Australian And New Zealand Dollars Extend Decline Against Most Majors

May 14 2012 - 5:13AM

RTTF2

In early European deals on Monday, the Australian and New

Zealand dollars are extending their previous session's slide

against most major currencies on growing concerns about the

Eurozone debt crisis.

Risk aversion grew after Greece's political parties failed in

their latest efforts to form a coalition government and Chancellor

Angela Merkel's conservatives suffered a stinging defeat in the

North Rhine-Westphalia state elections on Sunday.

Greece appears to be heading towards fresh elections after the

far-left Syriza party indicated that it will not participate in

further negotiations aimed at forming a coalition government in the

wake of last week's indecisive elections.

Syriza party leader Alexis Tsipras reportedly insisted that his

party will not participate in coalition negotiations with other

Greek political parties that back earlier deals reached with the

troika of international creditors, namely the European Union,

European Central Bank (ECB) and the International Monetary Fund

(IMF), in exchange for bailout loans.

With the Syriza opting to stay away from the negotiations, the

center-right New Democracy, the socialist Pasok as well as the

Democratic Left, a more moderate leftist party, are expected to

attend the talks at the presidential mansion to try and form a

coalition government to avoid fresh elections that are expected to

be announced later this week.

Such a development would lead to weeks of uncertainty in the

eurozone over Greece's continued membership in the single currency

zone. At a meeting in Brussels later today, eurozone finance

ministers are likely to increase pressure on Greece to continue

with austerity and structural measures.

The New Zealand dollar is trading at a 10-day low of 1.6567

against the euro and a fresh 4-month low of 0.7769 against the US

dollar, compared to Friday's close of 1.6494 and 0.7831,

respectively. The next downside target level for the kiwi is seen

at 1.70 against the euro and 0.770 against the greenback.

Against the Japanese yen, the New Zealand dollar is trading at a

5-day low of 62.21. If the kiwi-yen pair weakens further, it will

fall below 62 level. At Friday's close, the kiwi-yen pair was

quoted at 62.60.

The Australian dollar also declined, hitting a 10-day low of

1.2920 against the euro and a 5-day low of 79.79 against the yen.

On the downside,the aussie may 1.30 target against the euro and

79.0 against the yen. The euro-aussie and the aussie-yen pairs were

worth 1.2897 and 80.12, respectively at Friday's close.

Meanwhile, the Australian dollar continued to fall below parity

against the U.S. dollar for the first time since December 2011.The

aussie-greenback pair is now trading at 0.9965 with 0.990 seen as

the next downside target level. The pair ended last week's trading

at 1.0024.

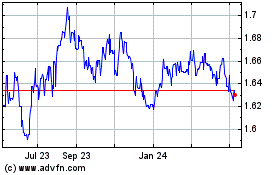

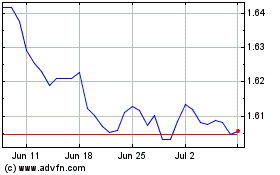

Euro vs AUD (FX:EURAUD)

Forex Chart

From Mar 2024 to Apr 2024

Euro vs AUD (FX:EURAUD)

Forex Chart

From Apr 2023 to Apr 2024