- Prospectus filed pursuant to Rule 424(b)(2) (424B2)

May 18 2012 - 4:20PM

Edgar (US Regulatory)

|

|

FINAL TERMS SUPPLEMENT

(To Prospectus dated January 11, 2012, Product Supplement dated January 11, 2012 and Prospectus Supplement dated March 14, 2012)

|

Filed Pursuant to Rule 424(b)(2)

Registration Statement No. 333-178960

|

Final Terms Supplement

UBS AG Trigger Yield Optimization Notes

UBS AG $99,994.40 Notes Linked to the common stock of MGM Resorts International due May 23, 2013

|

|

Issuer

|

UBS AG, London Branch

|

|

Issue Price per Note

|

Equal to the initial price of the underlying equity.

|

|

Principal Amount per Note

|

Equal to the initial price of the underlying equity.

|

|

Term

|

Approximately 12 months.

|

|

Underlying Equity

|

The common stock of MGM Resorts International

|

|

Coupon Payments

|

UBS AG will pay interest on the principal amount of the Notes on the coupon payment dates; provided that, if any coupon payment date would otherwise fall on a date which is not a business day, the relevant coupon payment date will be the first following day which is a business day unless that day falls in the next calendar month, in which case the relevant coupon payment date will be the first preceding day which is a business day. Each payment of interest due on a coupon payment date or on the maturity date, as the case may be, will include interest accrued from the last unadjusted coupon payment date to which interest has been paid or made available for payment (or the issue date in the case of the first coupon payment date) to the relevant unadjusted coupon payment date.

UBS will compute interest on the Notes on the basis of a 360-day year of twelve 30-day months. If the maturity date is postponed beyond the originally scheduled maturity date due to the occurrence of a market disruption event on the final valuation date, interest will cease to accrue on the originally scheduled maturity date. The table below sets forth each coupon payment date and reflects the coupon rate of 9.66% per annum. Amounts in the table below may have been rounded for ease of analysis.

|

|

|

Coupon Payment Date*

|

Coupon Payment (per Note)

|

|

|

September 24, 2012

|

$0.0832

|

|

|

November 23, 2012

|

$0.0832

|

|

|

December 24, 2012

|

$0.0832

|

|

|

February 25, 2013

|

$0.0832

|

|

|

*Coupon payment dates are subject to postponement in the event of a market disruption event, as described in the Trigger Yield Optimization Notes product supplement. The record date for coupon payment will be one business day preceding the coupon payment date.

|

|

Coupon Rate

|

The Notes will bear interest at a rate of 9.66% per annum.

|

|

Total Coupon Payable

|

9.67%

|

|

Payment at Maturity (per Note)

|

If the final price of the underlying equity is equal to or greater than the trigger price, we will pay you an amount in cash at maturity equal to your principal amount.

If the final price of the underlying equity is below the trigger price, we will deliver to you one share of the underlying equity for each Note you own, subject to adjustments in the case of certain corporate events, as described in the Trigger Yield Optimization Notes product supplement. In this scenario, the share of the underlying equity that will be delivered to you is expected to be worth significantly less than the principal amount of your Note and may have no value at all. We will pay cash in lieu of delivering any fractional shares.

|

|

Closing Price

|

On any trading day, the last reported sale price (or, in the case of NASDAQ, the official closing price) of the underlying equity during the principal trading session on the principal national securities exchange on which it is listed for trading, as determined by the calculation agent.

|

|

Initial Price

|

$10.33, which is the closing price of the underlying equity on the trade date.

|

|

Trigger Price

|

$5.17, which is 50.00% of the initial price of the underlying equity. The trigger price is subject to adjustments in the case of certain corporate events, as described in the Trigger Yield Optimization Notes product supplement.

|

|

Final Price

|

The closing price of the underlying equity on the final valuation date.

|

|

Trade Date

|

May 18, 2012

|

|

Settlement Date

|

May 23, 2012

|

|

Final Valuation Date

|

May 20, 2013. The final valuation date may be subject to postponement in the event of a market disruption event, as described in the Trigger Yield Optimization Notes product supplement.

