREDITWORTHINESS OF UBS. IF UBS WERE TO DEFAULT ON ITS PAYMENT OBLIGATIONS YOU MAY NOT RECEIVE ANY AMOUNTS OWED TO YOU UNDER THE SECURITIES AND YOU COULD LOSE YOUR ENTIRE INVESTMENT.

4

How will Your Payment at Maturity be Calculated?

Your Payment at maturity will depend on the basket return. The following steps are necessary to calculate the basket return:

Step 1: Calculate the Currency Return for each of the Basket Currencies.

The AUD currency return is the difference between the USD/AUD initial spot rate and the USD/AUD final spot rate, divided by the USD/AUD initial spot rate, expressed as a percentage and calculated as follows:

|

|

|

|

|

AUD Currency Return =

|

|

USD/AUD Initial Spot Rate – USD/AUD Final Spot

Rate

|

|

|

|

USD/AUD Initial Spot Rate

|

An increase in the value of the Australian dollar relative to the U.S. dollar is expressed as a decrease in the USD/AUD spot rate.

The CAD currency return is the difference between the USD/CAD initial spot rate and the USD/CAD final spot rate, divided by the USD/CAD initial spot

rate, expressed as a percentage and calculated as follows:

|

|

|

|

|

CAD Currency Return =

|

|

USD/CAD Initial Spot Rate – USD/CAD Final Spot

Rate

|

|

|

|

USD/CAD Initial Spot Rate

|

An increase in the value of the Canadian dollar relative to the U.S. dollar is expressed as a decrease in the USD/CAD spot rate.

The BRL currency return is the difference between the USD/BRL initial spot rate and the USD/BRL final spot rate, divided by the USD/BRL initial spot

rate, expressed as a percentage and calculated as follows:

|

|

|

|

|

BRL Currency Return =

|

|

USD/BRL Initial Spot Rate – USD/BRL Final Spot

Rate

|

|

|

|

USD/BRL Initial Spot Rate

|

An increase in the value of the Brazilian real relative to the U.S. dollar is expressed as a decrease in the USD/BRL spot rate.

Step 2: Calculate the Basket Level.

The basket

level will be calculated as follows:

100 x [1 + (AUD Currency Return x 1/3) + (BRL Currency Return x 1/3) + (CAD Currency

Return x 1/3)]

Step 3: Calculate the Basket Return.

|

|

|

|

|

Basket Return =

|

|

Final Basket Level – Initial Basket Level

|

|

|

|

Initial Basket Level

|

Step 4: Calculate the Payment at Maturity.

If on the final valuation date the basket return is zero or positive, UBS will pay you an amount in cash equal to your principal amount plus a return equal to the digital return of 20.00% to 23.00% (to be

determined on the trade date).

If on the final valuation date the basket return is negative but the percentage decline from the initial basket level to

the final basket level is equal to or less than the buffer amount, UBS will pay you an amount in cash per Security equal to your principal amount: $10.

If on the final valuation date the basket return is negative and the percentage decline from the initial basket level to the final basket level is greater than the

buffer amount, UBS will pay you an amount per Security that is less than your principal amount resulting in a loss on your investment that is equal to the negative basket return in excess of the buffer amount, up to a 90% loss of principal.

5

Hypothetical Examples and Return Table of the Securities at Maturity

The following payment examples for the Securities show scenarios for the payment at maturity of the Securities, illustrating positive and negative basket returns.

The following examples are based on hypothetical Initial Spot Rates and hypothetical Final Spot Rates (the actual initial spot rates will be determined on the trade date and the actual final spot rates will be determined on the final valuation

date), for the basket currencies, and the resulting basket return.

The hypothetical initial and final spot rate values for the basket currencies have been chosen arbitrarily for the purpose of illustration only, are not associated with UBS

research forecasts for any basket currency’s exchange rate and should not be taken as indicative of the future performance of any basket currency. In some instances, values have been rounded for ease of analysis.

|

|

|

|

|

Principal Amount:

|

|

$10.00

|

|

Term:

|

|

2 years

|

|

Initial Basket Level:

|

|

100

|

|

Digital Return:

|

|

20.00% (or $2.00)

|

|

Buffer Amount

|

|

10%

|

Example A: The basket return is positive and the level of the basket increases from an initial basket level of 100 to a final

basket level of 115 on the final valuation date.

Since the basket return is zero or positive, UBS will pay you on the maturity date a total of

$12.00 per Security, reflecting your principal amount plus the digital return of $2.00, for a 20.00% total return on the Securities.

