Euro Pares Recent Gains Against Most Majors; ECB In Focus

May 03 2012 - 5:32AM

RTTF2

The euro that gained against its most major counterparts in

early European deals on Thursday pulled back shortly as investors

focus on the European Central Bank's interest rate decision and the

President Mario Draghi's press conference.

The European Central Bank is set to maintain its key rates at

historic low of 1 percent as elevated inflation provides no scope

for a rate cut. The central bank is also likely to refrain from

restarting its bond-buying program despite calls for more action

amid a surge in the unemployment rate and recessions in Spain and

Italy.

Following the interest rate announcement at 7:45 am ET, the

central bank President Mario Draghi is set to hold a regular

post-decision press conference at 8.30 am ET. Amid indications that

commitment to austerity is waning, he is likely to call the

governments to act to restore market confidence, Jennifer McKeown,

an economist at Capital Economics said in a note.

The euro that rose to 1.3164 against the dollar at 3:30 am ET

and 105.74 against the yen at 4:05 am ET declined thereafter. As of

now, the euro is worth 105.45 against the yen and 1.3128 against

the dollar. The next downside target level for the euro is seen at

1.310 against the dollar and 105.2 against the yen.

In economic news, Eurozone's producer prices increased less than

forecast by economists in March. Data from Eurostat showed that the

producer price index rose 0.5 percent month-on-month in March,

slower than 0.6 percent gain in February. Economists had forecast

an increase of 0.6 percent. Prices has now increased for three

consecutive months.

On an annual basis, PPI rose 3.3 percent in March compared to

3.6 percent rise in February and 3.4 percent increase expected.

Against the pound, the euro is currently worth 0.8118, down from

a high of 0.8139 hit at 4:25 am ET. If the euro-pound pair weakens

further, it will break yesterday's fresh multi-month low of 0.8115

and target the 0.807 level.

But the euro remained lower against the franc and is presently

trading at a 2-day low of 1.2015. On the downside, 1.2010 is seen

as the next target level for the European currency.

From the U.S., weekly jobless claims report for the week ended

April 28, preliminary report on fourth quarter non-farm

productivity and unit labor costs and the Institute for Supply

Management's non-manufacturing survey for April are expected in the

New York morning session.

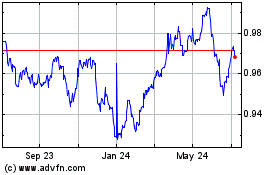

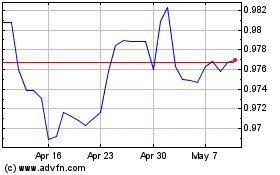

Euro vs CHF (FX:EURCHF)

Forex Chart

From Mar 2024 to Apr 2024

Euro vs CHF (FX:EURCHF)

Forex Chart

From Apr 2023 to Apr 2024