|

|

Maturity Date

|

May 23, 2013. The maturity date may be subject to postponement in the event of a market disruption event, as described in the Trigger Yield Optimization Notes product supplement.

|

|

CUSIP

|

90268V604

|

|

ISIN

|

US90268V6048

|

|

Tax Treatment

|

There is no tax authority that specifically characterizes the Notes. UBS and you agree, in the absence of an administrative determination or judicial ruling to the contrary, to characterize the Notes for tax purposes as an investment unit consisting of a non-contingent debt instrument and a put option contract in respect of the underlying equity. With respect to coupon payments you receive, you agree to treat such payments as consisting of interest on the debt component and a payment with respect to the put option as follows:

|

|

|

Coupon Rate

|

Interest on Debt Component

|

Put Option Component

|

|

|

9.66% per annum

|

1.34% per annum

|

8.32% per annum

|

|

|

For further details and possible alternative tax treatments, please refer to the section entitled "What are the Tax Consequences of the Notes" in the prospectus supplement for more information.

|

NOTICE TO INVESTORS: THE NOTES ARE SIGNIFICANTLY RISKIER THAN CONVENTIONAL DEBT INSTRUMENTS. THE ISSUER IS NOT NECESSARILY OBLIGATED TO REPAY THE FULL PRINCIPAL AMOUNT OF THE NOTES AT MATURITY, AND THE NOTES CAN HAVE DOWNSIDE MARKET RISK SIMILAR TO THE UNDERLYING EQUITY. THIS MARKET RISK IS IN ADDITION TO THE CREDIT RISK INHERENT IN PURCHASING A DEBT OBLIGATION OF UBS. YOU SHOULD NOT PURCHASE THE NOTES IF YOU DO NOT UNDERSTAND OR ARE NOT COMFORTABLE WITH THE SIGNIFICANT RISKS INVOLVED IN INVESTING IN THE NOTES.

YOU SHOULD CAREFULLY CONSIDER THE RISKS DESCRIBED UNDER “KEY RISKS” BEGINNING ON PAGE 3, UNDER "KEY RISKS" BEGINNING ON PAGE 5 OF THE PROSPECTUS SUPPLEMENT AND UNDER

"

RISK FACTORS

"

BEGINNING ON PAGE PS-13 OF THE TRIGGER YIELD OPTIMIZATION NOTES PRODUCT SUPPLEMENT BEFORE PURCHASING ANY NOTES. EVENTS RELATING TO ANY OF THOSE RISKS, OR OTHER RISKS AND UNCERTAINTIES, COULD ADVERSELY EFFECT THE MARKET VALUE OF, AND THE RETURN ON, YOUR NOTES. YOU MAY LOSE SOME OR ALL OF YOUR INITIAL INVESTMENT IN THE NOTES.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these Notes or passed upon the adequacy or accuracy of this final terms supplement, or the previously delivered prospectus supplement, Trigger Yield Optimization Notes product supplement and prospectus. Any representation to the contrary is a criminal offense. The Notes are not deposit liabilities of UBS AG and are not FDIC insured.

See "Additional Information about UBS and the Notes" on page 3. The Notes we are offering will have the terms set forth in the Prospectus Supplement dated March 14, 2012 relating to the Notes, the Trigger Yield Optimization Notes product supplement, the accompanying prospectus and this final terms supplement.

|

Offering of Notes

|

Issue Price to Public

|

Underwriting Discount

|

Proceeds to UBS AG

|

|

|

Total

|

Per Note

|

Total

|

Per Note

|

Total

|

Per Note

|

|

MGM Resorts International

|

$99,994.40

|

$10.3300

|

$999.9440

|

$0.1033

|

$98,994.4560

|

$10.2267

|

UBS Financial Services Inc.

|

UBS Investment Bank

|

Final Terms Supplement dated May 18, 2012

|

Additional Information About UBS and the Notes

|

UBS has filed a registration statement (including a prospectus, as supplemented by a product supplement and a prospectus supplement for the Notes) with the Securities and Exchange Commission, or SEC, for the offering for which this final terms supplement relates. Before you invest, you should read these documents and any other documents relating to the Notes that UBS has filed with the SEC for more complete information about UBS and this offering. You may obtain these documents for free from the SEC website at www.sec.gov. Our Central Index Key, or CIK, on the SEC website is 0001114446. Alternatively, UBS will arrange to send you these documents if you so request by calling toll-free 1-877-387-2275.