$10.00 + ($10.00 x the Digital Return) =

$10.00 + ($10.00 x 20%) = $12.00 (a 20.00%

return)

The table below illustrates how the final basket level in the above example was calculated:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basket Currency

|

|

Hypothetical Initial

Spot Rate

|

|

Hypothetical Final

Spot Rate

|

|

Currency Return

|

|

Basket Currency

Weighting

|

|

|

|

Weighted Currency

Return

|

|

AUD

|

|

1.0090

|

|

0.8072

|

|

20.00%

|

|

1/3

|

|

|

|

6.67%

|

|

CAD

|

|

1.0125

|

|

0.8606

|

|

15.00%

|

|

1/3

|

|

|

|

5.00%

|

|

BRL

|

|

2.0023

|

|

1.8021

|

|

10.00%

|

|

1/3

|

|

|

|

3.33%

|

|

|

|

|

|

Sum of weighted Currency Returns

|

|

=

|

|

15.00%

|

|

|

|

Final Basket Level = 100 (1 + Sum of weighted Currency

Returns)

|

|

=

|

|

115.00

|

Example B: The basket return is positive and the level of the basket increases from an initial basket level of 100 to a final

basket level of 130 on the final valuation date.

Since the basket return is zero or positive, UBS will pay you on the maturity date a total of

$12.00 per Security, reflecting your principal amount plus the digital return of $2.00, for a 20.00% total return on the Securities.

$10.00 + ($10.00 x the Digital Return) =

$10.00 + ($10.00 x 20%) = $12.00 (a 20.00%

return)

The table below illustrates how the final basket level in the above example was calculated:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basket Currency

|

|

Hypothetical Initial

Spot Rate

|

|

Hypothetical Final

Spot Rate

|

|

Currency Return

|

|

Basket Currency

Weighting

|

|

|

|

Weighted Currency

Return

|

|

AUD

|

|

1.0090

|

|

0.7568

|

|

25.00%

|

|

1/3

|

|

|

|

8.33%

|

|

CAD

|

|

1.0125

|

|

0.5569

|

|

45.00%

|

|

1/3

|

|

|

|

15.00%

|

|

BRL

|

|

2.0023

|

|

1.6018

|

|

20.00%

|

|

1/3

|

|

|

|

6.67%

|

|

|

|

|

|

Sum of weighted Currency Returns

|

|

=

|

|

30.00%

|

|

|

|

Final Basket Level = 100 (1 + Sum of weighted Currency

Returns)

|

|

=

|

|

130.00

|

Example C: The basket return is

negative and the level of the basket decreases from an initial basket level of 100 to a

final basket level of 95 on the final valuation date.

Since the basket return is negative on the final valuation date but the 5% decline from the

initial basket level to the final basket level is less than the 10.00% buffer amount, UBS will repay the full principal amount and the payment at maturity is equal to $10.00 per Security.

6

The table below illustrates how the final basket level in the above example was calculated:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basket Currency

|

|

Hypothetical Initial

Spot Rate

|

|

Hypothetical Final

Spot Rate

|

|

Currency Return

|

|

Basket Currency

Weighting

|

|

|

|

Weighted Currency

Return

|

|

AUD

|

|

1.0090

|

|

1.1099

|

|

-10.00%

|

|

1/3

|

|

|

|

-3.33%

|

|

CAD

|

|

1.0125

|

|

1.0530

|

|

-4.00%

|

|

1/3

|

|

|

|

-1.33%

|

|

BRL

|

|

2.0023

|

|

2.0223

|

|

-1.00%

|

|

1/3

|

|

|

|

-0.33%

|

|

|

|

|

|

|

|

Sum of weighted Currency Returns

|

|

=

|

|

-5.00%

|

|

|

|

Final Basket Level = 100 (1 + Sum of weighted Currency

Returns)

|

|

=

|

|

95.00

|

Example D: The basket return is negative and the level of the basket decreases from an initial basket level of 100 to a final

basket level of 70 on the final valuation date.

Since the basket return is negative on the final valuation date and the 30% decline from the

initial basket level to the final basket level is greater than the 10.00% buffer amount by 20.00%, UBS will pay you less than the full principal amount and the payment at maturity per Security is as follows:

$10.00 + [$10.00 x (Basket Return + Buffer Amount)] = $10.00 + ($10.00 × (-30.00% + 10.00%)) = $8.00 (a -20.00% return)

The table below illustrates how the Final Basket Level in the above example was calculated:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basket Currency

|

|

Hypothetical Initial

Spot Rate

|

|

Hypothetical Final

Spot Rate

|

|

Currency Return

|

|

Basket Currency

Weighting

|

|

|

|

Weighted Currency

Return

|

|

AUD

|

|

1.0090

|

|

1.3117

|

|

-30.00%

|

|

1/3

|

|

|

|

-10.00%

|

|

CAD

|

|

1.0125

|

|

1.5188

|

|

-50.00%

|

|

1/3

|

|

|

|

-16.66%

|

|

BRL

|

|

2.0023

|

|

2.2025

|

|

-10.00%

|

|

1/3

|

|

|

|

-3.33%

|

|

|

|

|

|

|

|

Sum of weighted Currency Returns

|

|

=

|

|

-30.00%

|

|

|

|

Final Basket Level = 100 (1 + Sum of weighted Currency

Returns)

|

|

=

|

|

70.00

|

The following return table illustrates the hypothetical payment amount at maturity per Security for a range of Basket Returns and

based on the terms for the examples specified above. You should consider carefully whether the Securities are suitable to your investment goals. The numbers appearing in the table below have been rounded for ease of analysis.

