LinkedIn Delivers Robust 1Q Numbers - Analyst Blog

May 04 2012 - 8:45AM

Zacks

LinkedIn Corporation (LNKD) reported adjusted

net earnings of 5 cents per share in the first quarter of 2012,

much better than the Zacks Consensus Estimate of 2 cents.

Revenues

Revenues in the quarter stood at $188.5 million, up 100.6% from

$93.9 million in the first quarter of 2012. The company witnessed

stupendous revenue growth across all three product segments.

Segment wise, Hiring Solutions products totaled

$102.6 million, up a massive 121.3% year over year. This segment

represented 54.4% of the total revenue in the first quarter of

2012.

Marketing Solutions products increased 73.2%

year over year to $47.5 million. Marketing Solutions revenue

represented 25.2% of the total revenue.

Premium Subscriptions products totaled $37.9

million, an increase of 91.0% year over year. Premium Subscriptions

represented 20.0% of the total revenue in the reported quarter.

Geographically, U.S. revenues totaled $120.8 million, and

represented 64.0% of revenues in the first quarter of 2012. Revenue

from the international market amounted to $67.6 million, and

represented 36.0% of the total revenue in first quarter 2012.

Operating Results

The company reported operating income of $10.6 million, up from

the year-ago level of $1.3 million. Operating income increased as

revenue grew at a higher rate than cost and expenses.

Net profit on a GAAP basis in the first quarter was $5.0 million

versus $2.1 million in the first quarter of 2011. Excluding special

items like amortization of intangibles, non-GAAP earnings per share

was 5 cents compared with 3 cents per share earned in the first

quarter of 2011.

Balance Sheet

LinkedIn Corporation ended the quarter with cash and cash

equivalents of $342.3 million versus $339.0 million in the prior

quarter. Accounts receivable in the quarter was $116.3 million

compared with $111.4 million in the previous quarter, and there was

no long-term debt. Total deferred revenue in the quarter was $174.8

million, up from $139.8 million in the previous quarter.

Guidance

The company expects revenue in the range of $210.0 million to

$215.0 million for the second quarter of 2012. Adjusted EBITDA is

expected in the range of $40.0 million to $42.0 million. Moreover,

depreciation and amortization is projected in the range of $18.5

million and $19.5 million, and stock-based compensation is expected

in the range of $18.0 million to $19.0 million.

The company expects full-year 2012 revenue in the range of

$880.0 million to $900.0 million. Adjusted EBITDA is expected

between $170.0 million and $175.0 million. The company expects

depreciation and amortization in the range of $75.0 million to

$85.0 million, and stock-based compensation in the range of $80.0

million to $90.0 million.

Conclusion

LinkedIn commands a leadership position in the emerging online

professional networking segment. The company has attained worldwide

popularity and has grown steadily over the last few quarters.

LinkedIn reported impressive first quarter numbers, and witnessed

considerable revenue upside across segments. The company did

particularly well in the Hiring solution segment (up 121.3%

y/y).

The company reported consistent top-line growth, and effectively

implemented certain cost control measures to improve its bottom

line. Currently, competition is not severe in the professional

networking space, but IT majors like Facebook,

Google (GOOG) and Microsoft

(MSFT) are expected to enter the market soon. Hence, the

competitive scenario could change rapidly over the next few

years.

The company has a Zacks #3 Rank (implying a Hold rating).

GOOGLE INC-CL A (GOOG): Free Stock Analysis Report

LINKEDIN CORP-A (LNKD): Free Stock Analysis Report

MICROSOFT CORP (MSFT): Free Stock Analysis Report

To read this article on Zacks.com click here.

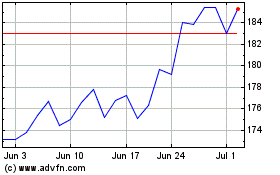

Alphabet (NASDAQ:GOOGL)

Historical Stock Chart

From Mar 2024 to Apr 2024

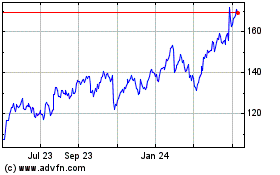

Alphabet (NASDAQ:GOOGL)

Historical Stock Chart

From Apr 2023 to Apr 2024