You may access these documents on the SEC web site at www.sec.gov as follows:

|

•

|

Prospectus Supplement dated March 14, 2012

|

|

|

http://www.sec.gov/Archives/edgar/data/1114446/000119312512115143/d312234d424b2.htm

|

|

•

|

Trigger Yield Optimization Notes product supplement dated January 11, 2012

|

|

|

http://www.sec.gov/Archives/edgar/data/1114446/000119312512008816/d281322d424b2.htm

|

|

•

|

Prospectus dated January 11, 2012

|

|

|

http://www.sec.gov/Archives/edgar/data/1114446/000119312512008669/d279364d424b3.htm

|

References to "UBS," "we," "our" and "us" refer only to UBS AG and not to its consolidated subsidiaries. In this document, "Trigger Yield Optimization Notes" or the "Notes" refer to the Notes that are offered hereby. Also, references to "prospectus supplement" mean the UBS prospectus supplement dated March 14, 2012, references to "Trigger Yield Optimization Notes product supplement" mean the UBS product supplement, dated January 11, 2012, relating to the Notes generally and references to the "accompanying prospectus" mean the UBS prospectus titled, "Debt Securities and Warrants", dated January 11, 2012.

|

Key Risks

|

|

|

|

An investment in the Notes involves significant risks. Some of the risks that apply to the Notes are summarized here and are comparable to the corresponding risks discussed in the "Key Risks" section of the prospectus supplement, but we urge you to read the more detailed explanation of risks relating to the Notes generally in the "Risk Factors" section of the Trigger Yield Optimization Notes product supplement. We also urge you to consult your investment, legal, tax, accounting and other advisors before you invest in the Notes.

|

|

|

|

•

|

Risk of loss at maturity -

The Notes differ from ordinary debt securities in that UBS will not necessarily pay the full principal amount of the Notes at maturity. UBS will only pay you the principal amount of your Notes in cash if the final price of the underlying equity is greater than or equal to the trigger price and only at maturity. If the final price of the underlying equity is below the trigger price, UBS will deliver to you one share of the underlying equity at maturity for each Note that you own instead of the principal amount in cash. If you receive shares of the underlying equity at maturity, the value of the shares you recieve is expected to be significantly less than the principal amount of the Notes or may have no value at all.

|

|

•

|

Higher coupon rates are generally associated with a greater risk of loss -

Greater expected volatility with respect to the Note’s underlying equity reflects a higher expectation as of the trade date that the price of the underlying equity could close below its trigger price on the final valuation date of the Note. This greater expected risk will generally be reflected in a higher coupon payable on that Note. However, the underlying equity’s volatility can change significantly over the term of the Notes and the price of the underlying equity for your Note could fall sharply, which could result in a significant loss of principal.

|

|

•

|

The contingent repayment of your principal applies only at maturity -

You should be willing to hold your Notes to maturity. If you are able to sell your Notes prior to maturity in the secondary market, you may have to sell them at a loss relative to your initial investment even if the underlying equity price is above the trigger price.

|

|

•

|

Your return on the Notes is expected to be limited to the coupons paid on the Notes