|

|

|

|

|

|

|

|

Hypothetical Final

Basket Level

|

|

Hypothetical Basket

Return

|

|

Payment at Maturity

per Security

|

|

Total Return of

Security at Maturity

|

|

150.00

|

|

50.00%

|

|

$12.00

|

|

20.00%

|

|

140.00

|

|

40.00%

|

|

$12.00

|

|

20.00%

|

|

130.00

|

|

30.00%

|

|

$12.00

|

|

20.00%

|

|

120.00

|

|

20.00%

|

|

$12.00

|

|

20.00%

|

|

115.00

|

|

15.00%

|

|

$12.00

|

|

20.00%

|

|

110.00

|

|

10.00%

|

|

$12.00

|

|

20.00%

|

|

105.00

|

|

5.00%

|

|

$12.00

|

|

20.00%

|

|

100.00

|

|

0.00%

|

|

$12.00

|

|

20.00%

|

|

95.00

|

|

-5.00%

|

|

$10.00

|

|

0.00%

|

|

90.00

|

|

-10.00%

|

|

$10.00

|

|

0.00%

|

|

80.00

|

|

-20.00%

|

|

$9.00

|

|

-10.00%

|

|

70.00

|

|

-30.00%

|

|

$8.00

|

|

-20.00%

|

|

60.00

|

|

-40.00%

|

|

$7.00

|

|

-30.00%

|

|

50.00

|

|

-50.00%

|

|

$6.00

|

|

-40.00%

|

|

40.00

|

|

-60.00%

|

|

$5.00

|

|

-50.00%

|

|

30.00

|

|

-70.00%

|

|

$4.00

|

|

-60.00%

|

|

20.00

|

|

-80.00%

|

|

$3.00

|

|

-70.00%

|

|

10.00

|

|

-90.00%

|

|

$2.00

|

|

-80.00%

|

|

0.00

|

|

-100.00%

|

|

$1.00

|

|

-90.00%

|

|

-10.00

|

|

-110.00%

|

|

$1.00

|

|

-90.00%

|

|

-20.00

|

|

-120.00%

|

|

$1.00

|

|

-90.00%

|

|

-30.00

|

|

-130.00%

|

|

$1.00

|

|

-90.00%

|

7

Because you will receive a return equal to the digital return if the basket return is zero or positive, the return on

the Securities at maturity is capped at the digital return regardless of the appreciation of the basket, which could be significant. In addition, since the currency return is calculated pursuant to the formula set forth in “Indicative

Terms”, there is no comparable limit on the negative performance of a basket currency or the basket return. However, in no case will the amount payable by UBS at maturity be less than 10% of your principal amount.

Accordingly, if the basket return is less than -10%, meaning the percentage decline from the initial basket level to the final basket level is greater than 10%,

UBS will pay you less than the full principal amount resulting in a loss on your investment that is equal to the negative basket return in excess of the buffer amount and you may lose up to 90% of your principal.

8

An investment in the Securities involves significant risks. Some of the risks that apply to the Securities are summarized here, but we urge you to read the more detailed explanation of risks relating to the

Securities generally in the “Risk Factors” section of the product supplement and the currency and commodity supplement. We also urge you to consult your investment, legal, tax, accounting and other advisors before you decide to invest in

the Securities.

|

¨

|

|

Risk of loss at maturity

— The Securities differ from ordinary debt securities in that UBS will not make periodic interest payments or necessarily

pay the full principal amount of the Securities at maturity. UBS will only repay you the full principal amount of your Securities if the basket return is equal to or greater than -10% and will only make such payment at maturity. If the basket return

is less than -10%, meaning the percentage decline from the initial basket level to final basket level is greater than the 10% buffer amount, you will suffer a loss of your initial investment in an amount equal to that negative basket return in

excess of the buffer amount, but in no case will the amount payable by UBS at maturity be less than 10% of the principal amount. Accordingly, you may lose up to 90% of your initial investment if the percentage decline from the initial basket level

to the final basket level is greater than 10%.

|

|

¨

|

|

Downside market exposure to the basket is buffered only if you hold the Securities to maturity

— You should be willing to hold your Securities to

maturity. If you are able to sell your Securities prior to maturity in the secondary market, you may have to sell them at a loss relative to your initial investment even if the level of the basket at such time is not below the initial basket level

by a percentage greater than the buffer amount.

|

|

¨

|

|

The digital return applies only if you hold the Securities to maturity

— You should be willing to hold your Securities to maturity. If you are able

to sell your Securities prior to maturity in the secondary market, the price you receive will likely not reflect the full economic value of the digital return or the Securities themselves, and the return you realize may be less than the

basket’s return even if such return is positive and below the digital return. You can receive the full benefit of the digital return from UBS only if you hold your Securities to maturity.

