CA Offers New Services - Analyst Blog

May 03 2012 - 1:30PM

Zacks

Computing major CA Technologies (CA) recently

won a deal from the Swift Exchange, which selected the CA

SiteMinder to improve the security and accessibility of its loyalty

program commerce system, which is also called Swift Exchange.

It is expected that the single sign-on, flexible authentication,

policy-based authorization, and improved scalability, reliability

and availability would increase the efficiency of the new Swift

Exchange system, thereby reducing its cost of operation.

However, CA is not limiting itself to the enterprise segment.

The company is also focused on innovation for the education sector,

which is showing some promise. To tap this opportunity, CA is

hosting an education show, which it called May Mainframe Madness

2012 (MMM 2012), a free, virtual trade show delivering educational

presentations to customers around the globe throughout the month of

May.

This apart, CA has made strategic moves to capitalize on its

virtualization/cloud computing expertise, which is expected to be

accretive to growth over the next two-three years. Cloud computing

leads to increased service and elevated security requirements for

the companies that use it and CA's product portfolio is well

positioned to benefit from it.

Although the company is growing through initiatives in the IT

security and cloud computing segments, both of these come under the

broad umbrella ofthe information technology (IT) management

software market, where competition is stiff. While CA remains a

leading player in its served markets, we recognize that these

markets are not without challenges.

This apart, CA encounters aggressive competition in other areas

of its business activity like financial and project management,

anti-spy or antivirus software segment, etc. Some of CA’s largest

competitors include International Business Machine

(IBM), BMC Software (BMC), and

Hewlett-Packard Company (HPQ) and Symantec

Corp. (SYMC).

Although CA has posted decent third quarter results with

improvement in revenue and profit, the product demand trend was

moderate in the reported quarter. We believe that the company

provided conservative fiscal 2012 guidance. In addition, its high

debt balance, reduction in tech spending by government agencies and

European exposure may pose some challenges going forward.

The company has a Zacks #4 Rank (implying a Sell rating in the

short term).

BMC SOFTWARE (BMC): Free Stock Analysis Report

CA INC (CA): Free Stock Analysis Report

HEWLETT PACKARD (HPQ): Free Stock Analysis Report

INTL BUS MACH (IBM): Free Stock Analysis Report

SYMANTEC CORP (SYMC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

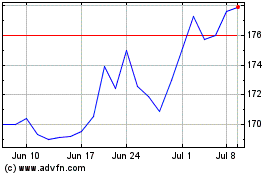

International Business M... (NYSE:IBM)

Historical Stock Chart

From Mar 2024 to Apr 2024

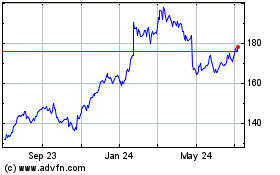

International Business M... (NYSE:IBM)

Historical Stock Chart

From Apr 2023 to Apr 2024