-

You will not participate in any appreciation of the underlying equity from the trade date to the final valuation date and your return is expected to be limited to the coupon payments. If the closing price of the underlying equity on the final valuation date is greater than or equal to the trigger price, UBS will pay you the principal amount of your Notes in cash at maturity and you will not participate in any appreciation in the price of the underlying equity even though you risked being subject to the decline in the price of the underlying equity. If the closing price of the underlying equity on the final valuation date is less than the trigger price, UBS will deliver to you shares of the underlying equity at maturity which will be worth less than the trigger price as of the final valuation date and are unlikely to be worth more than the principal amount as of the maturity date. Therefore, your return on the Notes as of the maturity date is expected to be limited to the coupons paid on the Notes and may be less than your return would be on a direct investment in the underlying equity.

|

|

•

|

Credit risk of UBS -

The Notes are unsubordinated, unsecured debt obligations of the issuer, UBS, and are not, either directly or indirectly, an obligation of any third party. Any payment to be made on the Notes, including any repayment of principal, depends on the ability of UBS to satisfy its obligations as they come due. As a result, the actual and perceived creditworthiness of UBS may affect the market value of the Notes and, in the event UBS were to default on its obligations, you may not receive any amounts owed to you under the terms of the Notes and you could lose your entire investment.

|

|

•

|

Market risk

- The price of the underlying equity can rise or fall sharply due to factors specific to that underlying equity and (i) in the case of common stock or American depositary shares, its issuer ("underlying equity issuer") or (ii) in the case of an exchange traded fund, the securities, futures contracts or physical commodities constituting the assets of that underlying equity. These factors include price volatility, earnings, financial conditions, corporate, industry and regulatory developments, management changes and decisions and other events, as well as general market factors, such as general market volatility and levels, interest rates and economic and political conditions. You, as an investor in the Notes, should make your own investigation into the underlying equity issuer and the underlying equity for your Notes.

We urge you to review financial and other information filed periodically by the underlying equity issuer with the SEC.

|

|

•

|

Owning the Notes is not the same as owning the underlying equity -

The return on your Notes may not reflect the return you would realize if you actually owned the underlying equity. For instance, you will not receive or be entitled to receive any dividend payments or other distributions on the underlying equity, and you will not participate in any appreciation of the underlying equity, over the term of the Notes. Furthermore, the underlying equity may appreciate substantially during the term of your Notes and you will not participate in such appreciation.

|

|

•

|

No assurance that the investment view implicit in the Notes will be successful -

It is impossible to predict whether and the extent to which the price of the underlying equity will rise or fall. There can be no assurance that the underlying equity price will not rise by more than the coupons paid on the Notes or will not close below the trigger price on the final valuation date. The price of the underlying equity will be influenced by complex and interrelated political, economic, financial and other factors that affect the issuer of the underlying equity. You should be willing to accept the risks of owning equities in general and the underlying equity in particular, and the risk of losing some or all of your initial investment.

|

|

•

|

There is no affiliation between the underlying equity issuer, or for Notes linked to exchange traded funds, the issuers of the constituent stocks comprising the underlying equity (the "underlying equity constituent stock issuers"), and UBS, and UBS is not responsible for any disclosure by such issuer(s) -

We are not affiliated with the underlying equity issuer or, if applicable, any underlying equity constituent stock issuers. However, we and our affiliates may currently or from time to time in the future engage in business with such issuer(s). Nevertheless, neither we nor our affiliates assume any responsibility for the accuracy or the completeness of any information about such issuer(s). You, as an investor in the Notes, should make your own investigation into the underlying equity issuer or, if applicable, each underlying equity constituent stock issuer. Neither the underlying equity issuer nor any underlying equity constituent stock issuer is involved in the Notes offered hereby in any way and has no obligation of any sort with respect to your Notes. Such issuer(s) have no obligation to take your interests into consideration for any reason, including when taking any corporate actions that might affect the value of your Notes.

|

|

•

|

The calculation agent can make adjustments that affect the payment to you at maturity