|

|

¨

|

|

Your potential return on the Securities is limited

— The return potential of the Securities is limited to the digital return of 20% to 23% (actual

digital return to be determined on the trade date). Therefore, you will not benefit from any positive basket return in excess of the digital return and your return on the Securities may be less than it would be in a hypothetical direct investment in

the basket currencies.

|

|

¨

|

|

No interest —

You will not receive interest payments on the Securities over the term of the Securities.

|

|

¨

|

|

Credit risk of UBS

— The Securities are unsubordinated, unsecured debt obligations of UBS and are not, either directly or indirectly, an obligation

of any third party. Any payment to be made on the Securities, including any repayment of principal, depends on the ability of UBS to satisfy its obligations as they come due. As a result, the actual and perceived creditworthiness of UBS may affect

the market value of the Securities and, in the event UBS were to default on its obligations, you may not receive any amounts owed to you under the terms of the Securities and you could lose your entire initial investment.

The Securities

are not deposit liabilities or other obligations of a bank and are not insured by the Federal Deposit Insurance Corporation or any other governmental agency or program of the United States or any other jurisdiction.

|

|

¨

|

|

Market risk

— The return on the Securities at maturity is linked to the performance of the basket currencies relative to the U.S. dollar, and will

depend on whether, and the extent to which, such basket currencies appreciate against the U.S. dollar during the term of the Securities. The value of the basket will be affected by movements in the exchange rates of the basket currencies relative to

the U.S. dollar. The exchange rates for the basket currencies relative to the U.S. dollar are the result of the supply of, and the demand for, those basket currencies. Changes in the exchange rates result over time from the interaction of many

factors directly or indirectly affecting economic and political conditions in the country of each basket currency and the United States, including economic and political developments in other countries. Of particular importance to foreign exchange

risk are: existing and expected rates of inflation; existing and expected interest rate levels; the balance of payments; and the extent of governmental surpluses or deficits in the relevant foreign country and the United States. All of these factors

are in turn sensitive to the monetary, fiscal and trade policies pursued by the governments of various countries and the United States and other countries important to international trade and finance. You, as an investor in the Securities, should

make your own investigation into the respective basket currencies and the merits of an investment linked to the basket.

|

|

¨

|

|

The Securities are not regulated by the Commodity Futures Trading Commission

— An investment in the Securities does not constitute either an

investment in futures contracts, options on futures contracts, or currency options and therefore you will not benefit from the regulatory protections attendant to CFTC regulated products. This means that the Securities are not traded on a regulated

exchange and issued by a clearinghouse. See “There may be little or no secondary market for the Securities” below. In addition, the proceeds to be received by UBS from the sale of the Securities will not be used to purchase or sell any

currency futures contracts, options on futures contracts or options on currencies for your benefit. Therefore an investment in the Securities does not constitute a collective investment vehicle that trades in these instruments. An investment in a

collective investment vehicle that invests in these instruments often is subject to regulation as a commodity pool and its operator may be required to be registered with and regulated by the CFTC as a commodity pool operator, which will not be the

case with these Securities.

|

|

¨

|

|

Changes in the exchange rate levels of the basket currencies may offset each other

— The Securities are linked to an equally weighted basket composed

of the basket currencies. At a time when the value of one or more basket currencies relative to the U.S. dollar increases, the value of one or more of the other basket currencies relative to the U.S. dollar may not increase as much or may even

decline. Therefore, in calculating the basket level, increases in the value of one or more of the basket currencies relative to the U.S. dollar

|

9

|

|

may be moderated, or offset, by lesser increases or declines in the value of one or more of the other basket currencies relative to the U.S. dollar. In addition, because the currency return for

each basket currency is calculated by dividing (i) the difference of the initial spot rate minus the final spot rate by (ii) the initial spot rate, there is no limit on the negative performance of a basket currency or resulting overall negative

performance of the basket return. Consequently, even if two of the basket currencies were to appreciate significantly relative to the U.S. dollar, that positive performance could be offset by a severe depreciation of the third basket currency.

However, in no case will the amount payable at maturity by UBS be less than 10% of the principal amount.

|

|

¨

|

|

The amount you receive at maturity may result in a yield that is less than the yield on a standard debt security of comparable maturity

— The amount

you receive at maturity may result in a yield that is less than the return you could earn on other investments. For example, your yield may be lower than the yield you would earn if you bought a standard U.S. dollar-denominated senior non-callable

debt security of UBS with the same stated maturity date.

|

|

¨

|

|

There may be little or no secondary market for the Securities

— The Securities will not be listed or displayed on any securities exchange or any

electronic communications network. There can be no assurance that a secondary market for the Securities will develop. UBS Securities LLC and other affiliates of UBS may make a market in the Securities, although they are not required to do so and may

stop making a market at any time. The price, if any, at which you may be able to sell your Securities prior to maturity could be at a substantial discount from the issue price and to the intrinsic value of the product; and as a result, you may

suffer substantial losses.

