U.S. Dollar Strengthens On Greek Concerns

May 14 2012 - 12:45AM

RTTF2

The U.S. dollar climbed against its major counterparts in the

Asian session on Monday as traders bet on safe havens after Greece

failed to form a new government.

Coalition talks in Greece continued throughout the weekend with

party leaders failing to form a government, forcing Greek President

Karolos Papoulias to call a final meeting to be held Monday.

Also, German Chancellor Angela Merkel lost an election in North

Rhine-Westphalia, raising doubts that her party will be able to

stay in power after next year's general election.

The greenback reached a 10-day high of 80.14 against the yen and

new 2-month high of 0.9328 against the franc, compared to Friday's

closing values of 79.93 and 0.9299, respectively. The next upside

target level for the greenback is seen at 80.5 against the yen and

0.94 against the franc.

Against the pound and the euro, the greenback climbed to more

than a 3-week high of 1.6056 and near a 4-month high of 1.2883 with

1.60 and 1.28 seen as the next upside target levels, respectively.

The greenback finished last week's deals at 1.6076 against the

pound and 1.2922 against the euro.

The greenback rose above parity against the Australian dollar

for the first time since December 20, 2011. The greenback spiked up

to 0.9998 against the aussie from last week's closing value of

1.0024. If the greenback rises further, it may target 0.990

level.

The number of housing loans approved in Australia picked up for

the first time in three months in March, data from the Australian

Bureau of Statistics showed today.

The number of housing finance commitments for owner occupied

housing rose 0.3 percent month-on-month in March after falling 2.5

percent in February and 1.5 percent in January. Economists were

expecting a 2 percent decline.

Against the NZ currency, the greenback that rose to more than a

4-month high of 0.7799 in early deals moved sideways thereafter. On

the upside, the greenback may target 0.775 level. The

kiwi-greenback pair is now trading at 0.7820, compared to last

week's close of 0.7831.

Retail sales in New Zealand declined at the fastest pace in

three years in the March quarter, after a temporary boost from the

Rugby World Cup in the previous two quarters played out, data

released by Statistics New Zealand showed.

Retail sales, including trade in vehicles, fell 1.5 percent

quarter-on-quarter in the March quarter.

The US dollar edged up to as high as 1.0024 against its Canadian

counterpart and held steady thereafter. The next upside target

level for the greenback is seen at 1.007. At last week's close, the

pair traded at 1.0005.

In the European session, German wholesale price index, Swiss

producer & import prices for April and the Eurozone industrial

production for March are slated for release.

There are no major economic reports due from U.S. today.

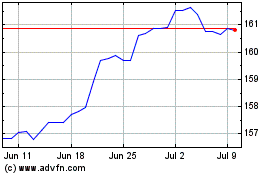

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Mar 2024 to Apr 2024

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Apr 2023 to Apr 2024