- The calculation agent may adjust the amount payable at maturity by adjusting the trigger price and the number of shares of the underlying equity that may be delivered for certain corporate events affecting the underlying equity, such as stock splits and stock dividends, and certain other actions involving the underlying equity. However, the calculation agent is not required to make an adjustment for every corporate event that can affect the underlying equity. If an event occurs that does not require the calculation agent to adjust the trigger price and the number of shares of the underlying equity that may be delivered at maturity, the market value of your Notes and the payment at maturity may be materially and adversely affected. In the case of common stock or American depositary shares, following certain corporate events relating to the issuer of the underlying equity where the issuer is not the surviving entity, the amount of cash or stock you receive at maturity may be based on the common stock or American depositary shares of a successor to the underlying equity issuer in combination with any cash or any other assets distributed to holders of the underlying equity in such corporate event. Additionally, if the issuer of the underlying equity becomes subject to (i) a reorganization event whereby the underlying equity is exchanged solely for cash or (ii) a merger or combination with UBS or any of its affiliates, the amount you receive at maturity may be based on the common stock or American depositary shares issued by another company. In the case of an exchange traded fund, following a delisting or discontinuance of the underlying equity, the amount you receive at maturity may be based on a share of another exchange traded fund.The occurrence of these corporate events and the consequent adjustments may materially and adversely affect the value of the Notes. For more information, see the section “General Terms of the Notes - Antidilution Adjustments” beginning on page PS-30 of the Trigger Yield Optimization Notes product supplement. Regardless of the occurrence of one or more dilution or reorganization events, you should note that at maturity UBS will pay you an amount in cash equal to your principal amount, unless the final price of the underlying equity is below the trigger price (as such trigger price may be adjusted by the calculation agent upon occurrence of one or more such events). Regardless of any of the events discussed above, any payment on the Notes is subject to the creditworthiness of UBS.

|

|

•

|

There may be little or no secondary market for the Notes -

No offering of the Notes will be listed or displayed on any securities exchange or any electronic communications network. A secondary trading market for the Notes may not develop. UBS Securities LLC and other affiliates of UBS may make a market in the Notes, although they are not required to do so and may stop making a market at any time. The price, if any, at which you may be able to sell your Notes prior to maturity could be at a substantial discount from the issue price to public and to its intrinsic economic value; and as a result, you may suffer substantial losses.

|

|

•

|

Price of Notes prior to maturity -

The market price of your Notes will be influenced by many unpredictable and interrelated factors, including the market price of, the expected price volatility of and the dividend rate on the underlying equity, as well as the time remaining to the maturity of your Notes, interest rates, geopolitical conditions, economic, financial and political, regulatory or judicial events.

|

|

•

|

Impact of fees on the secondary market price of Notes -

Generally, the market price of the Notes immediately after issuance is expected to be lower than the issue price to public of the Notes, since the issue price included, and the secondary market prices are likely to exclude, commissions, hedging costs or other compensation paid with respect to the Notes.

|

|

•

|

Potential UBS impact on the market price of the underlying equity -

Trading or transactions by UBS or its affiliates in the underlying equity and/or over-the-counter options, futures or other instruments with returns linked to the performance of the underlying equity may adversely affect the market price of the underlying equity and, therefore, the market value of your Notes.

|

|

•

|

Potential conflict of interest -

UBS and its affiliates may engage in business with the issuer of the underlying equity, which may present a conflict between the obligations of UBS and you, as a holder of the Notes. The calculation agent, an affiliate of UBS, will determine whether the final price is below the trigger price and accordingly the payment at maturity on your Notes. The calculation agent may also postpone the determination of the final price and the maturity date if a market disruption event occurs and is continuing on the final valuation date and may make adjustments to the trigger price, the number of shares of the underlying equity that may be delivered to you and the underlying equity itself for certain corporate events affecting the underlying equity. For more information, see the section “General Terms of the Notes — Antidilution Adjustments” beginning on page PS-30 of the Trigger Yield Optimization Notes product supplement.

|

|

•

|

Potentially inconsistent research, opinions or recommendations by UBS -

UBS and its affiliates may publish research or express opinions or provide recommendations that are inconsistent with purchasing or holding the Notes, and which may be revised without notice. Any research, opinions or recommendations expressed by UBS or its affiliates may not be consistent with each other and may influence the value of the Notes.