|

|

¨

|

|

The formula for calculating the payment at maturity of the Securities will not take into account all developments in the basket currencies

— Changes

in the exchange rate for the basket currencies relative to the U.S. dollar during the term of the Securities before the final valuation date may not be reflected in the calculation of the payment at maturity. Generally, the calculation agent will

calculate the payment at maturity by comparing only the initial basket level on the trade date and the final basket level on the final valuation date. No other levels will be taken into account. As a result, the basket return may be less than zero

even if the relevant exchange rates for the basket currencies have moved favorably at certain times during the term of the Securities before moving to an unfavorable level on the final valuation date.

|

|

¨

|

|

The calculation agent can accelerate or postpone the determination of the basket level on the final valuation date and therefore the maturity date, if a

market disruption event occurs on the final valuation date

— If the calculation agent determines that a market disruption event has occurred or is continuing with respect to a basket currency on the final valuation date, the final valuation

date will be postponed in the case of the USD/AUD or USD/CAD spot rate or accelerated or postponed in the case of USD/BRL spot rate, until the first business day on which no market disruption event occurs or is continuing. If such an acceleration or

postponement occurs, then the calculation agent will instead determine the basket level with reference to the spot rate of the affected basket currency on the first business day after that day on which no market disruption event occurs or is

continuing with respect to such basket currency. In no event, however, will the final valuation date be postponed by more than 10 consecutive days for the calculation of the USD/AUD and USD/CAD spot rates or 30 consecutive days for the calculation

of the USD/BRL spot rates. As a result, the maturity date for the Securities could also be accelerated or postponed.

|

If the final valuation date is postponed to the last possible day, but a market disruption event occurs or is continuing on that day, that day will

nevertheless be the applicable final valuation date for such basket currency. If the spot rate of such basket currency is not available on the last possible day that qualifies as the applicable valuation date, either because of a market disruption

event or for any other reason, the calculation agent will make a good faith and commercially reasonable estimate of the basket currency spot rate that would have prevailed in the absence of the market disruption event or such other reason.

See “General Terms of the Securities — Market Disruption Event” on page PS-22 of the product supplement and the

descriptions of additional market disruption events applicable to USD/BRL on pages CCS-12 of the currency and commodity supplement.

|

¨

|

|

Owning the Securities is not the same as owning the individual basket currencies

— The return on your Securities may not reflect the return you would

realize if you actually converted your U.S. dollars into or purchased a foreign exchange contract on the Australian dollar, the Brazilian real and Canadian dollar.

|

|

¨

|

|

No assurance that the investment view implicit in the Securities will be successful

— It is impossible to predict whether and the extent to which the

basket currencies will appreciate or depreciate relative to the U.S. dollar (or whether the U.S. dollar will appreciate or depreciate relative to the foreign currencies), and as a result, whether the basket level will rise or fall. There can be no

assurance that the final basket level will not rise by more than the digital return or will not decline by more than the buffer amount as of the final valuation date. The spot rates of the basket currencies and therefore the basket level will be

influenced by complex and interrelated factors such as political and economic developments. You should be willing to accept the risks of losing up to 90% of your initial investment.

|

|

¨

|

|

The spot rates for the basket currencies will be influenced by unpredictable factors which interrelate in complex ways —

The USD/AUD spot rate, the

USD/BRL spot rate and the USD/CAD spot rate are a result of the supply of, and demand for, each currency. Changes in the foreign exchange rate may result from the interactions of many factors, including economic, financial, social and political

conditions in the United States, Australia, Brazil and Canada. These conditions include, for example, the overall growth and performance of the economies of the United States, Australia, Brazil and Canada, the relative strength of, and confidence

in, the U.S. dollar, the trade and current account balance between the United States and Australia, Brazil and Canada, market interventions by the Federal Reserve Board or the respective central banks of Australia, Brazil and Canada, inflation and

expected rates of future inflation, interest rate levels, the performance of the stock markets in the United States, Australia, Brazil and Canada, the stability of the government of the United States and the governments of Australia, Brazil and

Canada and their respective banking systems, the structure of and confidence in the global monetary system, wars in which the United States, Australia Brazil and Canada are directly or indirectly involved or that occur anywhere in the world, major

natural disasters in the United States, Australia, Brazil and Canada and other foreseeable and unforeseeable global or regional economic, financial, political, judicial or other events. It is not possible to predict the aggregate effect of

|

10

|

|

all or any combination of these factors. Your Securities are likely to trade differently from the exchange rates of the basket currencies relative to the U.S. dollar, and changes in the exchange

rates of the basket currencies relative to the U.S. dollar are not likely to result in comparable changes in the market value of your Securities.

|

|

¨

|

|

The liquidity, trading value and amounts payable under the Securities could be affected by the actions of sovereign governments of the United States,

Australia, Brazil and Canada

— Exchange rates of most economically developed nations, including the United States, Australia and Canada are “floating,” meaning they are permitted to fluctuate in value relative to the U.S. dollar.

