E.ON Defends Emerging Markets Push As Shareholders Voice Criticism

May 03 2012 - 8:57AM

Dow Jones News

German utility E.ON AG (EOAN.XE) Thursday defended its push into

emerging markets outside Europe to tap high energy demand growth,

as shareholders voiced criticism of the plans and called on the

company to conserve cash after huge write-downs on the European

assets acquired in recent years.

"One gets the impression that E.ON earns money in Germany to

burn it abroad," said Ingo Speich, portfolio manager at investment

fund company Union Investment, at E.ON's annual general meeting.

"Your plans in Brazil appear to be too daring," Speich added.

Christoph Ohme, senior portfolio manager at Deutsche Bank AG's

(DB) investment fund unit DWS Investment, also warned E.ON not to

overpay for its expansion.

Ohme and other shareholders pointed to the massive impairment

charges the company had to book on assets it acquired in Italy,

Spain and France in recent years.

The assets were acquired for more than EUR10 billion, but E.ON

had to write-down nearly half of their value, attributing this to

changes in regulation as well as deteriorated economic

prospects.

"In our view, E.ON should clearly define the next steps of its

international expansion," said Ohme.

However, E.ON Chief Executive Johannes Teyssen insisted that the

strategy to expand into emerging countries is correct, because

those markets offer much higher growth rates than saturated

European markets.

The comments come after E.ON earlier this year announced plans

to form a joint venture with Brazilian energy company MPX Energia

SA (MPXE3.BR), with the aim of developing 11 gigawatt of power

generation capacity in Brazil and Chile.

E.ON had previously singled out Brazil, Turkey and India as

potentially attractive growth markets and Teyssen Thursday added

that the company is in "promising talks" with partners in Turkey

and India over possible partnerships.

Teyssen continued that investment in Brazil will remain fairly

limited as most of the planned projects will be majority-financed

via debt.

"To the end of this decade, we expect investment in the low

single-digit billion euro range in Brazil, or EUR100 million to

EUR200 million per year," Teyssen said.

He also said the partnership with MPX gives E.ON access to gas

and coal that the companies can use to fuel their power plants.

"Not many players in the Brazilian energy market have that sort of

access to fuels," he said.

MPX is a unit of a broader industrial conglomerate, owned by

Brazil's richest man, Eike Batista. Other operations of Batista's

empire of companies include coal mining and gas production

companies.

-By Jan Hromadko, Dow Jones Newswires; +49 69 29 725 503;

jan.hromadko@dowjones.com

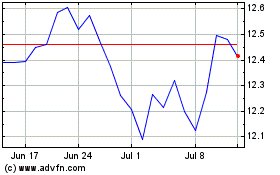

E. On (TG:EOAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

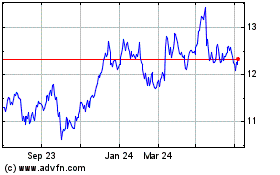

E. On (TG:EOAN)

Historical Stock Chart

From Apr 2023 to Apr 2024