|

|

•

|

Dealer incentives -

UBS and its affiliates may act as a principal, agent or dealer in connection with the sale of the Notes. Such affiliates, including the sales representatives, will derive compensation from the distribution of the Notes which may serve as an incentive to sell these Notes instead of other investments. We will pay total underwriting compensation of 1.0% per Note to any of our affiliates acting as agents or dealers in connection with the distribution of the Notes.

|

|

•

|

Uncertain tax treatment -

Significant aspects of the tax treatment of the Notes are uncertain. You should read carefully the sections entitled "What are the Tax Consequences of the Notes?" in the prospectus supplement and “Supplemental U.S. Tax Considerations ” beginning on page PS-44 of the Trigger Yield Optimization Notes product supplement and consult your tax advisor about your tax situation.

|

|

Information about the Underlying Equity

|

|

All disclosures regarding the underlying equity are derived from publicly available information. Neither UBS nor any of its affiliates assumes any responsibilities for the adequacy or accuracy of information about the underlying equity provided in this final terms supplement.

You should make your own investigation into the underlying equity.

The underlying equity will be registered under the Securities Exchange Act of 1934, as amended (the "Exchange Act"). Companies with securities registered under the Exchange Act are required to file financial and other information specified by the SEC periodically. Information filed by the issuer of the underlying equity with the SEC can be reviewed electronically through a website maintained by the SEC. The address of the SEC’s website is http://www.sec.gov. Information filed with the SEC by the issuer of the underlying equity under the Exchange Act can be located by reference to its SEC file number provided below. In addition, information filed with the SEC can be inspected and copied at the Public Reference Section of the SEC, 100 F Street, N.E., Room 1580, Washington, D.C. 20549. Copies of this material can also be obtained from the Public Reference Section, at prescribed rates.

|

|

MGM Resorts International

|

According to publicly available information, MGM Resorts International ("MGM") is a holding company, which conducts its operations through its wholly-owned subsidiaries, engaged in gaming, hospitality and entertainment. MGM primarily owns and operates casino resorts, which offer gaming, hotel, dining, entertainment, retail and other resort amenities. Other resort amenities may be owned and operated by MGM but managed by third parties for a fee, or leased to third parties. MGM also operates many managed outlets, utilizing third-party management for specific expertise in areas, such as restaurants and nightclubs, as well as for branding opportunities. Information filed by MGM with the SEC under the Exchange Act can be located by reference to its SEC file number: 001-10362, or its CIK Code: 0000789570. MGM's website is http://www.mgmresorts.com. MGM's common stock is listed on the New York Stock Exchange under the ticker symbol "MGM."

Information from outside sources is not incorporated by reference in, and should not be considered part of, this final terms supplement or any accompanying prospectus. We make no representation or warranty as to the accuracy or completeness of the information contained in outside sources.

Historical Information

The following table sets forth the quarterly high and low closing prices for MGM's common stock, based on daily closing prices on the primary exchange for MGM. We obtained the closing prices below from Bloomberg Professional service (“Bloomberg”), without independent verification. The closing prices may be adjusted by Bloomberg for corporate actions such as stock splits, public offerings, mergers and acquisitions, spin-offs, extraordinary dividends, delistings and bankruptcy. We make no representation or warranty as to the accuracy or completeness of the information obtained from Bloomberg. MGM's closing price on May 18, 2012 was $10.33.