However, governments of other nations such as Brazil, from time to time, do not allow their currencies to float freely in response to economic forces. Governments, including United States’, Australia’s, Brazil’s and Canada’s, use

a variety of techniques, such as intervention by their central bank or imposition of regulatory controls or taxes, to affect the exchange rates of their respective currencies. Governments may also issue a new currency to replace an existing currency

or alter the exchange rate or relative exchange characteristics by devaluation or revaluation of a currency. Thus, a special risk in purchasing the Securities is that their liquidity, trading value and amounts payable could be affected by the

actions of the sovereign governments of United States, Australia, Brazil and Canada, which could change or interfere with theretofore freely determined currency valuation, fluctuations in response to other market forces and the movement of

currencies across borders. There will be no adjustment or change in the terms of the Securities in the event that exchange rates should become fixed, or in the event of the issuance of a replacement currency or in the event of other developments

affecting the Australian dollar, the Brazilian real, the Canadian dollar, and the U.S. dollar or any other currency.

|

|

¨

|

|

Currency exchange risks can be expected to heighten in periods of financial turmoil

— In periods of financial turmoil, capital can move quickly out

of regions that are perceived to be more vulnerable to the effects of the crisis than others with sudden and severely adverse consequences to the currencies of those regions. In addition, governments around the world, including the United States

government, the European Union and the governments of their member entities and governments of other major world currencies, have recently made, and may be expected to continue to make, very significant interventions in their economies, and

sometimes directly in their currencies. Such interventions affect currency exchange rates globally. Further interventions, other government actions or suspensions of actions, as well as other changes in government economic policy or other financial

or economic events affecting the currency markets, may cause currency exchange rates to fluctuate sharply in the future, which could have a material adverse effect on the value of the Securities and your return on your investment in the Securities

at maturity.

|

|

¨

|

|

Legal and regulatory risks

— Legal and regulatory changes could adversely affect foreign exchange rates. In addition, many government agencies and

regulatory organizations are authorized to take extraordinary actions in the event of market emergencies. It is not possible to predict the effect of any future legal or regulatory action relating to foreign exchange rates, but any such action could

cause unexpected volatility and instability in currency markets with a substantial and adverse effect on the performance of the basket and, consequently, on the value of the Securities.

|

|

¨

|

|

Currency markets may be volatile

— Currency markets may be highly volatile, particularly in relation to emerging or developing nations’

currencies, and, in certain market conditions, also in relation to developed nations’ currencies. Significant changes, including changes in liquidity and prices, can occur in such markets within very short periods of time. Foreign exchange rate

risks include, but are not limited to, convertibility risk and market volatility and potential interference by foreign governments through regulation of local markets, foreign investment or particular transactions in foreign currency. The liquidity,

trading value and amount payable under the Securities could be affected by action of the governments of Australia, Brazil and Canada. These factors may affect the value of the basket currencies relative to the U.S. dollar and the value of your

Securities in varying ways, and different factors may cause the values of the basket currencies, as well as the volatility of their exchange rates, to move in inconsistent directions at inconsistent rates.

|

|

¨

|

|

Emerging markets risk

— The Brazilian real is an emerging market currency. The possibility exists of significant changes in rates of exchange between

a non-emerging market currency and an emerging market currency or between emerging market currencies and the possibility of the imposition or modification of exchange controls by either the U.S. or a foreign government. Such risks generally depend

on economic and political events over which UBS has no control and such risks may be more pronounced in connection with emerging market currencies. Governments in emerging market countries have imposed from time to time, and may in the future

impose, exchange controls which could affect exchange rates as well as the availability of a currency at the time of payment. You must be willing to accept that fluctuations in spot exchange rates involving one or more emerging market currencies

that have occurred in the past are not necessarily indicative of fluctuations that can occur during the term of this investment and that the volatility inherent in emerging market currency transactions could significantly affect the overall return

on your investment in the Securities.

|

|

¨

|

|

Historical performance of the USD/AUD spot rate, the USD/BRL spot rate and the USD/CAD spot rate should not be taken as an indication of the future

performance of the basket currencies during the term of the Securities

— It is impossible to predict whether any of the USD/AUD spot rate, the USD/BRL spot rate and the USD/CAD spot rate will rise or fall. The USD/AUD spot rate, the USD/BRL

spot rate and the USD/CAD spot rate will be influenced by complex and interrelated political, economic, financial and other factors.

|

|

¨

|

|

Information on the basket currencies may not be readily available

— There is no systematic reporting of last-sale information for many currencies.

Reasonable current bid and offer information may be available in certain brokers’ offices, in bank trading offices, and to others who wish to subscribe for this information, but this information will not necessarily reflect the applicable

foreign exchange rate relevant for determining the value of the Securities. The absence of last-sale information and the limited availability of quotations to individual investors make it difficult for you and other investors to obtain timely,

accurate data about the state of the currency markets. Certain relevant information relating to Australia, Brazil and Canada may not be as well known or as rapidly or thoroughly reported in the United States as comparable to U.S. developments.

Prospective purchasers of the Securities should be aware of the possible lack of availability of important information that can affect the value of the basket currencies and must be prepared to make special efforts to obtain such information on a

timely basis.

|

11

|

¨

|

|

The market value of the Securities may be influenced by unpredictable factors

— The market value of your Securities may fluctuate between the date

you purchase them and the final valuation date when the calculation agent will determine your payment at maturity. Several factors, many of which are beyond our control, will influence the market value of the Securities. We expect that generally the

USD/AUD spot rate, the USD/BRL spot rate and the USD/CAD spot rate on any day will affect the market value of the Securities more than any other single factor. Other factors that may influence the market value of the Securities include:

|

|

|

¨

|

|

supply and demand for the Securities, including inventory positions held by UBS Securities LLC or any other market maker;

|

|

|

¨

|

|

Australian dollar, Brazilian real, Canadian dollar and U.S. dollar interest rates;

|

|

|

¨

|

|

the time remaining to the final valuation date;

|

|

|

¨

|

|

the creditworthiness of UBS; and

|

|

|

¨

|

|

volatility of the USD/AUD spot rate, the USD/BRL spot rate and the USD/CAD spot rate.

|

|

¨

|

|

Even though the Australian dollar, the Brazilian real, the Canadian dollar and the U.S. dollar are traded around-the-clock, if a secondary market develops,

the Securities may trade only during regular trading hours in the United States

— The spot market for the Australian dollar, the Brazilian real, the Canadian dollar and the U.S. dollar is a global, around-the-clock market. Therefore, the

hours of trading for the Securities, if any, may not conform to the hours during which the Australian dollar, the Brazilian real, the Canadian dollar and the U.S. dollar are traded. To the extent that U.S. markets are closed while the markets for

the Australian dollar, the Brazilian real and the Canadian dollar remain open, significant price and rate movements may take place in such markets that will not be reflected immediately in the value of the Securities.

|

|

¨

|

|

Impact of fees on the secondary market price of the Securities —

Generally, the price of the Securities in the secondary market is likely to be lower

than the issue price to public since the issue price to public included, and the secondary market prices are likely to exclude, commissions, hedging costs or other compensation paid with respect to the Securities.

|

|

¨

|

|

There are potential conflicts of interest between you and the calculation agent

— Our affiliate, UBS Securities LLC, will serve as the calculation

agent. UBS Securities LLC, will, among other things, decide the amount paid out to you on each Security offering at maturity. For a fuller description of the calculation agent’s role, see “General Terms of the Securities — Role of

Calculation Agent” on page PS-26 of the product supplement. The calculation agent will exercise its judgment when performing its functions. For example, the calculation agent may have to determine whether a market disruption event affecting a

basket currency has occurred or is continuing on a day when the calculation agent will determine adjustments to the terms of the Securities in the event of extraordinary government actions and market emergencies as well as the spot rate for a

particular basket currency. These determinations may, in turn, depend on the calculation agent’s judgment whether the event has materially interfered with our ability to unwind our hedge positions. Since these determinations by the calculation

agent may affect the market value of the Securities and your payment at maturity, the calculation agent may have a conflict of interest if it needs to make any such decision.

|

|

¨

|

|

The business activities of UBS or its affiliates may create conflicts of interest —

We and our affiliates expect to engage in trading activities

related to the basket currencies that are not for the account of holders of the Securities or on their behalf. These trading activities might present a conflict between the holders’ interest in the Securities and the interest of UBS and its

affiliates will have in their proprietary accounts, in facilitating transactions, including options and other derivatives transactions for their customers and in accounts under their management.

|

|

¨

|

|

Potentially inconsistent research, opinions or recommendations by UBS

— We and our affiliates may publish research, express opinions or provide

recommendations that are inconsistent with investing in or holding the Securities, and which may be revised at any time. Any such research, opinions or recommendations could affect the spot rates of the basket currencies to which the Securities are

linked or the value of the Securities.

|

|

¨

|

|

You must rely on your own evaluation of the merits of an investment linked to the basket currencies

— In the ordinary course of business, UBS or one

or more of its affiliates from time to time expresses views on expected movements in the basket currencies. These views are sometimes communicated to clients who participate in currency exchange markets. However, these views, depending upon

world-wide economic, political and other developments, may vary over differing time-horizons and are subject to change. Moreover, other professionals who deal in foreign currencies markets may at any time have significantly different views from

views of UBS or those of its affiliates. For reasons such as these, UBS believes that most investors in currency exchange markets derive information concerning those markets from multiple sources. In connection with your purchase of the Securities,

you should investigate the currency exchange markets and not rely on views which may be expressed by UBS or its affiliates in the ordinary course of business with respect to future spot rates of the basket currencies relative to the U.S. dollar.

|

|

¨

|

|

Dealer incentives

— UBS and its affiliates act in various capacities with respect to the Securities. We and our affiliates may act as a principal,

agent or dealer in connection with the sale of the Securities. Such affiliates, including the sales representatives, will derive compensation from the distribution of the Securities and such compensation may serve as an incentive to sell these

Securities instead of other investments. We will pay total underwriting compensation of $0.20 per Security to any of our affiliates acting as agents or dealers in connection with the distribution of the Securities.

|

|

¨

|

|

Uncertain tax treatment —

Significant aspects of the tax treatment of the Securities are uncertain. You should read carefully the section above

entitled “What Are the Tax Consequences of the Securities?” and consult your tax advisor about your tax situation.

|

You are urged to review “Risk Factors” in the product supplement for additional description of the risks related to an investment in the

Securities.