Past performance of the underlying equity is not indicative of the future performance of the underlying equity.

|

Quarter Begin

|

Quarter End

|

Quarterly High

|

Quarterly Low

|

Quarterly Close

|

|

07/02/2007

|

09/28/2007

|

$90.33

|

$68.61

|

$89.44

|

|

10/01/2007

|

12/31/2007

|

$99.75

|

$82.08

|

$84.02

|

|

01/02/2008

|

03/31/2008

|

$81.60

|

$58.39

|

$58.77

|

|

04/01/2008

|

06/30/2008

|

$62.13

|

$33.89

|

$33.89

|

|

07/01/2008

|

09/30/2008

|

$36.52

|

$23.14

|

$28.50

|

|

10/01/2008

|

12/31/2008

|

$26.79

|

$8.79

|

$13.76

|

|

01/02/2009

|

03/31/2009

|

$16.10

|

$1.89

|

$2.33

|

|

04/01/2009

|

06/30/2009

|

$13.10

|

$2.63

|

$6.39

|

|

07/01/2009

|

09/30/2009

|

$13.51

|

$5.52

|

$12.04

|

|

10/01/2009

|

12/31/2009

|

$12.33

|

$8.91

|

$9.12

|

|

01/04/2010

|

03/31/2010

|

$12.52

|

$9.73

|

$12.00

|

|

04/01/2010

|

06/30/2010

|

$16.64

|

$9.64

|

$9.64

|

|

07/01/2010

|

09/30/2010

|

$11.44

|

$9.01

|

$11.28

|

|

10/01/2010

|

12/31/2010

|

$14.92

|

$10.78

|

$14.85

|

|

01/03/2011

|

03/31/2011

|

$16.76

|

$12.33

|

$13.15

|

|

04/01/2011

|

06/30/2011

|

$15.72

|

$11.89

|

$13.21

|

|

07/01/2011

|

09/30/2011

|

$15.87

|

$9.15

|

$9.29

|

|

10/03/2011

|

12/30/2011

|

$12.02

|

$8.23

|

$10.43

|

|

01/03/2012

|

03/30/2012

|

$14.74

|

$11.04

|

$13.62

|

|

04/02/2012*

|

05/17/2012*

|

$13.93

|

$10.40

|

$10.40

|

* As of the date of this final terms supplement, available information for the second calendar quarter of 2012 includes data for the period from April 2, 2012 through May 17, 2012. Accordingly, the “Quarterly High,” “Quarterly Low” and “Quarterly Close” data indicated are for this shortened period only and do not reflect complete data for the second calendar quarter of 2012.

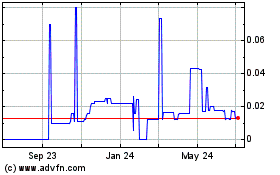

The graph below illustrates the performance of MGM's common stock for the period indicated, based on information from Bloomberg. The solid line represents the trigger price of $5.17, which is equal to 50.00% of the closing price on May 18, 2012.

Past performance of the underlying equity is not indicative of the future performance of the underlying equity.

|

Supplemental Plan of Distribution (Conflicts of Interest)

|

|

We have agreed to sell to UBS Financial Services Inc. and certain of its affiliates, together the "Agents," and the Agents have agreed to purchase, all of the Notes at the issue price less the underwriting discount indicated on the cover of this final terms supplement, the document filed pursuant to Rule 424(b) containing the final pricing terms of the Notes.

We or one of our affiliates may enter into swap agreements or related hedge transactions with one of our other affiliates or unaffiliated counterparties in connection with the sale of the Notes; and UBS or its affiliates may earn additional income as a result of payments pursuant to the swap or related hedge transactions.

Conflicts of Interest

- Each of UBS Securities LLC and UBS Financial Services Inc. is an affiliate of UBS and, as such, has a "conflict of interest" in this offering within the meaning of FINRA Rule 5121. In addition, UBS will receive the net proceeds (excluding the underwriting discount) from the initial public offering of the Notes and, thus creates an additional conflict of interest within the meaning of FINRA Rule 5121. Consequently, the offering is being conducted in compliance with the provisions of Rule 5121. Neither UBS Securities LLC nor UBS Financial Services Inc. is permitted to sell Notes in the offering to an account over which it exercises discretionary authority without the prior specific written approval of the account holder.

|

THC Farmaceuticals (PK) (USOTC:CBDG)

Historical Stock Chart

From Mar 2024 to Apr 2024

THC Farmaceuticals (PK) (USOTC:CBDG)

Historical Stock Chart

From Apr 2023 to Apr 2024