12

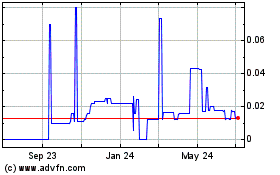

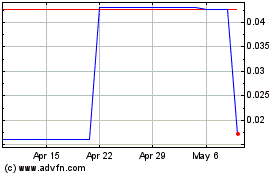

The following graphs show the hypothetical performance of the basket as well as the performance of each basket currency from May 16, 2002 through May 16, 2012. Each of the basket currency spot rates were obtained

from Bloomberg L.P., without independent verification. On May 16, 2012 at approximately 5: 00 p.m. New York City time the USD/AUD spot rate was 1.0089, the USD/BRL spot rate was 2.0023 and the USD/CAD spot rate was 1.0125. The actual value of each

basket currency will be determined on the trade date as described in “Spot Rates” on page 20 of this free writing prospectus. For purposes of illustrating the hypothetical performance of the basket, the initial basket level is set to 100,

each basket currency is deemed to have a 1/3 weighting in the basket and the historical exchange rates of each basket currency on the relevant dates were the closing spot exchange rates on such dates. The hypothetical basket performance is based on

actual historical data of the basket currencies and the hypothetical basket performance displayed in the graph below is a reflection of this aggregated historical data. The hypothetical historical performance of the basket and the historical

performance of each basket currency should not be taken as an indication of future performance, and no assurance can be given as to the basket level or spot rate of each basket currency on any given day.

Your payment at maturity will be based on the performance of an equally-weighted basket of currencies relative to the U.S. dollar. The decline of the exchange rate

of any basket currency (meaning such basket currency strengthens relative to the U.S. dollar) will have a positive impact on the overall basket return. Conversely, the increase in the exchange rate of any basket currency (meaning such basket

currency weakens relative to the U.S. dollar) will have a negative impact on the overall basket return. Exchange rate movements in the basket currencies may not correlate with each other, and the decrease in the exchange rate (or strengthening) of

one basket currency relative to the U.S. dollar may be moderated, or more than offset, by lesser decreases or an increase in the exchange rate (or weakening) of the other basket currencies relative to the U.S. dollar.

13

14

What Are the Tax Consequences of the Securities?

The United States federal income tax consequences of your investment in the Securities are uncertain. Some of these tax consequences are summarized below, but we

urge you to read the more detailed discussion in “Supplemental U.S. Tax Considerations — 11. Currency-Linked Securities that it Would be Reasonable to Treat as Derivative Contracts” beginning on page PS-52 of the product supplement

and discuss the tax consequences of your particular situation with your tax advisor.

There are no statutory provisions, regulations, published rulings

or judicial decisions addressing the characterization for U.S. federal income tax purposes of securities with terms that are substantially the same as the Securities. Pursuant to the terms of the Securities, UBS and you agree, in the absence of a

statutory or regulatory change or an administrative or judicial ruling to the contrary, to characterize your Securities as a pre-paid derivative contract with respect to the underlying basket. If your Securities are so treated, you should not

generally recognize taxable income or loss prior to maturity of your Securities, other than pursuant to a sale or exchange. You should generally recognize gain or loss upon the sale or maturity of your Securities. Such gain or loss would generally

be ordinary foreign currency gain or loss under Section 988 of the Internal Revenue Code of 1986, as amended (the “Code”), unless you are able to , and make a valid election to treat such gain or loss as capital gain or loss under

applicable Treasury regulations. Under these regulations, holders of certain forward contracts, future contracts or option contracts generally are entitled to make such election. (“Section 988 Election”).

To make this election, you must, in accordance with detailed procedures set forth in the regulations under Section 988 and summarized in the product

supplement on page PS-52, either (a) clearly identify the Securities on your books and record on the date you acquire them as being subject to such election and file the relevant statement verifying such election with your federal income tax

return or (b) otherwise obtain an independent verification of the election. Assuming the election is available, if you make a valid election before the close of the day on which you acquire your Securities, your gain or loss on the Securities

should be capital gain or loss and should be long-term capital gain or loss if at the time of sale, exchange or maturity you have held the Securities for more than one year. The deductibility of capital losses is subject to certain limitations. You

should consult your tax advisor regarding the advisability, availability, mechanics and consequences of a Section 988 Election.

In the opinion